Property Insurance Cost

Property insurance is a crucial aspect of safeguarding your valuable assets, be it your home, business, or personal belongings. The cost of property insurance is a significant consideration for many individuals and businesses, as it directly impacts their financial planning and security. Understanding the factors that influence insurance premiums and how to optimize coverage is essential for making informed decisions. This comprehensive guide aims to delve into the intricacies of property insurance costs, providing you with the knowledge to navigate this complex landscape.

Understanding Property Insurance Costs

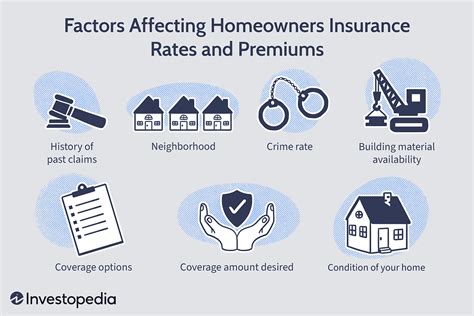

Property insurance costs, often referred to as premiums, are determined by a myriad of factors, each playing a unique role in assessing the risk associated with insuring a particular property. These factors can be broadly categorized into two main groups: the characteristics of the property itself and the characteristics of the policyholder.

Property-Related Factors

The physical attributes of a property are significant determinants of insurance costs. These include the location, construction type, age, and the presence of any safety or security features. For instance, a property located in an area prone to natural disasters like hurricanes or earthquakes will typically command higher insurance premiums due to the increased risk of damage.

The construction materials used can also impact insurance costs. Properties built with more durable materials, such as brick or concrete, may be eligible for lower premiums compared to those constructed with more flammable materials like wood. Additionally, the age of the property is a factor, with older properties often requiring more extensive coverage due to potential issues with aging infrastructure.

Safety and security features can also play a role in reducing insurance costs. Properties equipped with fire suppression systems, burglar alarms, or reinforced doors and windows may be considered lower risk by insurers, resulting in more favorable premium rates.

Policyholder-Related Factors

The characteristics of the policyholder, or the individual or business seeking insurance, are equally important in determining insurance costs. Insurers assess the potential risk associated with each policyholder, considering factors such as their claim history, credit score, and even their occupation.

A history of frequent or costly claims can indicate a higher risk to the insurer, potentially leading to increased premiums or even denial of coverage. Similarly, a low credit score may suggest financial instability, which could impact the policyholder's ability to pay premiums or cover deductibles in the event of a claim. Certain occupations, particularly those with high-risk activities or exposure to hazardous materials, may also influence insurance costs.

Coverage and Deductibles

The type and extent of coverage chosen by the policyholder also significantly impact insurance costs. Comprehensive coverage, which offers protection against a wide range of perils, will generally cost more than basic coverage, which may only protect against specific types of damage. The policyholder’s choice of deductibles, which represent the amount they agree to pay out of pocket before the insurance coverage kicks in, can also affect premiums. Higher deductibles typically result in lower premiums, as the policyholder is taking on more financial responsibility in the event of a claim.

Optimizing Property Insurance Costs

While the cost of property insurance is influenced by numerous factors that may be beyond your control, there are strategies you can employ to optimize your insurance costs and ensure you’re getting the best value for your money.

Conduct a Comprehensive Risk Assessment

Before purchasing property insurance, it’s essential to conduct a thorough risk assessment of your property. Identify potential hazards and vulnerabilities, and take steps to mitigate these risks. For instance, if your property is located in a flood-prone area, consider investing in flood barriers or raising electrical sockets to minimize the risk of water damage.

Regular maintenance and upgrades can also help reduce insurance costs. Ensuring your property is in good condition, with all systems functioning properly, can lower the risk of unexpected damage and subsequent claims. Upgrading to more durable construction materials or installing safety features can also make your property more attractive to insurers, potentially leading to lower premiums.

Shop Around and Compare Quotes

The property insurance market is highly competitive, with numerous insurers offering a wide range of policies and premiums. It’s crucial to shop around and compare quotes from multiple insurers to ensure you’re getting the best deal. Online comparison tools can be a valuable resource for this, allowing you to quickly and easily compare policies and premiums from various providers.

When comparing quotes, pay close attention to the coverage details. Ensure that the policies you're comparing offer the same level of coverage, as differences in coverage can make direct comparisons challenging. Consider not only the premium but also the policy's deductibles, coverage limits, and any additional perks or benefits that may be included.

Bundle Policies for Discounts

If you have multiple insurance needs, such as home, auto, and life insurance, consider bundling your policies with the same insurer. Many insurers offer multi-policy discounts, which can result in significant savings. By consolidating your insurance needs with one provider, you may also benefit from simplified billing and claims processes.

Review and Adjust Your Coverage Regularly

Your insurance needs may change over time, whether due to changes in your property, your financial situation, or the insurance market. It’s important to review your insurance coverage regularly, at least once a year, to ensure it still meets your needs and provides the best value. This review process should involve assessing any changes to your property, such as renovations or additions, as well as any changes to your financial situation, such as an increase in income or savings.

If your circumstances have changed, you may be able to adjust your coverage to better suit your needs. For instance, if you've installed new security features or made significant upgrades to your property, you may be eligible for lower premiums. Conversely, if your property has aged or sustained damage, you may need to increase your coverage limits to adequately protect your assets.

Future Implications and Trends

The landscape of property insurance is continually evolving, influenced by technological advancements, changing environmental conditions, and shifting consumer preferences. Keeping abreast of these trends is essential for making informed decisions about your property insurance needs.

Impact of Climate Change

Climate change is a significant factor influencing property insurance costs, particularly in regions prone to natural disasters. As the frequency and severity of events like hurricanes, wildfires, and floods increase, insurers are adjusting their risk assessments and premium structures accordingly. This means that property owners in high-risk areas may face higher insurance costs or even difficulty obtaining coverage.

To mitigate these risks, insurers are increasingly investing in advanced risk modeling and predictive analytics. These tools allow insurers to more accurately assess the potential impact of natural disasters on specific properties, helping to ensure that premiums are fairly and accurately priced. Property owners can also take advantage of these advancements by using tools and resources to assess their property's risk profile and take steps to mitigate potential hazards.

Rise of Telematics and Smart Home Technology

The integration of telematics and smart home technology is revolutionizing the property insurance industry. Telematics, which uses data from sensors and devices to monitor and analyze risk, is increasingly being used by insurers to offer usage-based insurance policies. These policies are tailored to the individual risk profile of the property, offering more personalized coverage and potentially lower premiums for policyholders who demonstrate lower risk behaviors.

Smart home technology, such as smart thermostats, leak detectors, and security systems, is also playing a role in reducing insurance costs. These devices can help prevent accidents and mitigate damage in the event of an incident, making properties with smart home technology more attractive to insurers. Additionally, the data collected by these devices can provide insurers with valuable insights into the property's risk profile, allowing them to offer more tailored coverage and potentially lower premiums.

The Role of Insurtech

Insurtech, the fusion of insurance and technology, is transforming the property insurance industry by introducing innovative solutions and streamlining processes. Insurtech startups and established insurers are leveraging technology to enhance customer experiences, improve operational efficiency, and develop new products and services.

One notable trend in Insurtech is the use of artificial intelligence (AI) and machine learning to automate various aspects of the insurance process, from risk assessment and underwriting to claims processing. These technologies enable insurers to make more accurate and timely decisions, reduce costs, and provide a more seamless experience for policyholders. Additionally, Insurtech companies are developing innovative products, such as on-demand insurance and parametric insurance, which offer flexible coverage tailored to the needs of modern consumers.

Conclusion

Property insurance is a complex but essential aspect of protecting your assets. By understanding the factors that influence insurance costs and implementing strategies to optimize your coverage, you can ensure you’re adequately protected while keeping costs manageable. The future of property insurance is promising, with technological advancements and changing consumer preferences driving innovation and offering new opportunities for policyholders to secure the coverage they need at a competitive price.

How do I choose the right property insurance coverage for my needs?

+Choosing the right property insurance coverage involves assessing your specific needs and understanding the various types of coverage available. Consider factors such as the value of your property, the potential risks it faces, and your financial ability to recover from losses. Common types of coverage include structures coverage, personal property coverage, liability coverage, and additional living expenses. It’s important to review these options and select a policy that provides adequate protection without unnecessary expenses.

What factors can I control to reduce my property insurance costs?

+While many factors influencing property insurance costs are beyond your control, there are several strategies you can employ to potentially reduce your premiums. These include maintaining a good credit score, regularly reviewing and updating your coverage to ensure it aligns with your current needs, and taking steps to mitigate risks, such as installing security systems or making your property more resistant to natural disasters.

How often should I review my property insurance policy?

+It’s recommended to review your property insurance policy annually, or whenever there are significant changes to your property or personal circumstances. Regular reviews ensure that your coverage remains adequate and up-to-date, allowing you to make necessary adjustments to your policy as your needs evolve.