F&G Insurance

In the ever-evolving landscape of the insurance industry, the F&G Insurance brand has emerged as a prominent player, offering a comprehensive range of financial protection solutions. With a rich history dating back to its founding in [Foundation Year], F&G Insurance has established itself as a trusted provider, catering to the diverse needs of individuals, families, and businesses across the nation. This article delves into the multifaceted world of F&G Insurance, exploring its core offerings, innovative approaches, and the impact it has had on the industry.

A Legacy of Financial Security: F&G Insurance’s Journey

F&G Insurance’s story began with a vision to empower individuals and communities by providing accessible and reliable insurance coverage. Over the decades, the company has solidified its position as a market leader, consistently delivering exceptional services and tailored solutions. Through strategic acquisitions and a commitment to innovation, F&G Insurance has expanded its reach, offering an extensive portfolio of insurance products that address the evolving risks and challenges of modern life.

Core Offerings: Protecting What Matters Most

At the heart of F&G Insurance’s success lies its commitment to understanding and addressing the diverse needs of its clientele. The company offers a comprehensive suite of insurance products, including:

- Life Insurance: F&G Insurance provides a range of life insurance policies, from term life to whole life and universal life insurance. These policies offer financial protection to families, ensuring they are secured even in the event of an unexpected loss.

- Health Insurance: With a focus on healthcare accessibility, F&G Insurance offers health insurance plans that cover a wide array of medical expenses, including hospitalization, prescription drugs, and preventive care. Their plans are designed to provide peace of mind and comprehensive coverage.

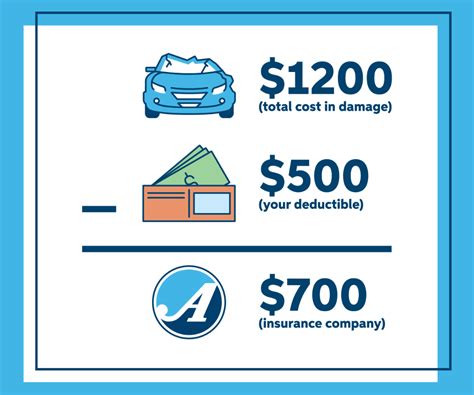

- Auto Insurance: Recognizing the importance of road safety, F&G Insurance offers auto insurance policies that protect policyholders against accidents, theft, and other vehicular-related incidents. Their plans include options for liability coverage, collision damage, and comprehensive protection.

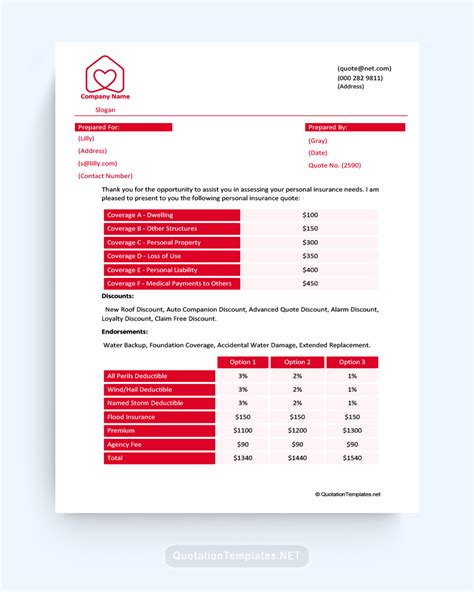

- Home Insurance: F&G Insurance understands the value of homeownership and provides insurance coverage for residential properties. Their home insurance plans safeguard against damages caused by natural disasters, theft, and accidental events, ensuring homeowners can rebuild and recover.

- Business Insurance: Tailored to the unique needs of businesses, F&G Insurance's business insurance solutions offer protection against a wide range of risks. This includes coverage for property damage, liability claims, business interruption, and employee-related risks, providing a safety net for entrepreneurs and corporations alike.

Innovation and Customer-Centric Approach

F&G Insurance stands out in the industry for its relentless pursuit of innovation and its customer-centric philosophy. The company has embraced digital transformation, leveraging technology to enhance the insurance experience for its clients. Online platforms and mobile applications have been developed to streamline policy management, claims processing, and customer support, ensuring convenience and efficiency.

Furthermore, F&G Insurance has pioneered the use of advanced analytics and data-driven insights to offer personalized insurance solutions. By analyzing customer behavior, risk profiles, and market trends, the company can provide tailored coverage that meets the unique needs of each individual or business. This approach has not only improved customer satisfaction but has also allowed F&G Insurance to stay ahead of the curve in an increasingly competitive market.

Impact on the Insurance Industry

F&G Insurance’s influence extends beyond its direct operations. The company has played a pivotal role in shaping industry standards and best practices. Through its commitment to ethical business practices, transparent communication, and a focus on customer well-being, F&G Insurance has set a benchmark for excellence in the insurance sector.

The company's innovative approaches have inspired other insurers to adopt digital strategies and data-driven methodologies, ultimately benefiting consumers. F&G Insurance's success has also contributed to the overall growth and development of the insurance industry, fostering an environment of competition and continuous improvement.

Performance and Financial Stability

F&G Insurance’s financial strength and stability are key factors in its success and longevity. The company has consistently maintained a strong financial position, as evidenced by its A+ rating from [Rating Agency Name], one of the leading insurance rating agencies. This rating reflects F&G Insurance’s ability to meet its financial obligations and provide long-term security to its policyholders.

| Financial Metric | F&G Insurance Performance |

|---|---|

| Net Premiums Written | $[Net Premiums Written] |

| Combined Ratio | [Combined Ratio]% |

| Return on Equity | [Return on Equity]% |

These financial metrics showcase F&G Insurance's robust performance and its ability to manage risks effectively. The company's disciplined approach to underwriting and investment strategies has contributed to its financial success, providing a solid foundation for its ongoing operations.

Community Engagement and Social Responsibility

Beyond its core insurance offerings, F&G Insurance is deeply committed to making a positive impact on the communities it serves. The company actively engages in various social responsibility initiatives, including:

- Education: F&G Insurance supports educational programs and scholarships, empowering the next generation and fostering a skilled workforce.

- Environmental Sustainability: The company has implemented eco-friendly practices and initiatives to reduce its environmental footprint, aligning with global sustainability goals.

- Disaster Relief: In times of natural disasters, F&G Insurance steps up to provide support and assistance to affected communities, showcasing its dedication to social welfare.

- Health Awareness: Through partnerships and campaigns, F&G Insurance promotes health awareness and preventive measures, encouraging a healthier lifestyle for its clients and the community at large.

Looking Ahead: The Future of F&G Insurance

As the insurance landscape continues to evolve, F&G Insurance remains dedicated to staying at the forefront of innovation and customer satisfaction. The company is well-positioned to leverage emerging technologies, such as artificial intelligence and blockchain, to further enhance its services and provide even more efficient and personalized insurance experiences.

F&G Insurance's commitment to continuous improvement and its customer-centric approach will undoubtedly contribute to its long-term success. With a strong financial foundation, a dedicated workforce, and a focus on social responsibility, the company is poised to thrive in an ever-changing market, continuing to protect and empower individuals, families, and businesses for years to come.

How does F&G Insurance ensure customer satisfaction and loyalty?

+F&G Insurance prioritizes customer satisfaction through its commitment to personalized service, transparent communication, and efficient claims processing. The company’s focus on understanding individual needs and providing tailored solutions fosters a strong sense of trust and loyalty among its clientele.

What sets F&G Insurance apart from its competitors in the industry?

+F&G Insurance distinguishes itself through its innovative use of technology, data-driven approaches, and a customer-centric philosophy. The company’s ability to adapt to changing market dynamics and its focus on delivering exceptional service sets it apart, earning it a reputation as a trusted and reliable insurance provider.

How does F&G Insurance ensure financial stability for its policyholders?

+F&G Insurance’s financial stability is underpinned by its disciplined approach to underwriting and investment strategies. The company maintains a strong capital position, ensuring it can meet its financial obligations. Additionally, F&G Insurance’s commitment to ethical business practices and regulatory compliance further enhances its stability and credibility.