Renters Insurence

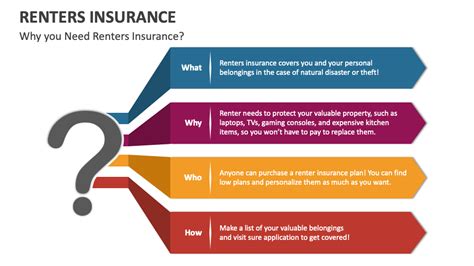

In today's world, renting a home or apartment has become increasingly common, offering individuals and families greater flexibility and financial freedom. However, with the rising costs of personal belongings and potential risks such as theft, fire, or accidents, it's crucial for renters to consider insurance coverage. Renters insurance provides peace of mind and financial protection, ensuring that renters are not left vulnerable to unexpected expenses. This article will delve into the world of renters insurance, exploring its benefits, coverage options, and how it can be a valuable investment for anyone renting a property.

Understanding Renters Insurance: The Essential Coverage

Renters insurance is a type of property insurance specifically designed to protect tenants and their belongings. Unlike homeowners insurance, which covers the structure of a house and its contents, renters insurance focuses on safeguarding the personal possessions and liabilities of those living in rental properties. This insurance policy provides a safety net, covering a range of potential risks and offering financial assistance in the event of losses or damages.

Coverage Options and Benefits

Renters insurance policies typically offer a comprehensive range of coverage options, tailored to meet the unique needs of tenants. Here’s an overview of the key benefits and what renters insurance can cover:

- Personal Property Coverage: This is the cornerstone of renters insurance. It provides financial protection for your personal belongings, including furniture, electronics, clothing, and other valuable items. In the event of a covered loss, such as theft, fire, or water damage, renters insurance will reimburse you for the replacement or repair costs of your possessions.

- Liability Protection: Renters insurance also extends to liability coverage, safeguarding you against legal claims and lawsuits. If someone is injured in your rental unit or your actions cause property damage to others, liability coverage can help cover the associated costs, including medical expenses and legal fees.

- Additional Living Expenses: In the unfortunate event that your rental unit becomes uninhabitable due to a covered loss, renters insurance can provide coverage for additional living expenses. This includes temporary accommodation costs, such as hotel stays or rental of alternative housing, until your primary residence is restored.

- Medical Payments: Renters insurance often includes medical payments coverage, which provides financial assistance for medical expenses incurred by guests who are injured in your rental unit. This coverage can help cover the costs of medical treatment, regardless of fault, up to a specified limit.

- Personal Injury Protection: Personal injury protection covers legal expenses and settlements related to specific non-bodily injury incidents, such as libel, slander, or invasion of privacy. This coverage adds an extra layer of protection, ensuring that renters are financially prepared for unexpected legal disputes.

It's important to note that the specific coverage options and limits can vary between insurance providers and policies. Renters should carefully review their policy documents and understand the scope of their coverage to ensure they have adequate protection.

| Coverage Category | Description |

|---|---|

| Personal Property | Reimbursement for loss or damage to personal belongings |

| Liability | Protection against legal claims and lawsuits |

| Additional Living Expenses | Coverage for temporary housing costs during repairs |

| Medical Payments | Assistance for medical expenses of injured guests |

| Personal Injury Protection | Legal coverage for non-bodily injury incidents |

The Importance of Renters Insurance: Real-Life Scenarios

Renters insurance plays a vital role in protecting tenants from financial hardships and unexpected expenses. Let’s explore a few real-life scenarios where having renters insurance can make a significant difference:

Scenario 1: Theft and Burglary

Imagine you come home from work one day to find that your apartment has been broken into and your valuables, including your laptop, jewelry, and expensive camera equipment, have been stolen. Without renters insurance, you would be left to cover the replacement costs of these items out of your own pocket, which could be financially devastating.

With renters insurance, however, you can file a claim and receive compensation for the stolen items, allowing you to replace them without incurring significant financial strain.

Scenario 2: Fire and Smoke Damage

Fires can occur unexpectedly and can cause extensive damage to personal belongings and the rental unit itself. In the event of a fire, renters insurance can provide coverage for the repair or replacement of damaged items, as well as additional living expenses if your rental unit becomes uninhabitable.

Additionally, renters insurance often includes smoke damage coverage, which is especially important as smoke can infiltrate and damage belongings even if the fire is contained in another part of the building.

Scenario 3: Water Damage and Flooding

Water damage is a common issue in rental properties, whether it’s due to a leaky roof, burst pipes, or natural disasters like floods. Renters insurance can provide coverage for water damage, including the cost of repairing or replacing damaged belongings and any necessary temporary housing expenses.

In areas prone to flooding, it’s crucial to have renters insurance that specifically covers flood damage, as standard policies may exclude this type of coverage.

Scenario 4: Guest Injuries and Liability Claims

Accidents can happen when guests visit your rental unit, and if someone is injured on your property, you could be held liable for their medical expenses and potential legal costs. Renters insurance with liability coverage steps in to provide financial protection in such situations.

For example, if a guest slips and falls in your rental unit, causing a serious injury, renters insurance can help cover the medical bills and any legal fees associated with a potential lawsuit.

Factors to Consider When Choosing Renters Insurance

When selecting a renters insurance policy, several factors should be taken into account to ensure you get the right coverage at an affordable price. Here are some key considerations:

Assess Your Needs and Valuables

Start by evaluating the value of your personal belongings and the potential risks associated with your rental property. Consider the cost of replacing your possessions, the likelihood of theft or natural disasters, and any specific liabilities you may face.

For instance, if you live in an area prone to floods or hurricanes, you may want to prioritize insurance coverage that specifically addresses these risks.

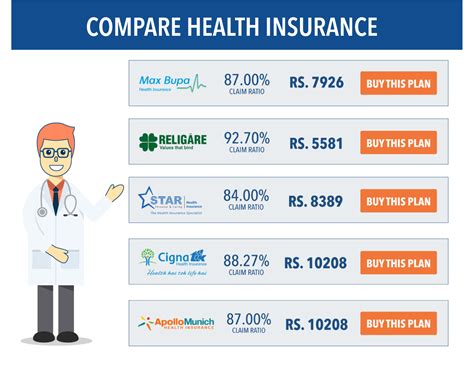

Compare Coverage Options and Limits

Different insurance providers offer varying coverage options and limits. Compare policies to ensure you understand what is and isn’t covered. Look for policies that align with your specific needs and provide adequate protection.

Pay attention to coverage limits, as these can vary significantly between providers. Ensure that the limits are sufficient to cover the replacement cost of your belongings and any potential liabilities.

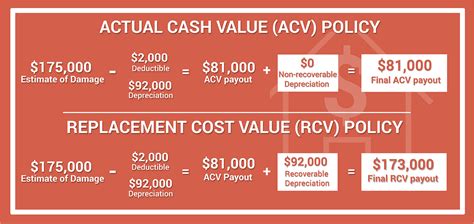

Deductibles and Premiums

Renters insurance policies typically have deductibles, which are the amounts you must pay out of pocket before the insurance coverage kicks in. Consider your financial situation and select a deductible that you can comfortably afford in the event of a claim.

Premiums, or the cost of the insurance policy, can also vary based on coverage limits, deductibles, and the insurer. Shop around and obtain quotes from multiple providers to find the best combination of coverage and affordability.

Additional Features and Riders

Some renters insurance policies offer additional features or riders that can enhance your coverage. These may include coverage for high-value items, such as jewelry or fine art, or specialized coverage for specific risks like identity theft.

Review the available add-ons and determine if any of them are necessary to provide comprehensive protection for your unique circumstances.

Claims Process and Customer Service

In the event of a claim, you’ll want to work with an insurance provider that has a streamlined and efficient claims process. Research the insurer’s reputation for handling claims and consider their customer service ratings.

Look for providers that offer easy-to-use online portals for filing claims and provide prompt and courteous assistance when needed.

Tips for Maximizing Renters Insurance Benefits

To ensure you make the most of your renters insurance policy and receive the full benefits when needed, consider these tips:

- Create an Inventory: Document your personal belongings with a detailed inventory, including photographs and purchase receipts. This will help expedite the claims process and ensure accurate compensation.

- Understand Your Policy: Read your policy documents thoroughly to understand the coverage limits, exclusions, and any specific requirements for filing claims. Familiarize yourself with the process to be prepared in the event of a loss.

- Review and Update Regularly: Life changes, such as acquiring new possessions or moving to a different rental property, may impact your insurance needs. Regularly review your policy and make adjustments as necessary to ensure it aligns with your current circumstances.

- Consider Bundling with Other Policies: Some insurance providers offer discounts when you bundle renters insurance with other policies, such as auto insurance. Bundling can save you money and provide additional convenience.

- Ask About Discounts: Inquire about available discounts, such as loyalty discounts, multi-policy discounts, or discounts for installing security systems or smoke detectors. These can help reduce your premiums.

Renters Insurance Myths Debunked

There are several misconceptions surrounding renters insurance that can deter people from obtaining this vital coverage. Let’s address some of these myths:

Myth 1: Renters Insurance is Expensive

Renters insurance is often more affordable than people realize. The average cost of a renters insurance policy is relatively low compared to other types of insurance. Additionally, by shopping around and comparing quotes, you can find policies that fit your budget while providing adequate coverage.

Myth 2: My Landlord’s Insurance Covers My Belongings

This is a common misconception. While your landlord may have insurance for the structure of the building, their policy typically does not cover your personal belongings. Renters insurance is necessary to protect your possessions and liabilities.

Myth 3: Renters Insurance is Only for High-Value Items

Renters insurance is not limited to covering high-value items. It provides protection for all your personal belongings, regardless of their value. Even if you don’t own expensive items, renters insurance can help cover the cost of replacing everyday items like clothing, furniture, and electronics.

Myth 4: I Don’t Need Renters Insurance if I Have Renter’s Liability Insurance

Renter’s liability insurance, often provided by landlords, only covers your legal liability for damages to the rental property. It does not provide coverage for your personal belongings or additional living expenses. Renters insurance is essential to fill these gaps in coverage.

Conclusion: Protecting Your Peace of Mind

Renters insurance is a valuable tool for protecting your financial well-being and peace of mind while renting a property. It provides a safety net against unexpected losses and liabilities, ensuring that you can recover from unforeseen circumstances without incurring significant financial strain.

By understanding the benefits, coverage options, and factors to consider when choosing a renters insurance policy, you can make an informed decision and enjoy the peace of mind that comes with knowing your possessions and liabilities are protected. Don’t wait until it’s too late; invest in renters insurance today and secure your future.

How much does renters insurance cost?

+The cost of renters insurance can vary based on factors such as location, coverage limits, and deductibles. On average, renters insurance policies range from 15 to 30 per month, but premiums can be higher or lower depending on individual circumstances. It’s recommended to obtain quotes from multiple insurers to find the best coverage at an affordable price.

Can I get renters insurance if I rent a room in a shared house?

+Yes, renters insurance is available for individuals who rent rooms in shared houses or apartments. The policy will cover your personal belongings and liabilities within your rented space. However, it’s important to note that the coverage may be limited to your specific area within the shared residence.

What happens if I need to file a claim for a stolen item, but I don’t have proof of purchase or value?

+In such cases, insurance providers often accept alternative forms of proof, such as photographs, appraisals, or receipts for similar items. It’s a good idea to maintain an inventory of your belongings and their values to simplify the claims process. If you have any concerns, consult your insurance agent or company for guidance on acceptable forms of proof.

Does renters insurance cover my belongings if I’m traveling or storing them elsewhere temporarily?

+Renters insurance typically covers your personal belongings wherever they are, whether you’re on vacation or have them in temporary storage. However, there may be limitations or exclusions for certain high-risk situations or specific types of property. Review your policy carefully or consult your insurer for clarification on coverage during travel or temporary storage.