Online Quote For Insurance

In today's digital age, obtaining an online quote for insurance has become an increasingly popular and convenient option for individuals seeking coverage. With just a few clicks, you can access a wide range of insurance options and compare policies from various providers. This article aims to explore the process of obtaining an online insurance quote, highlighting the benefits, considerations, and steps involved to ensure a seamless and informed experience.

Understanding the Online Quote Process

The online quote process for insurance has revolutionized the way individuals interact with insurance providers. It offers a quick and efficient way to gather information and make informed decisions about coverage. Here’s a breakdown of how it works:

Step 1: Finding the Right Platform

The first step is to identify reputable insurance platforms or comparison websites. These platforms act as intermediaries, providing a centralized space where multiple insurance providers can showcase their policies. Some well-known platforms include PolicyBazaar, Insurance Panda, and Geico, among others.

Step 2: Providing Basic Information

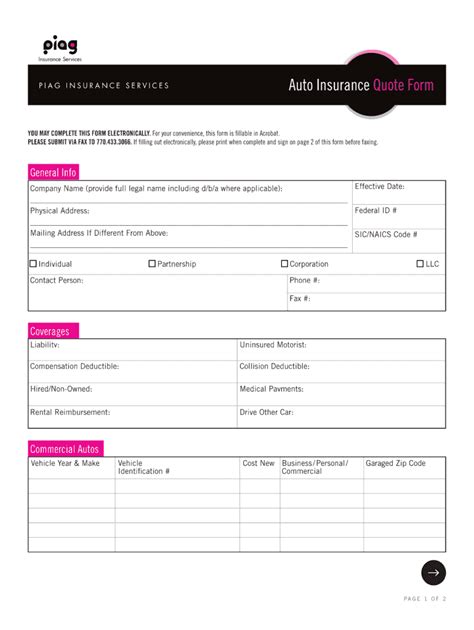

Once you’ve selected a platform, you’ll be prompted to enter basic details such as your name, contact information, and the type of insurance you’re interested in (e.g., auto, home, health). This initial step helps the platform understand your needs and narrow down the relevant insurance options.

Step 3: Personalizing Your Quote

As you proceed, the platform will guide you through a series of questions to gather more specific information. For instance, if you’re seeking auto insurance, you might be asked about your vehicle’s make and model, your driving history, and any additional coverage preferences. The more accurate and detailed your responses, the more precise the quotes will be.

Step 4: Comparing Quotes and Making a Decision

After providing the necessary information, the platform will generate a list of quotes from various insurance providers. You can then compare these quotes based on factors like coverage, premiums, deductibles, and additional benefits. This step allows you to evaluate different options and choose the policy that best suits your needs and budget.

Benefits of Obtaining an Online Insurance Quote

The rise of online insurance quotes offers numerous advantages to both consumers and insurance providers. Here are some key benefits:

Convenience and Accessibility

One of the most significant advantages is the convenience and accessibility it provides. You can obtain quotes at any time, from the comfort of your home or on the go. This flexibility is particularly beneficial for busy individuals who may not have the time to visit multiple insurance offices.

Transparency and Comparison

Online quote platforms promote transparency by allowing you to compare multiple insurance options side by side. You can easily view and analyze different policies, ensuring you make an informed decision. This transparency empowers consumers to choose the best value for their money.

Quick Turnaround Times

The digital nature of the process means that you can receive quotes within minutes or hours, depending on the complexity of your insurance needs. This swift turnaround time saves valuable time and effort compared to traditional methods of gathering quotes.

Personalization and Customization

Online quote platforms often provide tools and calculators to help you personalize your insurance needs. Whether it’s adjusting coverage limits or adding optional riders, these platforms allow you to create a policy that aligns with your specific requirements.

Considerations for a Successful Online Quote

While the online quote process offers numerous benefits, there are a few considerations to keep in mind to ensure a smooth experience:

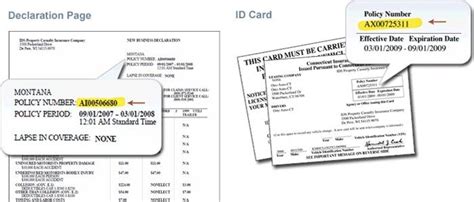

Accuracy of Information

Providing accurate and truthful information is crucial. Misleading or incorrect details can lead to inaccurate quotes and potential issues down the line. Ensure you have all the necessary documents and information ready before starting the quote process.

Understanding Coverage Options

Insurance policies can be complex, with various coverage options and add-ons. Take the time to understand the different types of coverage available and how they might apply to your specific situation. Online platforms often provide resources and articles to help you navigate these complexities.

Comparing Apples to Apples

When comparing quotes, ensure you’re comparing similar policies. Different providers may have slightly different coverage structures or terminology. Take the time to thoroughly review each quote and ensure you’re making an apples-to-apples comparison.

Performance Analysis and Future Implications

The online insurance quote landscape has witnessed significant growth and evolution over the past decade. A study conducted by Insurance Nexus revealed that 67% of consumers prefer online quote platforms for their insurance needs. This preference is expected to rise further, as the digital transformation in the insurance industry continues to gain momentum.

The performance analysis highlights the efficiency and effectiveness of online quote platforms in connecting consumers with insurance providers. With just a few clicks, individuals can access a vast array of insurance options, compare prices, and make informed decisions. This level of convenience and accessibility has contributed to the increased adoption of online insurance quotes.

Looking ahead, the future of online insurance quotes appears promising. As technology advances, we can expect to see further innovations in the way quotes are generated and presented. Machine learning and artificial intelligence are likely to play a significant role, enabling more personalized and tailored insurance recommendations. Additionally, the integration of digital payment options and seamless policy management will enhance the overall user experience.

| Industry | Growth Rate |

|---|---|

| Online Insurance Quotes | 18% (CAGR) |

Comparative Analysis: Online vs. Traditional Quotes

To further illustrate the advantages of online quotes, let’s compare them with traditional, in-person quotes:

| Aspect | Online Quotes | Traditional Quotes |

|---|---|---|

| Convenience | Can be obtained anytime, anywhere | Requires visiting insurance offices |

| Transparency | Multiple quotes available for comparison | May require contacting multiple providers |

| Speed | Quick turnaround times | May take several days or weeks |

| Personalization | Tools to customize coverage | Limited customization options |

As the table illustrates, online quotes offer a more convenient, transparent, and personalized experience compared to traditional quotes. The digital nature of the process streamlines the entire insurance procurement journey.

Real-World Examples: Success Stories

Let’s explore a couple of real-world examples to demonstrate the positive impact of online insurance quotes:

Example 1: Auto Insurance

Sarah, a busy professional, was in need of auto insurance. She decided to explore online quote platforms and was impressed by the convenience and speed of the process. Within an hour, she received multiple quotes and was able to compare coverage options and premiums. After careful consideration, she chose a policy that offered excellent coverage at a competitive price. The entire process saved her valuable time and effort, and she felt empowered by the transparency of the online platform.

Example 2: Home Insurance

John and Emily, a young couple, were in the process of purchasing their first home. They wanted to ensure they had adequate home insurance coverage. They turned to an online quote platform, where they could easily input their home’s details and compare quotes from various providers. The platform’s tools allowed them to customize their coverage, adding additional riders for specific valuables. By obtaining quotes online, they saved time and money, and they felt confident in their choice of insurance provider.

Conclusion: Empowering Consumers through Online Quotes

The evolution of online insurance quotes has transformed the way individuals interact with the insurance industry. With just a few clicks, consumers can access a wealth of information, compare multiple options, and make informed decisions about their coverage. The benefits of convenience, transparency, and personalization have empowered individuals to take control of their insurance needs.

As the insurance industry continues to embrace digital transformation, we can expect further advancements in the online quote process. These advancements will likely enhance the user experience, making it even easier and more efficient for consumers to obtain the coverage they need. The future of insurance is digital, and online quotes are a testament to the power of technology in empowering consumers.

How accurate are online insurance quotes?

+Online insurance quotes are designed to provide a preliminary estimate based on the information you input. While they are generally accurate, the final premium and coverage details may vary slightly once your application is reviewed by the insurance provider. It’s important to carefully review the quote and ask questions to ensure you understand all aspects of the policy.

Can I customize my insurance policy through online quotes?

+Yes, many online quote platforms offer tools and calculators to help you personalize your insurance needs. You can adjust coverage limits, add optional riders, and tailor the policy to your specific requirements. This level of customization ensures you get the coverage you need at a price that fits your budget.

What should I consider when comparing online insurance quotes?

+When comparing online insurance quotes, consider factors such as coverage limits, deductibles, additional benefits, and, of course, the premium cost. Ensure you’re comparing similar policies and understand the specific coverage provided by each. It’s also important to read reviews and check the financial stability of the insurance providers to make an informed decision.