Cheap Car Insurance For College Students

As a college student, finding affordable car insurance can be a challenging task. The costs associated with owning a vehicle often extend beyond just the purchase price, and insurance premiums can significantly impact your budget. However, with a bit of research and understanding of the factors that influence insurance rates, it's possible to secure cheap car insurance tailored to your needs as a student.

Understanding the Factors that Affect Insurance Premiums for College Students

Insurance companies consider various factors when calculating insurance premiums for college students. These factors can include your age, driving experience, the type of vehicle you drive, and your location. Understanding these influences can help you make informed decisions to lower your insurance costs.

Age and Driving Experience

Age is a significant factor in determining insurance premiums. Generally, younger drivers, especially those under 25, are considered high-risk due to their lack of driving experience. Insurance companies often charge higher premiums for younger drivers, as they are statistically more likely to be involved in accidents. However, as you gain more driving experience and reach an older age bracket, insurance rates tend to decrease.

Additionally, your driving history plays a crucial role. A clean driving record with no accidents or traffic violations can lead to lower insurance rates. Insurance companies reward safe driving behaviors, so maintaining a good driving record is essential for keeping your premiums affordable.

Vehicle Type and Usage

The type of vehicle you drive and how you use it can also impact your insurance premiums. Certain vehicle models, especially those with powerful engines or high-performance capabilities, may attract higher insurance costs due to their increased risk of accidents or theft. On the other hand, opting for a standard sedan or compact car with safety features can result in more affordable insurance rates.

Furthermore, the primary purpose of your vehicle usage matters. If you primarily use your car for commuting to college or running errands, your insurance premiums may be lower compared to those who use their vehicles for business purposes or long-distance travel. Insurance companies consider the frequency and distance of your trips when determining your risk profile.

Location and Distance

Your geographical location and the distance you travel can also affect your insurance rates. Insurance companies analyze local accident rates, crime statistics, and traffic conditions to assess the risk associated with insuring drivers in specific areas. Higher accident rates or increased theft risks in certain locations may result in higher insurance premiums.

Additionally, the distance you commute daily or the frequency of your long-distance trips can impact your insurance costs. Insurance companies consider the likelihood of accidents or claims based on the number of miles you drive. Shorter commutes or infrequent long-distance travel may result in lower insurance rates.

Tips to Find Cheap Car Insurance for College Students

Now that we’ve explored the factors influencing insurance premiums, let’s delve into some practical tips to help you find cheap car insurance as a college student.

Shop Around and Compare Quotes

One of the most effective ways to find affordable car insurance is to shop around and compare quotes from different insurance providers. Each company has its own unique rating system and factors that influence premiums. By obtaining quotes from multiple insurers, you can identify the most competitive rates for your specific circumstances.

Utilize online insurance comparison tools or reach out to insurance brokers who can provide quotes from various companies. This process allows you to quickly assess the range of insurance options available and make an informed decision based on your budget and coverage needs.

Explore Student Discounts and Special Programs

Many insurance companies offer student discounts or special programs tailored to college students. These discounts can significantly reduce your insurance premiums. Some common student discounts include:

- Good Student Discount: Many insurance providers offer reduced rates to students who maintain a certain grade point average (GPA) or higher. This discount recognizes the correlation between academic achievement and responsible driving behavior.

- Distance Education Discount: If you're attending college remotely or taking online courses, you may be eligible for a distance education discount. This discount is often provided to students who drive less frequently due to their educational setup.

- Multi-Policy Discount: Bundling your car insurance with other policies, such as renters' insurance or homeowners' insurance, can result in significant savings. Insurance companies often offer discounts when you have multiple policies with them, so it's worth exploring this option.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive or telematics insurance, is an innovative approach that calculates insurance premiums based on your actual driving behavior. This type of insurance uses a device or smartphone app to track your driving habits, such as mileage, speed, and braking patterns.

Usage-based insurance can be beneficial for college students who drive infrequently or have a safe driving record. By demonstrating responsible driving behavior, you may qualify for lower insurance rates. However, it's important to note that usage-based insurance may not be available in all areas or from all insurance providers.

Choose a Higher Deductible

Opting for a higher deductible can lower your insurance premiums. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. By agreeing to pay a higher deductible in the event of an accident or claim, you reduce the risk for the insurance company, which often translates to lower premiums.

However, it's essential to choose a deductible amount that you can comfortably afford. While a higher deductible can result in lower premiums, it means you'll have to pay more out of pocket if you need to make a claim. Consider your financial situation and select a deductible that strikes a balance between affordability and coverage.

Maintain a Clean Driving Record

As mentioned earlier, a clean driving record is crucial for keeping your insurance premiums affordable. Avoid traffic violations, such as speeding or running red lights, as these can result in points on your driving record and higher insurance rates. Additionally, strive to avoid accidents, as even minor fender benders can lead to increased insurance costs.

If you have a less-than-perfect driving record, consider taking defensive driving courses or completing traffic school programs. These courses can help improve your driving skills and may even qualify you for insurance discounts. Insurance companies often view these courses as a commitment to safer driving, which can positively impact your insurance rates.

Explore Group Insurance Discounts

If you’re part of a college organization, such as a fraternity, sorority, or student club, inquire about group insurance discounts. Some insurance companies offer discounted rates to members of specific groups or organizations. By leveraging your membership, you may be able to access lower insurance premiums.

Additionally, consider the possibility of shared insurance policies. If you live with roommates or fellow students, you might explore the option of insuring multiple vehicles under a single policy. Insurance companies often provide discounts for insuring multiple vehicles, so this approach can result in significant savings for everyone involved.

Choose a Safe and Affordable Vehicle

The type of vehicle you drive can have a significant impact on your insurance premiums. As mentioned earlier, certain vehicle models, especially high-performance cars, may attract higher insurance costs due to their increased risk of accidents or theft.

When choosing a vehicle, consider models that are known for their safety features and affordable insurance rates. Research online resources or consult with insurance agents to identify vehicles that are considered low-risk and cost-effective to insure. Opting for a safe and affordable vehicle can result in lower insurance premiums and provide peace of mind on the road.

The Impact of Insurance on Your College Budget

Insurance premiums can significantly impact your college budget, especially if you’re already juggling tuition fees, textbooks, and other living expenses. Finding affordable car insurance is essential to ensure that you can maintain your financial stability while enjoying the benefits of having a vehicle.

By implementing the tips outlined above, such as shopping around for quotes, exploring student discounts, and maintaining a clean driving record, you can reduce your insurance costs and allocate your finances more effectively. Affordable car insurance allows you to focus on your education and other important aspects of college life without the added financial burden.

The Future of Car Insurance for College Students

The insurance industry is constantly evolving, and the future of car insurance for college students holds promising prospects. With advancements in technology and data analytics, insurance companies are increasingly able to offer more personalized and affordable insurance options.

One notable trend is the rise of telematics and usage-based insurance. As mentioned earlier, this approach allows insurance companies to track and analyze your driving behavior, rewarding safe drivers with lower premiums. As more insurance providers adopt this technology, it's likely that college students who demonstrate responsible driving habits will have access to even more affordable insurance rates.

Additionally, the growing popularity of electric vehicles (EVs) and autonomous driving technologies may influence insurance premiums in the future. EVs are generally considered safer and more environmentally friendly, which could lead to lower insurance costs. Similarly, as autonomous driving technologies advance, insurance companies may adjust their risk assessments, potentially resulting in reduced premiums for college students who utilize these innovative features.

Key Takeaways

- Understanding the factors that influence insurance premiums, such as age, driving experience, vehicle type, and location, is crucial for finding cheap car insurance as a college student.

- Shopping around for quotes, exploring student discounts, and maintaining a clean driving record are effective strategies to reduce insurance costs.

- Usage-based insurance and shared insurance policies are innovative approaches that can result in significant savings for college students.

- The future of car insurance for college students looks promising, with advancements in technology and data analytics offering more personalized and affordable options.

What is the average car insurance premium for college students?

+The average car insurance premium for college students can vary depending on factors such as location, driving record, and vehicle type. However, on average, college students can expect to pay around 1,500 to 2,000 annually for car insurance. It’s important to note that these rates can fluctuate based on individual circumstances.

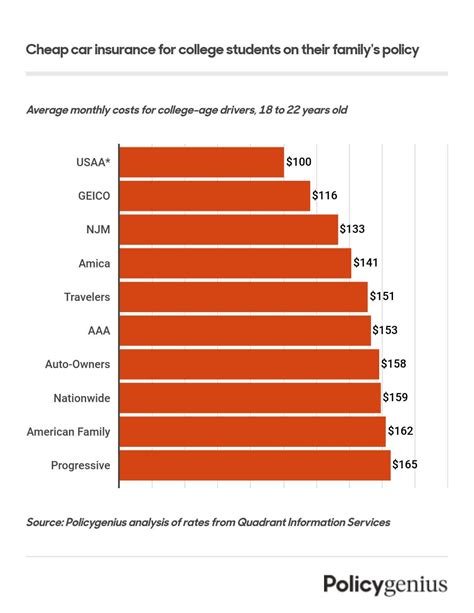

Are there any specific insurance providers that offer cheap rates for college students?

+Yes, several insurance providers offer competitive rates and student discounts. Some popular options include State Farm, Geico, and Progressive. However, it’s essential to shop around and compare quotes from multiple insurers to find the best deal for your specific circumstances.

Can I get a discount if I’m a good student with a high GPA?

+Absolutely! Many insurance companies offer a good student discount to encourage academic achievement. This discount typically applies to students with a GPA of 3.0 or higher. By maintaining a good academic record, you can qualify for reduced insurance rates.

What if I’m a part-time student or taking online courses? Can I still get cheap insurance rates?

+Yes, insurance providers often offer discounts for part-time students or those attending college remotely. These discounts, such as the distance education discount, recognize that you may drive less frequently due to your educational setup. It’s worth exploring these options to lower your insurance costs.

Are there any other ways to save on car insurance besides the tips mentioned above?

+Absolutely! Here are a few additional ways to save on car insurance:

- Take advantage of multi-policy discounts by bundling your car insurance with other policies, such as renters’ insurance.

- Consider adding safety features to your vehicle, as some insurance companies offer discounts for vehicles with advanced safety systems.

- Maintain a good credit score, as insurance companies often use credit-based insurance scores to assess risk and determine premiums.

- Inquire about loyalty discounts if you’ve been with the same insurance provider for an extended period.