Cheap Medical Insurance Illinois

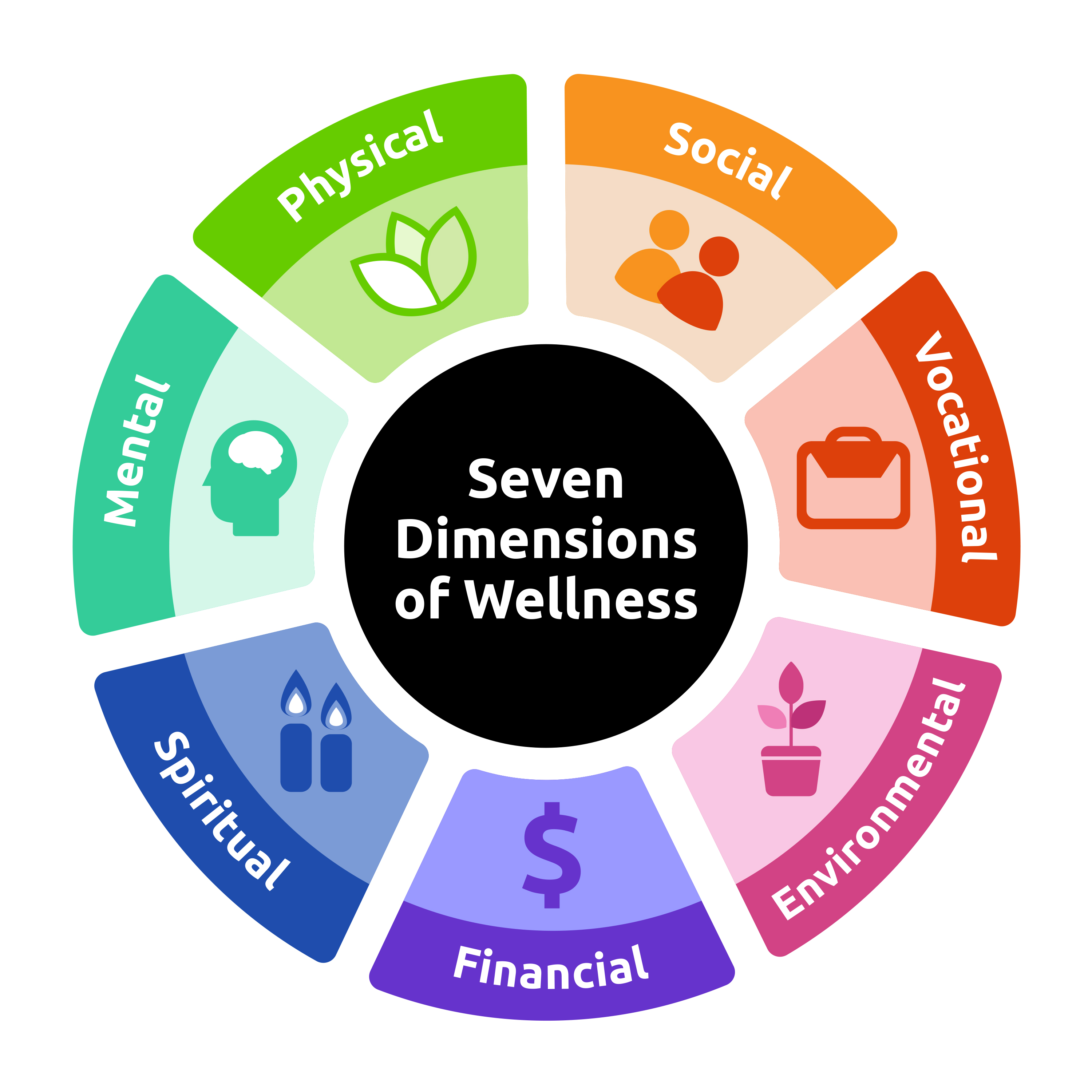

In the state of Illinois, finding affordable medical insurance is a top priority for many individuals and families. With a range of options available, it's important to understand the various plans, coverage, and costs to make an informed decision. This comprehensive guide will explore the landscape of cheap medical insurance in Illinois, providing insights into the best options, coverage details, and strategies to obtain the most cost-effective healthcare coverage.

Understanding the Illinois Healthcare Market

Illinois boasts a diverse healthcare market, offering a wide range of insurance plans to cater to different needs and budgets. From major metropolitan areas like Chicago to smaller rural communities, the state provides a variety of healthcare options, making it crucial to navigate these options effectively.

Affordable Healthcare Act (ACA) Plans

One of the key resources for affordable medical insurance in Illinois is the Affordable Healthcare Act (ACA). These plans, also known as Obamacare plans, are designed to provide accessible and affordable healthcare coverage to individuals and families. The ACA mandates that all insurance plans offered on the Health Insurance Marketplace must provide a minimum level of coverage, known as Essential Health Benefits, ensuring that basic healthcare needs are met.

Illinois actively participates in the Health Insurance Marketplace, offering a platform for residents to compare and purchase insurance plans. These plans are categorized into Metal Tiers, with Bronze, Silver, Gold, and Platinum options, each offering different levels of coverage and cost-sharing. Bronze plans typically have lower premiums but higher out-of-pocket costs, while Platinum plans offer the opposite, providing more coverage at a higher premium.

| Metal Tier | Average Premium | Out-of-Pocket Costs |

|---|---|---|

| Bronze | $350/month | Higher |

| Silver | $420/month | Moderate |

| Gold | $550/month | Lower |

| Platinum | $700/month | Minimal |

The cost of ACA plans in Illinois can vary based on factors such as age, location, and tobacco use. Additionally, income-based subsidies are available to reduce the cost of premiums for those who qualify, making these plans even more affordable.

Short-Term Health Insurance

For individuals seeking temporary coverage, short-term health insurance plans are an option. These plans offer more flexibility and typically have lower premiums compared to ACA plans. However, it’s important to note that short-term plans often have limited coverage and may not cover pre-existing conditions or offer the same level of protection as ACA plans.

Catastrophic Health Insurance

Catastrophic health insurance plans are designed for individuals under the age of 30 or those with specific hardships. These plans provide basic coverage for major medical expenses but generally have high deductibles and limited benefits. While they may be more affordable, they are best suited for those who are relatively healthy and do not anticipate frequent healthcare needs.

Tips for Finding the Best Cheap Medical Insurance in Illinois

When navigating the options for cheap medical insurance in Illinois, there are several strategies to consider:

Compare Multiple Plans

Take the time to compare various insurance plans, including ACA, short-term, and catastrophic options. Evaluate the coverage, premiums, deductibles, and out-of-pocket costs to find the plan that best suits your healthcare needs and budget.

Utilize Subsidies

If your income qualifies, take advantage of the premium subsidies offered through the ACA. These subsidies can significantly reduce the cost of your monthly premiums, making healthcare more affordable.

Consider High-Deductible Plans

If you are generally healthy and do not anticipate frequent medical expenses, opting for a high-deductible plan can be a cost-effective strategy. These plans often have lower premiums, allowing you to save money while still having access to essential healthcare services.

Evaluate Network Coverage

Ensure that the insurance plan you choose covers your preferred healthcare providers and facilities. Check the plan’s network to confirm that your primary care physicians, specialists, and hospitals are included, as out-of-network care can be more expensive.

Review Prescription Drug Coverage

If you regularly take prescription medications, carefully review the plan’s coverage for these drugs. Some plans may have limited coverage for certain medications or require higher copayments, so it’s essential to understand the details to avoid unexpected costs.

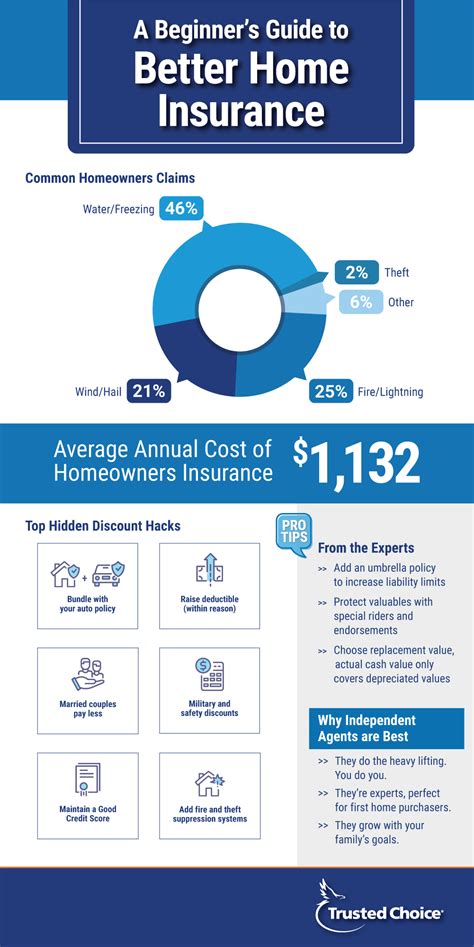

Explore Discount Programs

Many insurance providers offer discount programs or partnerships with healthcare providers to reduce costs. These programs can provide savings on services like dental care, vision care, or even alternative therapies. Research and take advantage of these opportunities to maximize your healthcare savings.

Cheap Medical Insurance Options in Illinois

Here are some specific cheap medical insurance options available in Illinois:

ACA Marketplace Plans

The Health Insurance Marketplace in Illinois offers a wide range of ACA plans with varying levels of coverage and costs. You can compare plans and enroll during the annual Open Enrollment Period or if you qualify for a Special Enrollment Period due to certain life events.

Blue Cross Blue Shield of Illinois

Blue Cross Blue Shield of Illinois is a well-known provider offering a variety of insurance plans, including ACA-compliant options. Their plans often provide comprehensive coverage and a wide network of healthcare providers.

Oscar Health

Oscar Health is a popular insurance provider known for its innovative approach to healthcare. They offer affordable plans with a focus on digital convenience, providing easy access to healthcare services and information through their mobile app.

UnitedHealthcare

UnitedHealthcare is a trusted name in the insurance industry, offering a range of affordable plans in Illinois. Their plans often include access to a large network of healthcare providers and additional benefits like wellness programs.

Conclusion: Navigating Affordable Healthcare in Illinois

Finding cheap medical insurance in Illinois requires careful consideration of your healthcare needs and budget. By understanding the different plan options, comparing costs and coverage, and utilizing available resources like subsidies and discount programs, you can secure affordable and comprehensive healthcare coverage. Remember to review your insurance needs annually and stay informed about any changes to the healthcare landscape in Illinois to ensure you always have the best and most cost-effective coverage.

Can I get cheap medical insurance if I have a pre-existing condition?

+Yes, thanks to the Affordable Care Act (ACA), insurance companies cannot deny coverage or charge more based on pre-existing conditions. However, the cost of your premium may vary depending on your age, location, and other factors. It’s important to compare plans and utilize available subsidies to find the most affordable option.

Are there any free or low-cost healthcare programs in Illinois for those with low incomes?

+Yes, Illinois offers various programs to provide healthcare coverage for low-income individuals and families. These include Medicaid and the FamilyCare Program. Eligibility is based on income and other factors, so it’s worth exploring these options to see if you qualify.

What is the penalty for not having health insurance in Illinois?

+As of 2019, there is no individual mandate or penalty for not having health insurance in Illinois. However, it’s still highly recommended to have insurance to protect yourself from potentially high medical costs.