Insurance Liability

In today's complex and ever-evolving world, understanding the intricacies of insurance liability is of paramount importance. As we navigate through various industries, personal endeavors, and unexpected life events, the concept of liability takes center stage, shaping the way we protect ourselves, our assets, and our future. This comprehensive guide aims to unravel the layers of insurance liability, offering a deep dive into its nuances, real-world applications, and the peace of mind it brings.

The Core of Insurance Liability

At its essence, insurance liability is a legal and financial mechanism designed to protect individuals and entities from the potential risks and consequences of their actions. It acts as a safety net, ensuring that the financial burden resulting from unforeseen events, accidents, or legal disputes doesn’t derail one’s financial stability.

In the broad spectrum of insurance, liability coverage stands out for its unique nature. Unlike other forms of insurance that primarily focus on personal or property protection, liability insurance is all about safeguarding the policyholder from claims and lawsuits arising from their actions or inactions. This could range from a simple slip and fall incident on one's property to more complex scenarios like professional negligence or product defects.

The importance of insurance liability cannot be overstated, especially in an increasingly litigious society. With the rise of awareness and accessibility to legal remedies, the potential for claims and lawsuits has grown exponentially. Having adequate liability insurance in place can mean the difference between a manageable financial setback and a devastating blow to one's financial health and stability.

The Scope and Types of Insurance Liability

Insurance liability encompasses a wide range of scenarios and industries, making it a versatile and indispensable tool for anyone seeking financial protection. Here’s a deeper look into the various types of liability insurance and their specific applications:

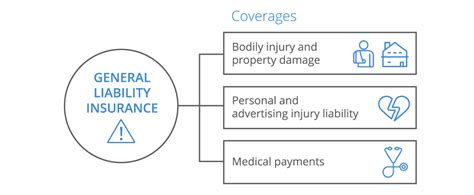

General Liability Insurance

General liability insurance is the cornerstone of most businesses’ insurance portfolio. It provides broad protection against a range of common risks, including bodily injury, property damage, and personal and advertising injury. This type of insurance is particularly vital for businesses that interact with the public, as it covers accidents that may occur on their premises or as a result of their operations.

For instance, a retail store with general liability insurance would be protected if a customer slips and falls, sustaining injuries. The insurance would cover the medical expenses and any legal fees associated with the claim, ensuring the business isn't financially crippled by the incident.

Professional Liability Insurance (Errors and Omissions)

Professional liability insurance, often referred to as errors and omissions (E&O) insurance, is tailored for professionals in various fields. It protects against claims arising from negligent acts, errors, or omissions in the course of providing professional services. This type of insurance is crucial for industries such as healthcare, law, accounting, and consulting, where the stakes are high and the potential for mistakes can be costly.

Imagine a scenario where a software consultant provides faulty advice to a client, leading to significant financial losses for the client. Professional liability insurance would step in to cover the consultant's legal fees and any settlement or judgment awarded to the client.

Product Liability Insurance

Product liability insurance is essential for businesses that manufacture, distribute, or sell physical goods. It provides coverage for claims arising from defects in the product that cause injury or property damage. In an era where product recalls and lawsuits are not uncommon, this type of insurance is a crucial safeguard for businesses to maintain their financial stability and reputation.

Consider a toy manufacturer that discovers a design flaw in one of its popular toys, leading to potential choking hazards for children. Product liability insurance would cover the costs associated with the recall, including legal fees and any compensation to affected consumers.

Cyber Liability Insurance

In the digital age, the risks associated with conducting business online have grown exponentially. Cyber liability insurance is designed to protect businesses and individuals from the financial fallout of cyber attacks, data breaches, and other online threats. With cybercrime on the rise, this type of insurance is becoming increasingly vital for anyone with an online presence.

A small business that falls victim to a ransomware attack, for example, would find cyber liability insurance invaluable. It would cover the costs associated with investigating and resolving the breach, as well as any potential legal claims arising from the incident.

Director and Officer (D&O) Liability Insurance

D&O liability insurance is a critical component of corporate governance. It provides coverage for directors and officers of a company against claims arising from their management decisions. This type of insurance is particularly important in protecting the personal assets of company leaders, who may be held personally liable for certain decisions made on behalf of the organization.

If a company's directors are sued for alleged misconduct in their decision-making process, D&O liability insurance would step in to cover the legal costs and any settlements or judgments.

Real-World Applications and Case Studies

Understanding the theory behind insurance liability is one thing, but witnessing its real-world applications can provide a deeper appreciation for its importance. Here are a few case studies that highlight the impact of insurance liability in various scenarios:

Case Study: Small Business Owner

John, a small business owner, runs a thriving coffee shop in a bustling city. One day, an elderly customer trips over a newly installed coffee machine, sustaining a serious injury. The customer sues John for negligence, seeking significant compensation for medical expenses and pain and suffering.

With general liability insurance in place, John is protected from the financial burden of this incident. His insurance provider covers the legal fees, compensates the customer, and even provides counseling services to help John manage the stress of the situation. Without this insurance, John's dream of owning a successful business could have been shattered.

Case Study: Professional Services Firm

A prominent accounting firm, specializing in tax planning, provides advice to a high-net-worth individual. Unfortunately, the advice leads to significant financial losses for the client, who sues the firm for negligence. The client alleges that the firm’s advice was flawed and resulted in a substantial tax liability.

Professional liability insurance steps in to protect the accounting firm. It covers the legal fees associated with defending the case and provides financial support for any settlement or judgment. This insurance ensures that the firm's reputation and financial stability remain intact, despite the mistake.

Case Study: E-commerce Business

Sarah, an entrepreneur, has built a successful e-commerce business selling handcrafted jewelry. One day, she receives a claim from a customer alleging that a piece of jewelry she sold caused an allergic reaction. The customer demands compensation for medical expenses and emotional distress.

Product liability insurance comes to Sarah's rescue. It covers the costs associated with investigating the claim, including testing the jewelry for allergens. If the claim is valid, the insurance would provide compensation to the customer, protecting Sarah's business from potential financial ruin.

The Peace of Mind Factor

Insurance liability is more than just a financial safeguard; it’s a powerful tool that provides peace of mind. Whether you’re a business owner, a professional, or an individual, knowing that you’re protected from unforeseen liabilities can alleviate a significant amount of stress and anxiety.

For business owners, liability insurance allows them to focus on growth and innovation without constantly worrying about the financial risks associated with their operations. Professionals can provide their services with confidence, knowing that any mistakes or omissions won't lead to personal financial ruin. Even individuals can rest easier, knowing that their assets are protected from potential lawsuits.

The peace of mind that comes with insurance liability is not just about financial security; it's about the freedom to pursue your passions, grow your business, and live your life without the constant fear of unforeseen liabilities.

Future Implications and Emerging Trends

As we move forward into an increasingly complex and interconnected world, the landscape of insurance liability is evolving. Here are some key trends and future implications to consider:

Rising Complexity of Claims

With advancements in technology and the increasing sophistication of legal strategies, claims are becoming more complex. This complexity requires insurance providers to adapt their policies and processes to handle these nuanced scenarios effectively.

Insurance companies will need to invest in specialized knowledge and technology to assess and manage these complex claims, ensuring that policyholders receive the coverage they need and deserve.

Growing Awareness and Accessibility

The public’s awareness of their legal rights and the potential for financial recovery is on the rise. This trend is expected to continue, leading to an increase in the number of claims and lawsuits. Insurance providers will need to stay ahead of these trends, offering comprehensive coverage that addresses the evolving risk landscape.

Digital Transformation

The insurance industry is undergoing a digital transformation, with an increasing focus on online platforms, data analytics, and artificial intelligence. These advancements will streamline the claims process, enhance risk assessment, and provide more accurate and efficient coverage.

Insurance providers will need to invest in these digital tools to remain competitive and provide the best possible service to their policyholders.

Environmental and Social Factors

With growing concerns about climate change and social responsibility, insurance providers are expected to play a more active role in these areas. This could lead to new types of liability coverage, such as environmental liability insurance, to address the unique risks associated with these emerging concerns.

Conclusion

Insurance liability is a multifaceted and essential aspect of modern life and business. It provides a crucial layer of protection, ensuring that individuals and businesses can navigate the complexities of the world without fear of financial ruin. From general liability to niche coverages like cyber liability and D&O insurance, the insurance industry is equipped to handle a wide range of risks.

As we move forward, it's clear that insurance liability will continue to evolve, adapting to the changing needs and risks of society. By staying informed and proactive about their insurance coverage, individuals and businesses can embrace the future with confidence, knowing they are protected from unforeseen liabilities.

How does insurance liability differ from other types of insurance?

+Insurance liability differs from other types of insurance in its focus on protecting the policyholder from claims and lawsuits arising from their actions or inactions. While other insurance types, like property or health insurance, primarily cover losses related to specific assets or individuals, liability insurance is about safeguarding the policyholder’s financial stability in the event of a claim or lawsuit.

What are some common scenarios where insurance liability is crucial?

+Insurance liability is vital in a range of scenarios, including slip and fall incidents on business premises, professional negligence claims, product defects that lead to injuries, cyber attacks and data breaches, and management decisions that result in lawsuits. It provides financial protection and peace of mind in these and many other situations.

How can individuals or businesses choose the right liability insurance coverage?

+Choosing the right liability insurance coverage involves assessing the specific risks associated with your industry or personal circumstances. It’s essential to work with an experienced insurance broker who can guide you through the process, ensuring you have adequate coverage without overspending. Regular reviews of your coverage are also crucial to adapt to changing risks and needs.