Cost Of Motorcycle Insurance

Motorcycle insurance is a crucial aspect of motorcycle ownership, providing financial protection in the event of accidents, theft, or other unforeseen circumstances. The cost of this insurance can vary significantly based on numerous factors, making it essential for riders to understand the variables that impact their premiums. In this comprehensive guide, we delve into the intricacies of motorcycle insurance costs, offering insights and strategies to navigate this complex landscape.

Understanding the Basics of Motorcycle Insurance Costs

The price of motorcycle insurance is determined by a multitude of factors, each contributing to the overall premium. These factors can be broadly categorized into personal characteristics, motorcycle specifics, and external influences. Personal characteristics include the rider’s age, driving record, and credit score, all of which can significantly impact insurance rates. For instance, younger riders, especially those under 25, often face higher premiums due to their perceived higher risk profile.

The motorcycle itself is another critical factor. The make, model, and age of the bike can influence insurance costs. Sport bikes and high-performance motorcycles, for example, are generally more expensive to insure due to their association with higher speeds and potentially riskier riding behaviors. Additionally, the motorcycle's usage, whether it's for daily commuting, occasional pleasure rides, or even participation in races, can affect insurance rates.

External Factors Influencing Motorcycle Insurance Costs

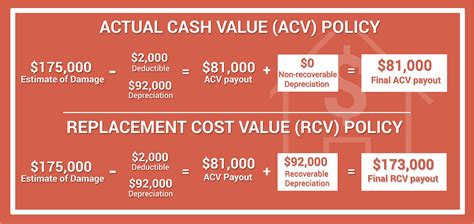

Beyond personal and motorcycle-specific factors, external influences play a significant role in determining insurance costs. These include the rider’s geographic location, with certain areas known for higher accident rates or theft incidents leading to increased premiums. The insurance company itself and the coverage options chosen also impact costs. Comprehensive and collision coverage, while offering broader protection, can raise premiums, while liability-only coverage might be more cost-effective but provides less financial security.

The insurance provider's evaluation of risk is another critical factor. Some companies may consider a rider's employment status or even their education level when assessing risk. For instance, a rider with a stable, well-paying job might be seen as a lower risk, potentially leading to more favorable insurance rates. Similarly, certain professions, like those in law enforcement or the military, might be viewed as having lower risk profiles due to their rigorous training and discipline, further influencing insurance costs.

| Factor | Impact on Cost |

|---|---|

| Rider's Age | Younger riders often pay more due to perceived higher risk. |

| Driving Record | Clean records can lead to lower premiums. |

| Credit Score | Higher scores may result in more favorable rates. |

| Make and Model of Motorcycle | Sport bikes and high-performance models are generally more expensive to insure. |

| Geographic Location | Areas with higher accident or theft rates may have increased premiums. |

| Coverage Options | Comprehensive and collision coverage offer broader protection but can be more costly. |

| Insurance Company | Different providers offer varying rates and coverage. |

Strategies to Reduce Motorcycle Insurance Costs

While various factors beyond a rider’s control influence insurance costs, there are strategies to potentially reduce premiums. Here are some effective approaches to consider:

Improve Your Riding Record

A clean riding record is a powerful tool in reducing insurance costs. Avoid traffic violations and maintain a safe riding practice. Insurance companies often reward riders with a long-standing clean record, so it’s a long-term strategy that can pay off.

Consider Bundling Policies

Bundling your motorcycle insurance with other policies, such as car insurance or home insurance, can lead to significant savings. Many insurance companies offer multi-policy discounts, so it’s worth exploring this option.

Shop Around and Compare Quotes

Insurance rates can vary significantly between providers. It’s crucial to shop around and compare quotes from different companies. Online tools and insurance brokers can facilitate this process, ensuring you find the best deal.

Explore Discounts and Special Offers

Insurance companies often provide discounts for various reasons. These can include discounts for completing a safe-riding course, being a member of certain organizations, or even having specific safety features on your motorcycle. Stay informed about these discounts and ensure you’re taking advantage of all applicable offers.

Adjust Your Coverage

Review your coverage needs regularly. If your circumstances change, you might not need the same level of coverage. For instance, if your motorcycle is older and has lower resale value, you might consider reducing your comprehensive and collision coverage, which can significantly lower your premiums.

The Future of Motorcycle Insurance Costs

As technology advances and our understanding of risk evolves, the landscape of motorcycle insurance costs is likely to change. The rise of telematics and usage-based insurance, for example, might offer new ways to tailor insurance policies to individual riding behaviors. Additionally, the increasing popularity of electric motorcycles and the potential for autonomous riding technologies could influence insurance costs and coverage requirements in the future.

Stay informed about these developments, as they might provide new opportunities for cost-effective insurance solutions. Keep an eye on industry trends and be ready to adapt your insurance strategy as needed.

How often should I review my motorcycle insurance policy?

+It’s recommended to review your policy annually or whenever your circumstances change significantly. This ensures your coverage remains adequate and you’re not overpaying for unnecessary features.

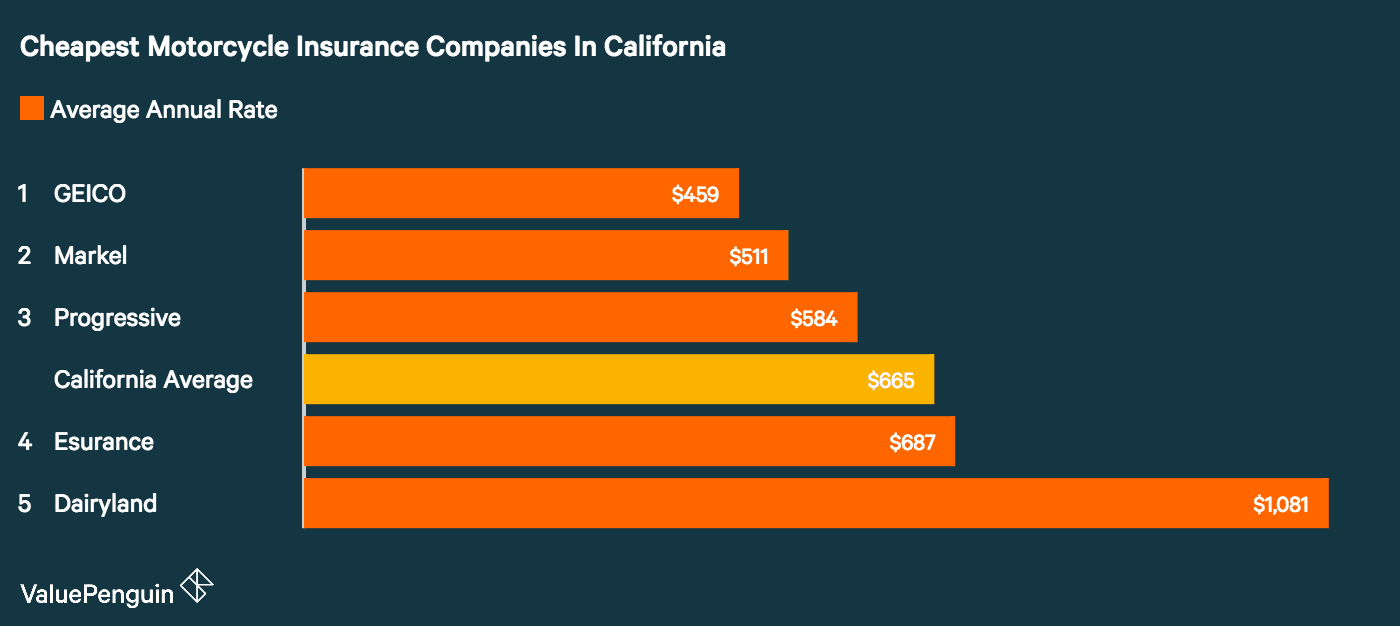

Are there any specific insurance providers known for offering the best rates for motorcycle insurance?

+While certain providers might have a reputation for offering competitive rates, it’s essential to shop around and compare quotes. What works best for one rider might not be the most cost-effective option for another due to the unique factors influencing insurance costs.

Can I negotiate my motorcycle insurance rates with the provider?

+Negotiation is possible, especially if you have a strong relationship with your insurance provider and a long-standing clean record. However, it’s important to approach this tactfully and be prepared with valid reasons for requesting a rate reduction.