Affordable Health Insurance Washington

Are you a resident of Washington state seeking affordable health insurance coverage? Look no further! In this comprehensive guide, we will delve into the various health insurance options available in Washington, helping you navigate the complex landscape of healthcare plans and make informed decisions for your well-being.

With a focus on accessibility and affordability, we aim to provide valuable insights into the healthcare market in Washington, ensuring you have the tools to secure the best possible coverage for your needs and budget.

Understanding the Health Insurance Landscape in Washington

Washington, like many other states, offers a diverse range of health insurance plans, catering to individuals, families, and small businesses. Understanding the unique characteristics of the Washington healthcare market is essential to finding the right coverage.

The state's insurance market is regulated by the Washington State Office of the Insurance Commissioner, which ensures that insurance providers adhere to state and federal guidelines. This regulation provides a layer of protection for consumers, ensuring fair practices and accessible coverage options.

Washington's insurance market is known for its robust competition, with multiple reputable insurers offering a wide array of plans. This competition often translates to better rates and more comprehensive coverage for residents. Major insurance carriers in Washington include Premera Blue Cross, Regence BlueShield, and Kaiser Permanente, each providing a unique set of plans and benefits.

In addition to traditional private insurers, Washington also has a robust public insurance market with programs like Apple Health (Medicaid) and the Washington Health Benefit Exchange (WAHealthPlanFinder), offering affordable coverage options for eligible individuals and families.

Exploring Affordable Health Insurance Options

Washington Health Benefit Exchange (WAHealthPlanFinder)

The Washington Health Benefit Exchange, or WAHealthPlanFinder, is a key resource for Washington residents seeking affordable health insurance. This online marketplace, established under the Affordable Care Act (ACA), offers a centralized platform for comparing and purchasing qualified health plans.

WAHealthPlanFinder provides a range of ACA-compliant plans from various insurance carriers, ensuring consumers have access to essential health benefits. These plans often come with cost-sharing subsidies, making them more affordable for individuals and families with lower incomes.

Eligible Washington residents can receive premium tax credits through WAHealthPlanFinder, which can significantly reduce the cost of their monthly premiums. Additionally, the exchange offers cost-sharing reductions for out-of-pocket expenses, making healthcare more accessible.

| Plan Type | Key Benefits |

|---|---|

| Bronze | Lower premiums, higher out-of-pocket costs |

| Silver | Balanced premiums and out-of-pocket costs |

| Gold | Higher premiums, lower out-of-pocket costs |

| Platinum | Most expensive premiums, lowest out-of-pocket costs |

Apple Health (Medicaid)

Apple Health, Washington's Medicaid program, provides comprehensive healthcare coverage to eligible low-income individuals and families. This program offers a wide range of benefits, including doctor visits, hospital stays, prescription drugs, and preventive care.

Eligibility for Apple Health is determined based on factors such as income, family size, and disability status. The program is especially beneficial for those who may not be able to afford private insurance plans. It covers a significant portion of healthcare costs, often with little to no out-of-pocket expenses.

To apply for Apple Health, individuals can visit the Washington Healthplanfinder website or contact their local Department of Social and Health Services (DSHS) office. The application process is straightforward, and applicants can receive a decision within a few weeks.

Premera Blue Cross Affordable Plans

Premera Blue Cross, a leading insurance provider in Washington, offers a range of affordable health insurance plans tailored to different needs and budgets. These plans provide comprehensive coverage, ensuring access to essential healthcare services without breaking the bank.

Premera's Value plans are designed for those seeking cost-effective coverage. These plans offer lower premiums and higher deductibles, making them ideal for individuals who prioritize affordability and have minimal healthcare needs.

For those with more complex healthcare requirements, Premera's Choice plans provide a broader range of benefits, including access to a larger network of healthcare providers. While these plans may have slightly higher premiums, they offer more flexibility and comprehensive coverage.

| Plan Type | Premium | Deductible |

|---|---|---|

| Value Plan | $350/month | $5,000 |

| Choice Plan | $420/month | $2,500 |

Additional Resources and Considerations

Washington Healthplanfinder Assistance Programs

For individuals who may need assistance navigating the insurance marketplace or understanding their coverage options, Washington Healthplanfinder offers free enrollment assistance. This service provides guidance from trained professionals who can help with plan selection, enrollment, and understanding benefits.

Additionally, the Washington Health Benefit Exchange provides resources and tools to help consumers make informed decisions. Their website offers a plan comparison tool that allows users to compare different plans based on their specific needs and budget.

Understanding Healthcare Costs and Coverage

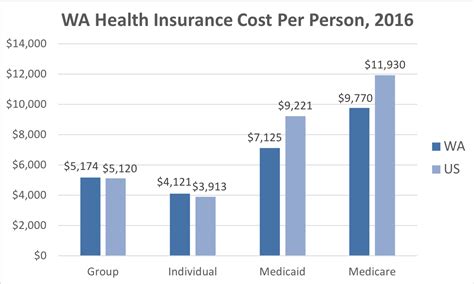

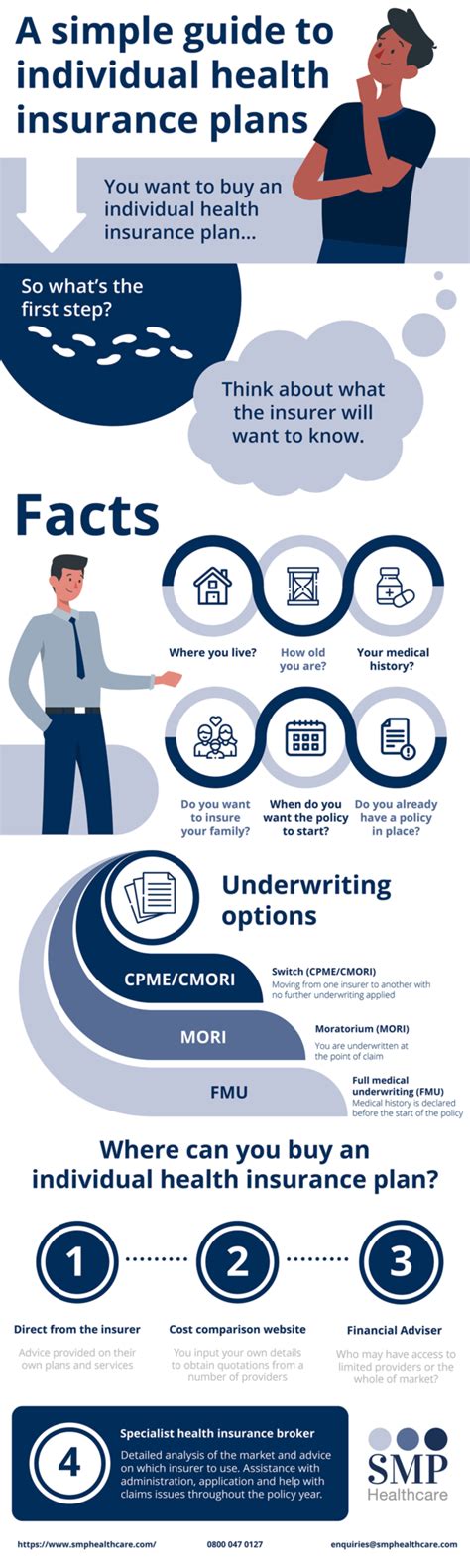

When evaluating health insurance options, it's essential to understand the various costs associated with healthcare coverage, including premiums, deductibles, copays, and coinsurance.

Premiums are the monthly payments made to maintain health insurance coverage. Deductibles, on the other hand, are the amounts individuals must pay out of pocket before their insurance coverage kicks in. Copays and coinsurance are additional costs incurred for specific healthcare services.

Understanding these costs and how they apply to different plans is crucial for choosing the right coverage. It's important to consider not only the monthly premium but also the potential out-of-pocket expenses when selecting a health insurance plan.

Special Enrollment Periods

In Washington, individuals may be eligible for special enrollment periods outside of the regular open enrollment period. These special enrollment periods allow individuals to enroll in or switch health insurance plans due to specific life events, such as marriage, divorce, birth or adoption of a child, or loss of other health coverage.

Staying informed about these special enrollment periods can ensure that individuals have access to the coverage they need when they need it, providing flexibility and peace of mind.

Conclusion: Finding the Right Affordable Health Insurance

Affordable health insurance in Washington is within reach for many residents. By exploring the various options available through the Washington Health Benefit Exchange, Apple Health, and private insurers like Premera Blue Cross, individuals can find coverage that meets their needs and budget.

Remember, the key to finding the right health insurance plan is to understand your healthcare needs, research your options thoroughly, and seek assistance when needed. With the right coverage, you can have peace of mind knowing that your healthcare is accessible and affordable.

How can I determine if I am eligible for Apple Health (Medicaid) in Washington?

+Eligibility for Apple Health (Medicaid) in Washington is primarily based on income and certain other factors. You can use the online eligibility checker on the Washington Healthplanfinder website to determine if you qualify. This tool considers factors like your household size, income, and any disabilities to provide an accurate assessment of your eligibility.

What are the key differences between Bronze, Silver, Gold, and Platinum health insurance plans?

+The main distinction between these plan types lies in their cost-sharing structure. Bronze plans have lower premiums but higher out-of-pocket costs, while Platinum plans offer the opposite—higher premiums and lower out-of-pocket expenses. Silver and Gold plans fall in between, offering a balance between premiums and out-of-pocket costs.

Can I switch health insurance plans during the year, or am I locked into my choice for 12 months?

+In Washington, you can switch health insurance plans outside of the regular open enrollment period through special enrollment periods. These periods are triggered by life events like marriage, divorce, birth or adoption of a child, or loss of other health coverage. By understanding these special enrollment periods, you can ensure you have the coverage you need when life changes.