Medical Insurance Abroad

When traveling internationally, one often overlooks the importance of medical insurance coverage. However, having the right protection is crucial to ensure peace of mind and access to quality healthcare services in a foreign country. This article delves into the intricacies of medical insurance abroad, providing an in-depth analysis of the key considerations, coverage options, and potential challenges travelers may face.

Understanding Medical Insurance Abroad

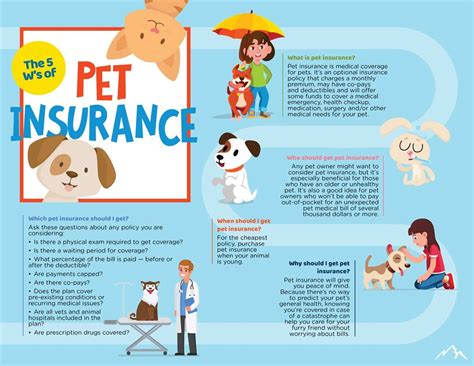

Medical insurance when traveling overseas, also known as travel medical insurance, is a specialized form of coverage designed to cater to the unique healthcare needs of individuals venturing into unfamiliar territories. It offers a safety net, providing financial support and access to medical facilities should any unexpected health issues arise during one’s journey.

The importance of this type of insurance cannot be overstated, especially when considering the significant variations in healthcare systems and costs across different countries. Without adequate coverage, travelers may face substantial financial burdens and logistical challenges in accessing appropriate medical care.

Key Considerations for Travelers

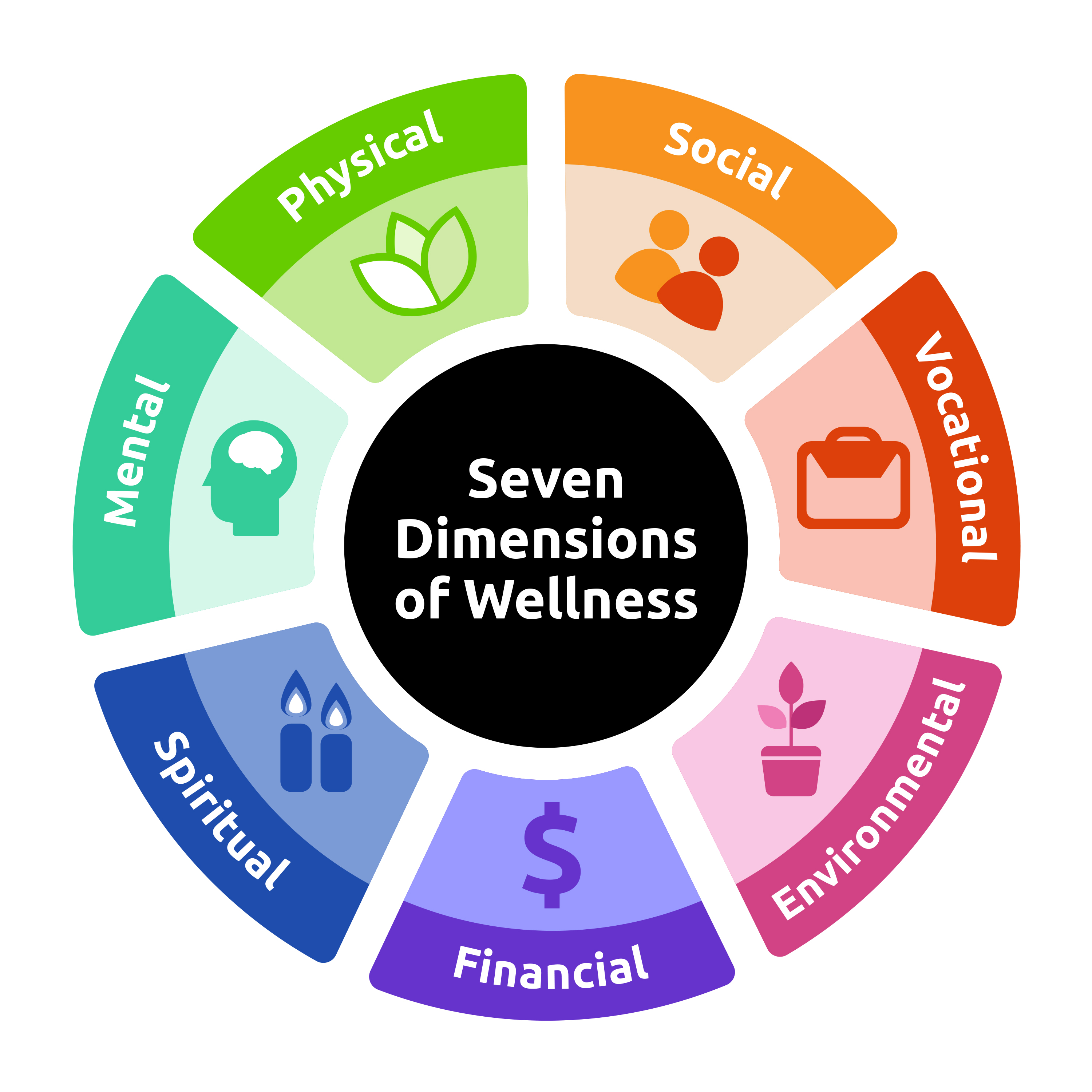

Before embarking on an international trip, it is essential to evaluate a range of factors that influence the choice of medical insurance coverage. These include the destination country’s healthcare system, the duration of the trip, the nature of activities planned, and the traveler’s existing medical conditions or vulnerabilities.

For instance, a trip to a remote region with limited medical facilities will require a different level of coverage compared to a city break in a country with a robust healthcare infrastructure. Similarly, engaging in high-risk activities like adventure sports or trekking in challenging terrain may necessitate specialized insurance policies.

| Consideration | Impact on Coverage |

|---|---|

| Destination Country | Influences the scope and cost of coverage, especially regarding the local healthcare system and its regulations. |

| Trip Duration | Longer trips may require more comprehensive coverage, whereas short-term trips might benefit from more basic policies. |

| Activity Type | High-risk activities demand specialized insurance, whereas low-risk activities may require standard coverage. |

| Existing Medical Conditions | Pre-existing conditions often require specific coverage to ensure treatment is covered, including any potential complications. |

It is also vital to understand the specific exclusions and limitations of each policy. Some policies may not cover certain pre-existing conditions or may have geographical limitations, restricting coverage to certain countries or regions.

Types of Medical Insurance for Overseas Travel

The market offers a variety of medical insurance options tailored for international travel, each with its unique features and benefits. Understanding these options is key to making an informed decision.

Standard Travel Insurance with Medical Coverage

Many travel insurance policies include a basic level of medical coverage as a standard feature. This type of insurance typically covers emergency medical treatment, hospital stays, and sometimes even repatriation in case of severe medical emergencies. However, the scope of coverage can vary significantly between providers, and it is essential to review the policy details carefully.

For instance, some policies may only cover a limited number of days for hospital stays, while others might have restrictions on the type of medical facilities that can be used. Additionally, certain policies may not cover pre-existing conditions or may require additional premiums for such coverage.

Specialized Travel Medical Insurance

For those with specific medical needs or for trips involving high-risk activities, specialized travel medical insurance is often the preferred choice. These policies are designed to offer more comprehensive coverage, including pre-existing condition coverage, evacuation services, and coverage for a wide range of activities.

For example, a specialized policy for adventure sports enthusiasts might include coverage for activities like skiing, rock climbing, or whitewater rafting. These policies often have higher limits for medical expenses and may provide access to a global network of medical providers.

International Health Insurance

International health insurance plans are designed for individuals who plan to live or work abroad for an extended period. These policies provide comprehensive healthcare coverage similar to domestic health insurance plans, often with the added benefit of global coverage.

International health insurance can be particularly beneficial for digital nomads, expatriates, or individuals on long-term assignments abroad. These policies typically cover a wide range of medical services, including routine check-ups, specialist consultations, and even dental and vision care.

The Process of Purchasing Medical Insurance for Overseas Travel

Procuring medical insurance for international travel is a straightforward process, but it requires careful consideration to ensure the chosen policy meets the specific needs of the traveler.

Assessing Your Needs

The first step in purchasing medical insurance is to assess your specific needs. Consider factors such as the duration and nature of your trip, your destination, any pre-existing medical conditions, and the activities you plan to engage in. This assessment will guide you in choosing the right type of insurance and the level of coverage required.

Comparing Insurance Providers

Once you have a clear understanding of your needs, it’s time to compare insurance providers. There are numerous companies offering travel medical insurance, each with its own set of policies and features. Compare the coverage limits, exclusions, and any additional benefits or services offered.

Look for providers who have a strong reputation and a good track record of handling claims efficiently. Reading reviews and seeking recommendations from fellow travelers can also provide valuable insights into the quality of service and coverage offered by different providers.

Obtaining Quotes and Purchasing Insurance

After shortlisting a few providers, obtain quotes to compare prices. Ensure you understand all the terms and conditions associated with the policy, including any deductibles, co-pays, or limitations on coverage. Once you have found a policy that meets your needs and fits your budget, you can proceed with the purchase.

It is advisable to purchase your travel medical insurance well in advance of your trip, preferably as soon as you book your travel arrangements. This ensures that you are covered from the moment you leave your home country.

Handling Medical Emergencies While Abroad

Despite our best preparations, medical emergencies can still occur while traveling. Being prepared and knowing how to navigate the healthcare system in a foreign country is crucial to ensuring timely and appropriate treatment.

Understanding Your Policy

Familiarize yourself with the details of your insurance policy before you depart. Understand what is covered, any limitations or exclusions, and the process for making a claim. Keep the policy details, including the emergency contact number, readily accessible during your travels.

In the event of a medical emergency, having this information at hand can streamline the process and ensure you receive the necessary treatment without delay.

Accessing Medical Care Abroad

When seeking medical care abroad, it is essential to choose a reputable medical facility. Researching and identifying suitable healthcare providers in your destination country in advance can be beneficial. Some insurance providers have partnerships with specific medical facilities, which can make accessing care more straightforward.

If your insurance provider has a preferred facility network, it is advisable to use these providers to ensure your treatment is covered. However, in the event of an emergency, it is important to prioritize your health and well-being over the potential additional costs that may arise from using an out-of-network provider.

Making a Claim

After receiving medical treatment, it is crucial to keep all relevant documentation, including receipts, medical reports, and any other supporting materials. These documents will be necessary to make a claim with your insurance provider.

Follow the claim process outlined in your policy. This may involve submitting the necessary documents online or by mail, depending on the provider's procedures. It is essential to keep records of any correspondence with the insurance company regarding your claim.

Future Implications and Industry Trends

The landscape of medical insurance for international travel is evolving, driven by technological advancements and changing traveler expectations. The industry is witnessing a shift towards more comprehensive and flexible coverage options, tailored to meet the diverse needs of modern travelers.

Technological Innovations

The integration of technology in the insurance industry has led to significant improvements in the efficiency and accessibility of travel medical insurance. Online platforms and mobile apps now enable travelers to purchase insurance policies, manage their coverage, and file claims remotely.

Additionally, the use of digital health records and telemedicine services is gaining traction, allowing travelers to access medical advice and consultations remotely, regardless of their location.

Growing Demand for Specialized Coverage

As travelers become more adventurous and engage in a wider range of activities, the demand for specialized insurance coverage is on the rise. This includes policies tailored for adventure sports, long-term travel, and digital nomad lifestyles.

Insurance providers are responding to this trend by offering more comprehensive policies that cater to specific traveler needs, ensuring that individuals can pursue their passions and lifestyles without compromising their health and financial security.

The Role of Government Initiatives

Government initiatives play a significant role in shaping the medical insurance landscape for international travel. Many countries have introduced policies and regulations to enhance the accessibility and affordability of healthcare for travelers, often in partnership with insurance providers.

For instance, some countries offer reciprocal healthcare agreements, allowing travelers from certain nations to access state-provided healthcare services on the same basis as local residents. Such initiatives can greatly reduce the financial burden of medical treatment for travelers, promoting more equitable access to healthcare.

FAQ

Can I purchase medical insurance after I’ve already started my trip?

+While it is possible to purchase medical insurance while already abroad, it can be more challenging and may come with higher premiums. Some providers offer policies specifically for travelers who are already overseas, but these often have more stringent requirements and limited coverage.

What happens if I don’t declare a pre-existing medical condition and need treatment for it while abroad?

+Failing to declare a pre-existing condition can lead to your claim being denied by the insurance company. It’s crucial to be honest about your medical history when applying for travel medical insurance to ensure your policy covers any potential issues.

Are there any countries that do not require medical insurance for visitors?

+While some countries may not have mandatory medical insurance requirements for visitors, it is always advisable to have coverage when traveling internationally. Even in countries with free or low-cost healthcare, there may be limitations or restrictions on the treatment available to non-residents.

Medical insurance for overseas travel is a critical component of any international journey. By understanding the different types of coverage available, assessing your specific needs, and choosing the right policy, you can ensure that your travels are not only memorable but also safe and secure.

Stay informed, be prepared, and enjoy your adventures with peace of mind, knowing that you have the necessary protection should any medical emergencies arise.