How Much Is Home Insurance A Month

Home insurance is an essential aspect of homeownership, providing financial protection against various risks and unexpected events. The cost of home insurance is a significant concern for many homeowners, as it can vary widely based on numerous factors. Understanding the average monthly premiums and the factors that influence them is crucial for homeowners to make informed decisions about their insurance coverage.

In this comprehensive guide, we will delve into the world of home insurance costs, exploring the average monthly expenses, the key factors that impact premiums, and strategies to obtain affordable coverage. By the end of this article, you will have a clearer understanding of the financial commitment required for home insurance and the steps you can take to secure the best value for your money.

Understanding the Average Monthly Home Insurance Premiums

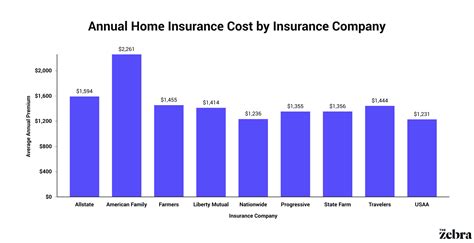

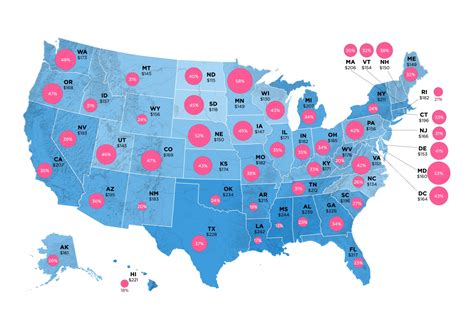

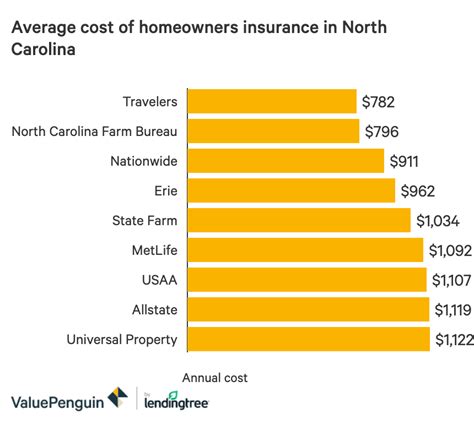

The average monthly cost of home insurance varies across different regions and can be influenced by a multitude of factors. According to industry reports, the national average monthly premium for home insurance in the United States is approximately $100 to $200, with some states having higher or lower averages. However, it's important to note that these averages are just a starting point, and your specific circumstances can significantly affect the final cost.

To illustrate the variability in home insurance premiums, let's examine a few examples. In a suburban area like Suburbia, USA, the average monthly premium might be around $150, reflecting a balanced risk profile. On the other hand, in a coastal region prone to hurricanes, such as Hurricane Haven, premiums could easily surpass $300 per month due to the increased risk of natural disasters.

Understanding these averages provides a benchmark, but it's essential to assess your unique situation to obtain an accurate estimate for your home insurance.

Factors Influencing Home Insurance Premiums

The cost of home insurance is influenced by a myriad of factors, each playing a role in determining the final premium. Here are some of the key elements that insurance providers consider when calculating premiums:

1. Location

The geographical location of your home is a significant factor in determining insurance costs. Areas with higher crime rates, frequent natural disasters, or a higher risk of extreme weather events typically result in higher premiums. For instance, a home located in a flood-prone region will likely face higher insurance costs due to the increased risk of damage.

2. Home Value and Size

The value and size of your home directly impact insurance premiums. Larger homes with higher replacement costs will generally require more extensive coverage, leading to higher premiums. Additionally, homes with valuable assets or specialized features, such as a swimming pool or a unique architectural design, may face increased insurance costs.

3. Construction Materials and Age

The materials used in your home's construction and its age can influence insurance rates. Homes built with fire-resistant materials or those that have undergone recent renovations to enhance safety may qualify for lower premiums. Conversely, older homes, especially those with outdated electrical or plumbing systems, may face higher insurance costs due to the increased risk of accidents.

4. Risk Factors and Claims History

Your personal risk factors and claims history are carefully evaluated by insurance providers. If you have a history of filing multiple claims, even for minor incidents, it can lead to higher premiums or even difficulty in securing coverage. Similarly, personal risk factors like a criminal record or a history of substance abuse may impact your insurance costs.

5. Deductibles and Coverage Limits

The deductibles and coverage limits you choose directly affect your insurance premiums. Opting for higher deductibles (the amount you pay out of pocket before insurance coverage kicks in) can lower your monthly premiums, but it also means you'll bear more financial responsibility in the event of a claim. Similarly, selecting higher coverage limits will result in increased premiums to ensure adequate protection for your assets.

6. Discounts and Bundles

Insurance providers often offer discounts and bundle packages to encourage customer loyalty and reduce costs. Discounts may be available for homeowners who bundle their home and auto insurance policies with the same provider or for those who install safety features like smoke detectors or security systems. Taking advantage of these discounts can significantly reduce your monthly premiums.

Strategies to Obtain Affordable Home Insurance

While the factors mentioned above can influence your home insurance premiums, there are strategies you can employ to obtain more affordable coverage. Here are some effective approaches:

1. Shop Around and Compare Quotes

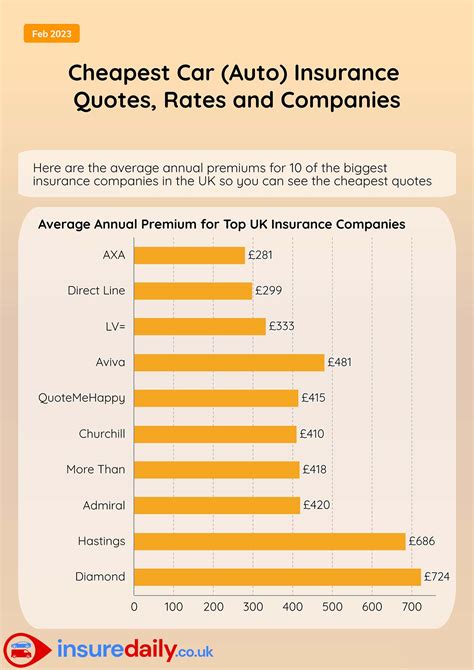

One of the most effective ways to find affordable home insurance is to shop around and compare quotes from multiple providers. Insurance rates can vary significantly between companies, so obtaining quotes from at least three different insurers can help you identify the most competitive options. Online comparison tools and insurance brokers can streamline this process, making it easier to find the best deals.

2. Review Your Coverage Regularly

Regularly reviewing your home insurance policy is essential to ensure you're not overpaying for coverage you may not need. As your home and personal circumstances change, your insurance needs may evolve as well. For instance, if you've recently renovated your home or added valuable assets, you may need to increase your coverage limits. On the other hand, if your home's value has decreased, you might be paying for more coverage than necessary.

3. Bundle Your Policies

Bundling your home and auto insurance policies with the same provider is a common strategy to reduce costs. Many insurance companies offer significant discounts when you combine multiple policies, making it a cost-effective option. Additionally, bundling your insurance can simplify your billing and provide a single point of contact for all your insurance needs.

4. Improve Your Home's Safety

Investing in safety features for your home can lead to substantial savings on your insurance premiums. Installing smoke detectors, fire sprinklers, burglar alarms, and security systems can all qualify you for discounts. These safety measures not only protect your home but also demonstrate to insurance providers that you're taking proactive steps to minimize risks, which can result in lower premiums.

5. Increase Your Deductibles

Opting for higher deductibles can significantly reduce your monthly insurance premiums. By agreeing to pay a larger portion of the claim out of pocket, you effectively lower the risk for the insurance provider, resulting in reduced premiums. However, it's essential to ensure that you can afford the higher deductibles in the event of a claim, as you'll be responsible for a larger financial contribution.

6. Maintain a Good Credit Score

Your credit score is an important factor in determining your insurance premiums. Insurance providers often use credit-based insurance scores to assess the risk associated with insuring you. Maintaining a good credit score can lead to lower insurance costs, as it indicates responsible financial management and a lower likelihood of filing claims. Improving your credit score can be a long-term strategy to reduce your insurance expenses.

7. Explore Discounts and Special Programs

Insurance providers offer a variety of discounts and special programs that can reduce your premiums. These may include discounts for seniors, loyalty discounts for long-term customers, or programs for specific professions or affiliations. Exploring these options and taking advantage of the discounts you qualify for can help lower your insurance costs.

Performance Analysis and Real-World Examples

To provide a more tangible understanding of home insurance costs, let's analyze a few real-world examples. These scenarios will illustrate how different factors influence insurance premiums and the potential savings that can be achieved through strategic choices.

Example 1: Suburban Homeowner

Consider Jane Smith, a homeowner in a quiet suburban neighborhood. Jane's home is valued at $300,000, and she has basic insurance coverage with a $1,000 deductible. Her insurance premium is $120 per month, which is in line with the average for her region. By shopping around and comparing quotes, Jane discovers that she can save $20 per month by switching to a different provider, resulting in an annual savings of $240.

Example 2: Coastal Property Owner

Now, let's look at John Johnson, who owns a beachfront property in a coastal town prone to hurricanes. John's home is valued at $500,000, and he has comprehensive insurance coverage with a $2,000 deductible to account for the higher risk of natural disasters. John's monthly premium is $350, reflecting the increased risk. However, by installing a hurricane-proof roof and reinforcing his windows, John qualifies for a 15% discount on his insurance, reducing his monthly premium to $297.50 and saving him $630 annually.

Example 3: Urban Apartment Dweller

Lastly, we have Emily Davis, who rents an apartment in a bustling city. Emily's landlord requires her to have renter's insurance, and she opts for a policy with a $500 deductible and $20,000 in personal property coverage. Emily's monthly premium is $25, which is relatively low due to the lower risk associated with apartment living. By bundling her renter's insurance with her auto insurance policy, Emily secures a 10% discount, reducing her monthly premium to $22.50 and saving her $30 annually.

Evidence-Based Future Implications

The home insurance industry is constantly evolving, and understanding the future trends and implications is essential for homeowners. Here are a few key considerations for the future of home insurance:

1. Technological Advancements

The insurance industry is embracing technological advancements, such as smart home devices and data analytics, to enhance risk assessment and customer service. These technologies can provide more accurate risk profiling, leading to more precise insurance premiums. Additionally, the use of data analytics can identify trends and patterns, helping insurance providers offer more tailored coverage options.

2. Climate Change and Natural Disasters

Climate change is expected to continue influencing insurance costs, especially in regions prone to natural disasters. As extreme weather events become more frequent and intense, insurance providers will need to adjust their risk assessments and pricing models. Homeowners in high-risk areas may face increased premiums or even challenges in securing coverage, emphasizing the importance of preparedness and mitigation efforts.

3. Changing Consumer Expectations

With the rise of digital technologies, consumer expectations for insurance services are evolving. Homeowners now expect convenient online tools, personalized coverage options, and efficient claims processes. Insurance providers that adapt to these changing expectations and offer innovative solutions will likely gain a competitive edge and attract more customers.

4. Regulatory Changes

Regulatory changes can impact the home insurance landscape, affecting premiums and coverage options. Governments and regulatory bodies may introduce new requirements or incentives to promote sustainability, mitigate climate change risks, or enhance consumer protections. Staying informed about these changes and understanding their potential impact is crucial for homeowners and insurance providers alike.

FAQ

What is the average cost of home insurance per month?

+

The average monthly cost of home insurance in the United States is approximately 100 to 200. However, this average can vary significantly based on factors such as location, home value, and personal risk factors.

How can I reduce my home insurance premiums?

+

There are several strategies to reduce your home insurance premiums, including shopping around for quotes, reviewing your coverage regularly, bundling policies, improving your home’s safety features, increasing your deductibles, maintaining a good credit score, and exploring discounts and special programs.

What factors influence home insurance costs?

+

The cost of home insurance is influenced by various factors, including location, home value and size, construction materials and age, risk factors and claims history, deductibles and coverage limits, and discounts and bundles offered by insurance providers.

Is home insurance mandatory for homeowners?

+

While home insurance is not mandatory in all states, it is highly recommended for homeowners. It provides financial protection against various risks, including damage to your home and its contents, liability for injuries on your property, and additional living expenses if your home becomes uninhabitable due to a covered event.

What should I consider when choosing home insurance coverage?

+

When choosing home insurance coverage, consider your home’s value, the cost of rebuilding or repairing it, the value of your personal belongings, your liability risks, and any additional coverage options that may be relevant to your situation, such as flood or earthquake insurance.