Catastrophic Coverage Health Insurance

Catastrophic Coverage Health Insurance: Understanding the Essential Benefits and Peace of Mind

Health insurance is a vital aspect of modern life, providing individuals and families with financial protection and access to essential healthcare services. While there are various types of health insurance plans available, catastrophic coverage health insurance stands out as a unique and crucial option, offering a safety net for those facing unforeseen medical emergencies. In this comprehensive article, we delve into the world of catastrophic coverage health insurance, exploring its features, benefits, and the peace of mind it provides to policyholders.

The Purpose of Catastrophic Coverage Health Insurance

Catastrophic coverage health insurance, often referred to as high-deductible health plans (HDHPs), is designed to protect individuals from the financial burden of unexpected and costly medical events. Unlike traditional health insurance plans that typically cover a broader range of services and have lower out-of-pocket costs, catastrophic coverage plans focus on providing substantial financial assistance for major medical incidents.

The primary objective of catastrophic coverage is to offer a safety net for individuals who may not have the means to afford extensive medical care without significant financial strain. By doing so, these plans ensure that individuals have access to necessary medical treatments and procedures when they need them most, without being deterred by the fear of overwhelming medical bills.

Key Features and Benefits of Catastrophic Coverage

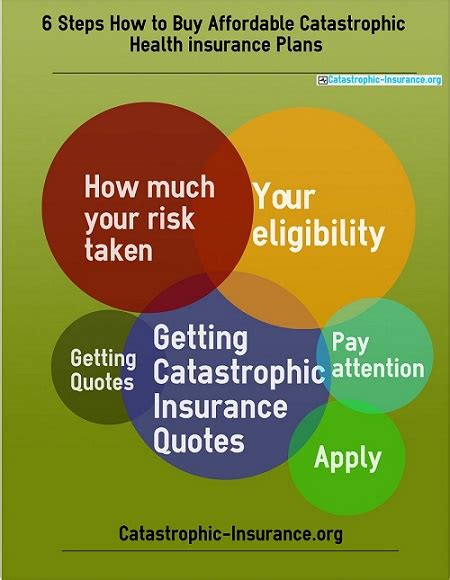

Catastrophic coverage health insurance plans come with a set of distinct features and benefits that make them an attractive option for certain individuals and families. Here’s a closer look at some of the key advantages:

High Deductibles and Lower Premiums

One of the defining characteristics of catastrophic coverage plans is their high deductibles. A deductible is the amount an individual must pay out of pocket before the insurance coverage kicks in. Catastrophic plans typically have deductibles ranging from several thousand dollars to over $10,000. While this may seem daunting, it leads to significantly lower monthly premiums compared to traditional health insurance plans.

For individuals who are generally healthy and have few medical needs, the lower premiums can be a more affordable option, allowing them to save money while still being prepared for unforeseen medical emergencies.

Comprehensive Coverage for Major Medical Events

Despite the high deductibles, catastrophic coverage plans provide comprehensive coverage once the deductible is met. This means that once an individual reaches their deductible threshold, the insurance plan covers a wide range of essential healthcare services, including hospitalization, emergency care, intensive care, and major surgeries. These plans are designed to handle the most costly and critical medical situations, offering peace of mind during challenging times.

Preventive Care and Wellness Services

Catastrophic coverage health insurance plans recognize the importance of preventive care and wellness. As such, many plans offer coverage for certain preventive services, such as annual physical exams, immunizations, and screenings, without requiring individuals to meet their deductible first. This encourages individuals to stay proactive about their health and catch potential issues early on.

Flexibility and Cost-Effective Care

Catastrophic coverage plans provide policyholders with flexibility in their healthcare choices. With a high deductible, individuals have the freedom to choose their healthcare providers and facilities, allowing them to explore cost-effective options and negotiate prices if needed. This flexibility can be particularly beneficial for those who value control over their healthcare decisions.

Who Benefits from Catastrophic Coverage Health Insurance?

Catastrophic coverage health insurance is particularly suitable for specific groups of individuals and families. Here are some scenarios where this type of insurance plan can be advantageous:

- Young and Healthy Individuals: Those who are in good health and have minimal medical needs can benefit from the lower premiums offered by catastrophic coverage plans. By opting for a high-deductible plan, they can save money while still being protected in the event of a major medical emergency.

- Families with Limited Healthcare Needs: Families who have relatively few medical expenses throughout the year may find catastrophic coverage plans more cost-effective. By selecting a plan with a higher deductible, they can allocate their healthcare budget more efficiently and save on monthly premiums.

- Individuals with High Deductible Health Savings Accounts (HSAs): Catastrophic coverage plans often pair well with HSAs, which allow individuals to save money tax-free for medical expenses. HSAs can be used to cover out-of-pocket costs, including deductibles and copayments, providing a valuable financial tool for managing healthcare expenses.

- Self-Employed Individuals: Self-employed individuals often have more flexibility in choosing their health insurance plans. Catastrophic coverage plans can be an attractive option for them, as they offer cost savings and the ability to allocate their healthcare budget strategically.

Performance Analysis and Real-World Examples

To illustrate the impact and effectiveness of catastrophic coverage health insurance, let’s examine a few real-world scenarios and analyze how these plans have benefited individuals:

Scenario 1: Unexpected Surgery

Imagine a young professional named Sarah, who leads an active lifestyle and has minimal healthcare needs. She opts for a catastrophic coverage plan with a high deductible of 8,000 and a monthly premium of 150. One day, Sarah injures herself while hiking and requires an emergency surgery with a total cost of 30,000. Thanks to her insurance plan, she only needs to pay the 8,000 deductible, saving a significant amount compared to traditional plans with higher premiums and lower deductibles.

Scenario 2: Family’s Peace of Mind

The Smith family, consisting of two parents and two children, chooses a catastrophic coverage plan with a 10,000 family deductible and a monthly premium of 250. Throughout the year, the family only incurs minor medical expenses, such as routine check-ups and prescriptions. With the savings from the lower premiums, they can allocate their budget for other family needs. Additionally, the peace of mind that comes with knowing they are prepared for any major medical emergencies is invaluable.

Scenario 3: Utilizing HSAs

John, a self-employed individual, opens an HSA alongside his catastrophic coverage plan. Throughout the year, he contributes to his HSA and uses the funds to cover his deductible and various medical expenses. This strategic approach allows him to manage his healthcare costs effectively and save on taxes. When he faces a medical emergency, such as a severe injury requiring hospitalization, his insurance plan covers the remaining costs, ensuring he doesn’t face financial hardship.

Comparative Analysis: Catastrophic Coverage vs. Traditional Plans

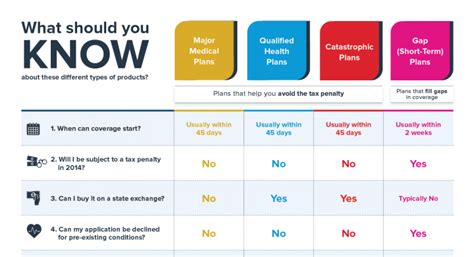

To further understand the value of catastrophic coverage health insurance, let’s compare it with traditional health insurance plans:

| Aspect | Catastrophic Coverage | Traditional Plans |

|---|---|---|

| Deductibles | High deductibles, often ranging from several thousand to over $10,000 | Lower deductibles, typically under $2,000 |

| Premiums | Lower monthly premiums | Higher monthly premiums |

| Coverage for Major Medical Events | Comprehensive coverage after the deductible is met | Cover a broader range of services, including preventive care |

| Flexibility | Flexibility in choosing healthcare providers and facilities | May have limited provider networks |

| Cost-Effectiveness | Suitable for individuals with minimal healthcare needs | More cost-effective for individuals with frequent medical needs |

While traditional health insurance plans offer a broader range of services and lower out-of-pocket costs, catastrophic coverage plans provide a cost-effective alternative for those who are generally healthy and want to save on premiums. It's important to carefully assess one's healthcare needs and financial situation when choosing between these options.

Future Implications and Industry Insights

Catastrophic coverage health insurance has gained traction in recent years, and its importance is likely to continue growing. As healthcare costs rise, individuals are increasingly seeking affordable options without compromising their financial security. Here are some key future implications and industry insights:

- Increased Demand: With rising healthcare expenses, more individuals are expected to opt for catastrophic coverage plans to manage their healthcare costs effectively.

- Enhanced Preventive Care: Insurance providers are likely to emphasize the importance of preventive care within catastrophic coverage plans, encouraging policyholders to take a proactive approach to their health.

- Integration with Digital Health Solutions: As digital health technologies advance, insurance companies may integrate these solutions into catastrophic coverage plans, offering remote monitoring, virtual consultations, and personalized health management tools.

- Focus on Value-Based Care: The industry is shifting towards value-based care models, where healthcare providers are incentivized to deliver high-quality, cost-effective care. Catastrophic coverage plans may play a role in promoting this shift by rewarding providers who deliver efficient and effective treatments.

Conclusion

Catastrophic coverage health insurance offers a vital safety net for individuals and families, providing peace of mind and financial protection in the face of unforeseen medical emergencies. With its unique features, including high deductibles and lower premiums, this type of insurance plan serves as a cost-effective solution for those who are generally healthy and have limited medical needs. As we navigate the complexities of healthcare, understanding the benefits and implications of catastrophic coverage is essential for making informed decisions about our health and financial well-being.

Frequently Asked Questions

Can I use a catastrophic coverage plan as my primary health insurance?

+

Yes, catastrophic coverage plans can serve as your primary health insurance. They provide comprehensive coverage for major medical events, ensuring you have access to necessary treatments. However, it’s important to consider your individual healthcare needs and financial situation when choosing a plan.

How do I know if a catastrophic coverage plan is suitable for me?

+

Catastrophic coverage plans are ideal for individuals who are generally healthy and have minimal medical needs. If you rarely require medical services and can afford the high deductible, a catastrophic plan can offer significant cost savings. However, if you anticipate frequent medical expenses, a traditional health insurance plan may be more suitable.

Can I combine a catastrophic coverage plan with other insurance options?

+

Yes, you can combine a catastrophic coverage plan with other insurance options to enhance your coverage. For example, you can pair it with a Health Savings Account (HSA) to save money tax-free for medical expenses. Additionally, you may consider supplemental insurance plans to cover specific needs, such as dental or vision care.

Are there any age restrictions for catastrophic coverage plans?

+

Catastrophic coverage plans are generally available to individuals of all ages. However, the specific terms and conditions may vary based on your age and the insurance provider. It’s important to review the plan details and consult with an insurance professional to ensure you understand the coverage and any potential age-related considerations.

What happens if I reach my deductible and still require medical care?

+

Once you reach your deductible, your catastrophic coverage plan will provide comprehensive coverage for the remaining medical expenses. The plan will cover a wide range of essential healthcare services, including hospitalization, emergency care, and major surgeries. However, it’s important to review your plan’s specific coverage details to understand any potential limitations or exclusions.