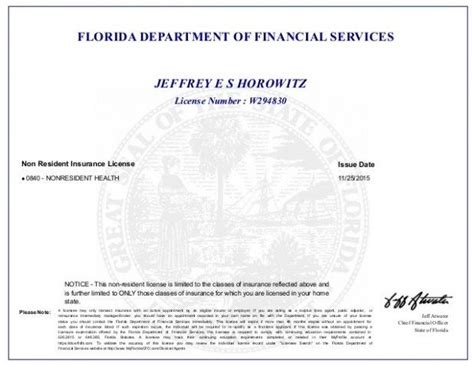

Fl Insurance License Search

Welcome to our comprehensive guide on the Florida Insurance License Search. As a resident of the Sunshine State, it's essential to have reliable access to information about insurance professionals and the licenses they hold. This guide will provide you with an in-depth understanding of the Florida insurance license search process, offering practical insights and step-by-step instructions to help you navigate the system effectively.

Whether you're a consumer looking to verify an insurance agent's credentials, an insurance professional aiming to stay updated with license requirements, or a business seeking to ensure compliance, this guide is tailored to your needs. We'll delve into the intricacies of the Florida Department of Financial Services' (DFS) license search platform, offering a seamless and efficient approach to accessing vital information.

Understanding the Florida Insurance License Search Platform

The Florida DFS has developed a robust online platform that enables the public to search for insurance professionals and their licensing status. This platform is user-friendly and accessible, allowing anyone with an internet connection to conduct a search. Here’s a detailed breakdown of the process and the key features of the platform.

Key Features of the DFS License Search Platform

- User-Friendly Interface: The DFS license search platform is designed with simplicity in mind. It features an intuitive layout, making it easy for users of all technical backgrounds to navigate and conduct searches effectively.

- Comprehensive Database: The platform boasts a comprehensive database, housing information on a wide range of insurance professionals, including agents, brokers, adjusters, and other licensed insurance practitioners.

- Real-Time Updates: The license information is updated regularly, ensuring that the data presented is current and accurate. This is crucial for maintaining compliance and making informed decisions.

- Advanced Search Options: Users can perform advanced searches by entering specific criteria such as an individual’s name, license number, or business entity name. This feature enhances the accuracy of search results, especially when dealing with common names.

- Detailed License Information: Upon searching for an insurance professional, the platform provides detailed information about their license. This includes license type, status, expiration date, and any disciplinary actions taken against the licensee.

Step-by-Step Guide to Conducting an Insurance License Search

- Access the DFS License Search Platform: Start by visiting the official website of the Florida Department of Financial Services. Navigate to the “License Search” section, which is typically found in the “Consumer Services” or “Industry Services” tab.

- Choose Your Search Criteria: On the license search page, you’ll be presented with multiple search options. Select the appropriate search criteria based on your needs. You can search by name, license number, or business entity.

- Enter the Required Information: Depending on your chosen search criteria, you’ll need to enter specific details. For instance, if searching by name, provide the first and last name of the insurance professional. If searching by license number, simply enter the number.

- Submit Your Search: Once you’ve entered the necessary information, click on the “Search” button to initiate the query. The platform will process your request and display the search results.

- Review the Search Results: The search results will provide a list of insurance professionals matching your criteria. Each result will display the individual’s name, license number, license type, and status. Click on the specific license to access detailed information.

- View Detailed License Information: Upon clicking on a license, you’ll be directed to a detailed page containing comprehensive information. This includes the licensee’s contact information, license type, status, expiration date, and any disciplinary actions taken against them. This information is vital for verifying an insurance professional’s credentials and ensuring compliance.

Practical Applications and Use Cases

The Florida Insurance License Search platform serves a variety of purposes and caters to different stakeholders within the insurance industry. Understanding these use cases can help you maximize the benefits of the platform.

Use Cases and Benefits

- Consumers: As a consumer, the license search platform is an invaluable tool for verifying the credentials of insurance agents and brokers. Before engaging in any insurance-related transactions, you can check the license status of the professional to ensure they are duly licensed and in good standing. This helps protect your rights and interests as a consumer.

- Insurance Professionals: Licensed insurance professionals can use the platform to stay updated on their own license status and requirements. Regularly checking your license information ensures that you’re compliant with Florida’s insurance regulations. It also allows you to promptly address any license-related issues or renewals.

- Businesses: For businesses operating in the insurance sector, the license search platform is crucial for maintaining compliance. Whether you’re an insurance agency, a brokerage firm, or an employer hiring insurance professionals, verifying the licenses of your staff and associates is essential. The platform ensures that your business operations remain compliant with state regulations.

- Regulatory Bodies: The Florida DFS uses the license search platform to monitor the insurance industry and enforce regulations. By keeping a close eye on license information, the DFS can identify and address any non-compliance issues, ensuring that insurance professionals adhere to the state’s standards.

Maximizing the Benefits

- Regular License Checks: It’s advisable to make the license search platform a part of your routine, especially if you’re an insurance professional or a business operating in the industry. Regular checks ensure that you stay informed about any changes to your license status and can promptly address any issues.

- Educate Consumers: As an insurance professional, educating your clients about the license search platform can foster trust and transparency. Encourage your clients to verify your credentials using the platform, demonstrating your commitment to ethical practices and compliance.

- Stay Updated with Regulations: The Florida DFS periodically updates its regulations and requirements for insurance professionals. The license search platform often provides notifications or updates regarding such changes. Stay informed about these updates to ensure your license remains in good standing.

Advanced Features and Insights

The Florida Insurance License Search platform offers several advanced features and insights that can enhance your understanding of the insurance industry and assist in making informed decisions.

Advanced Features and Insights

- License History: The platform provides a comprehensive license history for each insurance professional. This feature allows you to track the licensee’s journey, including past licenses held, renewals, and any disciplinary actions taken against them. This information is particularly useful when assessing an insurance professional’s credibility and reliability.

- License Renewal Reminders: To assist insurance professionals in maintaining their licenses, the platform often provides license renewal reminders. These reminders ensure that licensees are aware of the upcoming renewal dates and can take the necessary steps to renew their licenses on time.

- Disciplinary Action Details: If an insurance professional has faced disciplinary action, the platform provides detailed information about the action taken. This includes the reason for the action, the date it was imposed, and any subsequent resolutions. Understanding disciplinary actions can help consumers and businesses make informed choices.

- License Type Information: The platform offers insights into the different types of insurance licenses. This includes information on the requirements, scope of practice, and restrictions associated with each license type. Understanding license types can help consumers and businesses choose the right insurance professional for their needs.

Utilizing Advanced Features for Informed Decisions

- Consumer Empowerment: As a consumer, utilizing the advanced features of the platform can empower you to make more informed choices. By understanding the license history and disciplinary actions of insurance professionals, you can assess their credibility and reliability. This knowledge can help you choose the right insurance professional for your specific needs.

- Business Compliance: For businesses, understanding the advanced features of the platform is crucial for maintaining compliance. By staying informed about license histories and disciplinary actions, businesses can ensure that their staff and associates are reputable and trustworthy. This helps maintain a positive brand image and protects the business from potential liabilities.

- Regulatory Compliance: The advanced features of the platform also assist regulatory bodies in enforcing compliance. By closely monitoring license histories and disciplinary actions, the Florida DFS can identify and address any non-compliance issues promptly. This ensures that the insurance industry in Florida operates ethically and in the best interests of consumers.

Future Implications and Innovations

The Florida Insurance License Search platform is constantly evolving to meet the changing needs of the insurance industry and consumers. As technology advances and regulatory requirements evolve, the platform is expected to introduce new features and improvements.

Expected Innovations and Upgrades

- Mobile Optimization: With the increasing use of mobile devices, the platform is likely to undergo mobile optimization. This will allow users to access license information and conduct searches conveniently on their smartphones and tablets.

- Enhanced Search Functionality: The search functionality of the platform may be enhanced to include more advanced search options. This could include the ability to search by license expiration date, specific license types, or even by geographic location.

- Integration with Other Regulatory Bodies: To streamline the license verification process, the platform may integrate with other regulatory bodies within the state. This integration could facilitate a more comprehensive search experience, allowing users to access information from multiple sources in one place.

- Real-Time Alerts and Notifications: The platform may introduce real-time alerts and notifications to keep users informed about changes to license status or upcoming renewals. This feature would ensure that insurance professionals and businesses receive timely updates, helping them stay compliant.

- AI-Powered Search: Artificial Intelligence (AI) may be incorporated into the platform to enhance search accuracy and efficiency. AI-powered search could leverage natural language processing to understand and interpret user queries, providing more precise search results.

Potential Impact on the Insurance Industry

- Improved Consumer Experience: The expected innovations and upgrades to the platform will likely enhance the overall consumer experience. Mobile optimization and enhanced search functionality will make license verification more accessible and user-friendly. Real-time alerts and notifications will keep consumers informed, empowering them to make timely decisions.

- Enhanced Compliance: The potential integration with other regulatory bodies and the introduction of real-time alerts will significantly improve compliance within the insurance industry. Insurance professionals and businesses will have access to up-to-date information, enabling them to maintain their licenses and adhere to regulations effectively.

- Streamlined License Verification: The integration of the platform with other regulatory bodies will streamline the license verification process. This will benefit not only consumers but also insurance professionals and businesses, as they will be able to conduct comprehensive license checks more efficiently.

- Increased Transparency: The use of AI-powered search and the integration of additional data sources will enhance transparency within the insurance industry. Consumers will have access to more comprehensive information about insurance professionals, fostering trust and confidence in the industry.

Conclusion

The Florida Insurance License Search platform is a powerful tool that empowers consumers, insurance professionals, and businesses alike. By understanding the platform’s features, practical applications, and future innovations, you can maximize its benefits and make informed decisions in the insurance industry.

As the platform continues to evolve, it will play an increasingly crucial role in maintaining compliance, fostering trust, and protecting the rights of consumers. By staying updated with the platform's advancements and utilizing its features effectively, you can navigate the insurance landscape with confidence and ease.

How often should I check my insurance license status on the platform?

+It is recommended to check your insurance license status at least once a year, especially during the renewal period. However, it’s advisable to make it a routine to check your status every few months to ensure you’re aware of any changes or updates.

What should I do if I find incorrect information about my license on the platform?

+If you notice any incorrect or outdated information about your license, it’s crucial to contact the Florida Department of Financial Services immediately. Provide them with the correct details and any supporting documentation to rectify the issue.

Can I verify the license status of an insurance professional who works for a specific company?

+Yes, you can verify the license status of an insurance professional working for a specific company. Simply search for the individual’s name or license number on the platform. This will provide you with their license details, including their current status and any relevant information.

How can I stay updated with the latest changes and regulations regarding insurance licenses in Florida?

+To stay updated with the latest changes and regulations, it’s advisable to subscribe to the Florida DFS’s email notifications or follow their official social media accounts. Additionally, regularly visiting their website and reviewing the “News” or “Updates” section can provide you with the most recent information.

Is there a fee associated with using the Florida Insurance License Search platform?

+No, there is no fee associated with using the Florida Insurance License Search platform. The platform is a public service provided by the Florida DFS to ensure transparency and compliance in the insurance industry.