Aarp Life Insurance Login

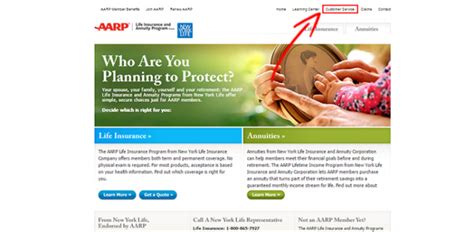

Welcome to the comprehensive guide on the AARP Life Insurance Login process. This article aims to provide an in-depth understanding of the steps involved in accessing your AARP life insurance policy online, along with valuable insights and tips to ensure a seamless experience. As a renowned provider of life insurance solutions for retirees and seniors, AARP offers a user-friendly platform for policyholders to manage their policies efficiently. In this guide, we will explore the AARP Life Insurance Login process, highlighting the key features and benefits of the online platform. By following this step-by-step guide, you will gain a clear understanding of how to navigate the AARP Life Insurance website, access your policy details, and make any necessary updates or changes with ease.

Understanding the AARP Life Insurance Login Process

The AARP Life Insurance Login process is designed to be straightforward and user-friendly, ensuring that policyholders can access their accounts securely and efficiently. Here’s an overview of the key steps involved:

- Account Creation: If you are a new user, the first step is to create an AARP Life Insurance account. This can be done through the official AARP website, where you will be guided through a simple registration process. You will need to provide basic personal information and create a unique username and password.

- Secure Login: Once your account is set up, you can access it by visiting the AARP Life Insurance login page. Here, you will enter your username and password to gain secure access to your policy details.

- Two-Factor Authentication: For added security, AARP may implement two-factor authentication. This means that after entering your password, you may receive a unique code via text message or email, which you will need to enter to complete the login process.

- Dashboard Overview: After successful login, you will be directed to your personalized dashboard. This dashboard provides an overview of your life insurance policy, including important details such as policy number, coverage amount, and premium payment status.

- Policy Management: The AARP Life Insurance login platform offers a range of features to manage your policy effectively. You can view and download policy documents, make premium payments, update personal information, and even submit claims (if applicable) directly from your online account.

Benefits of the AARP Life Insurance Login Platform

The AARP Life Insurance Login platform offers numerous benefits to policyholders, enhancing the overall experience of managing their life insurance policies. Here are some key advantages:

- Convenience: With the online platform, you can access your policy details anytime, anywhere, as long as you have an internet connection. This convenience eliminates the need for physical visits to the insurance office, saving you time and effort.

- Real-Time Updates: The login platform provides real-time updates on your policy status. You can quickly check premium payment due dates, policy changes, and any pending claims, ensuring that you stay informed and in control of your life insurance coverage.

- Secure Data Management: AARP prioritizes data security, and the login platform is designed with robust security measures. Your personal and policy information is protected through encryption and other security protocols, ensuring peace of mind while managing your life insurance online.

- Efficient Claims Process: In the event of a claim, the AARP Life Insurance Login platform simplifies the process. You can submit claims online, providing the necessary details and supporting documentation. This streamlined approach accelerates the claims process, allowing for faster resolution and payment.

- Policy Customization: The online platform offers flexibility in managing your life insurance policy. You can easily make changes to your coverage, such as increasing or decreasing the policy amount, adding beneficiaries, or adjusting payment schedules. These customization options ensure that your policy remains aligned with your changing needs.

Step-by-Step Guide to AARP Life Insurance Login

Now, let’s walk through the step-by-step process of logging into your AARP life insurance account. This guide will provide a clear and detailed explanation, ensuring a smooth login experience:

- Visit the AARP Website: Open your preferred web browser and navigate to the official AARP website. Ensure that you are accessing the secure login page by checking for the padlock icon in the address bar.

- Click on "Login" or "Member Login": Look for the login button or link on the homepage. It is typically located in the top right corner or as a dedicated section on the website. Clicking on it will take you to the login page.

- Enter Your Username and Password: On the login page, you will see fields for entering your username and password. Ensure that you enter the correct credentials as provided during account creation. Be cautious of phishing attempts and always verify the URL before entering sensitive information.

- Complete Two-Factor Authentication (if applicable): If AARP has enabled two-factor authentication, you will receive a unique code via text message or email after entering your password. Enter this code in the designated field to complete the login process securely.

- Access Your Dashboard: Upon successful login, you will be directed to your personalized dashboard. Here, you can review your policy details, make payments, update information, and access other features available on the platform.

- Explore the Platform Features: Take some time to familiarize yourself with the various features and options available on the AARP Life Insurance login platform. This includes viewing policy documents, updating beneficiary information, making premium payments, and submitting claims (if applicable). The platform is designed to be user-friendly, so navigating through these options should be intuitive.

- Keep Your Login Credentials Secure: It is crucial to maintain the security of your login credentials. Avoid sharing your username and password with others, and ensure that you use strong and unique passwords. Regularly update your password to enhance security and prevent unauthorized access to your account.

Troubleshooting Common Login Issues

While the AARP Life Insurance Login process is generally smooth, occasional issues may arise. Here are some common problems and their potential solutions:

- Forgotten Username or Password: If you forget your username or password, don't panic. AARP provides a password recovery or username retrieval option on the login page. Simply click on the "Forgot Password" or "Forgot Username" link, and follow the instructions to reset your credentials.

- Account Lockout: In the interest of security, AARP may lock your account after multiple unsuccessful login attempts. If this happens, you will need to contact AARP's customer support team to resolve the issue. They can guide you through the process of unlocking your account and resetting your credentials.

- Technical Glitches: Occasionally, technical glitches or website maintenance may cause temporary login issues. In such cases, try logging in after some time, as the issue may be resolved automatically. If the problem persists, contact AARP's technical support team for assistance.

- Browser Compatibility: Ensure that you are using a compatible web browser for the AARP Life Insurance Login platform. Some older browser versions may not support certain features or may cause compatibility issues. Update your browser to the latest version to ensure a seamless login experience.

Maximizing the Benefits of AARP Life Insurance Login

To make the most of your AARP Life Insurance Login experience, consider the following tips and best practices:

- Regularly Review Your Policy: Take the time to review your life insurance policy details regularly. Check for any changes in coverage, beneficiary information, or premium payment schedules. By staying informed, you can ensure that your policy aligns with your current needs and circumstances.

- Update Personal Information: Life events such as marriage, divorce, or the birth of a child may require updates to your personal information. Ensure that your AARP Life Insurance account reflects these changes accurately. This is crucial for ensuring proper beneficiary designations and maintaining the validity of your policy.

- Explore Additional Features: The AARP Life Insurance Login platform offers a range of features beyond policy management. Explore these features to make the most of your online account. For example, you may find resources for financial planning, retirement planning, or even access to discounts and special offers through AARP's partnerships.

- Set Up Automatic Premium Payments: To avoid late payments and potential policy lapses, consider setting up automatic premium payments through your AARP Life Insurance account. This ensures that your premiums are paid on time, providing continuous coverage and peace of mind.

- Seek Assistance When Needed: If you encounter any difficulties or have questions about your policy or the login process, don't hesitate to reach out to AARP's customer support team. They are trained to assist with a wide range of inquiries and can provide guidance tailored to your specific needs.

Conclusion: A Smooth and Secure Login Experience

The AARP Life Insurance Login process offers a secure and user-friendly platform for policyholders to manage their life insurance policies efficiently. By following the step-by-step guide outlined in this article, you can access your account with ease and take advantage of the various features and benefits provided by the online platform. Remember to keep your login credentials secure, regularly review your policy details, and explore the additional resources available through your AARP Life Insurance account. With a smooth and secure login experience, you can stay informed and in control of your life insurance coverage, ensuring peace of mind for yourself and your loved ones.

How do I create an AARP Life Insurance account?

+To create an AARP Life Insurance account, visit the official AARP website and navigate to the “Create Account” or “Register” section. You will be prompted to provide basic personal information, including your name, date of birth, and contact details. Follow the on-screen instructions to complete the registration process and set up your account.

What if I forget my AARP Life Insurance login credentials?

+If you forget your login credentials, such as your username or password, you can easily retrieve or reset them. On the AARP Life Insurance login page, look for the “Forgot Username” or “Forgot Password” links. Click on the appropriate link, and follow the instructions provided to reset your credentials. You will typically need to provide your email address or other identifying information to initiate the recovery process.

Can I access my AARP Life Insurance account on mobile devices?

+Yes, you can access your AARP Life Insurance account on mobile devices. AARP provides a mobile-optimized website or even a dedicated mobile app for Android and iOS devices. This allows you to manage your policy and access account features conveniently while on the go. Simply visit the AARP website on your mobile browser or download the AARP app from the respective app store.

How secure is the AARP Life Insurance login platform?

+The AARP Life Insurance login platform prioritizes security and employs various measures to protect your personal and policy information. The platform utilizes encryption protocols to secure data transmission, and you may also encounter two-factor authentication for added security. Additionally, AARP regularly updates its security systems to address emerging threats and vulnerabilities. It is important to maintain strong and unique passwords and be cautious of potential phishing attempts to further enhance the security of your account.

What should I do if I suspect fraudulent activity on my AARP Life Insurance account?

+If you suspect any fraudulent activity on your AARP Life Insurance account, it is crucial to take immediate action. Contact AARP’s customer support team as soon as possible to report the issue. They will guide you through the necessary steps to secure your account and investigate the fraudulent activity. It is important to remain vigilant and promptly report any suspicious activities to protect your policy and personal information.