Car Payment And Insurance

In the world of automotive finance, understanding the intricacies of car payments and insurance is essential. This article aims to delve into the complex yet vital aspects of managing these financial obligations, offering a comprehensive guide for those seeking clarity and expertise.

Navigating the World of Car Payments

When it comes to purchasing a vehicle, one of the most significant financial decisions is determining the method of payment. The car payment landscape is diverse, ranging from traditional loans to innovative leasing options. Let’s explore the key considerations and strategies to make informed choices.

Understanding Loan Terms

Car loans, often referred to as auto loans, are a common financing method. These loans typically involve a set interest rate, a fixed repayment period, and regular payments. The length of the loan, usually measured in months, can significantly impact the overall cost. For instance, a 60-month loan will have higher monthly payments compared to an 84-month loan, but the former may result in lower interest expenses.

It's crucial to assess your financial situation and long-term goals when choosing a loan term. While shorter loans can save on interest, they may not be feasible for individuals with limited income. In such cases, longer loans provide flexibility but come with the trade-off of higher overall interest costs.

| Loan Term | Monthly Payment (approx.) | Total Interest Paid |

|---|---|---|

| 36 months | $500 | $1,200 |

| 60 months | $350 | $2,400 |

| 84 months | $280 | $4,800 |

These figures are illustrative and may vary based on individual circumstances and lender policies. It's always advisable to seek personalized financial advice when making such decisions.

Exploring Leasing Options

Leasing a car is an alternative to traditional ownership. With leasing, individuals can enjoy the benefits of a new vehicle without the long-term commitment of ownership. Lease terms typically range from 24 to 48 months, providing a more flexible arrangement.

Leasing can be advantageous for those who prefer frequent upgrades or have specific mileage requirements. However, it's essential to understand the potential drawbacks. Lease payments often include restrictions on vehicle usage, and exceeding the agreed-upon mileage can result in substantial fees. Additionally, leasing may not provide the same long-term financial benefits as ownership, as the vehicle is returned at the end of the lease term.

Consider your personal preferences and financial goals when deciding between leasing and purchasing. Each option has its unique advantages and challenges, and a thorough understanding is key to making the right choice.

The Essential Role of Car Insurance

Car insurance is a critical aspect of vehicle ownership, providing financial protection in the event of accidents, theft, or other unforeseen circumstances. The world of insurance is intricate, with various coverage options and policy types. Let’s navigate this landscape to understand the essential components.

Types of Car Insurance

Car insurance policies come in different forms, each designed to address specific needs. The most common types include:

- Liability Insurance: This covers damages caused to others in an accident for which you are at fault. It includes both property damage and bodily injury liability.

- Collision Insurance: Pays for repairs to your vehicle after an accident, regardless of fault. This coverage is essential for protecting your investment.

- Comprehensive Insurance: Offers protection against non-collision incidents such as theft, vandalism, weather-related damage, and animal collisions.

- Personal Injury Protection (PIP): Provides coverage for medical expenses and lost wages resulting from an accident, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: Protects you if involved in an accident with a driver who lacks sufficient insurance.

The choice of insurance type depends on various factors, including your state's legal requirements, the value of your vehicle, and your personal financial situation. It's essential to tailor your insurance coverage to your specific needs to ensure adequate protection.

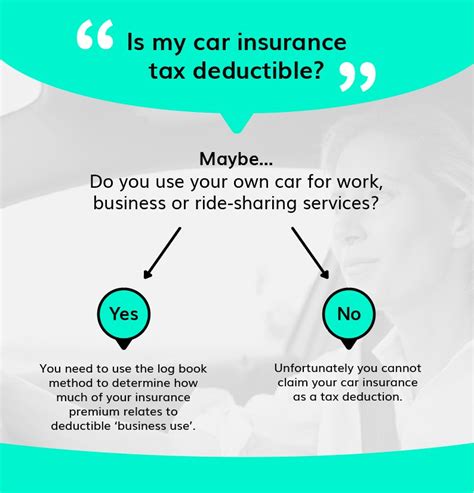

Factors Influencing Insurance Premiums

Insurance premiums, or the cost of your insurance policy, can vary significantly based on several factors. These include:

- Vehicle Type: The make, model, and year of your vehicle can impact premiums. Sports cars and luxury vehicles often have higher premiums due to their repair costs and potential for theft.

- Driver Profile: Your age, driving history, and location play a significant role. Younger drivers and those with a history of accidents or traffic violations may face higher premiums.

- Coverage Limits: The level of coverage you choose affects the premium. Higher coverage limits generally result in higher premiums.

- Deductibles: Choosing a higher deductible (the amount you pay out-of-pocket before insurance coverage kicks in) can lower your premium.

- Discounts : Many insurance companies offer discounts for safe driving records, multiple vehicles insured, and other factors. These can significantly reduce your overall premium.

Shopping around and comparing quotes from multiple insurance providers is crucial to finding the best coverage at the most competitive rates. Additionally, regular reviews of your policy and insurance needs can ensure you maintain adequate coverage without overpaying.

Managing Car Payments and Insurance Effectively

Effectively managing car payments and insurance involves a combination of financial planning, research, and understanding your rights and responsibilities. Here are some key strategies to navigate these financial obligations successfully.

Financial Planning for Car Payments

When it comes to car payments, financial planning is crucial. Assess your budget and determine how much you can comfortably afford for monthly payments. Consider not only the loan or lease payments but also associated costs such as fuel, maintenance, and insurance.

Create a realistic budget that accounts for all your expenses. This will help you make informed decisions about the type and cost of the vehicle you can afford. It's essential to avoid overextending yourself financially, as this can lead to long-term financial strain.

Maximizing Insurance Benefits

To get the most out of your car insurance, it’s important to understand your policy and the coverage it provides. Review your policy regularly and ensure it aligns with your current needs. Consider increasing your deductibles if you’re comfortable with a higher out-of-pocket expense to potentially lower your premium.

Additionally, take advantage of any available discounts. Many insurance companies offer discounts for safe driving records, loyalty, and bundling multiple policies. Explore these options to potentially reduce your insurance costs.

Avoiding Common Pitfalls

Navigating car payments and insurance comes with its fair share of potential pitfalls. Here are some common mistakes to avoid:

- Neglecting Regular Maintenance: Skipping routine maintenance can lead to costly repairs down the line. Regularly servicing your vehicle can help prevent major issues and extend its lifespan.

- Insufficient Coverage: Underestimating your insurance needs can leave you vulnerable to financial risks. Ensure you have adequate coverage for your vehicle's value and your personal financial situation.

- Ignoring Policy Changes: Insurance policies can change over time, and failing to review them regularly may result in unexpected gaps in coverage. Stay informed about any changes to your policy and adjust as needed.

- Overlooking Loan Terms: When taking out a car loan, carefully review the terms and conditions. Understand the interest rate, repayment period, and any penalties for early repayment or missed payments.

Conclusion: Empowering Financial Decisions

Understanding and effectively managing car payments and insurance is a crucial aspect of responsible vehicle ownership. By navigating the complexities of loan terms, leasing options, and insurance policies, individuals can make informed decisions that align with their financial goals and personal circumstances.

This comprehensive guide aims to provide a roadmap for those embarking on the journey of automotive finance. With a clear understanding of the options available and the potential pitfalls to avoid, individuals can make empowered choices that lead to financial stability and peace of mind.

How do I choose the right car loan term for my financial situation?

+When selecting a car loan term, consider your budget and financial goals. Shorter loan terms typically result in lower overall interest costs but higher monthly payments. Longer loan terms provide lower monthly payments but may result in higher interest expenses over time. Assess your income, expenses, and savings goals to determine the right balance for your situation.

What are the benefits of leasing a car instead of purchasing it?

+Leasing offers flexibility and the opportunity to drive a new vehicle every few years. It can be a cost-effective option for those who prefer not to own a vehicle long-term. However, leasing comes with restrictions on mileage and potential fees for excessive wear and tear. Consider your usage patterns and financial goals to determine if leasing aligns with your needs.

How can I reduce my car insurance premiums?

+To lower your car insurance premiums, consider increasing your deductible (the amount you pay out-of-pocket before insurance coverage kicks in). Additionally, shop around and compare quotes from multiple insurance providers. Take advantage of any available discounts, such as safe driving records, loyalty programs, or bundling multiple policies. Regularly review your policy and adjust coverage as needed to ensure you’re not overpaying.