Phone Insurance Apple

Apple devices, known for their cutting-edge technology and sleek design, have become an integral part of our daily lives. From the iconic iPhone to the versatile iPad, Apple products offer a range of features that cater to various needs. However, with the increasing cost of these devices and the potential risks of damage or theft, it's essential to consider the benefits of phone insurance, especially for Apple users.

Understanding Apple Phone Insurance

Apple phone insurance, also known as AppleCare+, is a comprehensive protection plan offered by Apple itself. It provides coverage for hardware repairs, software support, and accidental damage. By investing in AppleCare+, Apple users can gain peace of mind, knowing that their devices are protected against unexpected issues.

One of the key advantages of AppleCare+ is its coverage for accidental damage. Unlike standard warranties, which often exclude such incidents, AppleCare+ covers repair or replacement for damage caused by spills, drops, or other mishaps. This is particularly beneficial for individuals who lead active lifestyles or have children who may accidentally damage their devices.

AppleCare+ Coverage and Benefits

AppleCare+ offers a range of benefits, ensuring that Apple users receive prompt and reliable support. Here’s an overview of what’s included in the protection plan:

- Hardware Repairs: AppleCare+ covers repairs for hardware issues, such as defective components or malfunctioning parts. Whether it's a faulty camera, a cracked screen, or a malfunctioning battery, AppleCare+ ensures that users can have their devices repaired at an authorized service center.

- Software Support: Apple is renowned for its user-friendly software and seamless integration across devices. AppleCare+ provides access to expert software support, helping users troubleshoot any issues they may encounter. This includes assistance with iOS updates, app compatibility, and optimizing device performance.

- Accidental Damage Protection: As mentioned earlier, AppleCare+ stands out for its coverage of accidental damage. Whether it's a cracked screen from a clumsy mishap or water damage from an unexpected spill, AppleCare+ has users covered. The plan offers a fixed fee for each incident, providing an affordable and convenient solution for device repairs.

Furthermore, AppleCare+ provides users with additional benefits, such as priority access to Apple Support. This means that users can receive personalized assistance and guidance from Apple experts, ensuring a swift resolution to any technical issues they may face.

Real-World Scenarios and Cost Savings

Let’s consider a few real-life scenarios to understand the value of Apple phone insurance:

- Scenario 1: Screen Damage: Imagine you accidentally drop your iPhone, resulting in a shattered screen. Without AppleCare+, the cost of repairing the screen could range from $150 to $300 or more, depending on the iPhone model. However, with AppleCare+, you pay a fixed fee, typically around $29, and have your screen replaced at an authorized service center.

- Scenario 2: Liquid Damage: Water damage is a common issue, especially for devices like iPhones and iPads. If your device suffers water damage, the repair costs can be substantial, often exceeding $500. With AppleCare+, you're protected against such incidents, and the repair or replacement cost is significantly reduced.

- Scenario 3: Multiple Incidents: Let's say you're an adventurous soul and your iPhone takes a few tumbles during your travels. With AppleCare+, you can benefit from multiple incidents of coverage. For a small additional fee, you can have your device repaired or replaced multiple times within the coverage period, ensuring your device remains in top condition.

By investing in Apple phone insurance, users can save significantly on repair costs and avoid the hassle and financial burden of unexpected expenses. The peace of mind that comes with knowing your device is protected is invaluable, especially when considering the high cost of Apple products.

Comparing Apple Phone Insurance with Third-Party Options

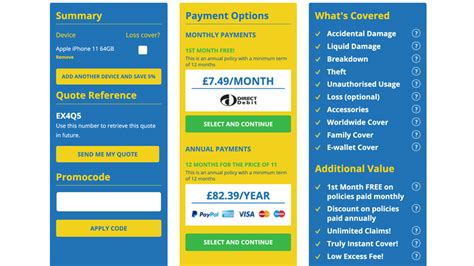

While AppleCare+ is a popular choice, there are also third-party insurance providers that offer coverage for Apple devices. It’s essential to compare the features, benefits, and costs of these options to make an informed decision.

Third-party insurance providers often offer more comprehensive coverage, including protection against theft and loss. While AppleCare+ covers accidental damage, it typically excludes theft and loss, which can be significant risks for mobile devices. Third-party insurers may also provide additional benefits, such as coverage for accessories and extended warranty periods.

| Category | AppleCare+ | Third-Party Insurance |

|---|---|---|

| Coverage | Hardware repairs, software support, accidental damage | Theft, loss, accessories, extended warranty |

| Cost | Varies by device and plan, typically around $150-$200 | Varies, often lower upfront cost with monthly premiums |

| Claims Process | Quick and convenient, with authorized service centers | Varies, some may require deductibles or additional fees |

When comparing Apple phone insurance options, it's crucial to consider your specific needs and preferences. If you prioritize convenience and a seamless repair experience, AppleCare+ may be the ideal choice. On the other hand, if you're looking for broader coverage and potentially lower costs, exploring third-party insurance providers could be beneficial.

Expert Insights on Apple Phone Insurance

It's important to note that the decision to purchase phone insurance, whether through Apple or a third-party provider, should be based on your individual circumstances. Factors such as the value of your device, your lifestyle, and the potential risks you face should all be considered when evaluating the benefits of insurance coverage.

Conclusion: The Value of Phone Insurance for Apple Users

In today’s fast-paced world, where technology plays a central role in our lives, investing in phone insurance is a wise decision. For Apple users, AppleCare+ provides a reliable and convenient protection plan, ensuring that their devices are covered against a range of issues. Whether it’s accidental damage, hardware malfunctions, or software glitches, AppleCare+ offers peace of mind and swift resolution.

While third-party insurance options may offer broader coverage, AppleCare+ remains a trusted choice for many Apple enthusiasts. The simplicity of the plan, coupled with Apple's renowned customer support, makes it an attractive option for those seeking a seamless and reliable insurance experience.

Ultimately, the decision to purchase phone insurance depends on your personal preferences and needs. By understanding the benefits and comparing the available options, you can make an informed choice and ensure that your Apple devices remain protected, allowing you to enjoy their full potential without worrying about unexpected expenses.

What is the cost of AppleCare+ for iPhone and iPad devices?

+The cost of AppleCare+ varies depending on the device and the plan chosen. For iPhone, AppleCare+ typically costs around 150 to 200, depending on the model. For iPad, the cost ranges from 60 to 100. These prices may vary based on the region and the specific AppleCare+ plan selected.

How does AppleCare+ coverage differ from standard warranties?

+Standard warranties typically cover manufacturing defects and hardware malfunctions. However, they often exclude accidental damage, which is a common occurrence for mobile devices. AppleCare+, on the other hand, provides coverage for accidental damage, ensuring that users can have their devices repaired or replaced in case of spills, drops, or other mishaps.

Can I purchase AppleCare+ after the initial warranty period?

+Yes, AppleCare+ can be purchased within a specific timeframe after the initial warranty period. The exact timing may vary depending on the device and the region. It’s important to check the eligibility requirements and purchase AppleCare+ within the specified window to ensure you have continuous coverage for your Apple device.