Out Of Pocket Insurance

In the world of healthcare, understanding the nuances of insurance coverage is crucial, especially when it comes to the term "Out of Pocket" expenses. This concept, often abbreviated as OOP, plays a significant role in how individuals manage their healthcare costs. It's not just a financial term; it's a key factor influencing the accessibility and affordability of healthcare services. As we delve into the intricacies of Out of Pocket insurance, we'll uncover the essential details, explore real-world examples, and provide insights to empower individuals in navigating this aspect of healthcare.

Demystifying Out of Pocket Insurance

Out of Pocket insurance refers to the expenses that an individual must pay for healthcare services that are not fully covered by their insurance plan. These costs are an essential component of healthcare plans and can significantly impact an individual's financial planning and decision-making regarding healthcare.

Understanding the Basics

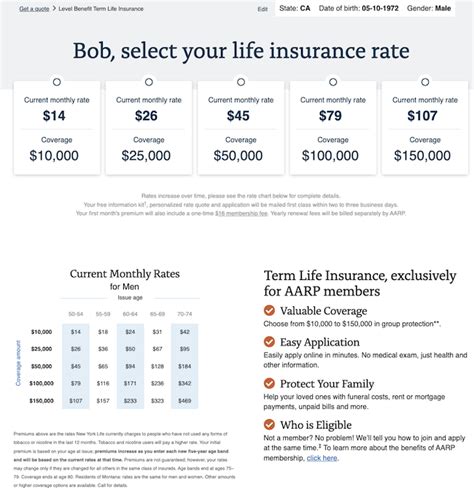

OOP expenses typically include deductibles, copayments, and coinsurance. A deductible is the amount an insured person must pay out of their own pocket before the insurance company starts covering the costs. For instance, if your plan has a $1,000 deductible, you'll pay the first $1,000 of your medical bills before insurance kicks in. Copayments, often referred to as copays, are fixed amounts you pay for a covered healthcare service, usually at the time of service. For example, a $20 copay for a doctor's visit. Coinsurance, on the other hand, is a percentage of the total cost of a covered healthcare service that you pay after you've met your deductible. It's usually expressed as a ratio, like 20% coinsurance, meaning you pay 20% of the cost, and your insurance covers the remaining 80%.

Real-World Examples

Let's illustrate this with an example. Imagine you have an insurance plan with a $500 deductible, a $20 copay for doctor visits, and 20% coinsurance. If you visit your primary care physician, you'll pay the $20 copay at the time of service. However, if you need specialized treatment or tests, and the total bill amounts to $1,500, here's how it breaks down:

| Expense | Cost |

|---|---|

| Deductible | $500 |

| Coinsurance (20% of $1,000) | $200 |

| Total Out of Pocket | $700 |

In this scenario, you'd pay a total of $700 out of pocket, covering the deductible, copay, and coinsurance. The insurance company would cover the remaining $800.

Managing Out of Pocket Costs

Managing Out of Pocket expenses is a crucial aspect of financial planning for healthcare. It involves a careful understanding of your insurance plan's specifics and strategic decision-making to optimize your healthcare choices.

Planning for Deductibles

Deductibles can be a significant expense, especially if you have a high-deductible health plan (HDHP). One strategy to manage deductibles is to set aside funds specifically for healthcare in a Health Savings Account (HSA) or a Flexible Spending Account (FSA). These accounts allow you to save pre-tax dollars to cover your Out of Pocket expenses. Additionally, if you anticipate needing significant medical care, you might consider a plan with a lower deductible, even if it means higher monthly premiums.

Copayments and Coinsurance Strategies

Copayments and coinsurance are more frequent expenses, and managing them effectively can make a difference in your overall healthcare costs. For instance, if you have a condition that requires regular doctor visits or medication, a plan with lower copays or coinsurance might be more cost-effective in the long run. Some plans offer negotiated rates with providers, which can reduce the amount you pay out of pocket for certain services.

Maximizing Preventive Care

Many insurance plans cover preventive care services, like annual check-ups, vaccinations, and certain screenings, without any Out of Pocket costs. Taking advantage of these services can help you stay healthy and catch potential issues early, potentially saving you from more significant expenses down the line.

| Preventive Care Example | Potential Savings |

|---|---|

| Annual Physical Exam | Early detection of health issues, avoiding more costly treatments later |

| Vaccinations | Preventing illness and associated medical costs |

| Screenings (e.g., Mammograms, Colonoscopies) | Early detection of serious conditions, leading to more effective and less expensive treatments |

The Impact of Out of Pocket Insurance on Healthcare Decisions

Out of Pocket expenses can significantly influence an individual's decisions regarding healthcare. It's not just about the financial burden; it's about the broader implications for health and well-being.

Access to Care

High Out of Pocket costs can act as a barrier to accessing necessary healthcare services. For individuals with limited financial means, the prospect of paying substantial sums for medical care can be a deterrent. This can lead to delayed or forgone treatment, which may result in more severe health issues and increased healthcare costs in the long run.

Treatment Choices

When faced with Out of Pocket expenses, individuals might opt for less expensive treatment options, even if they're not the most effective or recommended. This could include choosing generic medications over brand-name drugs or opting for a less comprehensive treatment plan to save costs. While cost-consciousness is important, it's crucial to balance financial considerations with medical advice to ensure the best health outcomes.

Financial Planning and Well-Being

Out of Pocket expenses can also impact an individual's financial planning and overall well-being. Unexpected medical bills can strain budgets, lead to debt, or require sacrifices in other areas of life. This financial stress can, in turn, affect mental health and overall quality of life. Therefore, understanding and managing Out of Pocket costs is not just a financial strategy but a holistic approach to maintaining good health and well-being.

The Future of Out of Pocket Insurance

The landscape of Out of Pocket insurance is evolving, driven by changes in healthcare policies, technological advancements, and shifts in consumer preferences. These changes are likely to shape the future of healthcare and how individuals interact with their insurance coverage.

Policy and Regulatory Changes

Policy changes at the federal and state levels can significantly impact Out of Pocket expenses. For instance, the implementation of the Affordable Care Act (ACA) in the United States brought about regulations that limit Out of Pocket maximums and mandate coverage for certain preventive services without any cost sharing. Such policies aim to make healthcare more accessible and affordable for all.

Technological Advancements

The digital revolution in healthcare is transforming how individuals manage their healthcare and Out of Pocket expenses. Mobile apps and online platforms now offer tools for tracking and managing healthcare costs, providing real-time information on Out of Pocket limits, and helping individuals make more informed decisions. Additionally, telemedicine and virtual healthcare services are often more affordable and convenient, offering an alternative to in-person visits with lower Out of Pocket costs.

Consumer-Centric Approaches

There's a growing trend towards consumer-centric healthcare, where individuals have more control and choice in their healthcare decisions. This includes a shift towards value-based care, where healthcare providers are incentivized to deliver high-quality, cost-effective care. In such a model, Out of Pocket expenses could become more transparent and manageable, aligning with the consumer's best interests.

| Consumer-Centric Healthcare | Potential Benefits |

|---|---|

| Transparent Pricing | Individuals can make informed choices about healthcare services based on cost and quality. |

| Value-Based Care | Providers are incentivized to deliver efficient, effective care, potentially reducing Out of Pocket expenses. |

| Personalized Plans | Insurance plans could be tailored to an individual's specific needs and budget, optimizing Out of Pocket costs. |

Frequently Asked Questions

How do Out of Pocket expenses impact my overall healthcare costs?

+Out of Pocket expenses can significantly influence your overall healthcare costs. They include deductibles, copays, and coinsurance, which you pay directly. These costs can add up, especially if you require extensive medical care. Understanding your plan’s Out of Pocket limits can help you budget effectively and choose the right healthcare options.

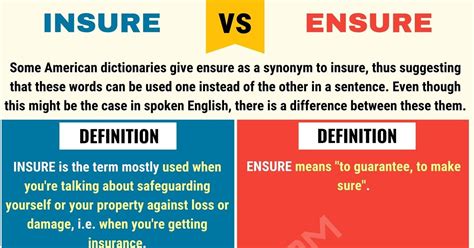

What is the difference between a deductible and coinsurance?

+A deductible is the amount you must pay out of pocket before your insurance coverage begins. It’s typically a fixed amount for each benefit period. Coinsurance, on the other hand, is a percentage of the total cost of a covered healthcare service that you pay after you’ve met your deductible. For example, if you have 20% coinsurance, you pay 20% of the cost, and your insurance covers the remaining 80%.

How can I reduce my Out of Pocket expenses for healthcare?

+There are several strategies to reduce Out of Pocket expenses. These include choosing a plan with a lower deductible or lower coinsurance, setting aside funds in a Health Savings Account (HSA) or Flexible Spending Account (FSA) for healthcare expenses, and taking advantage of preventive care services, which are often covered without any Out of Pocket costs. Additionally, staying informed about your plan’s benefits and negotiating rates with providers can help.

What are some common challenges associated with Out of Pocket insurance, and how can they be addressed?

+Common challenges include the financial burden of high Out of Pocket costs, which can deter individuals from seeking necessary healthcare. To address this, policies and initiatives can focus on limiting Out of Pocket maximums and making healthcare more affordable. Technological advancements, like healthcare apps and virtual services, can also make healthcare more accessible and cost-effective.