Car Insurance For Business Vehicles

Ensuring the proper coverage for business vehicles is crucial for any enterprise, as it protects both the company's assets and its employees. In this comprehensive guide, we will delve into the world of car insurance for business vehicles, exploring the unique considerations, policies, and strategies to help businesses navigate this essential aspect of their operations.

Understanding Business Vehicle Insurance

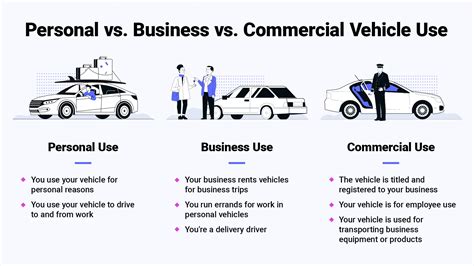

Business vehicle insurance, often referred to as commercial auto insurance, is designed to provide coverage for vehicles used for business purposes. This type of insurance is distinct from personal auto insurance, as it caters to the specific needs and risks associated with commercial operations. Whether it's a fleet of delivery vans, a single company car, or even a rideshare vehicle, understanding the nuances of business vehicle insurance is vital for effective risk management.

Key Differences from Personal Auto Insurance

While both personal and business auto insurance provide coverage for vehicles, there are significant differences. Business vehicle insurance policies typically offer more comprehensive coverage, especially for liability. They often include additional protections such as coverage for hired and non-owned autos, which can be crucial for businesses that utilize rental cars or employee-owned vehicles for work purposes.

Moreover, business auto insurance policies are tailored to address the unique risks associated with commercial operations. This includes coverage for goods in transit, employee injuries during work-related travel, and even cyber risks associated with modern connected vehicles. Understanding these differences is essential for businesses to ensure they have the right level of protection.

Types of Business Vehicle Insurance Policies

The insurance landscape for business vehicles is diverse, with various policies available to cater to different business needs. Here's an overview of the primary types of business vehicle insurance:

- Commercial Auto Insurance: This is the foundational policy for businesses with company-owned vehicles. It provides liability coverage, comprehensive and collision coverage, and medical payments for employees injured in work-related accidents.

- Hired and Non-Owned Auto Insurance: Designed for businesses that utilize rental cars or rely on employees' personal vehicles for work. This policy covers liability and physical damage for vehicles not owned by the business but used for business purposes.

- Rideshare Insurance: Specifically tailored for rideshare companies and drivers, this policy provides coverage during the various stages of ridesharing, including periods when the driver is waiting for a ride request or between rides.

- Fleet Insurance: Ideal for businesses with multiple company vehicles, fleet insurance offers a single policy for the entire fleet, providing streamlined coverage and often resulting in cost savings.

- Umbrella Insurance: An additional layer of protection that provides excess liability coverage beyond the limits of a commercial auto policy. It's particularly beneficial for businesses with high-value assets or extensive operations.

Evaluating Business Vehicle Insurance Needs

Assessing the insurance needs of a business's vehicle fleet is a critical step in ensuring adequate coverage. Here are some key considerations:

Vehicle Usage and Fleet Size

The nature and extent of vehicle usage play a significant role in determining insurance requirements. Factors such as the number of vehicles, the distance traveled annually, and the specific tasks each vehicle is used for all influence the level of risk and, consequently, the insurance coverage needed.

| Vehicle Type | Average Annual Mileage |

|---|---|

| Sedan | 10,000 - 15,000 miles |

| Delivery Van | 20,000 - 30,000 miles |

| Heavy-Duty Truck | 40,000 - 50,000 miles |

Liability Coverage

Liability insurance is a critical component of business vehicle insurance. It covers the business for bodily injury and property damage claims resulting from accidents involving company vehicles. The amount of liability coverage required depends on the nature of the business and the potential risks associated with its operations.

Comprehensive and Collision Coverage

These coverages protect the business vehicles themselves. Comprehensive coverage insures against non-collision incidents like theft, vandalism, or natural disasters, while collision coverage covers damages resulting from accidents. The value of the vehicles and the likelihood of incidents should guide the decision on the level of coverage needed.

Additional Coverages

Beyond the standard coverages, businesses should consider additional protections tailored to their specific needs. This could include coverage for specialized equipment, goods in transit, or even cyber risks associated with modern vehicles. Assessing these potential risks is essential for a comprehensive insurance strategy.

Obtaining the Right Business Vehicle Insurance

Securing the appropriate business vehicle insurance involves a thoughtful process of evaluating options and collaborating with insurance professionals. Here's a step-by-step guide:

Assess Your Business's Unique Needs

Start by understanding the specific requirements of your business. Consider factors like the type of vehicles used, the nature of operations, and the locations where the vehicles operate. This assessment will guide you in selecting the right type of insurance policy.

Review Existing Policies

If your business already has vehicle insurance, review the existing policies to identify any gaps or areas where coverage could be improved. This step is crucial to ensure you're not paying for unnecessary coverage while also ensuring essential protections are in place.

Shop Around and Compare Quotes

Insurance rates can vary significantly between providers. Obtain quotes from multiple insurers to compare coverage options and prices. Look for insurers who specialize in commercial auto insurance and have a solid reputation for claims handling.

Evaluate the Insurer's Reputation

Research the insurance company's track record. Check online reviews and ratings, and inquire about their claims process and customer service. A reputable insurer with a strong financial standing is essential to ensure prompt and fair claims handling.

Tailor Your Policy

Work with your insurance broker or agent to customize your policy to fit your business's needs. Discuss options for additional coverages, such as rental car reimbursement or coverage for employee tools and equipment. Ensure the policy limits are adequate to protect your business assets.

Understand the Policy's Fine Print

Before finalizing the policy, carefully review the terms and conditions. Pay attention to exclusions, deductibles, and any limitations on coverage. Ensure you understand the policy's language and how it applies to your specific business operations.

Regularly Review and Update Your Policy

Insurance needs can change over time as your business grows or evolves. Schedule regular policy reviews, ideally annually, to ensure your coverage remains adequate. This is also a good time to assess if you can negotiate better rates or add new coverages as your business needs change.

The Impact of Technology on Business Vehicle Insurance

Advancements in technology have revolutionized the insurance industry, and business vehicle insurance is no exception. From telematics to data analytics, technology is shaping the way businesses insure their fleets.

Telematics and Usage-Based Insurance

Telematics devices, which track vehicle usage and driver behavior, are becoming increasingly popular in business vehicle insurance. These devices can provide real-time data on driving habits, vehicle location, and even maintenance needs. Usage-based insurance policies, which utilize telematics data, offer a more accurate assessment of risk, potentially leading to lower premiums for safe drivers and businesses.

Data Analytics and Risk Assessment

Data analytics plays a pivotal role in modern insurance. Insurers use advanced analytics to assess risk, predict claims, and even offer personalized insurance products. For businesses, this means more accurate risk profiling, which can result in better-tailored insurance policies and potentially lower premiums.

Connected Vehicles and Cyber Risks

With the rise of connected vehicles, cyber risks have become a significant concern for businesses. Modern vehicles are equipped with advanced computer systems, making them vulnerable to cyberattacks. Business vehicle insurance policies now often include coverage for cyber risks, providing protection against data breaches, ransomware attacks, and other cyber incidents.

Future Trends in Business Vehicle Insurance

The landscape of business vehicle insurance is constantly evolving, influenced by technological advancements, changing regulations, and shifting consumer demands. Here are some key trends to watch:

Sustainable and Green Fleet Insurance

As businesses increasingly focus on sustainability, insurance providers are developing policies tailored to green fleets. These policies offer incentives for businesses adopting electric or hybrid vehicles, promoting environmentally friendly practices.

Autonomous Vehicle Insurance

The advent of autonomous vehicles is set to revolutionize transportation. Insurance providers are already exploring coverage options for self-driving cars, including liability and cyber risks associated with autonomous technology.

Digital Transformation and Insurtech

The insurance industry is undergoing a digital transformation, with insurtech startups disrupting traditional models. These innovative companies are leveraging technology to offer more efficient, personalized, and cost-effective insurance solutions, including for business vehicle insurance.

Risk Prevention and Mitigation

Insurance providers are increasingly focusing on risk prevention and mitigation. This includes offering services like driver training programs, vehicle maintenance checks, and safety equipment discounts to help businesses reduce accidents and claims, ultimately lowering insurance costs.

FAQ: Car Insurance for Business Vehicles

How often should I review my business vehicle insurance policy?

+It is recommended to review your policy annually or whenever there are significant changes to your business operations or fleet. Regular reviews ensure your coverage remains adequate and allow you to take advantage of any new policy options or discounts.

<div class="faq-item">

<div class="faq-question">

<h3>Can I get discounts on my business vehicle insurance?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, there are several ways to reduce your insurance premiums. These include implementing safety measures like driver training programs, installing security devices, and maintaining a clean driving record. Additionally, bundling your insurance policies with the same provider can often result in discounts.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What happens if an employee uses their personal vehicle for work and gets into an accident?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>If your business has hired and non-owned auto insurance, it will cover liability and physical damage for accidents involving employee-owned vehicles used for work purposes. However, it's crucial to ensure your policy includes this coverage, as it's not standard in all business auto insurance policies.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How can I reduce the risk of cyber attacks on my business vehicles?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>To mitigate cyber risks, ensure your vehicles' software is regularly updated and patched. Implement strong password policies and consider investing in cybersecurity training for employees. Additionally, review your insurance policy to ensure it includes coverage for cyber incidents.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What should I do if I'm involved in an accident while using a business vehicle?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>In the event of an accident, ensure the safety of all involved parties. Collect contact and insurance information from the other driver(s) involved. Take photos of the accident scene and any damage. Promptly report the accident to your insurance provider, providing them with all the details and any necessary documentation.</p>

</div>

</div>

</div>