Lowest Rate Auto Insurance

Securing the best auto insurance coverage at the lowest rates is a priority for many drivers. With a myriad of insurance providers and coverage options available, it can be a daunting task to navigate the market and find the most suitable and affordable policy. This comprehensive guide aims to demystify the process, offering expert insights and practical tips to help you identify the lowest rate auto insurance tailored to your needs.

Understanding Auto Insurance Rates

Auto insurance rates are determined by a complex interplay of factors. These include the driver’s age, gender, and driving history, as well as the type of vehicle insured, its make and model, and the coverage limits and deductibles chosen. Geographical location and the number of miles driven annually also play a significant role. Understanding how these variables impact rates is crucial to finding the best deal.

For instance, younger drivers, especially males, often face higher premiums due to their perceived higher risk of accidents. Similarly, sports cars and luxury vehicles typically attract higher insurance costs due to their expensive repair and replacement costs. On the other hand, safe drivers with clean records and older, more economical vehicles may enjoy significant discounts.

Factors Influencing Rates

- Driver Profile: Age, gender, driving record, and years of experience are key considerations. Younger, less experienced drivers often pay more due to their higher accident risk.

- Vehicle Details: The type, make, and model of your vehicle, along with its safety features and accident history, influence rates. Vehicles with advanced safety systems may qualify for discounts.

- Coverage Selection: The level of coverage you choose, including liability, collision, comprehensive, and additional features like rental car coverage, impacts your premium.

- Deductibles: Opting for higher deductibles can lower your premium, but it’s important to ensure you can afford the deductible in the event of a claim.

- Location: Where you live and garage your vehicle can affect your rates. Urban areas with higher traffic density and theft rates often command higher premiums.

- Mileage: The number of miles you drive annually is a factor. High-mileage drivers may pay more due to increased exposure to risks.

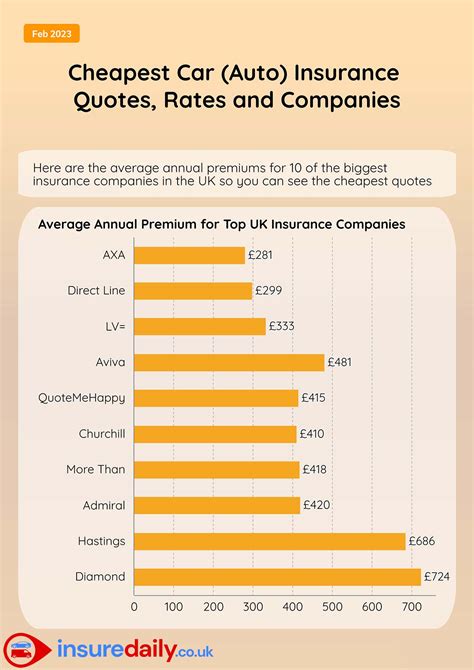

Comparing Insurance Providers

With a landscape of insurance providers offering a range of policies, comparing options is essential. Online comparison tools and aggregator websites can provide a quick overview of different providers’ rates and coverage. However, it’s important to delve deeper and understand the fine print of each policy to ensure it meets your specific needs.

Consider the financial stability and reputation of the insurance company. A financially stable insurer is more likely to honor claims promptly and fairly. Customer reviews and industry ratings can provide valuable insights into an insurer's reliability and service quality.

Additionally, look for insurers that offer discounts. Many providers offer discounts for safe driving records, vehicle safety features, multi-policy purchases, and loyalty. Bundling your auto insurance with other policies, such as home or renters insurance, can often result in substantial savings.

| Insurance Provider | Average Annual Premium | Discounts Offered |

|---|---|---|

| State Farm | $1,300 | Safe driver, multiple policy, good student |

| GEICO | $1,250 | Military, federal employee, good student |

| Progressive | $1,450 | Snapshot (usage-based), home/auto bundle |

| Allstate | $1,500 | Safe driving bonus, multi-policy |

| Esurance | $1,350 | Paperless billing, DriveSense (usage-based) |

Optimizing Your Auto Insurance Coverage

Tailoring your auto insurance coverage to your specific needs is essential to getting the best value for your money. While it’s tempting to opt for the lowest premium, ensuring you have adequate coverage is crucial. This ensures you’re protected in the event of an accident or other unforeseen circumstance.

Assessing Your Coverage Needs

Start by evaluating your vehicle’s value and your personal financial situation. If your vehicle is older and less valuable, you may not need as extensive coverage as someone with a newer, more expensive car. However, if you have significant assets or savings, you’ll want to ensure your policy provides sufficient liability coverage to protect your financial well-being in the event of an at-fault accident.

Consider your personal tolerance for risk. If you're comfortable assuming more financial responsibility in the event of an accident, you can opt for higher deductibles and lower premiums. Conversely, if you prefer more financial protection, lower deductibles and higher premiums may be more suitable.

Choosing the Right Coverage Limits

Liability coverage is a critical component of any auto insurance policy. It protects you financially if you’re at fault in an accident, covering the costs of injuries and property damage you cause to others. Most states have minimum liability requirements, but it’s generally recommended to carry higher limits to provide adequate protection.

Collision and comprehensive coverage are optional but highly recommended. Collision coverage pays for repairs or replacement of your vehicle if it's damaged in an accident, while comprehensive coverage covers non-accident-related incidents like theft, vandalism, or natural disasters. These coverages typically come with deductibles, so choose wisely based on your budget and risk tolerance.

Utilizing Usage-Based Insurance (UBI)

Usage-based insurance, or UBI, is an innovative approach that tailors your premium to your actual driving behavior. With UBI, your insurance provider tracks your driving habits, such as miles driven, time of day, and braking patterns, to assess your risk level. This can lead to significant discounts for safe drivers.

Some insurance providers offer telematics devices that plug into your vehicle's onboard diagnostics port, while others use smartphone apps to track your driving. By participating in UBI programs, you can potentially lower your premiums significantly, especially if you drive safely and sparingly.

Maximizing Discounts and Savings

Insurance providers offer a range of discounts to attract and retain customers. Understanding these discounts and qualifying for them can significantly reduce your auto insurance premiums. Here’s a closer look at some of the most common discounts available.

Safe Driver Discounts

Insurance providers reward safe driving with discounts. If you’ve maintained a clean driving record for a certain period, usually 3-5 years, you may qualify for a safe driver discount. This discount can be substantial, often 10-20% off your premium.

Multi-Policy Discounts

Bundling your auto insurance with other policies, such as home, renters, or life insurance, can lead to significant savings. Many insurance providers offer multi-policy discounts, sometimes up to 25% off your auto insurance premium.

Loyalty Discounts

Insurance providers appreciate customer loyalty and often offer discounts to long-term policyholders. The longer you’ve been with the same insurer, the more substantial the loyalty discount may be. It’s worth inquiring about loyalty discounts when shopping for a new policy or renewing your existing one.

Other Discounts

- Good Student Discount: Many insurers offer discounts to students with good academic records. This discount typically applies to full-time students under 25 years old and can be up to 20% off the premium.

- Military Discount: Service members and their families often qualify for military discounts, with savings of up to 15%.

- Vehicle Safety Features: If your vehicle is equipped with advanced safety features like anti-lock brakes, air bags, or an anti-theft system, you may qualify for a discount.

- Paperless Billing: Opting for paperless billing and policy management can lead to small but worthwhile savings.

Future Trends in Auto Insurance

The auto insurance landscape is evolving rapidly, driven by technological advancements and changing consumer needs. Here’s a glimpse into the future of auto insurance and how it may impact rates and coverage.

Connected Car Technology

The integration of advanced telematics and connectivity technologies into vehicles is transforming the auto insurance industry. Connected car technology enables insurers to collect real-time data on driving behavior, vehicle performance, and location. This data can be used to offer more personalized and accurate insurance rates, as well as innovative usage-based insurance products.

Artificial Intelligence and Machine Learning

AI and machine learning algorithms are being increasingly utilized by insurance providers to analyze vast amounts of data and identify patterns. These technologies can improve underwriting accuracy, detect fraud, and personalize insurance products. By leveraging AI, insurers can offer more competitive rates and better-tailored coverage to individual drivers.

Autonomous Vehicles

The advent of autonomous vehicles is poised to revolutionize auto insurance. With self-driving cars, the risk of human error-related accidents could significantly decrease, potentially leading to lower insurance premiums. However, the introduction of autonomous vehicles also raises new liability and coverage questions that insurers will need to navigate.

Shared Mobility and Subscription Models

The rise of shared mobility services like ride-sharing and car-sharing is challenging traditional auto insurance models. Insurers are adapting by offering flexible, usage-based insurance products that cater to the needs of shared mobility users. Additionally, subscription-based insurance models, where customers pay a monthly fee for coverage, are gaining traction and offering an alternative to traditional annual policies.

Conclusion

Securing the lowest rate auto insurance involves a careful balance of understanding your coverage needs, comparing providers, and optimizing your policy. By leveraging the insights and tips provided in this guide, you can navigate the complex world of auto insurance with confidence and find a policy that offers the best value for your money.

FAQ

What is the cheapest car insurance company?

+

The cheapest car insurance company can vary based on individual factors such as your location, driving history, and the type of vehicle you own. However, some providers known for offering competitive rates include GEICO, State Farm, Progressive, and Esurance.

How can I get the lowest auto insurance rate?

+

To get the lowest auto insurance rate, compare quotes from multiple providers, ensure you’re taking advantage of all applicable discounts, and tailor your coverage to your specific needs. Opting for higher deductibles and limiting coverage to your essential needs can also lower your premium.

Do safe drivers pay less for auto insurance?

+

Yes, safe drivers typically pay less for auto insurance. Insurance providers reward drivers with clean records and offer safe driver discounts. These discounts can significantly reduce your premium, especially if you’ve maintained a clean driving record for several years.

What factors affect auto insurance rates?

+

Auto insurance rates are influenced by various factors, including your age, gender, driving history, the type of vehicle insured, coverage limits, deductibles, location, and annual mileage. Understanding how these variables impact rates is crucial to finding the best deal.

Can I switch auto insurance providers to save money?

+

Absolutely! Shopping around and comparing quotes from different providers is a great way to find the most competitive rates. If you’ve been with the same insurer for a while, it’s worth checking if you’re getting the best deal. You may be able to save significantly by switching to a new provider.