Insurance Car Comparison

In the complex world of insurance, finding the right coverage for your vehicle can be a challenging task. With numerous providers and varying policies, it's essential to conduct a comprehensive comparison to ensure you get the best value and protection for your car. This article aims to provide an in-depth analysis of the car insurance market, offering expert insights and practical tips to help you navigate this critical aspect of vehicle ownership.

Understanding the Landscape: A Comprehensive Guide to Car Insurance

The car insurance market is a diverse and dynamic sector, offering a range of policies and coverage options to cater to the unique needs of vehicle owners. From comprehensive coverage to liability-only plans, the choices can be overwhelming. This section aims to demystify the landscape, providing a clear understanding of the different types of car insurance and the factors that influence policy costs.

Types of Car Insurance Policies

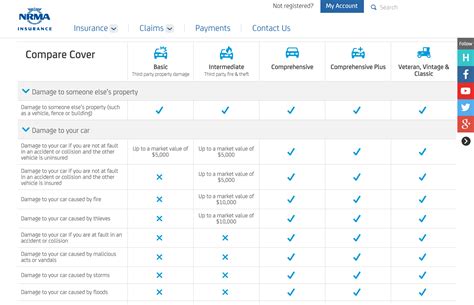

Car insurance policies can be broadly categorized into three main types: liability insurance, collision insurance, and comprehensive insurance. Liability insurance is the most basic form, covering the policyholder for damages caused to others in an accident. Collision insurance, as the name suggests, provides coverage for damage to the insured vehicle in the event of a collision. Comprehensive insurance offers the broadest coverage, protecting against a range of incidents, including theft, vandalism, and natural disasters.

Each type of policy has its own set of advantages and limitations. For instance, liability-only insurance is typically the most affordable option, making it attractive for budget-conscious drivers. However, it offers limited protection, leaving the driver vulnerable to significant out-of-pocket expenses in the event of an accident. On the other hand, comprehensive insurance provides the most extensive coverage, but it also comes with a higher premium.

Factors Influencing Policy Costs

The cost of car insurance policies is influenced by a multitude of factors. These include the type of vehicle being insured, with certain makes and models attracting higher premiums due to their repair costs or susceptibility to theft. The driver’s age and driving history are also significant factors, with younger drivers and those with a history of accidents or violations often facing higher premiums.

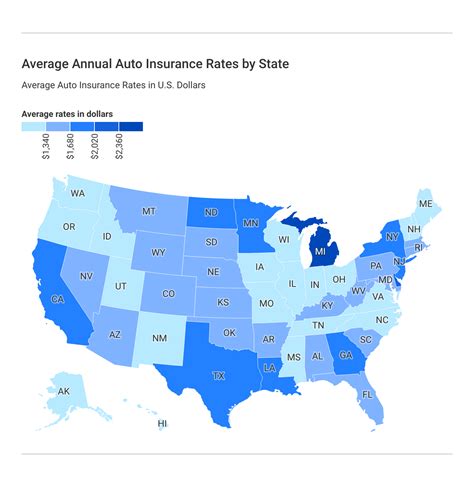

The geographical location plays a crucial role, with insurance rates varying significantly across different states and even within the same city. This is due to factors such as the local crime rate, traffic conditions, and the average cost of car repairs in the area. Additionally, the policyholder's credit score can impact the cost of insurance, with higher credit scores often resulting in lower premiums.

| Factor | Influence on Policy Cost |

|---|---|

| Vehicle Type | Some vehicles attract higher premiums due to their repair costs or theft risk. |

| Driver's Age and Driving History | Younger drivers and those with accident history may face higher premiums. |

| Geographical Location | Insurance rates vary based on state, city, and even neighborhood. |

| Credit Score | A higher credit score can lead to lower insurance premiums. |

Comparing Providers: A Deep Dive into Car Insurance Companies

The car insurance market is crowded with a plethora of providers, each offering unique policies and coverage options. This section aims to provide an in-depth comparison of some of the top car insurance companies, helping you make an informed decision about which provider best suits your needs.

Company A: A Leader in Innovation and Customer Satisfaction

Company A has established itself as a leader in the car insurance industry, renowned for its innovative approaches and exceptional customer service. They offer a comprehensive range of policies, including liability, collision, and comprehensive insurance, tailored to meet the diverse needs of their customers.

One of Company A's standout features is their digital-first approach. They've embraced technology to streamline the insurance process, offering an intuitive online platform for policy management and claims processing. This not only enhances the customer experience but also contributes to cost efficiency, allowing them to offer competitive premiums.

In terms of coverage, Company A provides flexible policy options, allowing customers to customize their plans to suit their budget and coverage needs. They also offer a range of additional perks, such as roadside assistance and rental car coverage, which can be added to policies for a small additional fee.

Company B: A Trusted Name with a Focus on Personalized Service

Company B has built its reputation on a foundation of trust and personalized service. They’ve been in the insurance business for decades, providing stable and reliable coverage to their customers. Their focus on customer satisfaction is evident in their dedicated customer support teams, who are readily available to assist policyholders with any queries or claims.

While Company B offers the standard range of car insurance policies, their strong suit lies in their personalized approach. They take the time to understand each customer's unique needs and tailor their policies accordingly. This level of customization ensures that policyholders receive the coverage they require without paying for unnecessary add-ons.

Company B also offers a loyalty rewards program, providing incentives to long-term customers. These rewards can include discounts on premiums, free roadside assistance, or even cash back rewards.

Company C: A Rising Star with a Competitive Edge

Company C is a relatively new player in the car insurance market but has quickly established itself as a force to be reckoned with. Their competitive pricing and comprehensive coverage options have attracted a significant customer base in a short span of time.

One of Company C's key strengths is their focus on transparency. They provide clear and concise policy information, ensuring that customers understand exactly what they're paying for and what they're covered for. This level of transparency builds trust and helps customers make informed decisions.

Additionally, Company C offers a range of discounts to their customers, including multi-policy discounts, safe driver discounts, and loyalty discounts. They also provide flexible payment options, allowing customers to pay their premiums monthly, quarterly, or annually, depending on their preference.

Policy Features and Add-ons: Enhancing Your Car Insurance Coverage

Car insurance policies can be customized with a range of features and add-ons to enhance coverage and provide additional peace of mind. This section explores some of the most common policy enhancements and how they can benefit policyholders.

Roadside Assistance: A Crucial Add-on for Peace of Mind

Roadside assistance is a popular add-on to car insurance policies, providing invaluable support in the event of a breakdown or emergency. This coverage typically includes services such as towing, flat tire changes, fuel delivery, and battery jump starts. Having roadside assistance as part of your policy can save you from unexpected costs and provide peace of mind when you’re on the road.

Rental Car Coverage: Keeping You Moving During Repairs

Rental car coverage is another beneficial add-on, particularly for those who rely heavily on their vehicles for daily activities. This coverage reimburses the policyholder for the cost of renting a substitute vehicle while their insured car is being repaired after an accident. By adding rental car coverage to your policy, you can ensure that your daily routine isn’t disrupted in the event of an accident.

Gap Insurance: Protecting Your Investment

Gap insurance, also known as guaranteed auto protection, is a valuable add-on for those who have financed or leased their vehicles. This coverage bridges the gap between the actual cash value of your car and the amount you still owe on your loan or lease. In the event of a total loss, gap insurance ensures that you’re not left with a large, unexpected bill.

| Policy Feature/Add-on | Description |

|---|---|

| Roadside Assistance | Provides essential services like towing and tire changes in case of breakdowns. |

| Rental Car Coverage | Reimburses the cost of renting a substitute vehicle while your car is being repaired. |

| Gap Insurance | Covers the difference between the actual cash value of your car and the amount owed on a loan or lease. |

Conclusion: Making an Informed Decision

Choosing the right car insurance provider and policy is a critical decision that can significantly impact your financial well-being. By understanding the different types of policies, the factors that influence costs, and the unique offerings of various providers, you can make an informed decision that best suits your needs and budget.

Remember, car insurance is a protective measure to safeguard you against financial losses in the event of an accident or other vehicle-related incidents. It's crucial to have adequate coverage, but it's equally important to ensure that you're not overpaying for features you don't need. Take the time to compare providers, understand your options, and tailor your policy to your unique circumstances.

With the right car insurance coverage, you can drive with confidence, knowing that you're protected against the unexpected. Stay informed, stay safe, and happy driving!

FAQ

What is the average cost of car insurance in the United States?

+

The average cost of car insurance in the U.S. varies widely depending on factors such as location, driving history, and the type of vehicle insured. According to recent data, the national average for annual car insurance premiums is around 1,674. However, this can range from as low as 500 in some states to over $3,000 in others.

Can I get car insurance without a license?

+

While it may be possible to purchase car insurance without a valid driver’s license, it can be challenging. Many insurance companies require proof of a valid license as part of their application process. However, there are some specialty insurers that cater to high-risk drivers, including those without a license, but these policies often come with higher premiums.

How often should I review and update my car insurance policy?

+

It’s a good idea to review your car insurance policy annually, or whenever you experience a significant life change that could impact your coverage needs. This includes events like getting married, having a child, buying a new car, or moving to a different state. Regular reviews can help ensure that your policy remains up-to-date and provides the coverage you need.

What should I do if I’m involved in a car accident?

+

If you’re involved in a car accident, the first priority is to ensure the safety of yourself and others involved. Call emergency services if necessary. Once the situation is stable, gather as much information as possible, including contact details of other drivers, witnesses, and photos of the accident scene. Notify your insurance company as soon as possible, and provide them with all the details you’ve collected. They will guide you through the claims process.

Can I switch car insurance providers mid-policy term?

+

Yes, you can switch car insurance providers at any time, even mid-policy term. However, be aware that you may have to pay a cancellation fee to your current insurer if you haven’t completed the full term of your policy. It’s also important to ensure that your new policy is effective immediately to avoid any gaps in coverage.