Texas Car Insurance

Texas is a large and diverse state, and its car insurance landscape reflects this diversity. From bustling cities like Houston and Dallas to the vast rural areas, Texans have unique needs when it comes to auto insurance. This article aims to delve into the world of Texas car insurance, exploring the various aspects that make it distinct and providing valuable insights for drivers in the Lone Star State.

Understanding Texas Car Insurance: A Comprehensive Guide

Texas is known for its independent spirit, and this extends to the world of car insurance. With a large number of insurance providers offering a wide range of coverage options, it can be challenging for drivers to navigate the market and find the best policy for their needs. In this section, we’ll break down the essential components of Texas car insurance, offering a comprehensive guide to help you make informed decisions.

Minimum Requirements and Coverage Options

Texas has specific legal requirements for car insurance, which serve as the foundation for all policies in the state. The minimum coverage mandated by law includes:

- Liability Coverage: This covers bodily injury and property damage caused to others in an accident you’re at fault for. The minimum limits in Texas are 30,000 per person, 60,000 per accident for bodily injury, and 25,000 for property damage.</li> <br> <li><strong>Personal Injury Protection (PIP)</strong>: Texas requires drivers to carry 2,500 in PIP coverage. This pays for medical expenses and lost wages for you and your passengers, regardless of fault.

However, many drivers opt for coverage beyond the state minimums to ensure they're adequately protected. Here are some common additional coverage options:

- Collision Coverage: This pays for repairs to your vehicle after an accident, regardless of fault. It's particularly useful if you have a newer or more valuable car.

- Comprehensive Coverage: This covers damages caused by events other than accidents, such as theft, vandalism, weather damage, or hitting an animal. It's often required if you have a loan or lease on your vehicle.

- Uninsured/Underinsured Motorist Coverage: In Texas, it's not uncommon to encounter drivers without insurance. This coverage protects you if you're in an accident with an uninsured or underinsured driver.

It's important to carefully consider your coverage options based on your specific needs and the value of your vehicle. While adding more coverage can increase your premium, it may provide crucial protection in the event of an accident.

Factors Affecting Insurance Premiums

Insurance premiums in Texas can vary significantly based on several factors. Understanding these factors can help you anticipate and potentially mitigate the costs of your car insurance.

- Location: Urban areas like Houston and Dallas tend to have higher insurance rates due to factors like higher population density, increased traffic, and a higher likelihood of accidents and theft.

- Age and Driving Experience: Younger drivers, particularly those under 25, often face higher premiums due to their relative inexperience. As drivers gain more years of experience, their premiums may decrease.

- Vehicle Type: The make, model, and year of your vehicle play a significant role in determining your premium. Sports cars and luxury vehicles, for example, are often more expensive to insure due to their higher repair costs.

- Driving Record: A clean driving record with no accidents or violations can lead to lower premiums. On the other hand, a history of accidents or traffic violations may result in higher rates.

- Credit Score: Believe it or not, your credit score can impact your insurance premium. Many insurance companies use credit-based insurance scores to assess the risk of insuring a driver. A higher credit score may result in lower premiums.

By being aware of these factors and taking steps to improve them (e.g., maintaining a clean driving record, improving your credit score), you can potentially reduce your insurance costs over time.

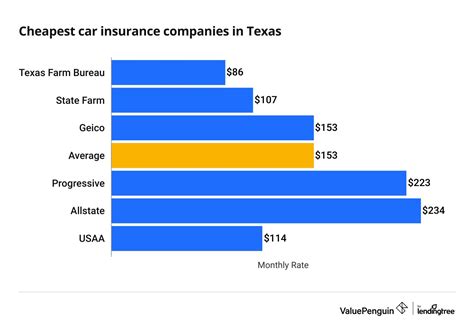

Choosing the Right Insurance Provider

With a plethora of insurance providers in Texas, choosing the right one can be a daunting task. Here are some key considerations to help you make an informed decision:

- Coverage Options and Customization: Look for an insurer that offers a wide range of coverage options and allows you to customize your policy to fit your specific needs. This ensures you’re not paying for coverage you don’t need.

- Competitive Rates: Compare quotes from multiple providers to ensure you’re getting a competitive rate. Online quote comparison tools can be particularly useful for this purpose.

- Claims Process and Customer Service: Read reviews and check ratings to assess the insurer’s reputation for handling claims and providing customer service. A smooth claims process and responsive customer service can make a significant difference in the event of an accident.

- Discounts and Rewards: Many insurers offer discounts for various reasons, such as good driving records, loyalty, bundling policies, or even safe driving habits. Look for insurers that provide discounts relevant to your situation.

Real-World Examples: Texas Car Insurance in Action

To bring these concepts to life, let’s look at some real-world scenarios and how Texas car insurance can play a crucial role in protecting drivers.

Case Study: Urban vs. Rural Insurance Premiums

Imagine two drivers, both 35 years old with clean driving records, but one lives in Houston and the other in a rural town in West Texas. Despite having similar profiles, their insurance premiums can differ significantly due to location-based factors.

| Location | Insurance Premium |

|---|---|

| Houston | 1,200 annually</td> </tr> <tr> <td>Rural West Texas</td> <td>850 annually |

The higher premium in Houston reflects the increased risks associated with urban driving, including heavier traffic, higher rates of accidents, and a greater likelihood of theft or vandalism.

Case Study: Understanding Coverage Options

Consider a driver who recently purchased a new sports car. While the state minimum insurance coverage would provide some protection, it might not be sufficient in the event of an accident. Here’s a breakdown of the coverage options this driver might consider:

- Collision Coverage: Given the higher repair costs associated with sports cars, collision coverage is essential. It ensures that the driver’s car can be repaired or replaced if damaged in an accident, regardless of fault.

- Comprehensive Coverage: With a new vehicle, comprehensive coverage is also crucial. It provides protection against theft, vandalism, and natural disasters, which can be particularly beneficial in areas prone to hurricanes or tornadoes.

- Uninsured/Underinsured Motorist Coverage: In Texas, this coverage is especially important due to the state’s relatively high rate of uninsured drivers. It ensures that the driver is protected if they’re involved in an accident with an uninsured or underinsured motorist.

Future Implications and Industry Trends

The world of Texas car insurance is constantly evolving, influenced by technological advancements, regulatory changes, and shifting consumer preferences. Here’s a glimpse into the future of Texas car insurance and some key trends to watch.

The Rise of Telematics and Usage-Based Insurance

Telematics refers to the use of technology to track and analyze driving behavior. Usage-based insurance, also known as pay-as-you-drive insurance, is an emerging trend that utilizes telematics to offer insurance premiums based on actual driving habits and mileage.

In Texas, this trend is gaining traction, with several insurers now offering usage-based insurance plans. These plans can be particularly beneficial for drivers with safe driving habits, as they allow them to save on insurance premiums by demonstrating their responsible driving behavior.

Regulatory Changes and Their Impact

Texas is known for its relatively lenient regulations when it comes to car insurance. However, this could change in the future, particularly with the increasing focus on road safety and consumer protection.

Potential regulatory changes could include:

- Stricter requirements for minimum insurance coverage, ensuring that drivers are better protected in the event of an accident.

- Implementation of new laws to combat uninsured driving, which is a significant issue in Texas.

- Changes to rating factors, particularly those related to credit scores, to ensure that insurance premiums are fair and not disproportionately affecting certain demographics.

The Role of Technology in Insurance

Technology is revolutionizing the insurance industry, and Texas is no exception. Here are some ways technology is shaping the future of car insurance in the state:

- Digital Claims Processing: Insurers are increasingly leveraging technology to streamline the claims process, making it faster and more efficient for policyholders.

- AI and Machine Learning: These technologies are being used to analyze vast amounts of data, helping insurers identify trends and make more accurate risk assessments.

- Mobile Apps: Many insurance providers now offer mobile apps that allow policyholders to manage their policies, file claims, and access policy information on the go.

Frequently Asked Questions (FAQ)

What are the penalties for driving without insurance in Texas?

+Driving without insurance in Texas can result in significant penalties, including a fine of up to $350 for a first offense and suspension of your driver’s license and vehicle registration. Repeat offenders may face even steeper fines and longer license suspensions.

Can I get car insurance if I have a poor driving record in Texas?

+Yes, even with a poor driving record, you can still obtain car insurance in Texas. However, your premiums are likely to be higher, reflecting the increased risk associated with your driving history. Some insurers specialize in providing coverage for high-risk drivers.

Are there any discounts available for Texas car insurance?

+Absolutely! Many insurance providers in Texas offer a variety of discounts to policyholders. Common discounts include those for good driving records, safe vehicle features, multi-policy bundles, and even loyalty discounts for long-term customers.

How often should I review and update my car insurance policy in Texas?

+It’s a good practice to review your car insurance policy annually or whenever your circumstances change significantly. This ensures that your coverage remains adequate and that you’re not paying for coverage you no longer need. Regular reviews also provide an opportunity to take advantage of any new discounts or coverage options that may have become available.

Can I switch insurance providers in Texas if I find a better deal?

+Absolutely! Texas has a highly competitive insurance market, and drivers have the freedom to switch providers at any time. If you find a better deal or are dissatisfied with your current insurer, switching can be a straightforward process. Just ensure you have the new policy in place before canceling your old one to avoid any gaps in coverage.