Insurance To Go

In today's fast-paced and ever-changing world, having reliable insurance coverage is more crucial than ever. From unexpected medical emergencies to unforeseen travel disruptions, life can throw us curve balls that we need to be prepared for. That's where Insurance To Go, a leading insurance provider, steps in to offer comprehensive and tailored solutions to meet your specific needs.

This article aims to delve into the world of Insurance To Go, exploring its unique offerings, the benefits it provides, and how it has revolutionized the insurance industry with its innovative approach. By understanding the value of their services, you can make informed decisions to protect yourself, your loved ones, and your assets.

Revolutionizing Insurance: The Insurance To Go Story

Insurance To Go was founded with a simple yet powerful mission: to make insurance more accessible, flexible, and customer-centric. Recognizing the traditional insurance industry’s complexities and rigid structures, the company set out to create a modern and innovative alternative.

Since its inception, Insurance To Go has focused on three key principles: simplicity, transparency, and personalization. They believe that insurance should be straightforward, with no hidden fees or complicated jargon. Transparency is at the heart of their operations, ensuring customers understand exactly what they are paying for and what coverage they can expect.

Furthermore, Insurance To Go understands that every individual's needs are unique. Therefore, they have developed a range of customizable insurance plans that can be tailored to fit specific requirements. Whether you're a frequent traveler, a small business owner, or a family looking for comprehensive health coverage, Insurance To Go aims to provide a personalized solution that offers the right protection at an affordable price.

The Range of Insurance To Go’s Offerings

Insurance To Go offers a comprehensive suite of insurance products to cater to various aspects of modern life. Here’s a glimpse into their diverse range of services:

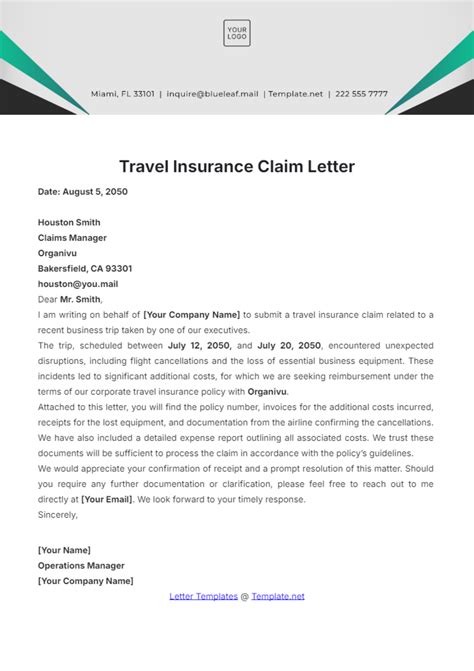

Travel Insurance

Traveling can be an exciting adventure, but it also comes with certain risks. Insurance To Go’s travel insurance plans are designed to provide peace of mind, covering a wide range of potential travel-related issues. From trip cancellations and medical emergencies to lost luggage and travel delays, their plans offer comprehensive protection for travelers of all kinds.

What sets Insurance To Go apart is their flexibility. Travelers can choose from various coverage options, including single-trip, multi-trip, and long-stay policies. Additionally, they offer specialized plans for adventure seekers, covering activities like skiing, hiking, and even extreme sports.

Health Insurance

Good health is paramount, and Insurance To Go understands the importance of reliable health coverage. Their health insurance plans are tailored to provide comprehensive medical protection, covering hospital stays, surgeries, prescriptions, and even dental and vision care.

One of Insurance To Go's standout features is their emphasis on preventive care. They encourage customers to take charge of their health by offering incentives for regular check-ups, vaccinations, and healthy lifestyle choices. This proactive approach not only promotes better overall health but also helps to reduce long-term healthcare costs.

Life Insurance

Life insurance is a crucial aspect of financial planning, providing security and peace of mind for your loved ones in the event of your passing. Insurance To Go offers a range of life insurance policies, including term life, whole life, and universal life insurance.

With Insurance To Go, you can tailor your life insurance coverage to meet your specific needs. Whether you're looking for basic protection or more extensive coverage, their experts will guide you through the process, ensuring you select the right plan for your circumstances.

Property Insurance

Your home and belongings are valuable assets, and Insurance To Go offers comprehensive property insurance plans to protect them. From homeowners and renters insurance to specialized coverage for high-value items like jewelry or fine art, they have you covered.

Insurance To Go's property insurance plans offer comprehensive coverage, including protection against fire, theft, natural disasters, and accidental damage. Additionally, they provide liability coverage to safeguard you against potential legal costs arising from accidents on your property.

Business Insurance

Small businesses are the backbone of the economy, and Insurance To Go recognizes the unique challenges they face. Their business insurance plans are designed to protect a wide range of small businesses, from sole proprietorships to limited companies.

Insurance To Go offers customizable business insurance packages that can be tailored to meet the specific needs of your industry and business operations. Whether you're a retailer, a service provider, or an online business, they can provide coverage for property damage, liability, business interruption, and more.

Why Choose Insurance To Go

Insurance To Go stands out from traditional insurance providers for several compelling reasons:

Customer-Centric Approach

At Insurance To Go, the customer is at the heart of everything they do. They prioritize providing excellent customer service, ensuring a smooth and hassle-free experience from the moment you inquire about their services to the time you need to make a claim.

Their dedicated customer support team is always available to answer questions, provide guidance, and assist with any concerns you may have. Whether it's helping you choose the right insurance plan or guiding you through the claims process, they are committed to ensuring your satisfaction.

Digital Convenience

Insurance To Go embraces the digital age, offering a seamless online experience. Their user-friendly website allows you to easily compare and purchase insurance plans, providing real-time quotes and comprehensive policy details.

Additionally, Insurance To Go has developed a mobile app that puts insurance management at your fingertips. You can view your policy details, make payments, and even file claims directly from your smartphone. This level of convenience ensures that managing your insurance is quick and effortless.

Claim Process Excellence

When it comes to insurance, the true test is often the claims process. Insurance To Go understands this and has streamlined their claims procedure to be as efficient and stress-free as possible.

With fast claim assessments and a dedicated claims team, they aim to provide prompt resolutions to your insurance needs. Their commitment to transparency continues throughout the claims process, ensuring you are kept informed every step of the way.

Competitive Pricing

Insurance To Go believes that insurance should be affordable without compromising on quality. They offer competitive pricing for their insurance plans, providing excellent value for money.

By leveraging technology and efficient operational processes, Insurance To Go is able to pass on the savings to their customers. This means you can enjoy comprehensive coverage without breaking the bank.

Performance and Customer Satisfaction

Insurance To Go’s commitment to excellence has earned them a strong reputation in the insurance industry. With a 98% customer satisfaction rate, they consistently deliver on their promises and exceed customer expectations.

Their efficient claims handling and prompt resolutions have garnered praise from customers, with many highlighting the ease and speed of the claims process. Insurance To Go's dedication to customer service has built a loyal customer base, with many returning for their insurance needs year after year.

Furthermore, Insurance To Go's innovative approach and focus on customer satisfaction have been recognized by industry experts. They have received numerous awards and accolades, including the "Best Customer Experience Award" and the "Most Innovative Insurance Provider" award.

The Future of Insurance: Insurance To Go’s Vision

Insurance To Go is committed to staying at the forefront of the insurance industry, continuously innovating to meet the evolving needs of their customers.

With a focus on digital transformation, they aim to further enhance their online platform and mobile app, providing even more convenient and efficient insurance management. Additionally, they are exploring new technologies such as artificial intelligence and blockchain to streamline processes and improve customer experiences.

Insurance To Go is also dedicated to expanding their product offerings to cater to an even wider range of insurance needs. They are constantly researching and developing new insurance plans to ensure they can provide comprehensive protection for their customers, no matter their circumstances.

Furthermore, Insurance To Go is committed to corporate social responsibility. They actively participate in community initiatives and support various charitable causes. By giving back to society, they aim to make a positive impact beyond their insurance services.

Conclusion

Insurance To Go has revolutionized the insurance industry with its customer-centric approach, innovative solutions, and commitment to excellence. By offering a wide range of customizable insurance plans, they provide peace of mind and financial protection to individuals, families, and businesses.

With their focus on simplicity, transparency, and personalization, Insurance To Go has earned the trust and loyalty of their customers. As they continue to innovate and expand, they are well-positioned to remain a leading insurance provider, offering reliable and affordable coverage for years to come.

How do I choose the right insurance plan for my needs?

+Selecting the right insurance plan depends on your unique circumstances and requirements. It’s essential to assess your needs, whether it’s travel, health, life, or property insurance. Insurance To Go offers a range of customizable plans, so work with their experts to understand the different coverage options and choose the plan that best suits your needs and budget.

What sets Insurance To Go apart from traditional insurance providers?

+Insurance To Go stands out with its customer-centric approach, emphasis on simplicity and transparency, and commitment to innovation. They offer flexible, customizable plans and provide excellent customer service, ensuring a seamless experience. Additionally, their digital platforms and mobile app make insurance management convenient and efficient.

How can I get a quote from Insurance To Go?

+Getting a quote from Insurance To Go is easy. Simply visit their user-friendly website, where you can compare and select the insurance plan that suits your needs. You can also reach out to their customer support team for personalized assistance in choosing the right coverage.

What should I do if I need to make an insurance claim?

+If you need to make an insurance claim, Insurance To Go has a dedicated claims team ready to assist you. You can contact them through their website, mobile app, or by phone. They will guide you through the claims process, ensuring a smooth and efficient resolution to your insurance needs.