Auto Insurance Compare Quotes

Securing the right auto insurance is a crucial step for every vehicle owner. With a myriad of options available, comparing quotes becomes an essential task to ensure you get the best coverage at the most affordable price. This comprehensive guide aims to provide an in-depth analysis of the auto insurance market, offering expert insights to help you navigate the process effectively.

Understanding Auto Insurance Coverage

Auto insurance is a contractual agreement between you and the insurance provider, designed to protect you against financial loss in the event of an accident or other vehicle-related incidents. It typically covers a range of scenarios, including liability for bodily injury and property damage, as well as potential costs arising from vehicle theft, vandalism, or natural disasters.

The coverage offered by auto insurance can be customized to meet your specific needs. Key components include:

- Liability Coverage: This protects you against claims resulting from accidents where you are at fault. It covers bodily injury and property damage to others.

- Collision Coverage: This pays for repairs to your vehicle after an accident, regardless of fault.

- Comprehensive Coverage: This covers damages caused by events other than collisions, such as theft, vandalism, or natural disasters.

- Medical Payments or Personal Injury Protection (PIP): These cover the cost of medical treatment for you and your passengers, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: This provides protection in case you're involved in an accident with a driver who doesn't have enough insurance to cover the damages.

The specific coverage you require will depend on your individual circumstances and the laws in your state. It's important to carefully review your policy to ensure it meets your needs.

Factors Influencing Auto Insurance Quotes

The cost of auto insurance can vary significantly, influenced by a range of factors. Understanding these factors can help you make more informed decisions when comparing quotes.

Vehicle Type and Usage

The make, model, and year of your vehicle play a significant role in determining your insurance premium. Generally, newer and more expensive vehicles will attract higher premiums. Additionally, the primary usage of your vehicle, such as personal use, commuting, or business purposes, can also impact your quote.

| Vehicle Type | Average Premium |

|---|---|

| Economy Car | $500 - $1000 annually |

| Luxury Car | $1500 - $3000 annually |

| Sports Car | $2000 - $4000 annually |

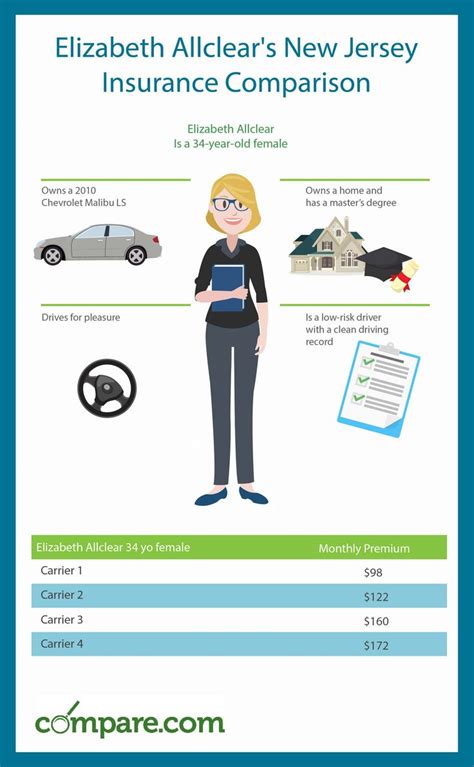

Driver Profile

Your driving history and personal details are key considerations for insurance providers. Factors such as your age, gender, marital status, and driving record can significantly affect your quote. Younger drivers, for instance, are often considered higher risk and may pay more for insurance.

Location and Mileage

The area where you live and work can impact your insurance premium. High-crime or high-accident areas may attract higher rates. Additionally, the number of miles you drive annually can influence your quote, with higher mileage often resulting in increased premiums.

Insurance Company and Policy Features

Different insurance companies offer varying levels of coverage and pricing. The specific features of a policy, such as deductibles, coverage limits, and optional add-ons, can significantly affect the overall cost. It’s important to compare policies from multiple providers to find the best fit for your needs.

Tips for Comparing Auto Insurance Quotes

Comparing auto insurance quotes can be a complex process, but these tips can help streamline the process and ensure you make an informed decision.

Gather Information

Before you start comparing quotes, gather essential information about your vehicle, driving history, and current insurance (if applicable). This will help you provide accurate details to insurance providers and ensure you get precise quotes.

Understand Your Needs

Assess your specific needs and priorities when it comes to auto insurance. Consider factors such as the level of coverage you require, your budget, and any optional add-ons that might be beneficial. This will help you narrow down your options and make more targeted comparisons.

Compare Multiple Providers

Don’t settle for the first quote you receive. Compare quotes from at least three to five different insurance providers to get a good sense of the market rates. This will also help you identify any potential discounts or special offers that could save you money.

Use Online Tools

Numerous online tools and comparison websites can make the quote comparison process more efficient. These tools often provide instant quotes from multiple providers, allowing you to quickly compare rates and coverage options.

Consider Bundle Deals

If you have multiple insurance needs, such as home and auto insurance, consider bundling your policies with the same provider. Many insurance companies offer significant discounts for customers who bundle multiple policies, potentially saving you a considerable amount on your overall insurance costs.

Read the Fine Print

While comparing quotes, pay close attention to the policy details and exclusions. Make sure you understand the coverage limits, deductibles, and any additional fees or charges. This will help you avoid any unpleasant surprises down the line.

The Future of Auto Insurance: Technology and Innovation

The auto insurance industry is undergoing significant changes, driven by technological advancements and shifting consumer needs. Here’s a glimpse into the future of auto insurance and how it might impact your experience.

Telematics and Usage-Based Insurance

Telematics refers to the technology that allows insurance companies to track your driving behavior and habits. Usage-based insurance policies, also known as pay-as-you-drive or pay-how-you-drive, use telematics to offer personalized premiums based on your actual driving behavior. This innovative approach rewards safe drivers with lower premiums, as it takes into account factors such as driving speed, mileage, and time of day.

Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning are transforming the way insurance companies assess risk and price policies. These technologies enable insurers to analyze vast amounts of data, including historical claims data and real-time information, to more accurately predict and price risk. This can lead to more tailored and competitive insurance offerings for consumers.

Digitalization and Convenience

The digital transformation of the insurance industry is enhancing the customer experience. Online platforms and mobile apps now offer convenient ways to purchase insurance, file claims, and manage policies. Additionally, digital technologies enable faster and more efficient claim processing, reducing the overall time and effort required from customers.

Emerging Technologies and Autonomous Vehicles

The rise of autonomous vehicles and advanced driver-assistance systems is poised to revolutionize the auto insurance industry. These technologies are expected to significantly reduce the number of accidents, leading to lower insurance premiums over time. However, the transition period could see increased costs as insurers adapt to this new paradigm.

Conclusion

Comparing auto insurance quotes is a vital step in ensuring you get the best coverage at the most competitive price. By understanding the factors that influence your premium and adopting a strategic approach to comparison, you can make an informed decision that aligns with your needs and budget. As the industry continues to evolve, staying informed about the latest innovations and technologies can help you make the most of your insurance coverage.

How often should I compare auto insurance quotes?

+

It’s recommended to review and compare your auto insurance quotes annually, or whenever your circumstances change significantly. This ensures you’re always getting the best value for your insurance needs.

Can I negotiate my auto insurance premium?

+

While auto insurance premiums are typically non-negotiable, you can often save money by shopping around and comparing quotes. Additionally, you may be eligible for various discounts, such as those for safe driving, multiple policies, or certain vehicle safety features.

What are some common discounts available for auto insurance?

+

Common discounts include safe driver discounts, multi-policy discounts (for bundling home and auto insurance), good student discounts, and discounts for vehicles with certain safety features. Some insurers also offer loyalty discounts for long-term customers.