State Farm Quotes Car Insurance

When it comes to car insurance, finding the right coverage and the best rates can be a challenging task. With numerous insurance providers in the market, it's essential to explore options that offer comprehensive protection and competitive pricing. State Farm, a leading insurance company, offers car insurance policies that cater to various needs. In this article, we will delve into State Farm's car insurance offerings, explore their quote process, and provide valuable insights to help you make an informed decision.

Understanding State Farm’s Car Insurance

State Farm is a well-established insurance provider known for its range of insurance products, including auto, home, life, and health insurance. Their car insurance policies are designed to offer flexibility and customization, allowing policyholders to tailor their coverage to their specific requirements.

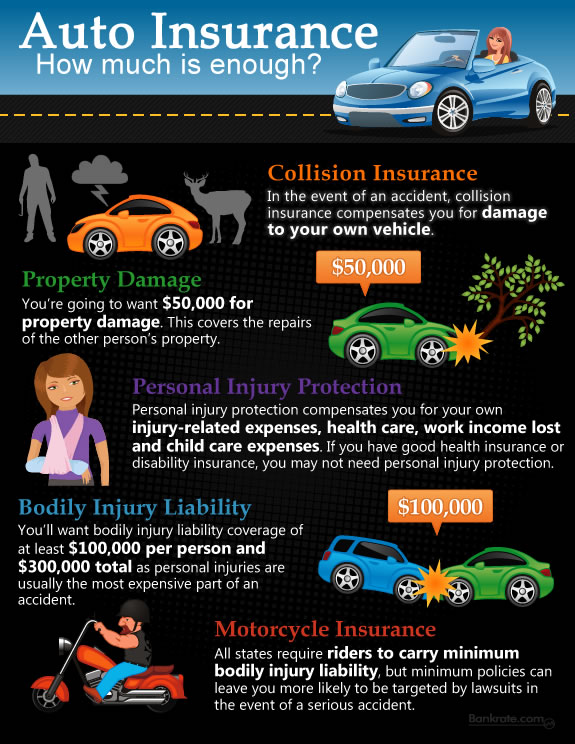

State Farm's car insurance policies typically include standard coverage options such as liability, collision, comprehensive, personal injury protection (PIP), and uninsured/underinsured motorist coverage. These coverages provide protection against various risks, including accidents, theft, natural disasters, and medical expenses.

Additionally, State Farm offers several optional coverages and endorsements to enhance your policy. These may include rental car coverage, roadside assistance, gap insurance, and custom parts and equipment coverage. By adding these endorsements, you can further customize your policy to suit your specific needs and ensure comprehensive protection.

The State Farm Car Insurance Quote Process

Obtaining a quote from State Farm is a straightforward process that can be done online, over the phone, or through an insurance agent. Here’s a step-by-step guide to help you navigate the quote process:

Step 1: Gather Information

Before initiating the quote process, it’s essential to have the necessary information readily available. This includes your personal details, such as name, address, and date of birth, as well as information about your vehicle, including make, model, year, and vehicle identification number (VIN). Additionally, having details about your driving history, such as accidents, tickets, and any previous insurance claims, will be beneficial.

Step 2: Choose Your Quote Method

State Farm offers multiple channels to obtain a quote. You can opt for an online quote by visiting their official website and filling out the online form. This method provides a quick and convenient way to get an estimate of your insurance costs. Alternatively, you can call their customer service hotline or connect with a local State Farm agent to discuss your insurance needs and receive a personalized quote.

Step 3: Provide Vehicle and Driver Information

During the quote process, you’ll be asked to provide details about your vehicle and your driving history. This information helps State Farm assess the level of risk associated with insuring your vehicle and determine an accurate quote. Be prepared to answer questions about your vehicle’s usage, such as whether it’s used for commuting, business purposes, or pleasure driving.

Step 4: Customize Your Coverage

State Farm allows you to customize your car insurance policy by selecting the coverages and limits that align with your needs and budget. You can choose the standard coverages mentioned earlier and explore optional endorsements to enhance your protection. Consider factors such as the value of your vehicle, the level of risk you’re comfortable with, and any specific requirements you may have.

Step 5: Review and Compare Quotes

Once you’ve provided the necessary information and selected your desired coverages, State Farm will generate a quote based on your specific circumstances. Take the time to review the quote thoroughly, ensuring that the coverages and limits match your expectations. Compare the quote with other insurance providers to evaluate the competitiveness of State Farm’s rates and make an informed decision.

Step 6: Discuss Payment Options and Policy Details

If you’re satisfied with State Farm’s quote and coverage options, the next step is to discuss payment options and finalize your policy. State Farm offers flexible payment plans, allowing you to choose the payment frequency that suits your financial situation. Additionally, you can review and understand the policy documents, ensuring that you’re aware of the terms, conditions, and exclusions associated with your coverage.

Benefits of Choosing State Farm Car Insurance

State Farm’s car insurance policies offer several advantages that make them a compelling choice for many drivers. Here are some key benefits to consider:

- Customizable Coverage: State Farm allows policyholders to tailor their coverage to their specific needs, ensuring that they have the right protection without paying for unnecessary add-ons.

- Competitive Rates: State Farm is known for offering competitive rates, especially for drivers with a clean driving record and a history of safe driving. Their quotes are often affordable and provide good value for money.

- Excellent Customer Service: State Farm prides itself on providing exceptional customer service. Their dedicated agents are readily available to assist with any inquiries or concerns, ensuring a smooth and hassle-free insurance experience.

- Discounts and Savings: State Farm offers a range of discounts to help policyholders save on their insurance premiums. These discounts may include multi-policy discounts, good student discounts, safe driver discounts, and more. By taking advantage of these savings, you can further reduce your insurance costs.

- Strong Financial Stability: State Farm is a financially stable insurance company, which provides peace of mind to policyholders. Their solid financial foundation ensures that they can honor claims and provide reliable coverage in the event of an accident or loss.

State Farm Car Insurance: Real-Life Examples

To provide a clearer understanding of State Farm’s car insurance offerings, let’s explore some real-life examples:

Example 1: John’s Comprehensive Coverage

John, a 30-year-old driver with a clean driving record, recently purchased a new car. He opted for a comprehensive State Farm car insurance policy, including liability, collision, and comprehensive coverage. With his safe driving history, John qualified for a 10% discount on his premium. He also added rental car coverage and custom parts and equipment coverage to protect his vehicle’s upgrades. State Farm’s quote provided John with affordable rates and peace of mind, knowing he had comprehensive protection for his new car.

Example 2: Sarah’s Customized Policy

Sarah, a 25-year-old professional, wanted a car insurance policy that reflected her specific needs. She customized her State Farm policy by selecting liability coverage with higher limits to protect her assets in the event of an accident. Additionally, Sarah added roadside assistance and gap insurance, ensuring she had assistance for breakdowns and coverage for the gap between her vehicle’s value and what her insurance pays in the event of a total loss. State Farm’s quote process allowed Sarah to tailor her policy, providing her with the coverage she desired without unnecessary add-ons.

Example 3: Family’s Multi-Vehicle Policy

A family with multiple vehicles decided to insure all their cars with State Farm to take advantage of their multi-policy discount. By insuring their two cars and an RV with State Farm, they qualified for a significant discount on their premiums. State Farm’s quote process allowed them to bundle their policies, resulting in cost savings and simplified insurance management. The family appreciated the convenience and peace of mind that came with having all their vehicles insured under one provider.

State Farm’s Performance and Customer Satisfaction

State Farm’s performance in the car insurance market has been commendable. They consistently rank among the top insurance providers, known for their reliability, customer satisfaction, and financial stability. Numerous customer reviews highlight State Farm’s excellent service, prompt claim handling, and fair settlements.

State Farm's commitment to customer satisfaction is evident through their dedicated claims teams and their focus on providing personalized support. Policyholders often praise State Farm for their efficient claim processes, quick turnaround times, and fair resolution of claims, ensuring a positive overall insurance experience.

Conclusion: Making an Informed Decision

State Farm’s car insurance quotes provide an excellent starting point for individuals seeking comprehensive and affordable coverage. By exploring their customizable policies, competitive rates, and range of discounts, you can find a policy that suits your specific needs and budget. Remember to compare quotes from multiple providers to ensure you’re getting the best value for your insurance dollar.

State Farm's reputation for customer satisfaction and financial stability further enhances their appeal as a trusted insurance provider. With their commitment to providing excellent service and tailored coverage, State Farm continues to be a popular choice for car insurance across the United States.

Frequently Asked Questions

Can I get a quote for car insurance without providing my Social Security Number (SSN)?

+Yes, you can obtain a quote for car insurance without providing your SSN. State Farm respects your privacy and does not require this information for the initial quote process. However, if you decide to proceed with a policy, they may request your SSN for identification and verification purposes.

What factors influence the cost of my car insurance quote with State Farm?

+The cost of your car insurance quote with State Farm is influenced by several factors, including your age, driving history, the type of vehicle you drive, the coverage limits you select, and your location. Additionally, discounts such as multi-policy, safe driver, and good student discounts can further impact the final quote.

How can I reduce my car insurance premiums with State Farm?

+To reduce your car insurance premiums with State Farm, consider exploring their range of discounts. You can qualify for discounts by maintaining a clean driving record, insuring multiple vehicles, bundling your policies (auto and home insurance), taking a defensive driving course, or being a good student. Additionally, reviewing your coverage limits and adjusting them to your needs can help lower your premiums.

What is the process for filing a claim with State Farm car insurance?

+Filing a claim with State Farm car insurance is straightforward. You can initiate the process by contacting their customer service hotline or using their online claim portal. They will guide you through the necessary steps, which typically involve providing details about the incident, submitting any required documentation, and working with their claims team to reach a fair settlement.

Can I add rental car coverage to my State Farm car insurance policy?

+Yes, you can add rental car coverage to your State Farm car insurance policy. This optional coverage provides reimbursement for the cost of renting a vehicle while your insured car is being repaired or replaced after an insured loss. By adding this endorsement, you can ensure uninterrupted mobility during such situations.