Insurance Quote

Insurance quotes are an essential part of the insurance industry, providing individuals and businesses with the information they need to make informed decisions about their coverage. These quotes serve as a preliminary estimate of the cost of an insurance policy, considering various factors unique to the policyholder and the risks involved. Obtaining an accurate insurance quote is a critical step towards securing adequate protection for assets, health, or liabilities. In this comprehensive guide, we will delve into the world of insurance quotes, exploring their intricacies, the factors influencing them, and the steps involved in securing the best coverage for your specific needs.

Understanding Insurance Quotes

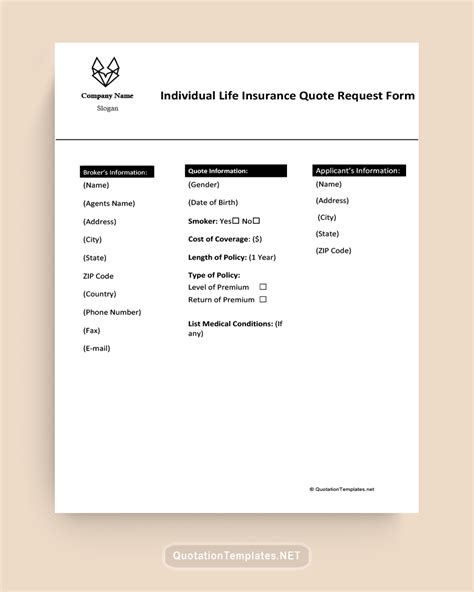

An insurance quote is a customized proposal outlining the potential cost and coverage details for an insurance policy. It is a vital tool that allows consumers to compare different insurance options and choose the one that best suits their requirements. Insurance quotes are generated by insurance providers or brokers based on the information provided by the prospective policyholder, including details about their assets, liabilities, health status, and desired coverage.

The quote process involves assessing the risks associated with the individual or business seeking coverage. Insurers consider a multitude of factors, including age, gender, location, occupation, driving history, credit score, and more, to determine the likelihood of a claim being made and the potential cost of that claim. This risk assessment forms the basis of the insurance quote, with higher-risk individuals or entities typically receiving higher quotes.

Key Components of an Insurance Quote

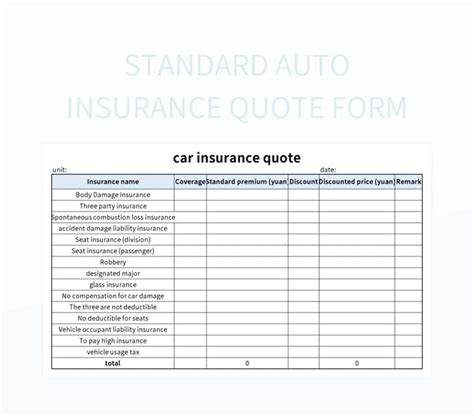

An insurance quote typically includes the following essential components:

- Premium: This is the amount the policyholder will pay for the insurance coverage, usually on a monthly, quarterly, or annual basis. The premium is the most visible aspect of the quote and is influenced by the level of coverage and the risks assessed.

- Coverage Details: The quote will outline the specific coverage limits, deductibles, and any additional benefits or riders included in the policy. This section provides a detailed breakdown of what the policy covers and the conditions under which coverage applies.

- Policy Term: Insurance policies are typically offered for a set period, such as one year. The quote will specify the term for which the policy is valid, and the premium amount may be different for varying policy terms.

- Exclusions: Insurance policies often have specific exclusions, which are events or circumstances not covered by the policy. Understanding these exclusions is crucial, as they can significantly impact the policy’s value.

- Additional Fees: Besides the premium, some insurance policies may have additional fees, such as administration charges or fees for optional add-ons. These fees should be clearly outlined in the quote.

Factors Influencing Insurance Quotes

Insurance quotes are highly personalized and can vary significantly between individuals and businesses. Several factors contribute to the variation in quotes, and understanding these factors can help policyholders negotiate better rates and more comprehensive coverage.

Risk Assessment

The primary factor influencing insurance quotes is the risk assessment conducted by the insurer. Insurers use a variety of tools and data to evaluate the risk associated with insuring a particular individual or entity. Here are some key risk assessment factors:

- Personal Information: Demographic details like age, gender, and marital status can impact insurance quotes. For instance, younger individuals may pay higher premiums for auto insurance, while married individuals may receive lower rates for certain policies.

- Location: The policyholder’s location plays a significant role in risk assessment. Areas with higher crime rates, natural disaster risks, or dense traffic may result in higher insurance quotes.

- Occupation: Certain occupations are considered riskier than others. For example, individuals working in high-risk jobs like construction may face higher insurance premiums.

- Health Status: For health and life insurance, the individual’s health status is a critical factor. Pre-existing medical conditions or a history of serious illnesses can lead to higher quotes or even denial of coverage.

- Driving Record: In auto insurance, the policyholder’s driving record is scrutinized. Individuals with a history of accidents or traffic violations may face higher premiums.

Coverage Preferences

The level of coverage desired by the policyholder is another significant factor influencing insurance quotes. Higher coverage limits or more comprehensive benefits will typically result in higher premiums. Policyholders should carefully consider their coverage needs and assess the value of additional benefits against the increased cost.

Deductibles and Copays

Deductibles and copays are cost-sharing mechanisms in insurance policies. By opting for higher deductibles or copays, policyholders can often reduce their insurance premiums. However, this strategy requires the policyholder to pay more out-of-pocket in the event of a claim, so it’s essential to find the right balance between premiums and deductibles/copays.

Discounts and Promotions

Insurance providers often offer discounts and promotions to attract new customers or reward loyalty. These discounts can significantly reduce insurance quotes. Common discounts include:

- Bundling: Purchasing multiple insurance policies (e.g., auto and home) from the same insurer often qualifies for a bundle discount.

- Safe Driver Discounts: For auto insurance, maintaining a clean driving record can lead to significant discounts.

- Loyalty Discounts: Long-term customers may receive discounts as a reward for their loyalty.

- Occupational Discounts: Certain occupations, like teachers or military personnel, may qualify for occupation-specific discounts.

Securing the Best Insurance Quote

Obtaining the best insurance quote requires a strategic approach and a thorough understanding of your coverage needs. Here are some steps to help you secure the most favorable insurance quote:

Assess Your Coverage Needs

Before requesting insurance quotes, take the time to evaluate your specific coverage needs. Consider your assets, liabilities, and potential risks. For example, if you own a home, you’ll need homeowners insurance; if you drive a car, you’ll need auto insurance; and if you have valuable possessions, you might consider personal property insurance. Assessing your needs will help you avoid over- or under-insuring yourself, ensuring you get the right coverage at the right price.

Shop Around and Compare Quotes

Insurance quotes can vary significantly between providers, so it’s essential to shop around and compare quotes from multiple insurers. Online insurance marketplaces can be a convenient way to quickly obtain and compare quotes from various providers. Remember to compare not only the premiums but also the coverage details, deductibles, and any additional fees or exclusions.

Negotiate with Insurers

Don’t be afraid to negotiate with insurance providers. If you’ve received multiple quotes, you can use these to leverage a better deal. Insurers often have some flexibility in setting premiums, and they may be willing to match or beat a competitor’s quote to secure your business.

Consider Alternative Insurance Options

Sometimes, the traditional insurance market may not offer the best rates or coverage for your specific needs. In such cases, consider alternative insurance options like peer-to-peer insurance or specialty insurance providers. These alternatives can sometimes provide more tailored coverage at competitive rates.

Review Your Quote Regularly

Insurance quotes are not set in stone, and your circumstances can change over time. It’s essential to review your insurance quote annually or whenever your circumstances change significantly. This could include moving to a new location, getting married, having children, changing jobs, or purchasing new assets. Regular reviews ensure your insurance coverage remains adequate and cost-effective.

The Future of Insurance Quotes

The insurance industry is undergoing significant transformation, and the way insurance quotes are generated and delivered is evolving. With the rise of technology and data analytics, insurers are now able to offer more personalized and accurate quotes. Here’s a glimpse into the future of insurance quotes:

Telematics and Usage-Based Insurance

Telematics devices installed in vehicles can track driving behavior, including speed, acceleration, and braking patterns. This data is then used to generate personalized insurance quotes based on actual driving habits. Usage-based insurance, or pay-as-you-drive insurance, is gaining popularity, as it offers a more accurate assessment of risk and can lead to significant savings for safe drivers.

Big Data and Advanced Analytics

Insurance providers are leveraging big data and advanced analytics to refine their risk assessment models. By analyzing vast amounts of data, insurers can identify patterns and correlations that were previously invisible. This enables them to offer more precise quotes and develop innovative insurance products tailored to specific customer segments.

Artificial Intelligence and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are transforming the insurance industry. These technologies can automate the quote process, making it faster and more efficient. AI-powered chatbots and virtual assistants can provide instant insurance quotes, while ML algorithms can continuously learn and improve the accuracy of risk assessments over time.

Blockchain and Smart Contracts

Blockchain technology has the potential to revolutionize insurance by providing a secure and transparent platform for policy documentation and claims processing. Smart contracts, which are self-executing contracts with the terms of the agreement directly written into code, can automate various insurance processes, including quote generation. This technology can enhance trust and efficiency in the insurance industry.

Conclusion

Insurance quotes are a critical aspect of the insurance industry, providing individuals and businesses with the information they need to make informed decisions about their coverage. By understanding the factors that influence insurance quotes and adopting a strategic approach to securing the best coverage, policyholders can ensure they receive the protection they need at a competitive price. As the insurance industry continues to evolve with technological advancements, the future of insurance quotes looks promising, offering more personalized, accurate, and efficient solutions.

How often should I review my insurance quotes and policies?

+It’s recommended to review your insurance quotes and policies at least once a year or whenever your circumstances change significantly. This ensures that your coverage remains adequate and cost-effective.

Can I negotiate with insurance providers to get a better quote?

+Absolutely! Negotiation is a normal part of the insurance process, and insurers often have some flexibility in setting premiums. Don’t hesitate to negotiate, especially if you have multiple quotes to compare.

What are some common discounts available for insurance policies?

+Common discounts include bundling discounts (for purchasing multiple policies from the same insurer), safe driver discounts (for auto insurance), loyalty discounts, and occupational discounts for certain professions.

How do usage-based insurance policies work, and are they a good option for me?

+Usage-based insurance, or pay-as-you-drive insurance, uses telematics devices to track driving behavior and offer personalized quotes based on actual driving habits. It can be a good option if you’re a safe driver, as it rewards responsible driving with lower premiums. However, it may not be suitable for everyone, and it’s important to consider the potential drawbacks, such as privacy concerns.