Average Price Of Long Term Care Insurance

Long-term care insurance is an essential financial planning tool that provides individuals with peace of mind, ensuring they have the necessary coverage for their future healthcare needs. This comprehensive article aims to delve into the average price of long-term care insurance, exploring the factors that influence its cost and offering valuable insights to help readers make informed decisions.

Understanding the Average Price

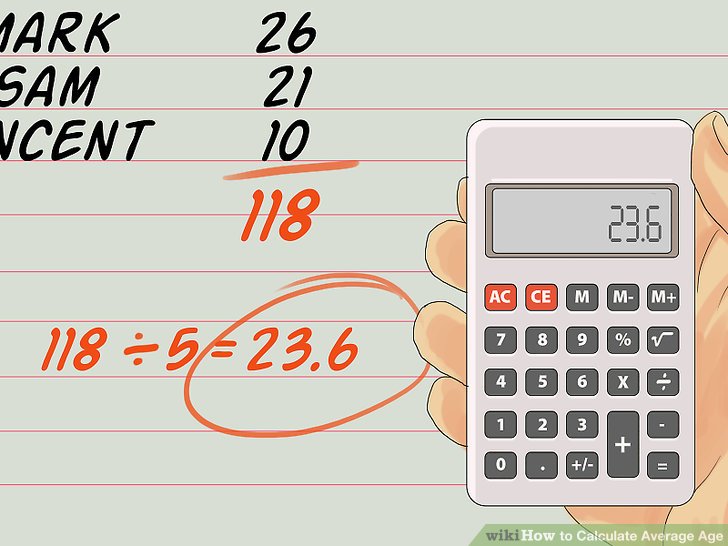

The average price of long-term care insurance can vary significantly depending on several key factors. While it’s challenging to provide an exact figure, we can explore the range and discuss the variables that impact the cost. Understanding these factors is crucial for individuals seeking to secure their financial future and ensure they receive the necessary care should they require it.

Factors Influencing the Cost of Long-Term Care Insurance

Several elements contribute to the average price of long-term care insurance. Let’s explore these factors in detail:

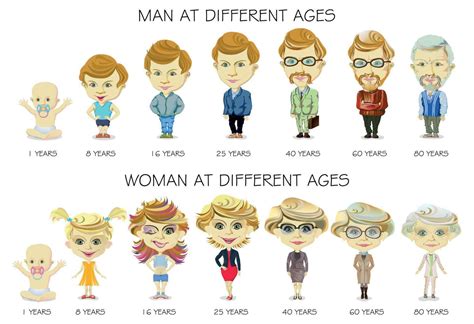

- Age of Purchase: One of the most significant factors is the age at which an individual purchases the insurance. Generally, the younger the person, the lower the premium. This is because younger individuals are less likely to require long-term care services immediately, reducing the insurer's risk.

- Health and Lifestyle: The state of an individual's health and their lifestyle choices play a crucial role in determining the cost of long-term care insurance. Insurers often consider medical history, current health conditions, and lifestyle factors such as smoking or obesity. A healthier individual may receive more favorable rates.

- Coverage Benefits: The level of coverage and benefits chosen significantly impact the insurance cost. Higher daily benefit amounts, longer benefit periods, and broader coverage for various care services will naturally result in higher premiums.

- Elimination Period: The elimination period, also known as the waiting period, refers to the time an individual must wait before their long-term care insurance coverage kicks in. Opting for a longer elimination period can reduce premiums, as it decreases the insurer's liability.

- Inflation Protection: Inflation protection is an optional feature that ensures the benefits of the insurance policy keep pace with rising healthcare costs. While it may increase the initial premium, it provides valuable protection against future cost increases.

- Policy Type and Provider: The type of policy and the insurance provider chosen can also affect the average price. Different providers offer various policy structures and pricing models, so it's essential to compare options.

- Regional Variations: Long-term care insurance costs can vary based on the region or state in which the policy is purchased. This is due to differences in healthcare costs and regulations across different areas.

Average Price Range

Considering the factors mentioned above, the average price of long-term care insurance can range from a few hundred dollars to over a thousand dollars annually. However, it’s crucial to remember that this is just an estimate, and actual prices can vary significantly based on individual circumstances and the chosen policy.

| Age | Average Annual Premium |

|---|---|

| 50 years | $1,200 - $2,500 |

| 60 years | $1,500 - $3,000 |

| 70 years | $2,000 - $4,000 |

The table above provides a rough estimate of average annual premiums based on age. It's important to note that these figures are for illustrative purposes only and may not reflect the exact costs for every individual.

Analyzing Real-World Examples

To better understand the average price of long-term care insurance, let’s examine a few real-world examples. These cases will showcase how different factors can influence the cost of coverage.

Case Study 1: Young and Healthy Individual

Sarah, a 35-year-old non-smoker with no significant health issues, decides to purchase long-term care insurance. She opts for a comprehensive policy with a daily benefit of 200 and a benefit period of 3 years. Considering her age and health, she receives a premium quote of approximately 800 annually. This example highlights the advantage of purchasing insurance at a younger age.

Case Study 2: Middle-Aged Individual with Health Concerns

John, a 55-year-old individual with a history of diabetes, is concerned about his future healthcare needs. He seeks long-term care insurance with a daily benefit of 300 and a benefit period of 5 years. Due to his health condition, John's premium quote is higher, around 2,000 annually. This case illustrates how pre-existing health conditions can impact the average price.

Case Study 3: Elderly Individual with Comprehensive Coverage

Emily, an 80-year-old retiree, wishes to ensure she has adequate long-term care coverage. She chooses a policy with a daily benefit of 400 and a benefit period of 10 years. Given her age and the comprehensive nature of the policy, Emily's premium is higher, at approximately 4,500 annually. This example demonstrates how the cost of insurance increases with age and the extent of coverage.

Performance Analysis and Future Implications

Analyzing the performance of long-term care insurance is essential to understand its value and potential impact on individuals’ financial well-being. Let’s delve into a comprehensive analysis and discuss the future implications.

Performance Metrics

To evaluate the performance of long-term care insurance, we can consider the following key metrics:

- Claim Acceptance Rate: The percentage of submitted claims that are accepted and paid out by insurance providers. A higher acceptance rate indicates better policy performance.

- Claim Processing Time: The average time it takes for insurance companies to process and approve claims. A shorter processing time ensures timely access to benefits.

- Customer Satisfaction: Measuring customer satisfaction through surveys and feedback can provide insights into the overall experience and effectiveness of long-term care insurance policies.

- Cost of Care: Monitoring the cost of long-term care services over time helps assess the adequacy of insurance coverage and the potential need for policy adjustments.

Future Implications

Long-term care insurance is an evolving field, and several factors may impact its future direction and importance. Here are some key implications to consider:

- Rising Healthcare Costs: As healthcare costs continue to increase, the demand for long-term care insurance may rise. Individuals will seek protection against escalating expenses, making insurance an essential financial tool.

- Changing Demographics: With an aging population, the need for long-term care services is expected to grow. This demographic shift may lead to increased awareness and adoption of long-term care insurance.

- Policy Innovations: Insurance providers may introduce new policy features and benefits to meet changing consumer needs. Innovations could include more flexible coverage options and improved inflation protection.

- Government Initiatives: Governments may play a more significant role in long-term care planning, potentially influencing the demand for private insurance. Public-private partnerships or expanded public programs could impact the insurance landscape.

Expert Insights and Recommendations

Based on our in-depth analysis, here are some expert insights and recommendations for individuals considering long-term care insurance:

FAQ

Can I purchase long-term care insurance after retirement?

+Yes, it is possible to purchase long-term care insurance after retirement. However, premiums may be higher due to increased age and potential health concerns. It’s advisable to explore options sooner rather than later to secure more affordable coverage.

Are there any tax benefits associated with long-term care insurance?

+Yes, long-term care insurance may offer tax advantages. Premiums paid for qualified long-term care insurance policies are typically tax-deductible if they meet certain criteria. Consult a tax professional for guidance on applicable deductions.

Can I customize my long-term care insurance policy?

+Absolutely! Long-term care insurance policies often allow for customization to meet individual needs. You can choose the daily benefit amount, benefit period, inflation protection, and other features to create a policy that aligns with your preferences and budget.

What if I change my mind and want to cancel my policy?

+Most long-term care insurance policies have a grace period during which you can cancel without penalty. After the grace period, cancellation may result in a refund of unearned premiums, but it’s important to review the specific terms and conditions of your policy.