Root Insurance

Root Insurance, a prominent name in the world of insurance, has been revolutionizing the industry with its innovative approach and technology-driven solutions. Founded in 2015, Root Insurance aims to disrupt the traditional insurance model by leveraging data and artificial intelligence (AI) to offer personalized and fair coverage to its customers. With a mission to provide affordable and transparent insurance, Root has gained significant traction and recognition, establishing itself as a leading insurtech company.

A Disruptive Force in Insurance: Root’s Journey

Root Insurance’s story began with a simple yet powerful idea: to create an insurance company that treats its customers fairly and provides coverage based on individual driving behavior rather than generalized profiles. The company’s founders, including Dan Mastrogiovanni, Alex Timm, and Jordan Griggs, recognized the inefficiencies and biases inherent in the traditional insurance system and set out to build a better alternative.

Root's journey has been marked by rapid growth and a series of notable achievements. The company has raised substantial funding, securing investments from prominent venture capital firms and securing partnerships with established insurance carriers. This capital infusion has enabled Root to invest heavily in research and development, further refining its AI-powered underwriting and pricing models.

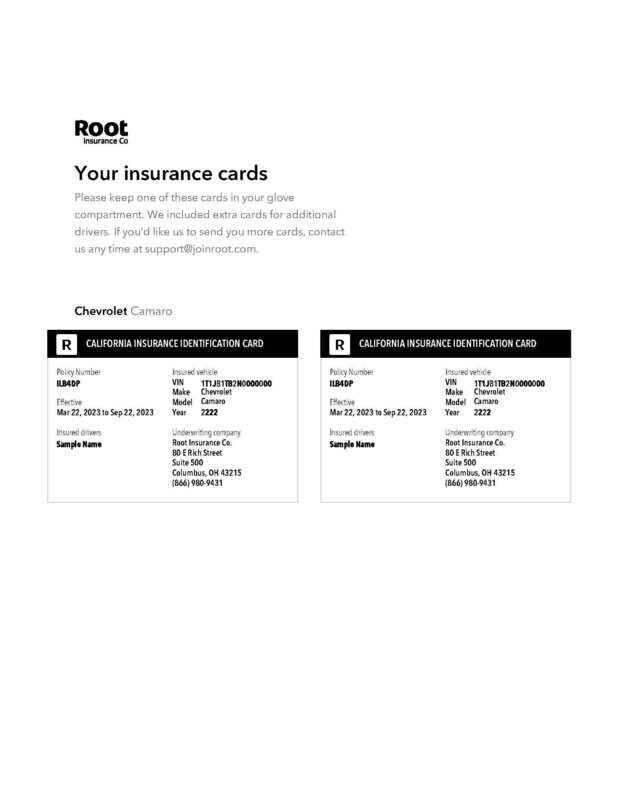

One of Root's key differentiators is its mobile app, which serves as the primary interface for customers. Through this app, Root offers a seamless and intuitive experience, allowing users to obtain quotes, purchase policies, and manage their insurance needs effortlessly. The app's design and functionality have garnered praise for their user-friendliness, contributing to Root's success in attracting and retaining customers.

Root’s Unique Value Proposition: Personalized Insurance

At the heart of Root Insurance’s innovation lies its commitment to personalized insurance. Unlike traditional insurance providers, Root does not rely solely on demographic factors and historical data to determine rates. Instead, it utilizes a combination of advanced data analytics and AI to assess individual driving behavior and risk profiles.

Root's underwriting process begins with a test drive period, during which prospective customers are asked to download the Root app and complete a short driving test. This test, conducted over a period of approximately two weeks, collects data on various driving behaviors, including acceleration, braking, and cornering. By analyzing this data, Root's algorithms can generate a comprehensive risk assessment, allowing the company to offer highly tailored insurance quotes.

This personalized approach has proven to be a game-changer, especially for safe drivers who have historically been grouped with higher-risk individuals, resulting in inflated insurance premiums. With Root, these drivers can now access coverage that accurately reflects their safe driving habits, often leading to significant savings.

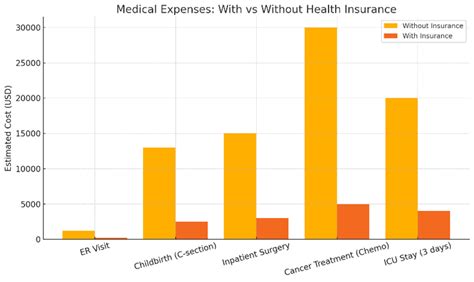

| Insurance Type | Average Savings |

|---|---|

| Auto Insurance | $400 annually |

| Home Insurance | $250 annually |

Expanding Horizons: Root’s Product Portfolio

While Root Insurance initially focused on auto insurance, its success and the positive reception from customers have prompted the company to expand its product offerings. Recognizing the interconnected nature of insurance needs, Root has diversified its portfolio to include a range of coverage options, aiming to become a comprehensive insurance provider for its customers.

Auto Insurance: The Foundation of Root’s Success

Root’s auto insurance product remains the cornerstone of its business. By leveraging its AI-powered underwriting system, Root offers competitive rates and comprehensive coverage, catering to a wide range of drivers. Whether you’re a cautious commuter or a frequent traveler, Root’s personalized quotes ensure that you receive fair and affordable insurance.

Root's auto insurance policies include standard coverage options such as liability, collision, and comprehensive coverage. Additionally, the company provides various add-ons and endorsements to tailor policies to individual needs. These include rental car coverage, roadside assistance, and gap insurance, ensuring that drivers have the protection they require without paying for unnecessary extras.

Home Insurance: Extending Protection Beyond the Road

In a strategic move to diversify its product range, Root Insurance introduced home insurance, allowing customers to bundle their auto and home policies for added convenience and potential savings. This expansion demonstrates Root’s commitment to understanding and meeting the evolving insurance needs of its customers.

Root's home insurance policies provide coverage for a range of dwelling types, including single-family homes, condominiums, and mobile homes. The policies offer protection against perils such as fire, theft, and vandalism, as well as liability coverage for injuries sustained by guests on the insured property. Additionally, Root's home insurance includes personal property coverage, ensuring that customers' belongings are safeguarded.

Renters Insurance: Protecting Tenants’ Peace of Mind

Understanding the unique needs of renters, Root Insurance also offers renters insurance, a crucial form of coverage often overlooked by tenants. Renters insurance provides protection for personal belongings and liability coverage, offering peace of mind to those who rent their living spaces.

Root's renters insurance policies typically include coverage for personal property, such as furniture, electronics, and clothing, against damage or loss due to perils like fire, theft, or vandalism. Additionally, the policies provide liability coverage, protecting renters from financial liability in the event that a guest is injured on their rented premises.

Root’s Technological Edge: AI and Data Analytics

Root Insurance’s success can be attributed in large part to its embrace of technology and its innovative use of AI and data analytics. By harnessing the power of these tools, Root has been able to streamline its operations, enhance customer experiences, and offer highly competitive insurance products.

AI-Powered Underwriting: Precision and Efficiency

At the core of Root’s underwriting process is its AI-powered system, which analyzes vast amounts of data to assess individual risk profiles. This system, developed by Root’s team of data scientists and machine learning experts, is trained on a diverse dataset, ensuring accurate and unbiased assessments.

The AI algorithm considers a multitude of factors, including driving behavior, vehicle type, geographical location, and historical claims data. By processing this information, the system generates a comprehensive risk score, allowing Root to offer personalized quotes that accurately reflect the customer's unique circumstances. This precision in underwriting not only benefits customers but also reduces the likelihood of adverse selection, a common challenge in the insurance industry.

Data-Driven Claims Management: Streamlining the Process

Root’s commitment to technology extends beyond underwriting to the claims management process. The company utilizes data analytics and digital tools to streamline the claims journey, ensuring that customers receive prompt and efficient service.

When a customer files a claim, Root's system analyzes the details and assigns a priority level based on the severity and complexity of the claim. This automated prioritization enables the company to allocate resources efficiently, ensuring that urgent claims are addressed promptly. Additionally, Root leverages digital tools such as photo and video documentation, allowing customers to provide evidence of damage or loss, further expediting the claims process.

Root’s Customer-Centric Approach: A Focus on Transparency

Root Insurance has made customer satisfaction and transparency key pillars of its business strategy. The company recognizes that insurance can be complex and often confusing, and it aims to demystify the process by providing clear and concise information to its customers.

Transparent Pricing and Coverage: Building Trust

Root’s approach to pricing and coverage is rooted in transparency. The company provides clear explanations of its underwriting process and the factors that influence insurance rates. By doing so, Root empowers customers to understand how their premiums are calculated, fostering trust and confidence in the company’s offerings.

Furthermore, Root's policies are designed with simplicity in mind. The company avoids complex jargon and provides straightforward explanations of coverage limits and exclusions. This commitment to transparency extends to the claims process as well, with Root offering clear guidelines and timelines for claim settlement, ensuring that customers are well-informed throughout the journey.

Personalized Customer Support: Going the Extra Mile

Root Insurance understands that insurance is not a one-size-fits-all proposition, and its customer support reflects this philosophy. The company offers personalized assistance, ensuring that customers receive tailored guidance based on their unique circumstances.

Root's customer support team is readily accessible through various channels, including phone, email, and live chat. The team is trained to provide accurate and timely information, addressing customer inquiries and concerns efficiently. Additionally, Root's support staff is equipped with the tools and knowledge to assist customers in navigating the often-complex world of insurance, ensuring a positive and stress-free experience.

The Future of Insurance: Root’s Vision and Impact

As Root Insurance continues to innovate and expand its reach, its impact on the insurance industry becomes increasingly evident. The company’s success has not only challenged traditional insurance models but has also inspired a new wave of insurtech startups, pushing the industry towards greater digitization and customer-centricity.

Driving Industry Evolution: The Insurtech Revolution

Root’s disruptive approach has sparked a revolution within the insurance industry, prompting established carriers to reevaluate their business models and embrace technological advancements. The success of Root and other insurtech companies has highlighted the importance of data-driven decision-making and customer-centric strategies, shaping the future of insurance.

By leveraging technology to enhance efficiency and personalize coverage, Root has demonstrated that insurance can be both innovative and fair. This paradigm shift has the potential to benefit not only Root's customers but also the broader insurance market, as carriers adopt more transparent and customer-friendly practices.

Expanding Access and Affordability: Root’s Social Impact

Root Insurance’s mission to provide affordable and accessible insurance has a profound social impact. By offering personalized rates based on individual driving behavior, Root has opened up opportunities for individuals who may have previously struggled to obtain affordable coverage. This includes young drivers, who are often burdened with high insurance premiums due to their lack of driving experience.

Additionally, Root's focus on transparency and customer education empowers individuals to make informed decisions about their insurance needs. By providing clear and concise information, Root enables customers to choose coverage that aligns with their unique circumstances, ensuring they receive the protection they require without unnecessary financial burden.

Conclusion: Embracing the Future of Insurance

Root Insurance stands as a testament to the power of innovation and technology in the insurance industry. Through its personalized approach, data-driven strategies, and customer-centric philosophy, Root has not only disrupted the traditional insurance model but has also set a new standard for fairness and accessibility.

As the company continues to expand its product portfolio and refine its offerings, it is poised to play a pivotal role in shaping the future of insurance. With its commitment to innovation and customer satisfaction, Root is well-positioned to lead the industry into a new era of transparency, efficiency, and personalized coverage.

How does Root Insurance determine insurance rates?

+Root Insurance utilizes AI-powered underwriting to assess individual driving behavior and risk profiles. This process includes a test drive period where prospective customers complete a short driving test, allowing Root’s algorithms to generate a comprehensive risk assessment. Based on this assessment, Root offers personalized insurance quotes.

What types of insurance does Root Insurance offer?

+Root Insurance primarily offers auto insurance, which forms the foundation of its business. However, the company has expanded its portfolio to include home insurance and renters insurance, allowing customers to bundle their policies for added convenience and potential savings.

How does Root Insurance ensure customer privacy and data security?

+Root Insurance prioritizes customer privacy and data security. The company employs robust data encryption and security measures to protect customer information. Additionally, Root adheres to strict data privacy regulations, ensuring that customer data is used ethically and securely.