Average Cost Of Full Coverage Auto Insurance

The cost of full coverage auto insurance can vary significantly depending on numerous factors, making it a complex and often confusing topic for vehicle owners. Understanding these factors and how they influence insurance rates is crucial for anyone seeking to find the best coverage at a reasonable price. This article aims to provide an in-depth analysis of the average cost of full coverage auto insurance, exploring the key variables that impact rates and offering insights on how to navigate this essential aspect of vehicle ownership.

Unraveling the Average Cost: A Comprehensive Overview

Full coverage auto insurance, also known as comprehensive insurance, is a policy that provides a more extensive level of protection compared to basic liability coverage. It typically includes coverage for damage to your vehicle in accidents, regardless of fault, as well as protection against non-accident-related incidents like theft, vandalism, and natural disasters. While it offers a higher level of protection, it also comes with a higher price tag, making it important for vehicle owners to understand the factors that influence these costs.

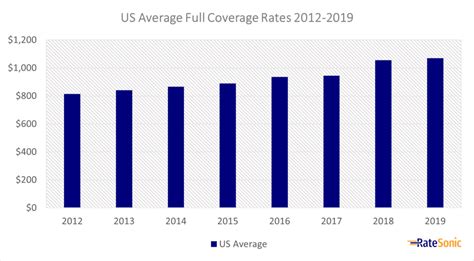

The average cost of full coverage auto insurance in the United States can vary significantly, with estimates ranging from $1,000 to $2,500 per year. However, these averages can be misleading, as they fail to account for the wide range of factors that influence insurance rates. For instance, a driver with a clean record and a history of safe driving in a low-risk area might pay significantly less than the average, while a driver with multiple violations and accidents in a high-risk area could easily surpass the upper limit of these estimates.

Key Factors Influencing Full Coverage Auto Insurance Costs

Several factors play a crucial role in determining the cost of full coverage auto insurance. Understanding these factors can help vehicle owners make informed decisions when choosing an insurance policy and potentially save on their premiums.

- Driving Record: Your driving history is one of the most significant factors influencing your insurance rates. A clean driving record with no accidents or violations typically results in lower premiums, while a history of accidents or traffic violations can lead to significantly higher costs.

- Location: The area where you live and drive can have a substantial impact on your insurance rates. High-risk areas, such as those with a high crime rate or a history of severe weather events, often result in higher insurance costs. Similarly, densely populated urban areas with heavy traffic and a higher likelihood of accidents can also drive up insurance rates.

- Age and Gender: Insurance companies often consider age and gender when calculating premiums. Generally, younger drivers (especially those under 25) and male drivers tend to be associated with higher risk and therefore face higher insurance costs. However, this trend can vary depending on the specific insurance provider and the region.

- Vehicle Type and Usage: The type of vehicle you drive and how you use it can also affect your insurance rates. Sports cars and luxury vehicles, for instance, often come with higher insurance costs due to their higher repair and replacement costs. Additionally, vehicles used for business purposes or those driven frequently may also lead to increased insurance premiums.

- Coverage and Deductibles: The level of coverage you choose and the deductibles you opt for can significantly impact your insurance costs. Higher coverage limits and lower deductibles generally result in higher premiums, while lower coverage and higher deductibles can lead to lower costs. It's important to strike a balance between the level of coverage you need and the cost you're willing to pay.

Real-World Examples and Data

To illustrate the impact of these factors, let’s look at some real-world examples. Consider two drivers, both aged 30, with clean driving records. Driver A lives in a rural area with low crime and a history of mild weather conditions, while Driver B resides in an urban area with a high crime rate and frequent severe weather events. Despite their similar driving records and ages, Driver B is likely to pay significantly higher insurance premiums due to the higher risk associated with their location.

Similarly, let's compare two vehicles: a standard sedan and a high-performance sports car. Even with the same driver and similar usage patterns, the sports car is likely to incur higher insurance costs due to its higher repair and replacement costs. This highlights the significant influence of vehicle type on insurance premiums.

| Factor | Impact on Premium |

|---|---|

| Clean Driving Record | Lower Premiums |

| Low-Risk Location | Lower Premiums |

| Older Drivers | Lower Premiums (compared to younger drivers) |

| Standard Vehicles | Lower Premiums (compared to luxury or sports cars) |

| Higher Deductibles | Lower Premiums |

Navigating Full Coverage Auto Insurance: Tips and Strategies

Understanding the factors that influence full coverage auto insurance rates is the first step towards navigating this complex landscape. Here are some additional tips and strategies to help you find the best coverage at a reasonable cost.

Shop Around and Compare Quotes

Insurance rates can vary significantly between providers, so it’s crucial to shop around and compare quotes from multiple insurers. Online comparison tools can be a great starting point, but it’s also beneficial to speak directly with insurance agents to understand the specific coverage and pricing they offer.

Consider Bundle Discounts

Many insurance providers offer bundle discounts when you purchase multiple types of insurance from them. For instance, you might be able to save on your auto insurance by also purchasing your home or renters insurance from the same provider. These bundle discounts can lead to significant savings, so it’s worth considering when shopping for insurance.

Explore Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive insurance, is an innovative approach that allows insurance providers to set rates based on how, when, and where you drive. This can be a great option for safe drivers who don’t spend much time on the road. By tracking your driving behavior, these policies can offer personalized rates that reflect your actual risk level.

Maintain a Clean Driving Record

As mentioned earlier, your driving record is a significant factor in determining your insurance rates. Maintaining a clean driving record by avoiding accidents and traffic violations can help keep your premiums low. If you do have violations or accidents on your record, consider taking defensive driving courses or other safe driving programs to potentially reduce the impact on your insurance rates.

Choose Your Vehicle Wisely

The type of vehicle you drive can have a substantial impact on your insurance costs. When choosing a new vehicle, consider the insurance costs associated with different makes and models. Generally, vehicles with lower repair and replacement costs, as well as those with better safety ratings, tend to be more affordable to insure. You can use online tools and resources to research the insurance costs of different vehicles before making a purchase.

Understand Your Coverage Options

Full coverage auto insurance typically includes multiple types of coverage, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage. It’s important to understand the specific coverages included in your policy and their limits. This ensures that you have the protection you need without paying for coverage you don’t require. If you’re unsure about your coverage options, consult with an insurance agent to discuss your specific needs and risks.

Consider Higher Deductibles

While higher deductibles can increase the out-of-pocket costs if you need to make a claim, they can also lead to lower insurance premiums. If you’re a safe driver and don’t anticipate making many claims, opting for a higher deductible can be a strategic way to save on your insurance costs.

Take Advantage of Discounts

Many insurance providers offer a range of discounts that can help lower your premiums. These discounts can include safe driver discounts, multi-policy discounts, good student discounts, loyalty discounts, and more. Ask your insurance agent about the discounts you may be eligible for, and consider making lifestyle changes (such as taking a defensive driving course) to qualify for additional discounts.

Future Trends and Implications

The landscape of auto insurance is continually evolving, driven by advancements in technology and changing consumer behaviors. Here are some future trends and their potential implications for full coverage auto insurance.

The Rise of Telematics and Usage-Based Insurance

Telematics, the technology that allows insurance providers to track driving behavior, is expected to play an increasingly significant role in the auto insurance industry. As usage-based insurance gains popularity, it could lead to more personalized and accurate insurance rates, rewarding safe drivers with lower premiums. However, it also raises privacy concerns, and consumers will need to carefully consider the trade-offs between personalized rates and data privacy.

Impact of Autonomous Vehicles

The advent of autonomous vehicles has the potential to revolutionize the auto insurance industry. As these vehicles become more prevalent, insurance providers may need to adjust their underwriting models to account for the reduced risk of human error. This could lead to lower insurance costs for owners of autonomous vehicles, although the transition period may be complex as insurers adapt to this new technology.

Increased Focus on Data Analytics

Insurance providers are increasingly leveraging data analytics to improve their underwriting processes and risk assessment. This trend is expected to continue, with insurers using advanced analytics to more accurately predict and price risk. While this can lead to more accurate and competitive insurance rates, it also highlights the importance of maintaining a positive data profile, such as a clean driving record and a history of safe driving behavior.

The Role of AI and Machine Learning

Artificial intelligence (AI) and machine learning are already being used in the insurance industry to automate tasks, improve risk assessment, and personalize insurance offerings. As these technologies continue to advance, they are expected to play an even larger role in the auto insurance landscape. This could lead to more efficient and effective insurance processes, but it also underscores the need for consumers to understand and manage their digital footprints, as these technologies rely on data-driven decision-making.

Conclusion: Empowering Vehicle Owners

Understanding the average cost of full coverage auto insurance and the factors that influence these costs is a crucial step towards making informed decisions as a vehicle owner. By navigating the complex landscape of auto insurance with a strategic approach, you can find the coverage you need at a price you can afford. Whether it’s shopping around for the best rates, exploring usage-based insurance, or taking advantage of discounts, there are numerous strategies you can employ to save on your insurance costs without compromising on protection.

As the auto insurance industry continues to evolve, staying informed about emerging trends and technologies is essential. By keeping up with these changes and adapting to new opportunities, vehicle owners can stay ahead of the curve and ensure they're getting the best value for their insurance dollar. The future of auto insurance is exciting and full of potential, and by staying proactive and informed, you can navigate this evolving landscape with confidence and peace of mind.

How much does full coverage auto insurance typically cost?

+The average cost of full coverage auto insurance in the United States can range from 1,000 to 2,500 per year. However, this is just an average, and actual costs can vary significantly depending on a range of factors, including driving record, location, age and gender, vehicle type and usage, and coverage and deductibles.

What factors influence the cost of full coverage auto insurance?

+Several factors influence the cost of full coverage auto insurance, including driving record, location, age and gender, vehicle type and usage, and coverage and deductibles. A clean driving record, low-risk location, older age, standard vehicle, and higher deductibles generally result in lower insurance premiums.

How can I save on full coverage auto insurance costs?

+To save on full coverage auto insurance costs, consider shopping around and comparing quotes from multiple insurers, exploring bundle discounts, considering usage-based insurance, maintaining a clean driving record, choosing your vehicle wisely, understanding your coverage options, opting for higher deductibles, and taking advantage of available discounts.

What is usage-based insurance, and how does it work?

+Usage-based insurance, also known as pay-as-you-drive insurance, allows insurance providers to set rates based on how, when, and where you drive. By tracking your driving behavior, these policies offer personalized rates that reflect your actual risk level. This can be a great option for safe drivers who don’t spend much time on the road.

How might the rise of autonomous vehicles impact auto insurance rates?

+The advent of autonomous vehicles is expected to revolutionize the auto insurance industry. As these vehicles become more prevalent, insurance providers may need to adjust their underwriting models to account for the reduced risk of human error. This could lead to lower insurance costs for owners of autonomous vehicles, although the transition period may be complex as insurers adapt to this new technology.