Progressive Insurance Claim Number

Progressive Insurance is a leading name in the insurance industry, known for its innovative approaches and comprehensive coverage options. With a focus on customer satisfaction and efficient claim processes, Progressive has established itself as a trusted provider. In this article, we delve into the world of Progressive Insurance, exploring the intricacies of their claim processes and specifically examining the significance of the Progressive Insurance claim number.

Understanding Progressive Insurance Claims

Progressive Insurance offers a wide range of insurance products, including auto, home, life, and business insurance. Their claim process is designed to be straightforward and accessible, ensuring that policyholders can navigate the path to recovery with ease. When an insured individual experiences a covered loss, the claim journey begins with a comprehensive assessment and documentation of the incident.

The claims team at Progressive is highly trained and dedicated to providing prompt and accurate services. They work diligently to evaluate the extent of the damage, assess the validity of the claim, and determine the appropriate course of action. This process involves careful consideration of the policy details, applicable laws, and the specific circumstances surrounding the incident.

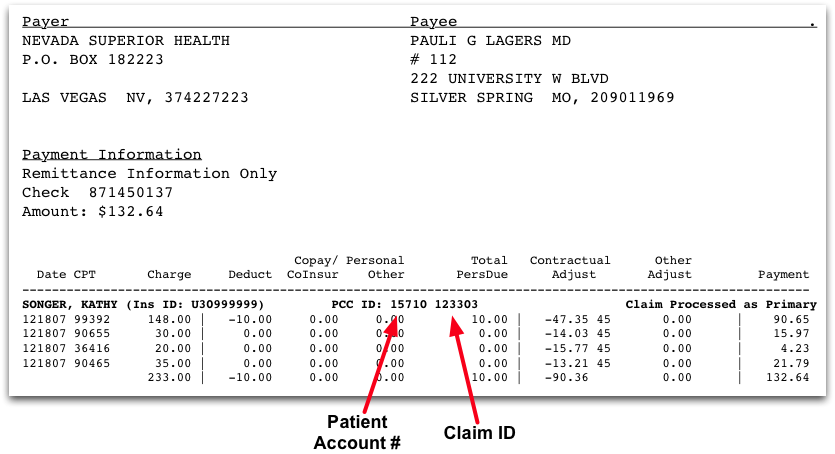

Once the claim is filed, Progressive assigns a unique claim number, which serves as a crucial identifier throughout the entire claim process. This claim number is a vital tool for both the insured and the insurance company, providing a streamlined approach to managing and tracking the claim's progress.

The Significance of the Progressive Insurance Claim Number

The Progressive Insurance claim number is a unique identifier, assigned to each claim, that plays a pivotal role in the claim management process. Here’s a deeper look at its significance:

Streamlined Communication

The claim number acts as a central reference point for all communications related to the claim. When policyholders, claims adjusters, or other involved parties need to discuss the claim, they refer to this number. It ensures that all conversations and correspondence are organized and directed towards the specific claim, reducing confusion and streamlining the overall process.

Easy Tracking and Monitoring

Progressive Insurance utilizes advanced claim management systems that are designed to track and monitor claims efficiently. The claim number is integral to this process, allowing the company to keep a detailed record of each claim’s progress. From the initial filing to the final settlement, the claim number enables Progressive to monitor the claim’s lifecycle, ensuring that no step is missed and that the process moves forward smoothly.

Data Analysis and Insights

The claim number also plays a vital role in data analysis and trend identification. Progressive can analyze the claim data associated with each number to gain valuable insights into claim patterns, common issues, and areas for improvement. This data-driven approach allows the company to refine its processes, enhance customer satisfaction, and continuously optimize its services.

Secure and Confidential Identification

In the insurance industry, maintaining the confidentiality and security of customer information is of utmost importance. The claim number serves as a secure identifier, ensuring that sensitive details remain protected. Progressive employs robust security measures to safeguard the claim data associated with each number, providing peace of mind to policyholders.

| Claim Number Feature | Description |

|---|---|

| Unique Identifier | Each claim number is distinct, ensuring no confusion between different claims. |

| Central Reference | Serves as a single point of reference for all claim-related communications. |

| Data Tracking | Enables Progressive to track and analyze claim data for continuous improvement. |

| Security and Privacy | Protects sensitive information, maintaining confidentiality throughout the process. |

The Progressive Insurance Claim Process

Understanding the claim process is essential for policyholders, as it provides clarity on what to expect during a claim. Progressive has implemented a systematic approach, ensuring a smooth and transparent journey.

Filing a Claim

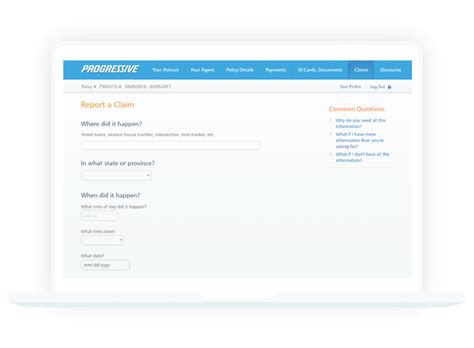

The first step in the Progressive Insurance claim process is filing a claim. Policyholders can initiate the process by contacting Progressive’s dedicated claims department through various channels, including phone, online forms, or mobile apps. Progressive’s user-friendly interface makes it convenient for insured individuals to provide the necessary details and documentation.

Once the claim is filed, Progressive assigns a dedicated claims adjuster who becomes the primary point of contact. The adjuster guides the policyholder through the process, ensuring a comprehensive understanding of the claim's scope and potential outcomes.

Claim Assessment and Investigation

After the initial filing, Progressive’s claims team conducts a thorough assessment and investigation. This involves evaluating the extent of the damage, verifying the policy coverage, and gathering evidence to support the claim. The adjuster may request additional information or documentation to ensure an accurate and fair evaluation.

During this stage, Progressive's expertise in claims handling shines through. Their experienced adjusters possess a deep understanding of various claim scenarios and can provide valuable insights to policyholders, helping them navigate complex situations.

Claim Resolution and Settlement

Once the claim assessment is complete, Progressive works towards a timely resolution. The claims team considers the policyholder’s needs and the specific circumstances of the claim to determine the appropriate course of action. This may involve repairs, replacements, or financial settlements, depending on the nature of the loss.

Progressive strives to provide fair and prompt settlements, ensuring that policyholders can get back on their feet as quickly as possible. Their commitment to customer satisfaction extends to this critical phase, as they work diligently to meet the needs of their insured individuals.

Benefits of Progressive’s Claim Management System

Progressive Insurance’s claim management system is designed with efficiency and customer satisfaction in mind. Here are some key benefits:

Speed and Efficiency

Progressive’s claim process is renowned for its speed and efficiency. By utilizing advanced technology and a streamlined approach, they can process claims swiftly, ensuring that policyholders receive prompt assistance and support.

Personalized Experience

Progressive understands that every claim is unique, and their claims team provides a personalized experience. Each policyholder is assigned a dedicated adjuster who offers tailored guidance and support throughout the process, ensuring a customized approach to claim resolution.

Transparent Communication

Clear and transparent communication is a cornerstone of Progressive’s claim management system. Policyholders receive regular updates on the status of their claim, ensuring they are well-informed and involved in the process. This transparency builds trust and confidence in the insurance provider.

Expertise and Support

Progressive’s claims team consists of highly skilled and knowledgeable professionals. They possess extensive experience in handling various claim scenarios and provide valuable expertise to policyholders. This support extends beyond the claim process, offering guidance and assistance whenever needed.

The Future of Progressive Insurance Claims

As the insurance industry continues to evolve, Progressive Insurance remains committed to innovation and technological advancements. They are continually refining their claim processes to enhance efficiency and improve the overall customer experience.

Digital Transformation

Progressive embraces digital transformation, leveraging technology to streamline the claim process further. They have developed advanced mobile apps and online platforms that enable policyholders to file claims, track progress, and receive real-time updates. This digital approach enhances convenience and accessibility, ensuring a seamless experience.

Artificial Intelligence and Machine Learning

Progressive is exploring the potential of artificial intelligence (AI) and machine learning (ML) to revolutionize the claim process. These technologies can automate certain tasks, enhance data analysis, and provide valuable insights. By leveraging AI and ML, Progressive aims to improve claim accuracy, speed, and overall efficiency.

Customer-Centric Innovations

Progressive remains dedicated to putting customers at the heart of their operations. They continuously seek feedback and incorporate customer insights to enhance their claim management system. By prioritizing customer satisfaction, Progressive ensures that their claim processes remain responsive and tailored to the needs of their policyholders.

How long does it take for Progressive to process a claim?

+The time it takes for Progressive to process a claim can vary depending on the complexity of the claim and the availability of necessary documentation. On average, simple claims can be processed within a few days, while more complex claims may take several weeks. Progressive strives to provide timely updates and keep policyholders informed throughout the process.

Can I track the progress of my claim online?

+Yes, Progressive offers online claim tracking through their website and mobile app. Policyholders can log in to their account and view the status of their claim, including updates, documents required, and estimated timelines. This provides transparency and convenience, allowing individuals to stay informed about their claim’s progress.

What should I do if I disagree with the claim settlement offered by Progressive?

+If you have concerns or disagree with the claim settlement offered by Progressive, it’s important to communicate your perspective to your claims adjuster. Provide additional information or documentation to support your claim and explain your position. Progressive values open communication and will work with you to find a fair resolution.