Best Insurance For Small Business

In the world of small businesses, finding the right insurance coverage is crucial to protect your ventures and ensure their longevity. With numerous options available, it can be daunting to navigate the insurance landscape. This comprehensive guide aims to shed light on the best insurance options tailored specifically for small businesses, helping you make informed decisions to safeguard your hard work and investments.

Understanding the Importance of Insurance for Small Businesses

Insurance serves as a vital risk management tool for small businesses, providing financial protection against various unforeseen events. From natural disasters to legal liabilities, having the right insurance coverage can mean the difference between a minor setback and a devastating blow to your business.

For instance, consider a small retail store that experiences a fire, causing significant damage to the premises and inventory. Without adequate insurance, the owner might face overwhelming costs for repairs and replacements, potentially leading to bankruptcy. On the other hand, with comprehensive property insurance, the business can recover and get back on its feet much more quickly.

Furthermore, insurance also plays a crucial role in building customer trust and confidence. Many clients and partners now prefer to work with businesses that demonstrate a responsible approach to risk management, which includes having appropriate insurance coverage.

Identifying Your Small Business Insurance Needs

Before selecting insurance policies, it’s essential to assess your unique business needs. Different industries and business models come with their own set of risks and liabilities. Understanding these risks is the first step toward crafting a robust insurance strategy.

Assessing Risks and Liabilities

Take time to identify the specific risks associated with your industry and business operations. For example, if you run a manufacturing business, you may face risks such as equipment breakdown, product defects, or worker injuries. On the other hand, a service-based business might prioritize professional liability insurance to protect against client claims of negligence or errors.

Creating a comprehensive risk assessment can help you prioritize insurance needs and allocate your budget effectively.

Customizing Coverage to Your Business

Not all insurance policies are created equal, and it’s important to choose options that align with your business’s specific requirements. Consider factors such as your business size, location, and the nature of your operations.

For instance, a small online business with a primarily digital presence might focus on cyber liability insurance to protect against data breaches and online security threats. Meanwhile, a local bakery might prioritize product liability insurance to cover potential claims related to food safety or customer injuries.

Exploring the Best Insurance Options for Small Businesses

Now that we’ve emphasized the importance of insurance and the need to customize coverage, let’s delve into some of the best insurance options available for small businesses.

General Liability Insurance

General liability insurance is often considered the cornerstone of any small business insurance portfolio. It provides broad coverage for a range of common risks, including bodily injury, property damage, and personal and advertising injury claims.

For example, if a customer slips and falls in your store, general liability insurance can help cover the medical costs and potential legal fees associated with the incident. It also protects against claims of slander, libel, or copyright infringement, which are crucial considerations for businesses with an online presence.

| Policy Type | Coverage Highlights |

|---|---|

| General Liability | Bodily injury, property damage, personal & advertising injury |

| Product Liability | Claims related to products sold or manufactured |

| Professional Liability | Errors & omissions, negligence claims |

| Workers' Compensation | Medical costs & lost wages for work-related injuries |

Product Liability Insurance

If your small business involves the sale or manufacture of products, product liability insurance is an essential consideration. This coverage protects you against claims arising from defective products, including bodily injury or property damage caused by your products.

Imagine a small cosmetics company that launches a new skincare line. If one of their products causes an allergic reaction in a customer, product liability insurance can help cover the costs of any resulting lawsuits or medical expenses.

Professional Liability Insurance

Also known as errors and omissions (E&O) insurance, professional liability insurance is tailored for businesses that provide professional services. It protects against claims of negligence, errors, or omissions in the services provided.

For instance, a small accounting firm could face a claim from a client who alleges that an error in their tax preparation caused significant financial loss. Professional liability insurance would help cover the legal costs and potential settlement or judgment amounts.

Workers’ Compensation Insurance

Workers’ compensation insurance is a critical coverage for small businesses with employees. It provides benefits to workers who suffer work-related injuries or illnesses, covering medical expenses and a portion of lost wages.

In the event that an employee is injured on the job, workers' compensation insurance ensures they receive the necessary medical care and financial support without placing a burden on the business or its other employees.

Cyber Liability Insurance

In today’s digital age, small businesses are increasingly vulnerable to cyber threats and data breaches. Cyber liability insurance offers protection against these risks, covering costs associated with data breaches, cyber extortion, and other cyber-related incidents.

For a small e-commerce business, a data breach could result in significant financial losses and damage to its reputation. Cyber liability insurance can help cover the costs of investigating and resolving the breach, as well as providing support for notifying affected customers and offering credit monitoring services.

Factors to Consider When Choosing Insurance Providers

When it comes to selecting insurance providers, several factors can influence your decision. Here are some key considerations to keep in mind:

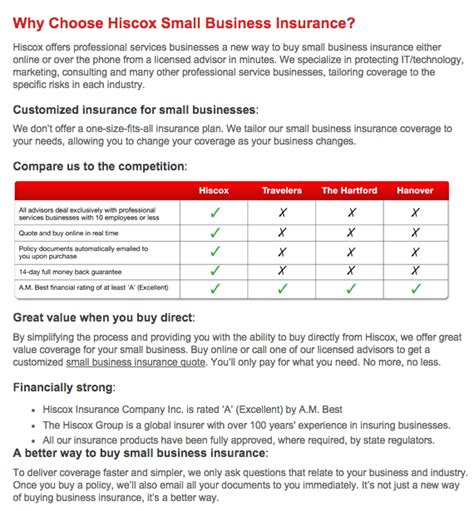

Reputation and Financial Stability

Look for insurance providers with a strong reputation and a history of financial stability. This ensures that the provider will be able to honor their commitments and pay out claims even in challenging economic times.

Check industry ratings and customer reviews to get a sense of the provider's reliability and customer satisfaction levels.

Coverage Options and Customization

Choose an insurance provider that offers a wide range of coverage options and allows for customization to meet your specific business needs. This flexibility ensures you can build a comprehensive insurance portfolio without paying for unnecessary coverage.

Claims Handling Process

Understanding the claims handling process is crucial. Research the provider’s track record in processing claims promptly and fairly. A streamlined and efficient claims process can make a significant difference when you need to make a claim.

Customer Service and Support

Excellent customer service and support can be invaluable when navigating the complexities of insurance. Choose a provider that offers easy access to knowledgeable representatives who can answer your questions and guide you through the insurance process.

Maximizing Your Insurance Coverage with Expert Tips

To get the most out of your small business insurance, consider these expert tips:

Stay informed about industry trends and emerging risks. This knowledge can help you anticipate potential issues and ensure your insurance coverage remains adequate.

Consider bundling multiple insurance policies with the same provider. Many providers offer discounts for multi-policy customers, helping you save on your insurance premiums.

Don't hesitate to reach out to insurance professionals for guidance. They can provide valuable insights and recommendations tailored to your specific business.

Conclusion: Navigating the Small Business Insurance Landscape

Securing the right insurance coverage is a fundamental step in protecting your small business and ensuring its long-term success. By understanding your unique insurance needs and exploring the best options available, you can build a robust insurance strategy that provides peace of mind and financial protection.

Remember, insurance is an investment in your business's future. With the right coverage in place, you can focus on what you do best: growing and thriving in the dynamic world of small business ownership.

What is the average cost of insurance for a small business?

+The cost of insurance for small businesses can vary widely depending on factors such as industry, location, and coverage needs. On average, small businesses spend around 0.6% to 2% of their total revenues on insurance, but this can range from a few hundred dollars to several thousand dollars annually.

How often should I review my insurance coverage?

+It’s recommended to review your insurance coverage annually or whenever there are significant changes to your business, such as expansion, new products or services, or hiring additional employees. Regular reviews ensure your coverage remains adequate and up-to-date.

Can I get insurance for my small business as a sole proprietor?

+Yes, sole proprietors can and should obtain insurance to protect their business and personal assets. The specific coverage needed will depend on the nature of your business and the risks it faces.