Burial Expense Insurance

Burial expense insurance, also known as funeral insurance or final expense insurance, is a type of insurance policy designed to cover the costs associated with end-of-life arrangements and burial expenses. It serves as a financial safeguard for individuals and their families, ensuring that the burden of funeral costs is alleviated during an already emotionally challenging time.

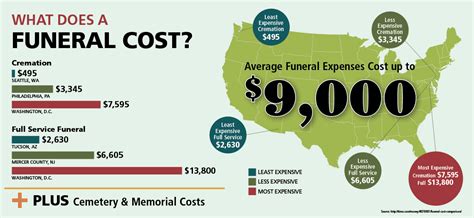

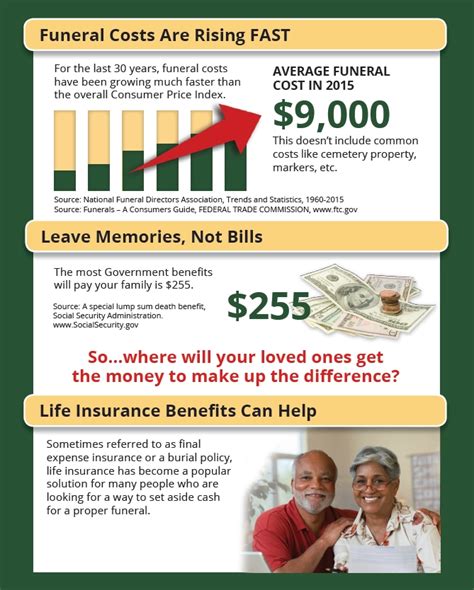

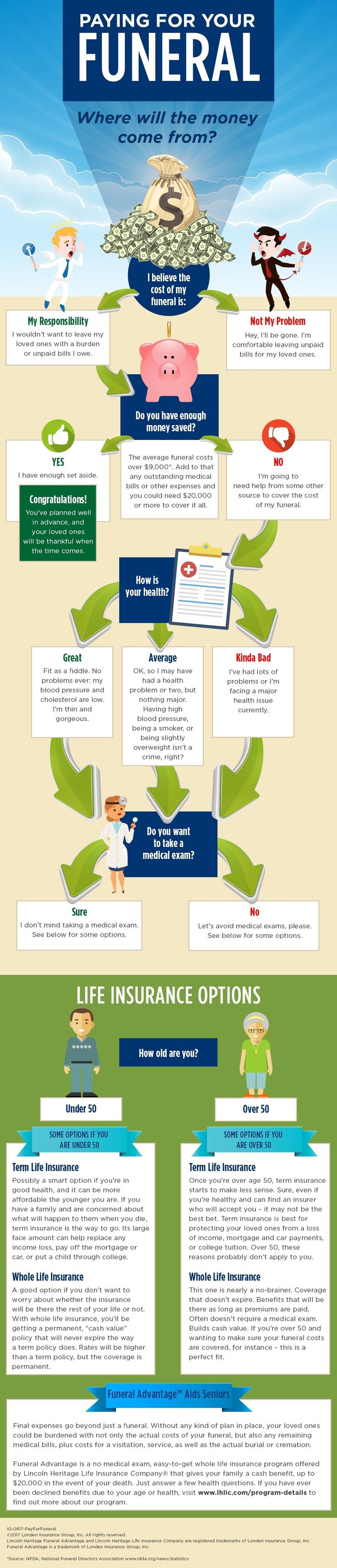

In today's world, where the average cost of a funeral can reach thousands of dollars, this type of insurance has become increasingly relevant. It provides peace of mind, knowing that the legacy left behind will not be burdened by unexpected expenses. This comprehensive guide aims to delve into the intricacies of burial expense insurance, exploring its benefits, coverage options, and the steps involved in obtaining such a policy.

Understanding Burial Expense Insurance

Burial expense insurance is a specialized form of life insurance, tailored to meet the unique needs of end-of-life planning. Unlike traditional life insurance policies that often provide significant sums to beneficiaries, these policies are designed to cover the specific costs associated with funerals and burial arrangements. This can include everything from cemetery fees and caskets to cremation services and obituary notices.

One of the key advantages of burial expense insurance is its accessibility. Many providers offer these policies with simplified application processes, often requiring minimal health assessments. This makes it an ideal option for individuals who may find it challenging to secure traditional life insurance due to age or health conditions. Furthermore, these policies often provide immediate coverage, with benefits payable upon death, ensuring that the insured's wishes are honored without delay.

The Benefits of Burial Expense Insurance

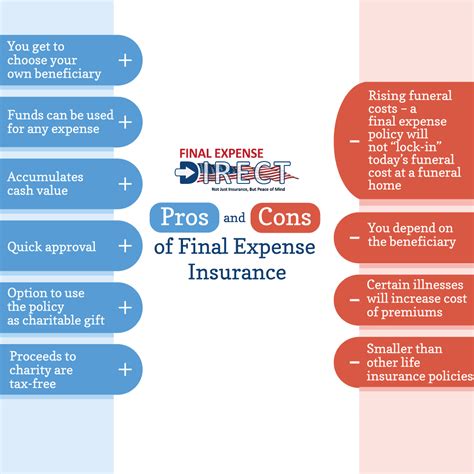

Burial expense insurance offers a multitude of benefits, both to the policyholder and their loved ones.

Financial Security and Peace of Mind

By securing a burial expense insurance policy, individuals can rest assured that their end-of-life wishes will be respected, and their loved ones will not be faced with the financial burden of arranging a funeral. This peace of mind is invaluable, allowing individuals to focus on their health and well-being without the added stress of financial worries.

Customizable Coverage

Burial expense insurance policies are highly customizable. Policyholders can choose coverage amounts that align with their specific needs and budget. This flexibility ensures that individuals can select a plan that adequately covers their anticipated funeral costs without overspending.

Guaranteed Acceptance

Many burial expense insurance policies offer guaranteed acceptance, meaning that individuals are not required to undergo extensive medical examinations or provide detailed health histories. This makes it an attractive option for those who may have pre-existing health conditions or are of advanced age, as it provides an easy and reliable way to secure necessary coverage.

Tax-Free Benefits

The benefits paid out from a burial expense insurance policy are typically tax-free, ensuring that the full amount designated for funeral expenses is available to the beneficiaries. This can provide significant financial relief during an already difficult time.

Coverage Options and Policy Details

Burial expense insurance policies can vary in terms of coverage amounts, payment structures, and additional benefits. It’s essential to understand these variations to choose a policy that aligns with individual needs.

Coverage Amounts

The coverage amount of a burial expense insurance policy refers to the total sum that will be paid out upon the policyholder’s death. This amount should ideally cover all anticipated funeral and burial costs, including cemetery plots, funeral home services, and any other related expenses. It’s important to review and update this amount periodically to account for inflation and changing costs.

| Coverage Category | Average Cost |

|---|---|

| Cemetery Plot | $2,000 - $10,000 |

| Casket or Urn | $1,500 - $5,000 |

| Funeral Home Services | $5,000 - $10,000 |

| Obituary Notices | $200 - $1,000 |

| Transportation | $500 - $2,000 |

| Total Estimated Cost | $9,200 - $28,000 |

Payment Structures

Burial expense insurance policies often offer various payment structures to cater to different financial situations. Some common options include:

- Single Premium: A one-time payment is made upfront, and the policy is fully funded. This is often a popular choice for those who wish to secure immediate coverage without ongoing payments.

- Annual Premium: Policyholders pay an annual premium, typically for a set number of years. This option provides flexibility and can be more affordable for those on a tight budget.

- Monthly Premium: Some policies allow for monthly payments, making it easier to manage financially. However, it's important to consider the long-term cost and ensure that payments can be sustained over time.

Additional Benefits

Many burial expense insurance policies offer additional benefits beyond the standard coverage. These can include:

- Accidental Death Benefit: This benefit provides an additional payout if the policyholder's death is the result of an accident.

- Terminal Illness Benefit: In the event of a terminal illness diagnosis, this benefit allows for a portion of the policy's death benefit to be paid out while the insured is still alive, providing financial assistance during a challenging time.

- Grief Counseling: Some providers offer access to grief counseling services, providing emotional support to beneficiaries during their time of loss.

Obtaining a Burial Expense Insurance Policy

Securing a burial expense insurance policy involves several steps to ensure that the policyholder’s needs are adequately met.

Assessing Individual Needs

The first step is to assess personal needs and preferences. Consider the desired type of funeral and burial arrangements, as well as any specific wishes or traditions that should be honored. This will help determine the appropriate coverage amount and any additional benefits that may be required.

Researching Providers

It’s essential to research and compare different insurance providers to find the best fit. Look for reputable companies with a strong financial standing and positive reviews. Consider factors such as the range of coverage options, flexibility in payment structures, and any additional benefits or services offered.

Reviewing Policy Terms

Once a suitable provider is identified, carefully review the policy terms and conditions. Pay close attention to the coverage amount, any exclusions or limitations, and the renewal or cancellation policies. Ensure that the policy aligns with personal needs and financial capabilities.

Applying for Coverage

The application process for burial expense insurance is generally straightforward. It often involves completing a simple application form, providing basic personal and health information. Some providers may require a brief health assessment, but this is typically less extensive than traditional life insurance applications.

Policy Activation and Maintenance

Once the policy is approved and activated, it’s important to keep it up-to-date. Regularly review the coverage amount to ensure it aligns with current funeral costs and make adjustments as needed. Additionally, keep the policy documentation and beneficiary information readily accessible for easy reference in the event of a claim.

Conclusion

Burial expense insurance is a valuable tool for individuals seeking to ensure their end-of-life wishes are honored and their loved ones are not burdened by unexpected funeral costs. With its accessible application process, customizable coverage, and immediate benefits, it provides a practical solution for financial peace of mind during life’s final chapter.

How much does burial expense insurance typically cost?

+

The cost of burial expense insurance can vary depending on factors such as age, health, coverage amount, and payment structure. On average, a policy with a coverage amount of 10,000 can range from 20 to $100 per month. It’s important to note that policies with guaranteed acceptance may have higher premiums.

Can burial expense insurance be used for any type of funeral arrangement, including cremation?

+

Absolutely! Burial expense insurance is designed to cover a wide range of funeral and burial costs, including cremation services. Policyholders can use the benefits to cover cremation fees, urn costs, and any other related expenses.

Is there an age limit for purchasing burial expense insurance?

+

Most burial expense insurance policies are available to individuals of all ages, including seniors. However, it’s important to note that premiums may increase with age, and some providers may have maximum age limits for new policies.

Can burial expense insurance be combined with other types of life insurance policies?

+

Yes, burial expense insurance can be a complementary addition to other life insurance policies. While traditional life insurance policies often provide larger death benefits, burial expense insurance ensures that specific funeral costs are covered, leaving the remaining life insurance proceeds for other financial needs or legacy purposes.

What happens if the burial expense insurance coverage amount is insufficient to cover all funeral costs?

+

In the event that the burial expense insurance coverage amount falls short of the actual funeral costs, beneficiaries may need to cover the remaining balance. It’s important to review and periodically update the coverage amount to ensure it adequately reflects current funeral expenses.