Replacement Cost Insurance Coverage

In the realm of insurance, understanding the concept of replacement cost coverage is essential for anyone seeking to protect their assets and belongings. This type of insurance policy, known as replacement cost insurance, offers a unique and comprehensive approach to ensuring that policyholders can adequately replace their lost or damaged possessions.

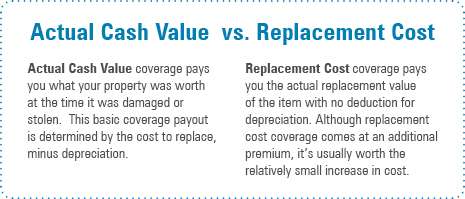

Replacement cost insurance is designed to provide financial coverage for the cost of replacing or repairing insured items with new ones of similar kind and quality, without deducting for depreciation. Unlike actual cash value insurance, which considers the item's current value, replacement cost insurance focuses on the future cost of replacing the item. This distinction is crucial, especially when dealing with items that may depreciate rapidly or have a limited lifespan.

This type of insurance coverage is particularly valuable for homeowners and businesses, as it ensures that, in the event of a covered loss, the insured party will receive enough money to fully replace or repair their property, rather than simply being reimbursed for the item's depreciated value. For instance, imagine a scenario where a homeowner's roof is damaged due to a storm. With replacement cost insurance, the policyholder would receive the necessary funds to install a new roof, rather than being compensated for the aged roof's depreciated value, which might not cover the full cost of the replacement.

The Benefits of Replacement Cost Insurance

Replacement cost insurance offers several advantages that make it an appealing choice for many individuals and businesses.

Full Coverage for Replacements

One of the primary benefits of replacement cost insurance is that it ensures full coverage for the replacement of insured items. Whether it’s furniture, electronics, or even structural elements of a building, this type of insurance policy guarantees that the policyholder will receive sufficient funds to replace these items with new ones of similar quality and kind.

For instance, if a homeowner's television is damaged due to a power surge, replacement cost insurance would cover the cost of a new television, rather than merely reimbursing the policyholder for the depreciated value of the old one. This ensures that the homeowner can enjoy the same level of functionality and quality as their previous television.

Protection Against Depreciation

Depreciation can significantly impact the value of insured items over time. With replacement cost insurance, policyholders are protected against this loss in value. The insurance company agrees to cover the full cost of replacing the item, regardless of how much it has depreciated since its purchase.

Consider a scenario where a business owner has a high-end laptop that suddenly stops working. If the business owner has replacement cost insurance, they can rest assured that they will receive enough funds to purchase a new laptop of similar specifications, even if the original laptop has significantly depreciated in value since its purchase.

Peace of Mind

Replacement cost insurance provides policyholders with peace of mind, knowing that they are fully covered in the event of a loss. This type of insurance coverage eliminates the uncertainty and potential financial burden that can arise from having to replace valuable items out of pocket.

For example, imagine a homeowner who has invested in a state-of-the-art home entertainment system. With replacement cost insurance, they can relax knowing that, in the event of a fire or other covered loss, they will be able to replace their entire entertainment system, including all the components, without incurring significant out-of-pocket expenses.

How Replacement Cost Insurance Works

Understanding the mechanics of replacement cost insurance is essential for anyone considering this type of coverage. Here’s a closer look at how this insurance policy operates.

Policy Terms and Conditions

Like all insurance policies, replacement cost insurance comes with its own set of terms and conditions. These terms outline the specific coverage, exclusions, and limitations of the policy. It’s crucial for policyholders to carefully review and understand these terms to ensure they are adequately protected.

For instance, some replacement cost insurance policies may have specific limitations on the coverage for certain types of items or may require policyholders to maintain a certain level of insurance to ensure full replacement coverage.

Assessing the Cost of Replacements

When a loss occurs and a claim is filed under a replacement cost insurance policy, the insurance company will assess the cost of replacing the damaged or lost item. This assessment takes into account the current market value of a similar new item, ensuring that the policyholder receives enough coverage to make a suitable replacement.

For example, if a homeowner's antique furniture is damaged in a flood, the insurance company will research the current market value of similar antique furniture to determine the replacement cost. This ensures that the homeowner can restore their home to its pre-loss condition.

Coverage for Different Types of Losses

Replacement cost insurance typically covers a wide range of losses, including but not limited to fire, theft, and natural disasters. However, it’s important to note that the specific coverage may vary depending on the insurance company and the policy chosen. Some policies may have specific exclusions or limitations for certain types of losses.

For instance, while a standard replacement cost insurance policy may cover fire damage, it might not cover losses due to flooding unless a separate flood insurance policy is purchased.

The Importance of Regular Policy Reviews

Regularly reviewing and updating one’s insurance policy is crucial, especially when it comes to replacement cost insurance. As the value of items may fluctuate over time, it’s essential to ensure that the policy limits are adequate to cover the current replacement costs.

For example, if a homeowner has made significant upgrades to their home's electrical system, they should review their insurance policy to ensure that the coverage limits are sufficient to cover the cost of replacing the upgraded electrical components. Failing to do so could result in inadequate coverage in the event of a loss.

Comparing Replacement Cost Insurance to Other Coverage Types

When considering insurance options, it’s essential to understand how replacement cost insurance differs from other types of coverage, such as actual cash value insurance and guaranteed replacement cost insurance.

Actual Cash Value Insurance

Actual cash value (ACV) insurance is a type of insurance policy that considers the item’s current value, including depreciation. Unlike replacement cost insurance, ACV insurance does not cover the full cost of replacing an item with a new one. Instead, it provides compensation based on the item’s depreciated value.

For instance, if a homeowner has an ACV insurance policy and their five-year-old television is damaged, the insurance company will reimburse them for the television's current value, which may be significantly less than the cost of purchasing a new television.

Guaranteed Replacement Cost Insurance

Guaranteed replacement cost insurance is a specialized type of coverage that guarantees the full replacement cost of a home, regardless of the policy limits. This type of insurance is particularly beneficial for homeowners who have made significant improvements or upgrades to their homes, ensuring that they are fully covered in the event of a total loss.

Consider a scenario where a homeowner has a guaranteed replacement cost insurance policy and their home is completely destroyed in a fire. With this type of coverage, the insurance company would provide the necessary funds to rebuild the home, even if the cost exceeds the policy limits.

Factors to Consider When Choosing Replacement Cost Insurance

When deciding whether to opt for replacement cost insurance, there are several key factors to consider. These factors can help individuals and businesses make informed decisions about their insurance coverage.

The Value of Your Possessions

The value of your possessions is a critical factor in determining whether replacement cost insurance is the right choice for you. If you own valuable items or have made significant investments in your property, replacement cost insurance can provide the necessary coverage to replace these items in the event of a loss.

For example, a business owner who has invested in high-end computer equipment may benefit from replacement cost insurance, as it would ensure they can replace their equipment with similar, new models if it were damaged or stolen.

The Likelihood of Losses

Consider the likelihood of potential losses when choosing an insurance policy. If you live in an area prone to natural disasters or have a high risk of theft or vandalism, replacement cost insurance can provide added protection to ensure you are fully covered in the event of a loss.

Imagine a homeowner living in a hurricane-prone region. In such a case, replacement cost insurance would provide peace of mind, knowing that if their home were damaged by a hurricane, they would receive sufficient funds to rebuild and restore their home to its pre-loss condition.

Cost of the Policy

The cost of insurance is always a significant consideration. While replacement cost insurance offers comprehensive coverage, it may be more expensive than other types of insurance policies. It’s essential to weigh the cost against the potential benefits to determine if it is the right choice for your situation.

For instance, a homeowner who has a low risk of losses and a limited number of valuable possessions may find that a less expensive insurance policy, such as actual cash value insurance, is sufficient for their needs.

Case Studies: Real-World Examples of Replacement Cost Insurance

Examining real-world examples can provide valuable insights into how replacement cost insurance works in practice. Here are a few case studies to illustrate the impact and benefits of this type of insurance coverage.

Case Study 1: Homeowner’s Policy

Imagine a homeowner, Ms. Johnson, who has a replacement cost insurance policy on her home. One day, a severe storm damages her roof, causing leaks and water damage throughout her home. With her replacement cost insurance policy, Ms. Johnson is able to file a claim and receive the necessary funds to repair her roof and address the water damage.

The insurance company assesses the cost of replacing the roof with a similar new one and covers the full cost, ensuring that Ms. Johnson's home is restored to its pre-loss condition. This example highlights how replacement cost insurance provides comprehensive coverage, even for significant structural damages.

Case Study 2: Business Insurance

Mr. Smith owns a small electronics repair shop and has a replacement cost insurance policy on his business equipment. Unfortunately, a fire breaks out in his shop, damaging his computers, tools, and other equipment. With his replacement cost insurance policy, Mr. Smith is able to replace his damaged equipment with new, high-quality items.

The insurance company assesses the cost of replacing the damaged equipment and provides Mr. Smith with the necessary funds. This case study demonstrates how replacement cost insurance can be a lifeline for small business owners, ensuring they can quickly recover from losses and continue their operations.

Case Study 3: Auto Insurance

Ms. Taylor has a replacement cost insurance policy on her car. While driving one day, she is involved in a severe accident that totals her vehicle. With her replacement cost insurance, Ms. Taylor is able to receive the necessary funds to purchase a new car of similar make and model.

The insurance company assesses the current market value of a new car of the same make and model as Ms. Taylor's totaled vehicle and provides her with the coverage needed to make the replacement. This example highlights how replacement cost insurance can provide peace of mind for vehicle owners, ensuring they can quickly get back on the road after an accident.

Future Implications and Considerations

As the insurance industry continues to evolve, it’s important to consider the future implications and potential developments related to replacement cost insurance.

Advancements in Technology

Advancements in technology, such as the use of artificial intelligence and machine learning, are likely to play a significant role in the future of replacement cost insurance. These technologies can improve the accuracy and efficiency of assessing replacement costs, ensuring policyholders receive the correct coverage amounts.

For instance, AI-powered systems could analyze vast amounts of data to determine the current market value of items, making the claims process faster and more accurate.

Changing Consumer Preferences

Consumer preferences are constantly evolving, and this can impact the demand for different types of insurance coverage. As more individuals become aware of the benefits of replacement cost insurance, it’s likely that there will be a growing demand for this type of coverage.

Insurance companies may need to adapt their policies and marketing strategies to cater to this changing demand, ensuring they offer competitive replacement cost insurance options to meet consumer needs.

Environmental Considerations

With growing concerns about environmental sustainability, insurance companies may need to consider the environmental impact of replacement cost insurance. This could involve promoting the use of sustainable materials or encouraging policyholders to make environmentally friendly replacements.

For example, an insurance company might offer incentives or discounts to policyholders who choose to replace their damaged items with energy-efficient or eco-friendly alternatives.

Conclusion

Replacement cost insurance is a valuable tool for anyone looking to protect their assets and belongings. By offering full coverage for replacements, protecting against depreciation, and providing peace of mind, this type of insurance policy ensures that policyholders can adequately restore their property in the event of a covered loss.

As the insurance industry continues to evolve, it's essential to stay informed about the latest developments and considerations related to replacement cost insurance. By understanding the benefits, mechanics, and future implications of this type of coverage, individuals and businesses can make informed decisions to protect their assets and ensure a secure future.

What is the difference between replacement cost insurance and actual cash value insurance?

+Replacement cost insurance covers the full cost of replacing an item with a new one of similar kind and quality, while actual cash value insurance considers the item’s current value, including depreciation. This means that replacement cost insurance provides more comprehensive coverage, ensuring policyholders can fully replace their possessions, while actual cash value insurance may result in lower compensation due to depreciation.

How is the cost of replacements assessed under a replacement cost insurance policy?

+When a loss occurs, the insurance company will assess the cost of replacing the damaged or lost item. This assessment considers the current market value of a similar new item, ensuring that the policyholder receives enough coverage to make a suitable replacement. The insurance company may conduct research or use industry data to determine the replacement cost.

Are there any limitations or exclusions with replacement cost insurance policies?

+Yes, replacement cost insurance policies typically have specific limitations and exclusions. These may vary depending on the insurance company and the policy chosen. It’s crucial to carefully review the terms and conditions of your policy to understand any limitations or exclusions that may apply to your coverage.