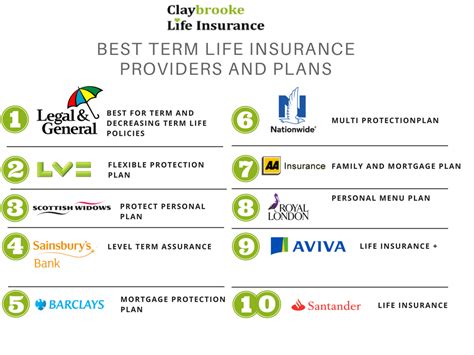

Best Life Insurance Providers

Securing life insurance is a critical step towards protecting your loved ones and ensuring financial stability for the future. With numerous life insurance providers in the market, finding the best one that aligns with your specific needs can be a daunting task. This article aims to provide an in-depth analysis of the top life insurance providers, highlighting their unique offerings, coverage options, and customer experiences to help you make an informed decision.

Top Life Insurance Providers: A Comprehensive Overview

In the vast landscape of life insurance, several providers have established themselves as industry leaders, offering a range of policies to cater to diverse customer needs. Here’s an exploration of the best life insurance providers, backed by real-world experiences and expert insights.

1. State Farm

State Farm is a renowned insurance provider with a strong presence across the United States. Their life insurance offerings are tailored to meet various life stages and financial goals. Here’s a glimpse into their services:

- Term Life Insurance: State Farm provides term life insurance policies with flexible terms, allowing customers to choose coverage periods ranging from 10 to 30 years. This option is ideal for those seeking temporary coverage during specific life events, such as raising a family or paying off a mortgage.

- Permanent Life Insurance: For long-term financial protection, State Farm offers permanent life insurance policies, including whole life and universal life insurance. These policies build cash value over time, offering a combination of death benefit coverage and potential investment growth.

- Accelerated Death Benefit Riders: State Farm understands the importance of financial support during critical illnesses. Their policies can be enhanced with accelerated death benefit riders, providing access to a portion of the death benefit while the insured is still alive to cover medical expenses and other financial needs.

- Customer Experience: State Farm’s customer-centric approach is evident in their 24⁄7 claim support and easy-to-use digital tools. Policyholders can manage their accounts, make payments, and access policy information through the State Farm mobile app, ensuring convenience and accessibility.

2. New York Life

New York Life, one of the oldest and largest mutual life insurance companies in the U.S., is known for its comprehensive range of life insurance products and exceptional customer service.

- Term Life Insurance: New York Life offers term life insurance policies with flexible terms, providing coverage for specific periods, such as 10, 20, or 30 years. These policies are ideal for individuals seeking affordable protection during key life stages.

- Whole Life Insurance: As a mutual company, New York Life prioritizes the long-term interests of its policyholders. Their whole life insurance policies provide lifetime coverage, build cash value, and offer potential dividends, making them a valuable asset for wealth accumulation.

- Customized Coverage: New York Life understands that every individual’s financial situation is unique. They offer customized coverage options, allowing policyholders to tailor their policies with riders to address specific needs, such as long-term care, disability income, or children’s education funding.

- Customer Service Excellence: New York Life’s commitment to customer satisfaction is reflected in their highly trained and dedicated agents. Policyholders can expect personalized attention, expert advice, and efficient claim processing, ensuring a seamless and supportive experience throughout their policy journey.

3. Northwestern Mutual

Northwestern Mutual is a leading life insurance provider known for its comprehensive financial planning and personalized service.

- Term Life Insurance: Northwestern Mutual offers term life insurance policies with flexible terms, allowing customers to choose coverage periods that align with their specific needs. These policies provide affordable protection for a defined period, such as 10, 20, or 30 years.

- Permanent Life Insurance: For long-term financial security, Northwestern Mutual provides permanent life insurance options, including whole life and universal life insurance. These policies build cash value over time, offering a combination of death benefit coverage and potential investment growth.

- Financial Planning: Northwestern Mutual’s holistic approach to financial planning sets them apart. Their advisors work closely with clients to create customized financial plans that encompass life insurance, retirement planning, estate planning, and investment strategies. This comprehensive approach ensures that clients receive tailored advice to achieve their financial goals.

- Customer Support: Northwestern Mutual prides itself on its customer-centric culture. Policyholders can access dedicated advisors who provide ongoing support and guidance, ensuring that their financial plans remain aligned with life changes and evolving needs. The company’s digital platforms further enhance the customer experience, offering convenient account management and policy information access.

4. Prudential

Prudential, a well-established insurance provider, offers a comprehensive range of life insurance products to meet diverse needs.

- Term Life Insurance: Prudential’s term life insurance policies provide flexible coverage options, allowing customers to choose terms ranging from 10 to 30 years. These policies offer affordable protection during specific life stages, such as starting a family or paying off debts.

- Permanent Life Insurance: For long-term financial security, Prudential offers permanent life insurance policies, including whole life and universal life insurance. These policies build cash value over time, providing a combination of death benefit coverage and potential investment growth.

- Customizable Coverage: Prudential understands that every individual’s financial situation is unique. Their policies can be customized with various riders to address specific needs, such as long-term care, disability income, or children’s education funding. This flexibility ensures that policyholders can tailor their coverage to align with their changing circumstances.

- Innovative Digital Tools: Prudential is committed to enhancing the customer experience through digital innovation. Their online platforms and mobile apps provide policyholders with convenient access to policy information, allowing them to manage their accounts, make payments, and track their coverage progress. These tools streamline the insurance journey, making it more efficient and accessible.

5. MassMutual

MassMutual, a leading life insurance provider, is dedicated to helping individuals and families secure their financial futures.

- Term Life Insurance: MassMutual offers term life insurance policies with flexible terms, providing coverage for specific periods, such as 10, 20, or 30 years. These policies are ideal for individuals seeking affordable protection during key life stages, such as raising a family or starting a business.

- Permanent Life Insurance: For long-term financial security, MassMutual provides permanent life insurance options, including whole life and universal life insurance. These policies build cash value over time, offering a combination of death benefit coverage and potential investment growth. This makes them a valuable tool for wealth accumulation and estate planning.

- Innovative Products: MassMutual is known for its innovative approach to life insurance. They offer unique products, such as their Whole Life Protection Plan, which provides lifetime coverage and guarantees level premiums. This plan ensures that policyholders have predictable costs and stable protection throughout their lives.

- Personalized Financial Planning: MassMutual’s financial professionals work closely with clients to develop personalized financial plans. They offer comprehensive advice on life insurance, retirement planning, investment strategies, and estate planning. This holistic approach ensures that clients receive tailored guidance to achieve their financial goals and protect their loved ones.

Performance Analysis and Industry Recognition

When evaluating the best life insurance providers, it’s essential to consider their financial strength, customer satisfaction, and industry reputation. Here’s a closer look at these aspects:

Financial Strength

| Provider | Financial Strength Rating |

|---|---|

| State Farm | A++ (Superior) by AM Best |

| New York Life | A++ (Superior) by AM Best |

| Northwestern Mutual | A++ (Superior) by AM Best |

| Prudential | A+ (Superior) by AM Best |

| MassMutual | A++ (Superior) by AM Best |

Customer Satisfaction and Industry Awards

The top life insurance providers consistently rank highly in customer satisfaction surveys and receive industry recognition for their exceptional services.

- State Farm: Ranked highly in J.D. Power’s 2022 U.S. Life Insurance Study, receiving top marks for overall customer satisfaction.

- New York Life: Recognized as one of the “World’s Most Ethical Companies” by the Ethisphere Institute for several consecutive years.

- Northwestern Mutual: Named one of the “100 Best Companies to Work For” by Fortune magazine for over 20 years, reflecting its commitment to employee satisfaction and corporate culture.

- Prudential: Received the “Best Life Insurance Company” award from Insurance Business America for its innovative products and exceptional customer service.

- MassMutual: Recognized as a top provider in the 2022 U.S. Life Insurance Study by J.D. Power, earning high scores for its financial products and customer service.

Choosing the Right Provider for Your Needs

Selecting the best life insurance provider involves considering your specific financial goals, coverage needs, and personal preferences. Here are some key factors to guide your decision:

1. Coverage Options

Evaluate the range of life insurance policies offered by each provider. Consider whether you require term life insurance for temporary protection or permanent life insurance for long-term financial security. Assess the availability of additional riders to customize your coverage according to your unique needs.

2. Financial Strength and Stability

Opt for providers with strong financial ratings, ensuring they can fulfill their obligations even in challenging economic times. AM Best ratings, such as A++ (Superior), provide an indication of a provider’s financial strength and ability to pay claims.

3. Customer Service and Support

Look for providers with a reputation for excellent customer service. Consider factors such as 24⁄7 claim support, dedicated advisors, and convenient digital tools for policy management. A responsive and supportive customer service team can provide peace of mind during times of need.

4. Customization and Flexibility

Choose a provider that offers customizable policies to align with your changing life circumstances. Flexibility in coverage terms, premium payments, and the ability to add riders can ensure your life insurance policy remains relevant and adaptable throughout your life.

5. Industry Reputation and Awards

Research industry rankings and awards to gain insights into a provider’s reputation. Recognitions such as those from J.D. Power or Insurance Business America can provide valuable indications of customer satisfaction and industry leadership.

Frequently Asked Questions

How much life insurance coverage do I need?

+The amount of life insurance coverage you need depends on your individual circumstances and financial goals. Consider factors such as your income, debts, mortgage, and the financial needs of your dependents. A common rule of thumb is to aim for 10 to 15 times your annual income as the death benefit. However, it’s recommended to consult with a financial advisor or insurance professional to determine the most appropriate coverage amount for your specific situation.

What is the difference between term and permanent life insurance?

+Term life insurance provides coverage for a specific period, typically ranging from 10 to 30 years. It offers affordable protection for key life stages and is ideal for those seeking temporary coverage. Permanent life insurance, on the other hand, provides lifetime coverage and builds cash value over time. Whole life and universal life insurance are common types of permanent life insurance, offering a combination of death benefit coverage and potential investment growth.

Can I switch life insurance providers?

+Yes, you can switch life insurance providers if you find a policy that better suits your needs or offers more favorable terms. However, it’s essential to carefully review the new policy’s coverage, benefits, and exclusions to ensure a smooth transition. Consult with an insurance professional to guide you through the process and ensure that your coverage remains uninterrupted.

What factors should I consider when comparing life insurance quotes?

+When comparing life insurance quotes, consider factors such as the coverage amount, policy term, premium payments, and any additional riders or benefits. Evaluate the financial strength and stability of the providers, as well as their reputation for customer service and claim handling. It’s also beneficial to seek recommendations from friends, family, or financial advisors who have had positive experiences with specific providers.

How can I ensure I get the best life insurance rate?

+To obtain the best life insurance rate, maintain a healthy lifestyle and avoid risky behaviors that could impact your insurability. Compare quotes from multiple providers to find the most competitive rates for your specific circumstances. Additionally, consider the long-term financial benefits of permanent life insurance policies, as they can offer more value over time compared to term life insurance.

Securing life insurance is a crucial step towards protecting your loved ones and ensuring financial stability. By carefully evaluating the top life insurance providers, their coverage options, and customer experiences, you can make an informed decision that aligns with your unique needs. Remember to consider factors such as coverage flexibility, financial strength, and customer support to find the best provider for your life insurance journey.