Insurance For Business Vehicles

Introduction

When it comes to running a business that relies on vehicles, having the right insurance coverage is essential. Whether you own a small fleet of delivery vans or operate a large-scale transportation company, understanding the intricacies of commercial vehicle insurance is crucial for protecting your assets and ensuring the smooth operation of your business. This comprehensive guide will delve into the world of insurance for business vehicles, providing you with valuable insights and practical advice.

In today’s dynamic business landscape, where road accidents and unforeseen events can have significant financial implications, having adequate insurance coverage is not just a smart decision but a necessity. By the end of this article, you’ll have a clear understanding of the various aspects of business vehicle insurance, from the types of policies available to the factors that influence premiums and the claims process.

Understanding the Need for Specialized Insurance

Unlike personal auto insurance, business vehicle insurance is tailored to the unique needs and risks associated with commercial operations. Whether you’re a contractor making site visits or a logistics company transporting goods, your vehicles are integral to your business’s success and reputation. A single accident or incident can disrupt operations, result in costly repairs, or even lead to legal liabilities.

The Importance of Adequate Coverage

Insufficient insurance coverage can leave your business vulnerable to financial strains and legal complications. For instance, a severe accident involving a company vehicle may result in lawsuits and substantial repair or replacement costs. Without adequate insurance, these expenses could quickly exceed your financial capabilities, potentially jeopardizing the future of your business.

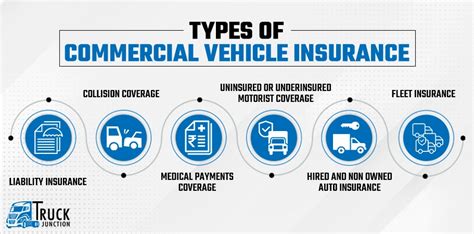

Types of Business Vehicle Insurance Policies

Commercial Auto Insurance

Commercial auto insurance is the backbone of any business vehicle insurance portfolio. This policy provides coverage for a range of vehicles, including cars, trucks, vans, and even specialized equipment like bulldozers or cranes. It offers protection against liability claims, medical expenses, and physical damage to your vehicles, ensuring that your business can recover quickly from unforeseen incidents.

Key Components of Commercial Auto Insurance:

- Liability Coverage: Protects your business against claims arising from accidents caused by your drivers. This coverage includes bodily injury and property damage liabilities.

- Physical Damage Coverage: Covers the cost of repairing or replacing your vehicles in the event of an accident, theft, or other covered perils.

- Medical Payments Coverage: Provides coverage for medical expenses incurred by your employees or passengers in an accident, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: Protects your business and employees in the event of an accident with a driver who lacks sufficient insurance coverage.

Truckers Insurance (for Trucking Businesses)

For businesses operating trucks, a specialized truckers insurance policy is essential. This type of insurance is designed to meet the unique needs of the trucking industry, providing comprehensive coverage for trucks, trailers, and cargo. It offers liability protection, physical damage coverage, and additional endorsements to address specific risks associated with long-haul transportation.

Truckers Insurance Key Features:

- Bobtail Insurance: Provides liability coverage for truckers when their trucks are not under dispatch, ensuring protection during personal use or deadheading.

- Non-Trucking Liability (NTL) Coverage: Offers protection for truckers when they are not actively engaged in trucking operations, such as during personal errands.

- Motor Truck Cargo Insurance: Covers the value of cargo transported by your trucks, ensuring financial protection in the event of loss or damage during transit.

Motor Carrier Liability Insurance

Motor carrier liability insurance is a crucial component for businesses engaged in the transportation of goods. This policy provides liability coverage for accidents and incidents involving the transport of cargo. It protects your business from financial losses resulting from claims made by third parties, ensuring that you can continue operating without significant disruption.

Motor Carrier Liability Coverage Highlights:

- Broad Liability Protection: Covers bodily injury, property damage, and other losses sustained by third parties as a result of accidents involving your vehicles.

- Motor Carrier MCS-90 Endorsement: A critical endorsement required by the Federal Motor Carrier Safety Administration (FMCSA), ensuring that the insurance company assumes liability for any final judgments against your business.

Factors Influencing Business Vehicle Insurance Premiums

Vehicle Type and Usage

The type of vehicles your business operates and their intended use play a significant role in determining insurance premiums. For instance, trucks and vans often have higher premiums due to their heavier weight and higher risk of accidents. Additionally, vehicles used for commercial purposes typically carry a higher premium compared to personal vehicles.

Driving History and Experience

The driving records of your employees and the overall safety culture within your business are critical factors. A clean driving history with few or no accidents or violations can lead to more affordable insurance rates. Conversely, a history of accidents or traffic violations may result in higher premiums.

Coverage Limits and Deductibles

The level of coverage you choose and the deductibles you opt for directly impact your insurance premiums. Higher coverage limits and lower deductibles generally result in higher premiums, while lower coverage limits and higher deductibles can lead to more affordable rates.

Business Size and Claims History

The size of your business, including the number of vehicles in your fleet, can influence insurance rates. Larger fleets may qualify for volume discounts, while smaller businesses may benefit from tailored policies designed for their specific needs. Additionally, a history of frequent claims can lead to higher premiums, as insurance companies consider past claims as an indicator of future risk.

The Claims Process for Business Vehicle Insurance

Reporting an Incident

In the event of an accident or incident involving a business vehicle, prompt reporting is crucial. Notify your insurance provider as soon as possible, providing them with all relevant details, including the date, time, location, and circumstances of the incident. Accurate and timely reporting can expedite the claims process and ensure a smoother resolution.

Documenting the Claim

Gather and maintain thorough documentation of the incident, including photographs of the vehicles involved, any visible damage, and the scene of the accident. Obtain statements from witnesses and record their contact information. If possible, create a detailed report of the events leading up to the incident, ensuring a clear and accurate record for your insurance claim.

Working with Your Insurer

Your insurance provider will assign a claims adjuster to handle your case. Cooperate fully with the adjuster, providing all necessary information and documentation. The adjuster will assess the claim, determine liability, and work towards a fair resolution. Throughout the process, maintain open communication with your insurer, addressing any concerns or questions promptly.

Future Implications and Industry Trends

Technology’s Impact on Business Vehicle Insurance

Advancements in technology, such as telematics and data analytics, are transforming the insurance industry. Telematics devices installed in vehicles can provide real-time data on driving behavior, allowing insurers to offer usage-based insurance policies. This data-driven approach can result in more accurate risk assessments and potentially lower premiums for businesses with safe driving records.

Environmental Considerations

As sustainability becomes a global priority, the insurance industry is adapting to the growing demand for green initiatives. Insurers are developing policies that incentivize businesses to adopt eco-friendly practices, such as electric vehicle fleets or carbon offset programs. These environmentally conscious choices not only benefit the planet but can also lead to reduced insurance premiums and enhanced reputation.

The Rise of Shared Mobility Solutions

The rise of shared mobility solutions, such as ride-sharing and car-sharing platforms, is reshaping the insurance landscape. Businesses operating in this space face unique challenges, requiring specialized insurance coverage. Insurers are developing innovative solutions to address the risks associated with shared mobility, offering comprehensive policies that cover both the vehicles and the drivers involved.

Conclusion

Insurance for business vehicles is a complex yet crucial aspect of running a successful and sustainable enterprise. By understanding the different types of policies, the factors influencing premiums, and the claims process, you can make informed decisions to protect your business and its assets. As the insurance industry continues to evolve, staying abreast of emerging trends and innovations will enable you to leverage opportunities for cost savings and enhanced coverage.

How often should I review my business vehicle insurance policy?

+It is recommended to review your policy annually or whenever there are significant changes to your business, such as adding new vehicles, expanding operations, or altering driving routes. Regular reviews ensure that your coverage remains adequate and aligned with your evolving needs.

Can I bundle my business vehicle insurance with other policies for cost savings?

+Yes, many insurance providers offer bundle discounts when you combine multiple policies, such as business vehicle insurance with general liability or workers’ compensation insurance. Bundling can result in significant cost savings and simplified administration.

What steps can I take to reduce my business vehicle insurance premiums?

+Implementing safety measures, such as driver training programs and vehicle maintenance protocols, can lead to reduced premiums. Additionally, maintaining a clean driving record and encouraging safe driving practices among your employees can positively impact your insurance rates.