Actual Cash Value Insurance

Understanding the concept of Actual Cash Value (ACV) insurance is crucial when it comes to protecting your assets and ensuring you receive fair compensation in the event of a loss. This comprehensive guide will delve into the world of ACV insurance, exploring its definition, how it works, and the key factors that influence its value. We will also compare it to other insurance types and discuss its benefits and potential drawbacks. By the end of this article, you'll have a clear understanding of whether ACV insurance is the right choice for your needs.

What is Actual Cash Value Insurance?

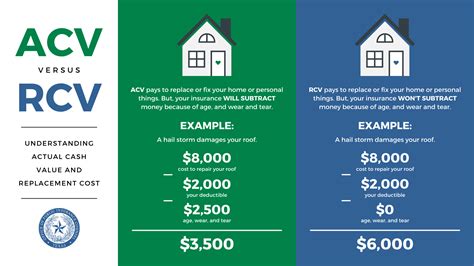

Actual Cash Value insurance, often referred to as ACV, is a type of insurance coverage that aims to reimburse policyholders for the actual value of their insured property at the time of loss or damage. Unlike other insurance types, ACV takes into account the depreciation of the property, which means the insurance company considers the property’s current worth, not its original purchase price or replacement cost.

In simpler terms, ACV insurance assesses the property's value based on its age, condition, and any pre-existing damage or wear and tear. It calculates the compensation by subtracting the depreciation from the property's original value. This approach ensures that policyholders receive a fair and accurate reimbursement, reflecting the true worth of their assets at the time of the incident.

How Does Actual Cash Value Insurance Work?

ACV insurance operates based on a straightforward principle: reimbursing policyholders for the actual value of their property at the time of loss. When a covered incident occurs, such as a fire, theft, or natural disaster, the insurance company will assess the damage and determine the ACV of the affected property.

The ACV calculation typically involves the following steps:

- Original Value: The insurance company determines the property's original purchase price or its initial value when it was new.

- Depreciation Calculation: Using industry-standard formulas and guidelines, the insurer calculates the depreciation of the property based on its age, condition, and expected lifespan. This depreciation reflects the property's loss in value over time.

- Current Value Determination: By subtracting the depreciation from the original value, the insurer arrives at the ACV of the property at the time of the incident. This value represents the compensation the policyholder is entitled to receive.

For instance, imagine you purchased a brand-new car worth $30,000 two years ago. If you were to file a claim for damage under an ACV insurance policy today, the insurer would calculate the depreciation over those two years. Let's say the depreciation is estimated at $5,000. In this case, the ACV of your car would be $25,000, which is the compensation you would receive to repair or replace your vehicle.

Factors Influencing Actual Cash Value

The calculation of ACV is influenced by several key factors, each playing a crucial role in determining the final compensation amount. Understanding these factors is essential for policyholders to make informed decisions and ensure they receive the appropriate coverage.

Property Age and Condition

The age and condition of the insured property are primary considerations when determining ACV. Older properties tend to have higher depreciation rates, as they have experienced more wear and tear over time. Additionally, any pre-existing damage or regular maintenance issues can impact the property’s value and, consequently, its ACV.

Market Conditions

Market conditions also play a significant role in ACV calculations. Fluctuations in the market value of similar properties can affect the ACV of the insured asset. For instance, if property values in your area have increased due to a thriving real estate market, the ACV of your home may be higher than its original purchase price.

Expected Lifespan

The expected lifespan of the insured property is another critical factor. Some assets, such as vehicles, have a predetermined lifespan based on industry standards. The insurer considers this lifespan when calculating depreciation, as properties nearing the end of their expected lifespan will have higher depreciation rates.

Maintenance and Upkeep

The level of maintenance and upkeep of the insured property can impact its ACV. Well-maintained properties often retain their value better and may have lower depreciation rates. On the other hand, properties that have been neglected or poorly maintained may experience accelerated depreciation, resulting in a lower ACV.

| Property Type | Depreciation Factors |

|---|---|

| Residential Homes | Age, condition, market trends, and regular maintenance. |

| Vehicles | Model year, mileage, overall condition, and market value. |

| Electronics | Age, technological advancements, and obsolescence. |

Actual Cash Value vs. Other Insurance Types

Understanding the differences between ACV insurance and other common insurance types is essential for making informed decisions about your coverage.

Replacement Cost Insurance

Replacement Cost insurance is often compared to ACV insurance. Unlike ACV, which considers depreciation, Replacement Cost insurance aims to reimburse policyholders for the cost of replacing the insured property with a new one of similar quality. This type of insurance provides a higher level of coverage, as it does not deduct depreciation from the reimbursement amount.

For example, if your 5-year-old laptop worth $1,000 is stolen, ACV insurance would reimburse you for the laptop's current value, taking into account its depreciation. On the other hand, Replacement Cost insurance would cover the full cost of purchasing a new laptop of similar specifications, regardless of the original laptop's depreciation.

Agreed Value Insurance

Agreed Value insurance is a type of coverage where the policyholder and the insurance company agree on a specific value for the insured property at the time of policy issuance. This agreed value remains constant throughout the policy term, regardless of any changes in the property’s actual value. Agreed Value insurance provides a guaranteed reimbursement amount, ensuring policyholders receive the full agreed value in the event of a total loss.

Actual Cash Value vs. Fair Market Value

While ACV and Fair Market Value (FMV) are related concepts, they are not the same. FMV refers to the price a property would fetch in an open and competitive market, considering its current condition and market trends. ACV, on the other hand, is the actual value of the property at the time of loss, taking into account its depreciation. While FMV is often used to determine the selling price of a property, ACV is the basis for insurance reimbursements.

Benefits and Drawbacks of Actual Cash Value Insurance

Like any insurance type, ACV insurance comes with its own set of advantages and potential drawbacks. Understanding these pros and cons can help you decide if ACV insurance is the right choice for your specific needs.

Benefits

- Affordable Premiums: ACV insurance typically offers lower premiums compared to other insurance types, such as Replacement Cost insurance. This makes it an attractive option for those on a budget or looking to save on insurance costs.

- Suitable for Older Assets: ACV insurance is ideal for older properties or assets that have already experienced significant depreciation. It provides a fair and accurate assessment of their current value, ensuring policyholders are not overinsured.

- Quick Claim Settlements: ACV insurance allows for quicker claim settlements, as the depreciation calculation is straightforward and does not require extensive valuation processes.

Drawbacks

- Lower Reimbursement: The main drawback of ACV insurance is the potential for lower reimbursement amounts. Since it considers depreciation, policyholders may receive less than the original purchase price or replacement cost of their property.

- Limited Coverage for High-Value Assets: ACV insurance may not provide sufficient coverage for high-value assets like luxury vehicles or fine art. In such cases, other insurance types, such as Agreed Value or Replacement Cost, may be more suitable.

- Depreciation Risks: ACV insurance exposes policyholders to the risk of rapid depreciation, especially for assets with short lifespans or those prone to technological obsolescence. In such cases, the ACV may not adequately reflect the asset’s value, leading to lower compensation.

Actual Cash Value Insurance: Real-World Examples

To better understand how ACV insurance works in practice, let’s explore some real-world scenarios and their potential outcomes.

Home Insurance

Imagine you own a 10-year-old home insured under an ACV policy. A severe storm causes significant damage to your roof, requiring complete replacement. The original purchase price of your home was 500,000, but after considering depreciation and market conditions, the insurance company determines the ACV to be 400,000. This value represents the compensation you will receive to repair or rebuild your home.

Vehicle Insurance

You’ve been involved in a car accident, and your 3-year-old vehicle, originally purchased for 35,000, has sustained major damage. The insurance company assesses the ACV of your vehicle, taking into account its model year, mileage, and overall condition. Let's say the ACV is calculated at 28,000. This amount will be the basis for your reimbursement, allowing you to repair or replace your vehicle.

Electronics Insurance

Your laptop, purchased two years ago for 1,500, is stolen. Under your ACV insurance policy, the insurer considers the laptop's age, technological advancements, and obsolescence. The ACV is determined to be 1,000, reflecting the depreciation of the laptop over the past two years. This value is the compensation you’ll receive to replace your stolen device.

Future Implications and Expert Insights

As the insurance landscape evolves, it’s essential to consider the future implications of ACV insurance and stay informed about potential changes and advancements.

Emerging Trends

The insurance industry is constantly innovating, and new trends are shaping the way ACV insurance is offered and utilized. One emerging trend is the use of technology-driven valuation tools, such as artificial intelligence and machine learning, to more accurately assess the ACV of properties. These tools can analyze vast amounts of data, including historical property values, market trends, and condition reports, to provide more precise ACV estimates.

Additionally, smart home technology is gaining popularity, and insurance companies are exploring ways to integrate this technology into their ACV calculations. Smart home devices, such as sensors and cameras, can provide real-time data on the condition and maintenance of properties, helping insurers make more informed decisions about depreciation and ACV.

Industry Insights

Industry experts emphasize the importance of understanding the limitations and potential drawbacks of ACV insurance. While it offers affordable coverage and quick claim settlements, policyholders should be aware of the risks associated with depreciation, especially for assets with high depreciation rates or those that quickly become obsolete.

Furthermore, experts recommend regularly reviewing and updating insurance policies to ensure they align with the changing value of insured assets. This proactive approach can help policyholders avoid gaps in coverage and ensure they receive adequate compensation when needed.

How does ACV insurance compare to Replacement Cost insurance in terms of premiums and coverage?

+ACV insurance typically offers lower premiums compared to Replacement Cost insurance. However, it provides lower coverage, as it considers depreciation. Replacement Cost insurance offers a higher level of protection, as it reimburses policyholders for the full replacement cost of their property, regardless of depreciation.

Can ACV insurance be used for all types of properties and assets?

+ACV insurance is suitable for a wide range of properties and assets, including homes, vehicles, electronics, and more. However, for high-value assets or those with unique characteristics, other insurance types, such as Agreed Value or Replacement Cost, may be more appropriate to ensure adequate coverage.

What factors can policyholders control to minimize depreciation and maximize ACV?

+Policyholders can take proactive measures to minimize depreciation and maximize ACV. Regular maintenance, timely repairs, and keeping assets in good condition can help slow down depreciation. Additionally, staying informed about market trends and property values can ensure coverage remains aligned with the actual worth of the insured assets.

How often should policyholders review and update their ACV insurance policies?

+It is recommended to review and update ACV insurance policies at least annually or whenever significant changes occur in the insured property's value. This ensures that the coverage remains adequate and reflects the current market conditions and depreciation rates.

In conclusion, Actual Cash Value insurance is a valuable tool for protecting your assets and ensuring fair compensation in the event of a loss. By understanding how ACV works, the factors influencing its value, and its differences from other insurance types, you can make informed decisions about your coverage. Remember to regularly review your insurance policies and consider emerging trends and industry insights to stay ahead of the curve and protect your assets effectively.