Cheapest Car Insurance For Full Coverage

When it comes to finding the cheapest car insurance for full coverage, there are several factors to consider. Full coverage insurance is a comprehensive policy that provides protection against various risks, including liability, collision, comprehensive, and sometimes additional perks. It is essential to strike a balance between affordable premiums and adequate coverage to ensure you are financially protected on the road.

Understanding Full Coverage Car Insurance

Full coverage car insurance, often referred to as comprehensive coverage, offers a more extensive range of protections compared to basic liability-only policies. Here’s a breakdown of what it typically entails:

- Liability Coverage: This is the most fundamental aspect of any car insurance policy. It covers the costs if you are found at fault in an accident, including injuries to others and damage to their property.

- Collision Coverage: This component covers the repair or replacement of your vehicle if it’s damaged in an accident, regardless of fault. It’s particularly beneficial for newer or valuable cars.

- Comprehensive Coverage: This part of the policy provides protection against non-collision incidents, such as theft, vandalism, natural disasters, and animal-related incidents. It ensures you’re not left financially burdened by unexpected events.

- Optional Add-ons: Some insurers offer additional perks like rental car reimbursement, roadside assistance, or gap coverage, which can further enhance your protection.

Factors Influencing Car Insurance Rates

Insurance companies calculate rates based on various factors, and these can significantly impact the cost of your full coverage policy. Here are some key considerations:

- Vehicle Type and Usage: The make, model, and year of your car play a role in determining rates. Additionally, how and how often you use your vehicle can impact your premium. For instance, high-performance sports cars often carry higher premiums due to their increased risk of accidents and higher repair costs.

- Driver Profile: Your age, gender, driving history, and credit score are all considered. Younger drivers, especially males, often face higher premiums due to their perceived higher risk of accidents. A clean driving record and a good credit score can work in your favor and lead to more affordable rates.

- Location and Usage: Where you live and how you use your vehicle matters. Urban areas with higher populations often have more accidents and thefts, leading to increased insurance costs. Similarly, if you use your car for work or commute long distances, your premiums may be higher.

- Coverage Options: The level of coverage you choose directly affects your premium. Higher limits for liability, collision, and comprehensive coverage will generally result in higher costs. It’s essential to find a balance that provides adequate protection without being excessive.

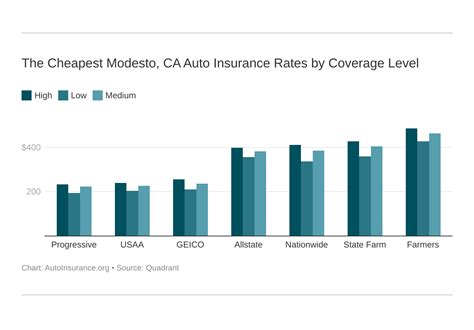

- Insurance Provider: Different insurance companies have varying rates and policies. It’s crucial to shop around and compare quotes from multiple providers to find the most affordable option without compromising on quality and coverage.

Tips for Finding the Cheapest Full Coverage Car Insurance

Securing the cheapest full coverage car insurance requires a strategic approach. Here are some tips to help you in your search:

- Compare Quotes: Obtain quotes from multiple insurance providers. This allows you to identify the most competitive rates and understand the range of prices in the market. Online comparison tools can be particularly useful for this task.

- Review Your Coverage: Assess your current coverage and consider if you truly need all the components. For instance, if you own an older car, you might opt for liability-only coverage instead of full coverage. This can significantly reduce your premiums.

- Explore Discounts: Insurance companies offer various discounts that can lower your premiums. These may include discounts for safe driving, multiple policies, good grades (for younger drivers), and loyalty. Be sure to inquire about all the available discounts and take advantage of those that apply to you.

- Increase Your Deductible: While it may not seem appealing, increasing your deductible (the amount you pay out of pocket before insurance kicks in) can lead to substantial savings on your premium. Just ensure you choose a deductible you can comfortably afford in case of an accident.

- Improve Your Driving Record: Maintaining a clean driving record is crucial. Avoid speeding tickets, avoid accidents, and always drive defensively. A good driving record not only keeps you safe but also leads to lower insurance premiums.

- Consider Bundling: If you have multiple vehicles or other insurance needs (like homeowners or renters insurance), consider bundling your policies with the same insurer. Bundling can often lead to significant savings and simplified billing.

- Shop Around Regularly: Insurance rates can change over time, and it’s essential to stay updated. Regularly review your insurance options and shop around every year or two to ensure you’re still getting the best deal. Don’t be afraid to switch providers if you find a better offer.

The Role of Deductibles in Full Coverage Insurance

Deductibles are an essential aspect of full coverage car insurance policies. A deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. Here’s how deductibles impact your policy:

- Lower Deductibles: Choosing a lower deductible means you’ll pay less out of pocket in the event of a claim. However, it also results in higher premiums. This option is ideal if you want more financial protection and can afford to pay a higher premium.

- Higher Deductibles: Opting for a higher deductible can lead to significant savings on your premium. You’ll pay more out of pocket if you need to make a claim, but it’s a good strategy if you want to lower your monthly or annual insurance costs. This option works best for those with a good emergency fund or the ability to cover unexpected expenses.

- Impact on Claims: When making a claim, your deductible is subtracted from the total amount of your claim. For instance, if your repair costs are 2,000 and your deductible is 500, you’ll pay 500, and your insurance will cover the remaining 1,500. It’s essential to choose a deductible that you’re comfortable paying in case of an accident.

Common Misconceptions about Full Coverage Insurance

There are several common misconceptions about full coverage car insurance. Understanding these myths can help you make more informed decisions about your coverage:

- Myth: Full Coverage Always Means the Best Protection: While full coverage offers a comprehensive range of protections, it doesn’t necessarily mean you’re getting the best protection for your needs. It’s essential to tailor your coverage to your specific situation and budget. Overinsuring can be just as detrimental as underinsuring.

- Myth: Full Coverage Covers All Types of Accidents: Full coverage policies don’t cover every possible scenario. For instance, they typically don’t cover wear and tear, mechanical breakdowns, or damages incurred during illegal activities. It’s crucial to read your policy carefully to understand what’s included and what’s not.

- Myth: Full Coverage Always Costs More: While full coverage policies generally carry higher premiums, this isn’t always the case. Some insurers offer competitive rates for full coverage, especially for low-risk drivers or those with a good driving record. It’s essential to shop around and compare quotes to find the best deal.

Additional Considerations for Full Coverage Insurance

When evaluating full coverage car insurance, there are some additional factors to keep in mind:

- Personal Liability Limits: Ensure your liability coverage limits are sufficient to protect your assets in case you’re found at fault in an accident. Consider your financial situation and the potential costs you might face if you’re sued.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who has no insurance or insufficient insurance. It’s a valuable addition to your policy and can provide peace of mind.

- Roadside Assistance: Consider adding roadside assistance to your policy, especially if you frequently travel long distances or to remote areas. This can provide valuable help in case of a breakdown or other roadside emergencies.

- Review Your Policy Regularly: Your insurance needs may change over time. Review your policy annually or whenever there’s a significant life event (like getting married, buying a new home, or having children) to ensure your coverage remains adequate and cost-effective.

Finding the Right Balance

The key to finding the cheapest car insurance for full coverage is striking a balance between affordability and adequate protection. It’s essential to understand your risks, assess your financial situation, and tailor your coverage accordingly. By comparing quotes, reviewing your coverage needs, and taking advantage of discounts, you can secure the most cost-effective full coverage policy that provides the protection you require.

What is the average cost of full coverage car insurance in the US?

+The average cost of full coverage car insurance in the US varies based on factors like location, driving record, and vehicle type. As of 2023, the average annual premium for full coverage is around 1,674, but this can range from as low as 1,000 to over $3,000.

How can I reduce my full coverage insurance costs?

+You can reduce your full coverage insurance costs by shopping around for quotes, increasing your deductible, maintaining a clean driving record, taking advantage of discounts, and considering bundling your policies with the same insurer.

Are there any states with particularly cheap full coverage insurance rates?

+Yes, some states have lower-than-average insurance rates due to factors like lower population density, fewer accidents, and lower cost of living. For instance, Maine, North Dakota, and Iowa are known for their relatively affordable insurance rates.