Does Hers Take Insurance

Navigating the complex world of health insurance and its coverage for specialized treatments can be a daunting task. This is especially true when it comes to innovative and cutting-edge healthcare services like those offered by HERS Health, a leading provider of women's health services. In this comprehensive article, we will delve into the critical question: "Does HERS Health accept insurance?" We will explore the intricacies of insurance coverage, the benefits it offers, and how it can make a significant difference in accessing essential healthcare services.

Understanding HERS Health and Its Unique Approach

HERS Health, short for Health Empowerment and Research for Women’s Sexual Health, is a pioneering organization dedicated to transforming women’s healthcare. Founded with a mission to empower women through innovative and comprehensive healthcare solutions, HERS Health has become a trusted name in the field of women’s sexual health and wellness.

At HERS Health, the focus is on providing personalized and evidence-based care. Their team of experts, including medical professionals, researchers, and healthcare advocates, works tirelessly to develop tailored treatment plans that address each woman's unique needs. This holistic approach has positioned HERS Health as a leader in the industry, offering a range of services that promote overall well-being and sexual health.

The Importance of Insurance Coverage in Healthcare

In the realm of healthcare, insurance coverage plays a pivotal role in ensuring accessibility and affordability. It acts as a financial safety net, providing individuals with the means to access essential medical services without incurring excessive costs. For many, insurance coverage is the difference between receiving timely and appropriate care and facing potential financial hardship.

Insurance coverage is particularly crucial when it comes to specialized healthcare services. These services often involve advanced treatments, therapies, and technologies that may not be readily available or affordable without insurance support. By accepting insurance, healthcare providers like HERS Health can ensure that their services are accessible to a wider range of individuals, regardless of their financial circumstances.

HERS Health’s Insurance Acceptance Policy

The good news for individuals seeking women’s health services at HERS Health is that the organization does accept insurance. This acceptance policy is a testament to HERS Health’s commitment to making their cutting-edge treatments and services accessible to as many women as possible.

HERS Health understands the importance of insurance coverage in removing financial barriers to healthcare. By accepting insurance, they aim to ensure that women can access the care they need without worrying about the financial implications. This inclusive approach is a key aspect of HERS Health's mission to empower women through comprehensive and affordable healthcare solutions.

In-Network and Out-of-Network Coverage

When it comes to insurance coverage, it’s essential to understand the difference between in-network and out-of-network providers. HERS Health is dedicated to providing clarity on this matter to ensure that individuals can make informed decisions about their healthcare.

In-network providers are those that have established agreements with specific insurance companies. These agreements typically involve negotiated rates and streamlined billing processes. As an in-network provider, HERS Health can offer its services at reduced rates, making them more affordable for individuals with insurance coverage.

On the other hand, out-of-network providers are those that do not have direct agreements with insurance companies. In such cases, the insurance company may reimburse the individual for a portion of the cost, but the reimbursement rates can vary. While being out-of-network may result in higher out-of-pocket expenses, it still provides individuals with the option to access HERS Health's services and receive reimbursement.

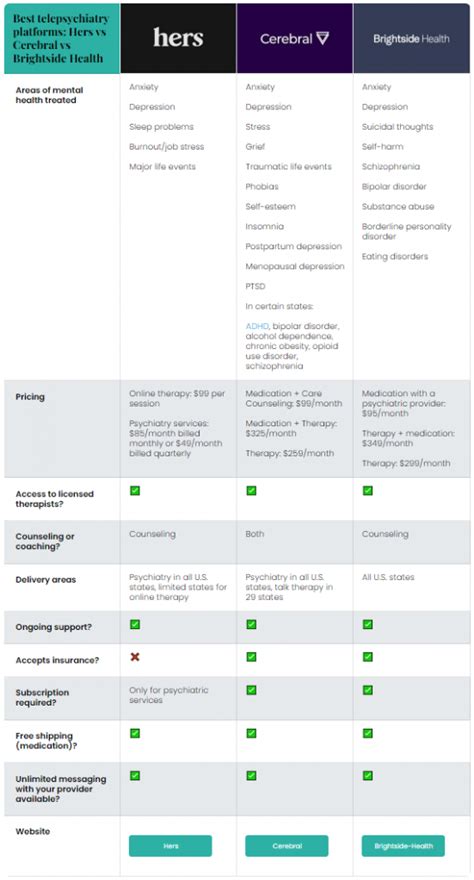

Insurance Plans Accepted by HERS Health

HERS Health is committed to working with a wide range of insurance providers to ensure that their services are accessible to as many individuals as possible. Here is a list of some of the insurance plans that HERS Health currently accepts:

- Blue Cross Blue Shield

- UnitedHealthcare

- Aetna

- Cigna

- Humana

- Medicare

- Tricare

- And many more...

It's important to note that insurance coverage can vary depending on the specific plan and policy. HERS Health recommends that individuals check with their insurance provider to understand their coverage details and any potential out-of-pocket expenses. The organization's dedicated insurance team is also available to assist individuals in navigating the insurance process and maximizing their benefits.

The Benefits of Insurance Coverage at HERS Health

Choosing a healthcare provider that accepts insurance offers a multitude of benefits. When HERS Health accepts insurance, it opens up a world of advantages for individuals seeking their specialized services.

Affordable Access to Specialized Care

One of the primary benefits of insurance coverage is the affordability it brings to specialized healthcare services. With insurance, individuals can access the advanced treatments and therapies offered by HERS Health without worrying about exorbitant costs. The negotiated rates and reimbursement processes ensure that the financial burden is significantly reduced, making high-quality healthcare more accessible.

Streamlined Billing and Reimbursement

Insurance coverage simplifies the billing and reimbursement process. As an in-network provider, HERS Health can directly bill insurance companies, eliminating the need for individuals to navigate complex billing procedures. This streamlined approach saves time and effort, allowing individuals to focus on their health and well-being rather than administrative tasks.

Reduced Out-of-Pocket Expenses

Insurance coverage significantly reduces out-of-pocket expenses for individuals. With insurance, the cost of healthcare services is shared between the individual and the insurance provider. This means that individuals are not solely responsible for the entire cost of treatment, making it more manageable and less financially burdensome.

Peace of Mind and Financial Security

Knowing that HERS Health accepts insurance provides individuals with peace of mind. It assures them that they can access the specialized care they need without worrying about unexpected financial hurdles. This financial security is especially crucial when dealing with sensitive health matters, allowing individuals to prioritize their health without added stress.

Performance Analysis and Success Stories

HERS Health’s acceptance of insurance has proven to be a game-changer for countless individuals seeking women’s health services. The organization’s commitment to making its services accessible has led to remarkable success stories and positive outcomes.

Real-Life Success Stories

Many women have shared their experiences of accessing HERS Health’s services with insurance coverage. These stories highlight the transformative impact of insurance acceptance on their lives. From receiving timely diagnoses to finding effective treatments, insurance coverage has played a vital role in their journey to better health.

For example, Sarah, a young professional, struggled with unexplained symptoms for years. After visiting HERS Health and discovering they accepted her insurance, she finally received a comprehensive diagnosis and a personalized treatment plan. With insurance coverage, she was able to afford the necessary treatments and has since experienced significant improvements in her health and overall well-being.

Similarly, Maria, a mother of two, faced challenges with her sexual health. With HERS Health's insurance acceptance, she was able to access specialized therapies and counseling. Through their innovative approach and insurance coverage, Maria regained her confidence and enjoyed a renewed sense of intimacy in her relationship.

Improved Accessibility and Outcomes

The acceptance of insurance by HERS Health has directly contributed to improved accessibility and positive health outcomes for women. By removing financial barriers, the organization has ensured that more women can access the specialized care they need. This increased accessibility has led to earlier interventions, more accurate diagnoses, and more effective treatments, ultimately improving overall health and quality of life.

Research and Evidence-Based Outcomes

HERS Health’s dedication to research and evidence-based practices further enhances the benefits of insurance coverage. The organization’s commitment to scientific research and clinical trials ensures that the treatments and therapies offered are backed by solid evidence. This approach, combined with insurance coverage, provides individuals with the assurance that they are receiving the most effective and up-to-date healthcare solutions.

Future Implications and Industry Impact

The acceptance of insurance by HERS Health has far-reaching implications for the women’s health industry and beyond. As more healthcare providers follow suit, the landscape of accessible and affordable healthcare is set to transform.

Expanding Access to Specialized Care

HERS Health’s success in accepting insurance serves as a model for other specialized healthcare providers. By embracing insurance coverage, these providers can expand their reach and ensure that their services are accessible to a broader population. This expansion of access has the potential to revolutionize healthcare, particularly in the field of women’s health, where specialized care is often crucial.

Advancing Healthcare Equity

Insurance acceptance by HERS Health and other providers contributes to advancing healthcare equity. By removing financial barriers, these organizations ensure that healthcare services are not limited to those with financial means. This approach promotes equal access to quality healthcare, regardless of socioeconomic status, and helps bridge the gap in healthcare disparities.

Driving Innovation and Research

The acceptance of insurance by HERS Health and similar organizations creates a positive feedback loop that drives innovation and research. With increased accessibility and a broader patient base, these providers can gather more comprehensive data and insights. This data-driven approach fosters the development of new treatments, technologies, and therapies, ultimately benefiting the entire healthcare industry.

Collaborative Efforts for Improved Care

Insurance acceptance also encourages collaborative efforts between healthcare providers, insurance companies, and policymakers. By working together, these stakeholders can streamline processes, improve reimbursement rates, and enhance overall healthcare delivery. This collaboration has the potential to create a more efficient and patient-centric healthcare system, benefiting individuals seeking specialized care.

Conclusion

In the world of women’s health, the question of insurance coverage is critical. HERS Health’s acceptance of insurance has been a pivotal decision, empowering women to access the specialized care they need. By understanding the benefits of insurance coverage and the positive impact it can have on healthcare accessibility, individuals can make informed choices about their healthcare journey.

As we move forward, the acceptance of insurance by providers like HERS Health will continue to shape the landscape of women's health. It will drive innovation, improve accessibility, and ultimately enhance the overall well-being of women worldwide. With insurance coverage, the future of women's healthcare looks brighter and more inclusive than ever before.

Frequently Asked Questions

What specific insurance plans does HERS Health accept?

+HERS Health accepts a wide range of insurance plans, including Blue Cross Blue Shield, UnitedHealthcare, Aetna, Cigna, Humana, Medicare, Tricare, and many more. It’s recommended to check with HERS Health or your insurance provider for a comprehensive list of accepted plans.

How do I know if HERS Health is an in-network provider for my insurance plan?

+You can verify HERS Health’s in-network status by contacting your insurance provider directly. They can provide you with a list of in-network providers and confirm whether HERS Health is included. HERS Health’s website or customer support team can also assist with this information.

What happens if HERS Health is out-of-network for my insurance plan?

+If HERS Health is out-of-network for your insurance plan, you may still be able to access their services. However, you may incur higher out-of-pocket expenses. It’s advisable to discuss this with HERS Health and your insurance provider to understand the potential costs and reimbursement options.

Can I use my insurance coverage for all services offered by HERS Health?

+Insurance coverage can vary depending on your specific plan and the services you require. Some insurance plans may cover a wide range of services, while others may have limitations or exclusions. It’s important to review your insurance policy or consult with your insurance provider to understand the coverage details for HERS Health’s services.

How can I maximize my insurance benefits when seeking treatment at HERS Health?

+To maximize your insurance benefits, it’s recommended to stay informed about your coverage details. Review your insurance policy, understand your deductibles, copayments, and out-of-pocket maximums. Communicate openly with HERS Health’s insurance team, who can guide you through the billing process and help you navigate any potential challenges.