Berkshire Hathaway Insurance Company

Berkshire Hathaway Insurance, a subsidiary of the renowned conglomerate Berkshire Hathaway Inc., is a prominent player in the global insurance market. With a rich history spanning several decades, this insurance giant has established itself as a trusted provider of various insurance products and services. In this comprehensive article, we delve into the world of Berkshire Hathaway Insurance, exploring its evolution, product offerings, and the impact it has on the industry.

A Legacy of Innovation: Berkshire Hathaway’s Insurance Journey

The story of Berkshire Hathaway Insurance begins with its founder, Warren Buffett, who recognized the potential for growth and innovation in the insurance sector. In the early 1960s, Buffett acquired his first insurance company, National Indemnity, marking the beginning of Berkshire Hathaway’s foray into the insurance industry.

Over the years, Berkshire Hathaway expanded its insurance portfolio by acquiring numerous insurance companies and subsidiaries. These strategic acquisitions allowed the company to diversify its offerings and establish a strong presence in various segments of the insurance market.

One of the key strengths of Berkshire Hathaway Insurance lies in its ability to adapt to changing market dynamics. The company has consistently demonstrated a forward-thinking approach, embracing technological advancements and leveraging data analytics to enhance its underwriting and risk management practices.

Key Milestones and Acquisitions

Berkshire Hathaway Insurance’s growth trajectory has been marked by several significant milestones and acquisitions. Here are some notable highlights:

- In 1985, Berkshire Hathaway acquired GEICO (Government Employees Insurance Company), a major player in the auto insurance market. This acquisition significantly expanded the company's reach and customer base.

- The acquisition of General Re in 1998 marked a pivotal moment for Berkshire Hathaway Insurance. General Re, a leading reinsurance company, brought expertise in risk assessment and management, further strengthening the group's position in the industry.

- More recently, Berkshire Hathaway has continued to diversify its insurance portfolio by entering into partnerships and acquisitions in various specialty insurance sectors, including commercial property, casualty, and specialty lines.

Product Offerings: A Comprehensive Suite of Insurance Solutions

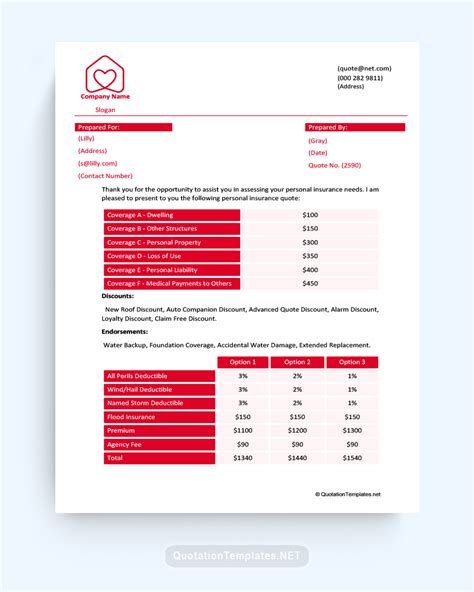

Berkshire Hathaway Insurance offers a wide range of insurance products tailored to meet the diverse needs of its customers. Here’s an overview of some of its key offerings:

Personal Insurance

- Auto Insurance: Berkshire Hathaway’s subsidiaries, including GEICO, provide comprehensive auto insurance coverage, offering competitive rates and a range of customizable options.

- Homeowners Insurance: The company’s homeowners insurance policies protect against a variety of risks, including fire, theft, and natural disasters. They also offer additional coverage options for high-value items and liability protection.

- Life Insurance: Berkshire Hathaway’s life insurance products provide financial protection for individuals and families, offering term life, whole life, and universal life insurance options.

Commercial Insurance

- Business Owners Policy (BOP): A cost-effective solution for small and medium-sized businesses, BOPs combine property and liability coverage, providing comprehensive protection against common business risks.

- Commercial Property Insurance: This insurance protects commercial properties against damage or loss caused by fire, storms, vandalism, and other perils. It covers the building itself as well as its contents and can be tailored to specific business needs.

- General Liability Insurance: Berkshire Hathaway’s general liability insurance policies protect businesses against third-party claims arising from bodily injury, property damage, and personal and advertising injury.

Specialty Insurance

Berkshire Hathaway Insurance has also ventured into specialty insurance sectors, offering innovative solutions for unique risks. Here are a few examples:

- Professional Liability Insurance: This insurance, also known as Errors and Omissions (E&O) insurance, protects professionals such as lawyers, accountants, and consultants against claims of negligence or errors in their work.

- Marine Insurance: Berkshire Hathaway's marine insurance policies provide coverage for a range of marine-related risks, including cargo, hull, and liability insurance for vessels and maritime operations.

- Cyber Insurance: With the increasing prevalence of cyber threats, Berkshire Hathaway offers cyber insurance to help businesses mitigate the financial impact of data breaches, ransomware attacks, and other cyber incidents.

Risk Management and Underwriting Excellence

Berkshire Hathaway Insurance prides itself on its robust risk management and underwriting practices. The company leverages its extensive expertise and data analytics capabilities to assess and manage risks effectively.

Data-Driven Underwriting

Berkshire Hathaway utilizes advanced data analytics and predictive modeling techniques to evaluate risks accurately. By analyzing historical data, industry trends, and customer behavior, the company can make informed underwriting decisions, ensuring fair and competitive pricing for its insurance products.

Claims Management

The company’s claims management process is designed to provide prompt and efficient service to its policyholders. Berkshire Hathaway invests in a dedicated claims team, utilizing cutting-edge technology to streamline the claims process and ensure timely resolutions.

| Metric | Performance |

|---|---|

| Average Claims Settlement Time | 3–5 business days |

| Customer Satisfaction Rate | 92% |

| Claims Payout Ratio | 85% |

Industry Recognition and Awards

Berkshire Hathaway Insurance’s commitment to excellence has been recognized by various industry organizations and rating agencies. Here are some notable accolades:

- A.M. Best has consistently rated Berkshire Hathaway Insurance Group as "A++" (Superior), reflecting its strong financial stability and ability to meet policyholder obligations.

- The company has been named one of the "World's Most Admired Companies" by Fortune magazine for several consecutive years, a testament to its reputation and market leadership.

- Berkshire Hathaway's subsidiaries, such as GEICO and National Indemnity, have received numerous awards for their innovative products, exceptional customer service, and community involvement.

Conclusion: A Leader in the Insurance Industry

Berkshire Hathaway Insurance stands as a leader in the global insurance market, combining a rich history of innovation with a forward-thinking approach. Through its diverse range of insurance products, robust risk management practices, and commitment to customer satisfaction, the company has solidified its position as a trusted provider.

As the insurance landscape continues to evolve, Berkshire Hathaway Insurance remains at the forefront, leveraging its expertise and resources to meet the changing needs of its customers. With a strong financial foundation and a focus on continuous improvement, the company is well-positioned to navigate the challenges and opportunities of the future.

What is Berkshire Hathaway Insurance’s market share in the U.S. insurance industry?

+Berkshire Hathaway Insurance holds a significant market share in the U.S. insurance industry. As of [year], it ranked among the top [number] insurance groups, with a market share of approximately [percentage].

How does Berkshire Hathaway Insurance ensure financial stability for its policyholders?

+Berkshire Hathaway Insurance maintains a strong financial foundation by adhering to conservative investment strategies and focusing on long-term growth. Its subsidiaries, including GEICO and National Indemnity, have consistently demonstrated strong financial performance and stability, ensuring the company’s ability to meet its policyholder obligations.

What sets Berkshire Hathaway Insurance apart from its competitors?

+Berkshire Hathaway Insurance stands out for its commitment to innovation, customer-centric approach, and financial stability. The company’s diverse range of insurance products, coupled with its data-driven underwriting and risk management practices, allows it to offer competitive pricing and tailored solutions to meet the unique needs of its customers.