Uber Car Insurance

In the ever-evolving world of ridesharing, understanding the nuances of insurance coverage is crucial, especially for those who rely on platforms like Uber for their livelihood. This comprehensive guide aims to shed light on Uber's car insurance policies, providing an in-depth analysis of the coverage, its applicability, and the potential implications for drivers and passengers alike.

Understanding Uber’s Insurance Ecosystem

Uber, the pioneering ridesharing company, has revolutionized the way people commute, offering a convenient and cost-effective alternative to traditional taxi services. However, with this innovative business model comes a unique set of insurance considerations. Uber’s insurance policies are designed to provide coverage during various stages of a trip, ensuring protection for drivers, passengers, and third parties.

The Phases of Uber Trips and Insurance Coverage

To comprehend Uber’s insurance strategy fully, it’s essential to understand the different phases of an Uber trip and the corresponding insurance coverage.

Offline Mode: When a driver is logged into the Uber app but is not currently accepting trips, their personal auto insurance policy applies. Uber's insurance does not provide coverage during this period.

Accepting a Trip: Once a driver accepts a trip request, Uber's insurance kicks in, providing liability coverage for bodily injury and property damage. This coverage is active from the moment the driver accepts the trip until the passenger's final destination is reached.

En Route to Pickup: During this phase, Uber's insurance covers the driver for liability claims arising from accidents. However, it's important to note that coverage for damage to the driver's vehicle is limited. Uber's insurance typically does not cover damage to the driver's car, which is why having comprehensive and collision coverage on the driver's personal auto insurance policy is crucial.

Passenger En Route: When a passenger is in the Uber vehicle, the company's insurance coverage is at its highest. Uber provides liability coverage for bodily injury and property damage claims, as well as comprehensive and collision coverage for damage to the driver's vehicle. This comprehensive coverage ensures peace of mind for both drivers and passengers during the trip.

Destination Reached: Once the passenger has arrived at their destination and exits the vehicle, Uber's insurance coverage reverts to the driver's personal auto insurance policy. It's essential for drivers to ensure they have adequate coverage during this phase to protect themselves and their vehicles.

| Uber Trip Phase | Insurance Coverage |

|---|---|

| Offline Mode | Driver's Personal Auto Insurance |

| Accepting a Trip | Uber's Liability Insurance |

| En Route to Pickup | Limited Coverage (Liability Only) |

| Passenger En Route | Comprehensive Uber Insurance |

| Destination Reached | Driver's Personal Auto Insurance |

Key Considerations for Uber Drivers

For individuals considering driving for Uber or those who are already active drivers, understanding the insurance implications is vital. Here are some key considerations to keep in mind:

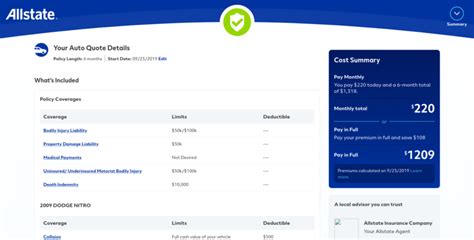

Personal Auto Insurance Requirements

While Uber provides insurance coverage during trips, drivers must have their own personal auto insurance policy. This policy should include liability, comprehensive, and collision coverage to ensure protection during all phases of driving, including when Uber’s insurance is not in effect.

Adequate Liability Coverage

Liability insurance is a critical component of any auto insurance policy, and it’s especially important for Uber drivers. Uber’s liability coverage kicks in when a driver accepts a trip, but having higher liability limits on your personal policy can provide additional protection in the event of a serious accident.

Uninsured/Underinsured Motorist Coverage

Given the diverse range of vehicles and drivers on the road, it’s essential for Uber drivers to have uninsured/underinsured motorist coverage. This coverage protects drivers and passengers in the event of an accident with a driver who does not have adequate insurance.

Rental Car Coverage

For drivers who use rental cars for Uber trips, it’s crucial to understand the insurance implications. Uber’s insurance may not cover damage to rental cars, so drivers should carefully review their rental agreements and consider purchasing additional coverage to protect themselves and the rental company.

Passenger Safety and Insurance

Uber’s insurance policies are not only designed to protect drivers but also to ensure the safety and security of passengers. Here’s a closer look at how Uber’s insurance coverage safeguards passengers during their rides:

Comprehensive Coverage for Passenger Safety

When a passenger is in an Uber vehicle, the company’s insurance coverage extends to protect them in the event of an accident. Uber’s liability insurance covers bodily injury and property damage claims, ensuring that passengers receive the necessary medical attention and compensation for any losses.

No-Fault Coverage

In many states, Uber provides no-fault coverage, which means that passengers can receive compensation for medical expenses and lost wages, regardless of who is at fault for the accident. This coverage provides peace of mind and ensures that passengers can focus on their recovery without worrying about financial burdens.

Uninsured/Underinsured Motorist Coverage for Passengers

Similar to drivers, passengers are also protected by Uber’s uninsured/underinsured motorist coverage. This coverage steps in when the at-fault driver does not have adequate insurance, ensuring that passengers can receive the compensation they deserve for their injuries and losses.

The Future of Uber’s Insurance Landscape

As the ridesharing industry continues to evolve, so too will the insurance landscape surrounding companies like Uber. Here are some potential future developments and implications to consider:

Enhanced Insurance Coverage

With increasing competition in the ridesharing market, Uber may opt to enhance its insurance offerings to attract and retain drivers and passengers. This could include increased liability limits, expanded coverage for rental cars, and additional benefits for drivers and passengers alike.

Regulatory Changes and Standardization

As ridesharing becomes more mainstream, there may be calls for increased regulation and standardization of insurance policies. Governments and insurance industry bodies may work together to establish minimum coverage requirements and ensure consistent protection for drivers, passengers, and third parties involved in ridesharing incidents.

Integration of New Technologies

The rapid advancement of autonomous vehicle technology could significantly impact the insurance landscape for ridesharing companies like Uber. As self-driving cars become more prevalent, insurance policies may need to adapt to cover new risks and liabilities associated with this emerging technology.

Conclusion

Understanding Uber’s car insurance policies is crucial for both drivers and passengers. By comprehending the various phases of an Uber trip and the corresponding insurance coverage, individuals can make informed decisions about their insurance needs and ensure they are adequately protected. As the ridesharing industry continues to evolve, staying informed about insurance developments will be key to navigating this dynamic landscape.

What happens if I’m in an accident while driving for Uber?

+

If you’re involved in an accident while driving for Uber, the specific insurance coverage will depend on the phase of the trip. During the trip, Uber’s liability insurance will cover bodily injury and property damage claims. However, it’s essential to have your own personal auto insurance policy with comprehensive and collision coverage to protect your vehicle. Always report the accident to Uber and your insurance provider promptly.

How does Uber’s insurance compare to traditional taxi insurance?

+

Uber’s insurance policies differ from traditional taxi insurance in several ways. While taxi drivers typically have commercial insurance policies that provide comprehensive coverage during all phases of a trip, Uber’s insurance coverage varies based on the trip phase. Uber provides liability coverage when a trip is accepted and in progress, but drivers must have their own personal auto insurance to cover other phases and protect their vehicles.

Can I rely solely on Uber’s insurance, or do I need my own policy?

+

While Uber provides insurance coverage during trips, it’s crucial to have your own personal auto insurance policy. Uber’s insurance has limitations and may not cover all scenarios. Having your own policy ensures you’re protected during offline modes and provides additional coverage for your vehicle, especially during phases when Uber’s insurance coverage is limited.