Private Health Insurance New York State

In the vast landscape of New York State, the healthcare system is a complex tapestry, and understanding the intricacies of private health insurance is crucial for residents. With a diverse population and varying healthcare needs, navigating the private insurance market can be challenging. This comprehensive guide aims to shed light on the essential aspects of private health insurance in New York State, providing valuable insights and expert advice.

The Landscape of Private Health Insurance in New York State

New York State boasts a vibrant healthcare industry, offering a wide range of private health insurance options to cater to its residents’ diverse needs. The state’s commitment to healthcare accessibility and innovation has led to the development of robust insurance markets, providing coverage for individuals, families, and small businesses.

Private health insurance in New York State is characterized by its comprehensive benefits and consumer-friendly regulations. The state has implemented measures to ensure affordability and accessibility, making it a leader in healthcare reform. This has resulted in a competitive market, with various insurers offering unique plans and specialized services.

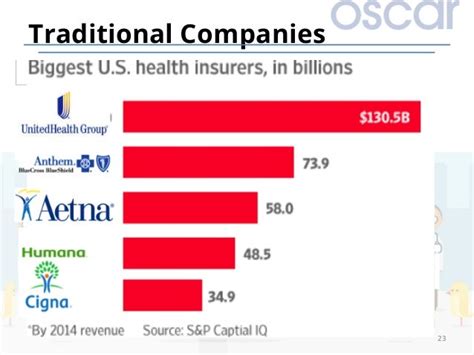

Key Players in the New York Health Insurance Market

The New York health insurance market is dominated by several major providers, each with its own distinct offerings and network of healthcare providers. Some of the key players include:

- Empire BlueCross BlueShield: A leading insurer, offering a wide range of plans, including PPOs, HMOs, and EPOs. They have an extensive network of providers across the state, ensuring easy access to healthcare services.

- UnitedHealthcare: Known for its comprehensive benefits and nationwide coverage, UnitedHealthcare provides a variety of plan options, including PPOs and HSAs. Their plans often include additional wellness programs and resources.

- Aetna: Aetna's presence in New York State offers a blend of traditional and innovative plans. They provide PPOs, HMOs, and specialty plans for specific healthcare needs, ensuring personalized coverage.

- Cigna: With a focus on holistic healthcare, Cigna offers plans that promote preventive care and wellness. Their network includes a variety of healthcare providers, from primary care physicians to specialists.

- Oscar Health: A newer player in the market, Oscar Health has made waves with its tech-savvy approach to insurance. They offer user-friendly plans with digital tools for managing healthcare, appealing to younger generations.

Understanding Plan Types and Benefits

When navigating the private health insurance market in New York State, it’s crucial to understand the different plan types and the benefits they offer. Here’s a breakdown of the most common plan types and their key features:

Preferred Provider Organizations (PPOs)

PPOs are popular in New York State, offering flexibility and a wide network of healthcare providers. With a PPO plan, you can visit any in-network doctor or hospital without a referral, and out-of-network services are also covered, although at a lower rate.

Key features of PPOs include:

- Flexibility: Visit any in-network provider without a referral.

- Extensive Network: PPOs typically have a large network of healthcare providers, ensuring easy access to specialists.

- Out-of-Network Coverage: While out-of-network services are covered, they come with higher out-of-pocket costs.

- Cost-Sharing: PPOs often have deductibles, copayments, and coinsurance, with costs varying based on the specific plan.

Health Maintenance Organizations (HMOs)

HMOs are known for their focus on preventive care and primary care physicians. With an HMO plan, you must choose a primary care physician (PCP) who coordinates your healthcare and provides referrals for specialists.

Key features of HMOs include:

- Primary Care Physician: You must choose a PCP who acts as your healthcare coordinator.

- Referrals Required: Specialist visits require a referral from your PCP.

- Limited Network: HMO plans typically have a smaller network of providers, which can restrict your choices.

- Lower Out-of-Pocket Costs: HMOs often have lower deductibles and copayments compared to other plan types.

Exclusive Provider Organizations (EPOs)

EPOs are a hybrid of PPOs and HMOs, offering a more limited network than PPOs but without the referral requirements of HMOs. With an EPO plan, you have access to a specific network of providers, and services outside this network are typically not covered.

Key features of EPOs include:

- Limited Network: EPOs have a defined network of providers, and out-of-network services are not covered.

- No Referrals Needed: Unlike HMOs, EPOs do not require referrals for specialist visits.

- Cost-Effective: EPO plans often have lower premiums compared to PPOs, making them a budget-friendly option.

- Wellness Programs: Many EPO plans offer wellness incentives and programs to encourage healthy lifestyles.

Evaluating Plan Costs and Coverage

When choosing a private health insurance plan in New York State, it's essential to carefully evaluate the costs and coverage to ensure it aligns with your healthcare needs and budget.

Premium Costs

The premium is the amount you pay monthly to maintain your health insurance coverage. Premium costs can vary based on factors such as age, location, plan type, and the level of coverage you choose.

New York State has implemented regulations to ensure premium affordability, and competition among insurers has also contributed to more competitive pricing. When comparing plans, pay close attention to the premium costs and consider your budget and ability to pay consistently.

Deductibles and Out-of-Pocket Maximums

Deductibles are the amount you must pay out of pocket before your insurance coverage kicks in. Out-of-pocket maximums, on the other hand, represent the most you will pay in a year for covered services. Understanding these costs is crucial when evaluating plan affordability.

New York State has set limits on out-of-pocket maximums to protect consumers. These limits vary based on plan type and whether you have individual or family coverage. When comparing plans, consider your healthcare needs and whether you anticipate high or low medical expenses.

| Plan Type | Out-of-Pocket Maximum (Individual) | Out-of-Pocket Maximum (Family) |

|---|---|---|

| PPO | $8,700 | $17,400 |

| HMO | $8,250 | $16,500 |

| EPO | $8,450 | $16,900 |

Covered Services and Benefits

Private health insurance plans in New York State must cover essential health benefits, as mandated by the Affordable Care Act (ACA). These benefits include:

- Ambulatory patient services

- Emergency services

- Hospitalization

- Maternity and newborn care

- Mental health and substance use disorder services

- Prescription drugs

- Rehabilitative and habilitative services

- Preventive and wellness services

- Chronic disease management

- Pediatric services, including dental and vision care

Beyond these essential benefits, plans may offer additional coverage for specific needs, such as dental, vision, or specialty services. When evaluating plans, carefully review the covered services and benefits to ensure they align with your healthcare requirements.

Navigating the Enrollment Process

Enrolling in private health insurance in New York State can be a straightforward process, especially with the state’s user-friendly online marketplace, the New York State of Health. This marketplace, also known as the Health Benefit Exchange, provides a centralized platform for residents to compare and enroll in qualified health plans.

The New York State of Health Marketplace

The New York State of Health marketplace offers a wide range of private health insurance plans from various insurers. You can compare plans based on cost, coverage, and network to find the one that best suits your needs.

To enroll through the marketplace, you'll need to create an account and provide basic information about yourself and your household. You'll also need to estimate your household income for the upcoming year, as this information is used to determine your eligibility for premium tax credits and other cost-saving programs.

The marketplace provides a simple and intuitive application process, guiding you through the steps to enroll in a plan that meets your needs. You can also receive assistance from trained navigators or brokers who can provide personalized guidance and support.

Open Enrollment and Special Enrollment Periods

In New York State, there are two main enrollment periods for private health insurance:

- Open Enrollment Period: This is a set period of time each year when anyone can enroll in a health insurance plan, regardless of their health status. The dates for the open enrollment period are typically announced in advance, giving residents ample time to prepare and compare plans.

- Special Enrollment Period: Outside of the open enrollment period, you may still be able to enroll in a plan if you experience a qualifying life event, such as losing other health coverage, getting married, or having a baby. These special enrollment periods allow for coverage changes outside of the standard open enrollment timeframe.

It's important to note that failing to enroll during these periods may result in a gap in coverage and potential penalties. Staying informed about the enrollment periods and taking advantage of the resources provided by the New York State of Health marketplace can ensure a smooth and timely enrollment process.

Utilizing Your Health Insurance Plan

Once you’ve enrolled in a private health insurance plan in New York State, it’s essential to understand how to make the most of your coverage and navigate the healthcare system effectively.

Choosing a Primary Care Physician (PCP)

Depending on your plan type, you may need to choose a primary care physician (PCP) who will coordinate your healthcare and provide referrals for specialists. When selecting a PCP, consider factors such as their location, office hours, and specialization.

Many insurance plans provide a directory of in-network providers, including PCPs, on their websites. You can also contact your insurance company's customer service to request a list of PCPs in your area. Take the time to research and choose a PCP who aligns with your healthcare needs and preferences.

Understanding Your Network and Provider Choices

Private health insurance plans in New York State typically have a network of preferred providers, including doctors, hospitals, and other healthcare facilities. It’s crucial to understand your plan’s network and the providers included to ensure you receive the best coverage and rates.

When seeking healthcare services, always verify that your provider is in-network. Out-of-network services may be covered by your plan, but they often come with higher out-of-pocket costs. Checking your plan's network and provider directory regularly can help you make informed decisions about your healthcare choices.

Managing Your Health Insurance Costs

Managing your health insurance costs is an essential aspect of making the most of your coverage. Here are some tips to help you navigate the financial aspects of your health insurance plan:

- Understand Your Plan’s Cost-Sharing Structure: Familiarize yourself with your plan’s deductibles, copayments, and coinsurance. Knowing these costs can help you budget for healthcare expenses and make informed decisions about seeking care.

- Take Advantage of Preventive Care: Many private health insurance plans in New York State cover preventive care services, such as annual check-ups, screenings, and immunizations, at no cost to you. Utilizing these services can help identify potential health issues early on and potentially save on future medical costs.

- Explore Wellness Programs and Incentives: Some insurance plans offer wellness programs and incentives to encourage healthy lifestyles. These programs may include discounts on gym memberships, weight loss programs, or smoking cessation resources. Taking advantage of these programs can improve your overall health and potentially reduce your healthcare costs.

- Review Your Explanation of Benefits (EOB): After receiving healthcare services, you’ll typically receive an Explanation of Benefits (EOB) from your insurance company. This document outlines the charges, any discounts applied, and the amount your insurance covers. Reviewing your EOB can help you understand your coverage and identify any billing errors or discrepancies.

Common Questions and Concerns

What if I have a pre-existing condition? Will I be able to get health insurance coverage in New York State?

+Yes, New York State prohibits insurers from denying coverage or charging higher premiums based on pre-existing conditions. This protection ensures that individuals with pre-existing conditions can access affordable health insurance coverage.

Can I keep my current doctor if I switch insurance plans?

+It depends on your new plan’s network. If your current doctor is in-network with your new plan, you can continue seeing them. However, if they are out-of-network, you may need to choose a new doctor within your plan’s network or pay higher out-of-pocket costs to see your current doctor.

Are there any financial assistance programs available for purchasing private health insurance in New York State?

+Yes, New York State offers premium tax credits and cost-sharing reductions to help make health insurance more affordable for eligible individuals and families. These programs can significantly reduce your out-of-pocket costs and make insurance more accessible.

How can I find out if a provider is in-network with my insurance plan?

+You can check your insurance plan’s provider directory, which is typically available on their website or by contacting their customer service. You can also call your provider’s office to verify their network participation with your insurance plan.

What should I do if I have a complaint or issue with my insurance company or plan?

+You can contact your insurance company’s customer service to discuss your concerns. If the issue remains unresolved, you can file a complaint with the New York State Department of Financial Services, which regulates insurance companies in the state. They can provide guidance and assistance in resolving insurance-related disputes.

Navigating the world of private health insurance in New York State requires careful consideration and research. By understanding the plan types, evaluating costs and coverage, and utilizing the resources available, you can make informed decisions about your healthcare and ensure you have the coverage you need. Remember, health insurance is an investment in your well-being, and taking the time to choose the right plan can provide peace of mind and access to quality healthcare services.