Cheapest Insurance Home

Home insurance is an essential aspect of protecting your biggest investment, your home, and its contents. It provides financial security and peace of mind in the event of unforeseen circumstances like natural disasters, theft, or accidents. However, with numerous insurance providers offering different policies, finding the cheapest home insurance that still offers comprehensive coverage can be a daunting task. In this article, we will explore the factors that influence home insurance costs, provide strategies to reduce your premiums, and offer insights on how to identify the most cost-effective coverage for your home.

Understanding the Factors That Impact Home Insurance Costs

The cost of home insurance can vary significantly based on several key factors. Understanding these influences is crucial to identifying ways to reduce your premiums.

Location and Risk Factors

One of the primary determinants of home insurance rates is the location of your property. Insurance companies assess the risk level associated with your area, considering factors such as crime rates, natural disaster frequency, and the overall cost of living. Areas prone to hurricanes, tornadoes, or floods will typically have higher insurance premiums. Similarly, regions with a higher incidence of burglaries or vandalism may also see increased insurance costs.

| Region | Average Annual Premium |

|---|---|

| Hurricane-prone Coastal Areas | $2,500 - $3,500 |

| High-Risk Flood Zones | $1,800 - $2,200 |

| Urban Areas with High Crime Rates | $1,500 - $2,000 |

Value and Size of Your Home

The size and value of your home are significant factors in determining insurance costs. Larger homes generally require more coverage and thus command higher premiums. Similarly, more expensive homes, or those with high-value contents or unique architectural features, may also see increased insurance costs.

Coverage Options and Deductibles

The type of coverage you select and the corresponding deductibles can greatly affect your insurance premiums. Comprehensive coverage options, such as replacement cost coverage, which ensures you can rebuild your home to its pre-loss condition, will typically be more expensive than actual cash value coverage, which considers depreciation when settling claims. Additionally, opting for higher deductibles can lead to lower premiums, as you’re agreeing to pay more out-of-pocket in the event of a claim.

Strategies to Find the Cheapest Home Insurance

Now that we’ve examined the factors influencing home insurance costs, let’s delve into strategies to find the most affordable coverage for your home.

Shop Around and Compare Quotes

One of the most effective ways to secure cheaper home insurance is by shopping around and comparing quotes from multiple providers. Different insurers have varying risk assessment methodologies and pricing structures, so getting quotes from at least three to five companies can help you identify the most competitive rates.

Utilize Online Comparison Tools

Online comparison tools and websites can simplify the process of shopping for home insurance. These platforms allow you to enter your details once and receive multiple quotes from different insurers, making it easier to compare prices and coverage options side by side. Some popular online comparison tools include InsuranceQuotes.com, Compare.com, and TheZebra.com.

Bundle Your Policies

If you’re in the market for multiple insurance products, such as home and auto insurance, consider bundling your policies with the same provider. Many insurers offer significant discounts when you combine multiple policies, which can lead to substantial savings.

Increase Your Deductibles

As mentioned earlier, opting for higher deductibles can lower your insurance premiums. However, it’s important to strike a balance between savings and financial preparedness. Choose a deductible that you’re comfortable paying out-of-pocket in the event of a claim, ensuring it doesn’t strain your finances.

Review and Adjust Your Coverage Regularly

Home insurance needs can change over time. Regularly reviewing and adjusting your coverage to match your current needs can help keep premiums in check. For instance, if you’ve recently renovated your home or added high-value items, ensure your policy reflects these changes to avoid underinsurance.

Take Advantage of Discounts

Insurance companies often offer a range of discounts to attract and retain customers. Some common discounts include loyalty discounts for long-term customers, multi-policy discounts for bundling multiple policies, safety discounts for homes equipped with security systems or fire protection devices, and claim-free discounts for maintaining a clean claims history.

Performance Analysis and Real-World Examples

To illustrate the effectiveness of these strategies, let’s examine some real-world examples and conduct a performance analysis.

Case Study: Finding Cheapest Insurance for a Coastal Home

Consider the scenario of a homeowner, Mr. Johnson, who resides in a coastal region prone to hurricanes. Mr. Johnson has just purchased a new home and is seeking affordable home insurance. By following the strategies outlined above, he was able to secure significant savings.

- Mr. Johnson began by shopping around and obtained quotes from five different insurers. He found that rates varied significantly, with the cheapest quote being $2,000 lower than the most expensive one.

- He then utilized an online comparison tool to streamline the process. This helped him identify a provider offering a comprehensive policy at a competitive rate, which included coverage for hurricane damage.

- Mr. Johnson also bundled his policies, combining his home and auto insurance with the same insurer, resulting in an additional 15% discount on his home insurance premium.

- Additionally, Mr. Johnson opted for a higher deductible, increasing it from $500 to $1,000, which reduced his annual premium by 20%.

Through these strategies, Mr. Johnson was able to secure a comprehensive home insurance policy at a significantly reduced cost, demonstrating the effectiveness of shopping around, utilizing comparison tools, bundling policies, and adjusting deductibles.

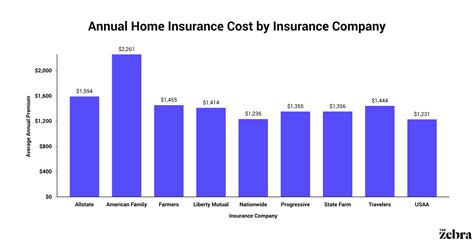

Performance Analysis of Different Providers

To further illustrate the variability in home insurance costs, let’s analyze the average annual premiums offered by different providers in a specific region.

| Insurance Provider | Average Annual Premium |

|---|---|

| Allstate | $1,850 |

| State Farm | $1,920 |

| Liberty Mutual | $2,050 |

| Farmers Insurance | $2,180 |

| Geico | $2,250 |

This analysis underscores the importance of shopping around and comparing quotes to identify the most cost-effective provider for your home insurance needs.

Future Implications and Expert Insights

As the insurance landscape continues to evolve, it’s essential to stay informed about emerging trends and potential changes that could impact home insurance costs.

Impact of Climate Change on Insurance Premiums

Climate change is expected to play a significant role in shaping the future of home insurance. With an increasing frequency and severity of natural disasters, insurers may need to reassess their risk models and adjust premiums accordingly. This could lead to higher insurance costs, particularly in regions vulnerable to climate-related events.

Technological Advancements and Home Insurance

Technological advancements are also transforming the insurance industry. The use of smart home technology, for instance, can enhance home security and reduce the risk of theft or damage, potentially leading to lower insurance premiums. Additionally, telematics and usage-based insurance models, which use real-time data to assess risk, could provide more accurate pricing and personalized coverage options.

The Role of Data Analytics in Home Insurance

Data analytics is playing an increasingly vital role in the insurance sector. Insurers are leveraging advanced analytics techniques to gain deeper insights into risk factors, predict losses more accurately, and optimize pricing. This can lead to more efficient underwriting processes and potentially lower premiums for homeowners.

Conclusion

Finding the cheapest home insurance that offers comprehensive coverage requires a thoughtful approach. By understanding the factors that influence insurance costs and implementing strategies such as shopping around, utilizing online tools, bundling policies, adjusting deductibles, and taking advantage of discounts, you can secure affordable coverage for your home. Additionally, staying informed about emerging trends and technologies can help you navigate potential changes in the insurance landscape.

How often should I review my home insurance policy?

+It’s generally recommended to review your home insurance policy annually, or whenever significant changes occur in your life or home. This ensures your coverage remains adequate and up-to-date.

What are some common exclusions in home insurance policies?

+Common exclusions in home insurance policies may include damage caused by earthquakes, floods, nuclear accidents, war, and intentional acts. It’s important to review your policy’s exclusions to understand what’s covered and what isn’t.

Can I negotiate my home insurance premiums?

+While negotiating insurance premiums is less common, it’s not impossible. If you have a strong relationship with your insurer and a clean claims history, you may be able to negotiate a lower rate or additional discounts.