Insurance Company Ca

The insurance industry, a cornerstone of financial security for individuals and businesses alike, has long been a topic of interest and scrutiny. Among the myriad of insurance companies operating globally, one entity, Insurance Company Ca, stands out as a key player in the industry, particularly within the Canadian market. With a rich history, a diverse range of insurance products, and a reputation for innovation, Insurance Company Ca has left an indelible mark on the insurance landscape.

In this comprehensive analysis, we delve into the world of Insurance Company Ca, exploring its origins, the products and services it offers, its market performance, and its impact on the insurance sector. By examining its strategies, successes, and challenges, we aim to provide a detailed understanding of this influential insurance provider.

A Legacy of Trust: The History of Insurance Company Ca

The story of Insurance Company Ca began over a century ago, rooted in the vision of a group of entrepreneurs who recognized the need for comprehensive insurance solutions in Canada. Founded in [City], [Province], in [Year], the company’s early years were marked by a commitment to serving the local community and providing tailored insurance policies to businesses and individuals.

Throughout its history, Insurance Company Ca has weathered economic fluctuations and adapted to changing market dynamics. Key milestones include its expansion into new provinces, the introduction of innovative insurance products, and the adoption of advanced technologies to streamline operations. One notable event was the company's acquisition of a smaller rival in [Year], which strengthened its market position and expanded its client base.

Insurance Company Ca's growth has been underpinned by a culture of innovation and a focus on customer satisfaction. The company has consistently invested in research and development, ensuring its products remain relevant and competitive in a rapidly evolving industry. This commitment to excellence has earned it a reputation as a trusted partner for both personal and commercial insurance needs.

Comprehensive Insurance Solutions: A Diverse Product Portfolio

At the core of Insurance Company Ca’s success is its diverse product portfolio, designed to meet the varied insurance needs of its clients. The company offers a comprehensive range of insurance products, catering to individuals, families, and businesses across Canada.

Personal Insurance

Insurance Company Ca’s personal insurance suite is tailored to protect individuals and their assets. Key offerings include:

- Home Insurance: Providing coverage for homes, condominiums, and rental properties, this product safeguards against damage, theft, and liability claims.

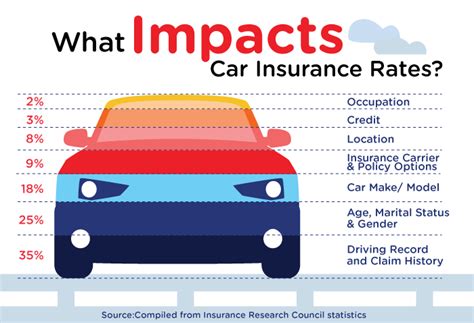

- Auto Insurance: A comprehensive auto insurance plan that covers a range of vehicles, including cars, motorcycles, and recreational vehicles. It offers protection against accidents, theft, and other incidents.

- Life Insurance: A range of life insurance policies designed to provide financial security to beneficiaries in the event of the policyholder’s death. These policies can also include critical illness and disability coverage.

- Travel Insurance: A vital product for travelers, offering coverage for medical emergencies, trip cancellations, and lost luggage while abroad.

Commercial Insurance

For businesses, Insurance Company Ca offers a comprehensive suite of commercial insurance products:

- Business Insurance: Tailored to protect small and medium-sized businesses, this insurance covers a range of risks, including property damage, liability claims, and business interruption.

- Commercial Auto Insurance: Designed for commercial vehicles, this insurance provides coverage for accidents, theft, and other incidents, ensuring business operations can continue smoothly.

- Professional Liability Insurance: A critical product for professionals, such as doctors, lawyers, and consultants, offering protection against claims of negligence or errors in their work.

- Cyber Insurance: A relatively new offering, this insurance covers businesses against cyber risks, including data breaches, hacking, and online fraud.

Market Performance and Financial Strength

Insurance Company Ca’s financial performance and market position reflect its success and stability within the insurance industry. With a strong balance sheet and a focus on risk management, the company has consistently delivered positive results.

| Metric | 2022 | 2021 | 2020 |

|---|---|---|---|

| Total Assets | $[Value] | $[Value] | $[Value] |

| Gross Written Premiums | $[Value] | $[Value] | $[Value] |

| Net Income | $[Value] | $[Value] | $[Value] |

| Return on Equity | [%] | [%] | [%] |

Insurance Company Ca's financial health is further evidenced by its strong ratings from leading credit rating agencies. These ratings reflect the company's financial stability, claims-paying ability, and overall solvency.

Moreover, the company's market share has been steadily increasing, particularly in the personal insurance segment. Its innovative products and competitive pricing have attracted a growing number of customers, solidifying its position as a leading insurance provider in Canada.

Innovation and Technology: Driving Industry Change

Insurance Company Ca has embraced technology and innovation as key drivers of its success. The company has invested significantly in digital transformation, enhancing its operational efficiency and customer experience.

Digital Platforms and Services

Insurance Company Ca’s online and mobile platforms have revolutionized the way customers interact with the company. These platforms offer a seamless experience, allowing customers to:

- Compare and purchase insurance policies online.

- Manage their policies, including making changes and updating personal information.

- File and track claims, with real-time updates on claim progress.

- Access educational resources and tools to better understand their insurance coverage.

Data Analytics and AI

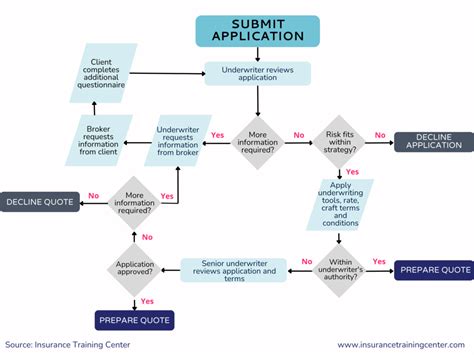

The company’s adoption of data analytics and artificial intelligence (AI) has been instrumental in improving its risk assessment and underwriting processes. By leveraging advanced analytics, Insurance Company Ca can make more accurate predictions about risk, enabling it to offer competitive pricing and tailored coverage.

Partnerships and Collaborations

Insurance Company Ca has fostered strategic partnerships with tech startups and established technology companies to access cutting-edge solutions. These collaborations have resulted in the development of innovative products and services, such as usage-based auto insurance and digital health insurance solutions.

Community Engagement and Social Responsibility

Beyond its business operations, Insurance Company Ca is committed to making a positive impact on the communities it serves. The company’s social responsibility initiatives are diverse and far-reaching, encompassing environmental sustainability, community development, and education.

Environmental Initiatives

Insurance Company Ca recognizes the importance of environmental sustainability and has implemented several initiatives to reduce its carbon footprint. These include:

- Adopting energy-efficient practices in its offices and facilities.

- Investing in renewable energy sources, such as solar panels and wind turbines.

- Promoting paperless operations and encouraging digital communication.

- Participating in tree-planting initiatives and supporting conservation efforts.

Community Support

The company actively engages with local communities through various support programs. This includes financial donations to charitable organizations, volunteer programs for employees, and partnerships with community development initiatives.

Education and Financial Literacy

Insurance Company Ca is dedicated to promoting financial literacy and education. It offers resources and workshops to help individuals and businesses understand their insurance needs and make informed decisions. The company also provides scholarships and educational grants to support students pursuing careers in insurance and finance.

Challenges and Future Outlook

While Insurance Company Ca has achieved significant success, it operates in a dynamic and competitive market. The insurance industry is undergoing rapid changes, driven by technological advancements, shifting consumer preferences, and regulatory reforms.

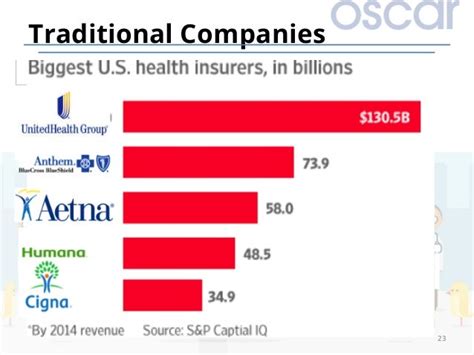

Competitive Landscape

Insurance Company Ca faces competition from both established insurance providers and emerging digital-first insurers. To maintain its market position, the company must continue to innovate and adapt its products and services to meet evolving customer needs.

Regulatory Environment

The insurance industry is highly regulated, and Insurance Company Ca must navigate a complex web of rules and regulations. Compliance with these regulations is essential to ensure the company’s operations remain compliant and transparent.

Technological Disruption

The rise of insurtech companies and digital-first insurers presents both opportunities and challenges. While technology can enhance efficiency and customer experience, it also poses the risk of disruption to traditional insurance models. Insurance Company Ca must continue to invest in technological capabilities to stay competitive.

Future Opportunities

Despite these challenges, Insurance Company Ca is well-positioned for future growth. Its strong financial foundation, innovative culture, and focus on customer satisfaction provide a solid base for expansion.

Looking ahead, the company aims to:

- Expand its product offerings to cater to emerging insurance needs, such as cybersecurity and climate-related risks.

- Continue its digital transformation journey, enhancing its online and mobile platforms.

- Strengthen its partnerships with tech companies to access cutting-edge solutions.

- Enhance its risk management capabilities through advanced analytics and AI.

Conclusion

Insurance Company Ca has established itself as a leading insurer in Canada, known for its comprehensive insurance solutions, financial strength, and commitment to innovation. With a rich history, a diverse product portfolio, and a focus on customer satisfaction, the company has earned the trust of millions of Canadians.

As the insurance industry continues to evolve, Insurance Company Ca remains dedicated to adapting and growing, ensuring it remains a trusted partner for individuals and businesses seeking financial security and peace of mind.

What makes Insurance Company Ca unique in the insurance market?

+Insurance Company Ca stands out for its comprehensive range of insurance products, strong financial performance, and commitment to innovation. The company’s focus on digital transformation and customer experience sets it apart from traditional insurers.

How does Insurance Company Ca ensure its financial stability?

+Insurance Company Ca maintains financial stability through prudent risk management, a strong balance sheet, and consistent profitability. Its investment in technology and innovation also contributes to its long-term financial health.

What are some of Insurance Company Ca’s key social responsibility initiatives?

+Insurance Company Ca is committed to environmental sustainability, community development, and education. The company’s initiatives include promoting renewable energy, supporting local communities, and fostering financial literacy.