Insurance Quotation

In today's complex world, insurance has become an indispensable tool for managing risks and securing our future. From health emergencies to unexpected damages, insurance quotations play a pivotal role in helping individuals and businesses make informed decisions about their financial protection. This article aims to delve into the intricacies of insurance quotations, exploring their significance, the factors that influence them, and the strategies to navigate the process effectively.

Understanding Insurance Quotations: The Foundation of Financial Protection

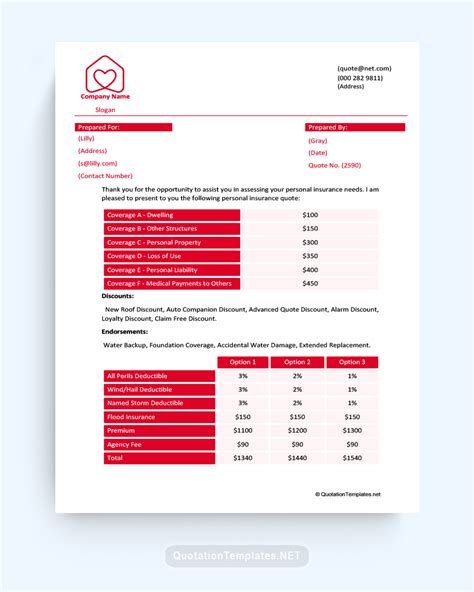

An insurance quotation, often referred to as an insurance quote, is a comprehensive document that outlines the cost and coverage details of an insurance policy. It serves as a crucial stepping stone towards obtaining the right insurance coverage tailored to an individual’s or a business’s unique needs. Quotations provide an opportunity to assess the potential risks, evaluate the financial implications, and make well-informed choices regarding insurance coverage.

The Significance of Insurance Quotations

Insurance quotations are invaluable tools that offer a glimpse into the world of insurance, allowing individuals to explore the various coverage options available. By providing detailed information about policy premiums, coverage limits, and exclusions, quotations empower individuals to make educated decisions about their financial security. Whether it’s safeguarding personal assets, ensuring business continuity, or protecting against health emergencies, insurance quotations are the first step towards achieving peace of mind.

Furthermore, insurance quotations serve as a benchmark for comparing different policies and providers. With multiple quotations in hand, individuals can evaluate the market, assess the competition, and negotiate better terms. This comparative analysis ensures that consumers receive the most competitive rates and the best value for their insurance needs.

Factors Influencing Insurance Quotations

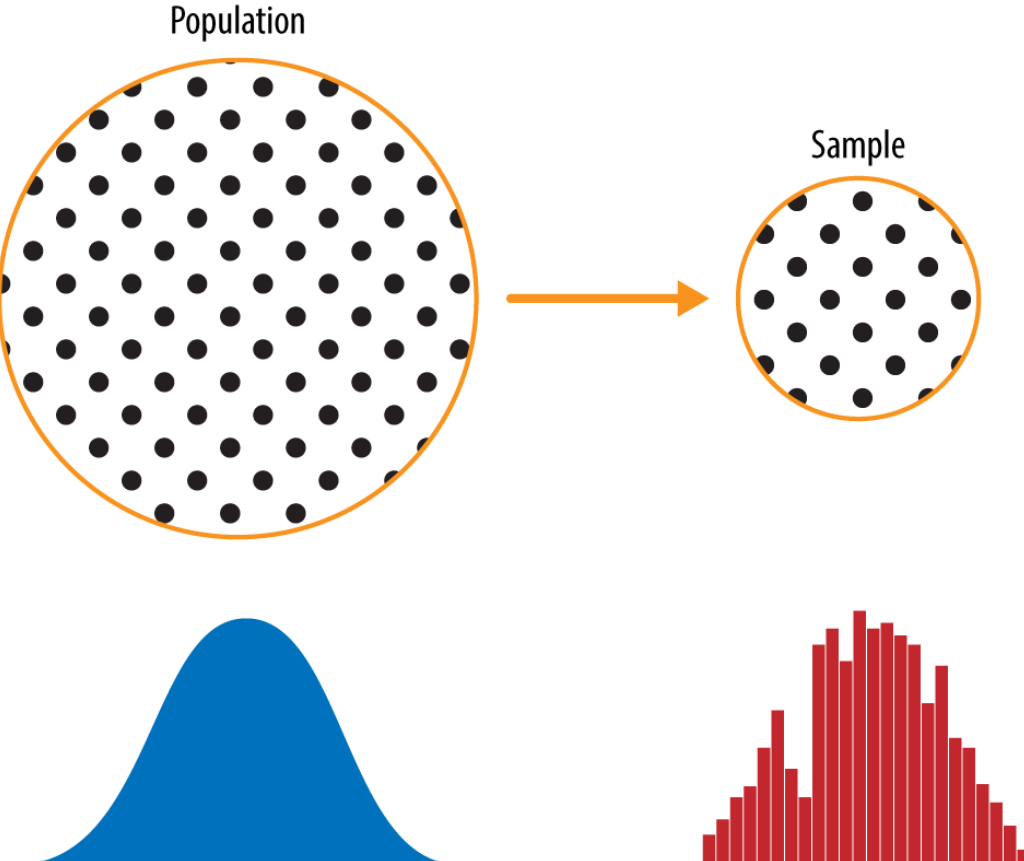

Insurance quotations are influenced by a multitude of factors, each playing a critical role in determining the cost and coverage of a policy. Understanding these factors is essential for individuals seeking to obtain accurate and favorable quotations.

- Risk Assessment: Insurance providers conduct a thorough risk assessment to evaluate the potential risks associated with an individual or business. Factors such as age, health status, occupation, driving history, and claim history are considered to determine the level of risk. Higher-risk profiles often result in higher premiums.

- Coverage Requirements: The extent of coverage desired by the policyholder significantly impacts the quotation. Comprehensive coverage, including additional benefits and add-ons, may lead to higher premiums. On the other hand, opting for basic coverage may result in lower costs.

- Policy Type and Provider: Different insurance policies cater to different needs. Life insurance, health insurance, property insurance, and liability insurance, among others, each have unique features and costs. Additionally, insurance providers may offer varying rates and coverage options, influencing the overall quotation.

- Location and Demographics: Geographical location and demographic factors play a role in insurance quotations. Areas with higher crime rates, natural disaster risks, or dense populations may result in increased premiums. Similarly, demographics such as age and gender can influence rates, especially in certain types of insurance.

- Market Competition: The insurance market is highly competitive, with various providers offering different rates and coverage. Market competition can drive down prices, providing consumers with more affordable options. Understanding the competitive landscape can help individuals negotiate better terms and secure favorable quotations.

Strategies for Obtaining Accurate and Favorable Insurance Quotations

Securing accurate and favorable insurance quotations requires a strategic approach. Here are some key strategies to navigate the process effectively:

- Conduct a Needs Assessment: Before seeking quotations, it is essential to understand your specific insurance needs. Evaluate your risks, consider your assets, and determine the level of coverage required. A thorough needs assessment ensures that you obtain quotations that align with your unique requirements.

- Research and Compare Providers: The insurance market is vast, with numerous providers offering a wide range of policies. Researching and comparing different providers can help you identify those that offer the best value for your needs. Consider factors such as reputation, financial stability, customer service, and coverage options when making your selection.

- Gather Multiple Quotations: Obtaining multiple quotations from different providers is crucial for comparative analysis. By gathering a range of quotations, you can assess the market, identify competitive rates, and negotiate better terms. Multiple quotations also provide a broader perspective on the coverage options available.

- Consider Bundling Policies: Many insurance providers offer discounts when multiple policies are bundled together. For example, combining home and auto insurance or life and health insurance can result in significant savings. Bundling policies not only provides convenience but also often leads to more favorable quotations.

- Utilize Online Comparison Tools: Online comparison tools and insurance marketplaces have revolutionized the quotation process. These platforms allow you to input your information once and receive multiple quotations from various providers. This streamlined approach saves time and effort, providing a comprehensive overview of the market in one place.

- Negotiate and Ask for Discounts: Don't be afraid to negotiate with insurance providers. Many providers are willing to offer discounts or customized rates, especially if you have a good claim history or meet certain criteria. Additionally, inquire about available discounts, such as safe driver discounts, loyalty discounts, or bundle discounts, to further reduce your premiums.

- Seek Professional Advice: If you find the insurance quotation process overwhelming or complex, consider seeking advice from insurance professionals or brokers. These experts can guide you through the process, help you understand the quotations, and ensure that you obtain the most suitable coverage at the best possible rate.

| Insurance Type | Average Premium (Yearly) |

|---|---|

| Health Insurance | $1,500 - $6,000 |

| Auto Insurance | $1,000 - $2,500 |

| Homeowners Insurance | $700 - $1,500 |

| Life Insurance | $500 - $2,000 |

| Liability Insurance | $500 - $1,000 |

The Future of Insurance Quotations: Technological Advancements and Consumer Empowerment

The insurance industry is undergoing a digital transformation, with technological advancements playing a pivotal role in shaping the future of insurance quotations. From streamlined online applications to advanced risk assessment algorithms, technology is revolutionizing the way insurance quotations are obtained and processed.

The Role of Technology in Insurance Quotations

Technology has brought about significant changes in the insurance quotation process, enhancing efficiency, accuracy, and convenience. Here are some key ways in which technology is impacting insurance quotations:

- Online Applications and Instant Quotations: Insurance providers have embraced digital platforms, allowing consumers to obtain instant quotations online. With user-friendly interfaces and secure data entry, individuals can input their information and receive personalized quotations in a matter of minutes. This instant access to quotations empowers consumers to make timely decisions and compare options with ease.

- Advanced Risk Assessment Algorithms: Technological advancements have enabled insurance providers to develop sophisticated risk assessment algorithms. These algorithms analyze vast amounts of data, including historical claims, demographic trends, and behavioral patterns, to accurately assess risks. By leveraging machine learning and artificial intelligence, insurance providers can offer more precise quotations, tailored to individual needs.

- Data Analytics and Personalization: Data analytics plays a crucial role in insurance quotations, enabling providers to understand customer behavior and preferences. By analyzing customer data, insurance providers can personalize quotations, offering customized coverage options and competitive rates. This level of personalization enhances the consumer experience and ensures that quotations are aligned with individual requirements.

- Telematics and Usage-Based Insurance: Telematics technology, which utilizes GPS and sensor data, is transforming the way insurance quotations are determined. Usage-based insurance, also known as pay-as-you-drive insurance, allows providers to monitor driving behavior and offer quotations based on actual usage. This innovative approach provides a more accurate assessment of risk and encourages safe driving practices, resulting in more favorable quotations for responsible drivers.

- Blockchain and Smart Contracts: Blockchain technology is gaining traction in the insurance industry, offering enhanced security, transparency, and efficiency. Smart contracts, which are self-executing contracts with predefined rules, can automate certain insurance processes, including quotation generation. By leveraging blockchain, insurance providers can streamline the quotation process, reduce administrative burdens, and provide faster, more accurate quotations to consumers.

Empowering Consumers Through Technological Innovations

The integration of technology into the insurance quotation process brings numerous benefits to consumers. Here’s how technological innovations are empowering individuals and businesses:

- Convenience and Accessibility: Technological advancements have made insurance quotations more accessible and convenient. Consumers can obtain quotations from the comfort of their homes, at any time, using their preferred devices. This level of accessibility eliminates the need for in-person meetings or lengthy paperwork, streamlining the entire process.

- Personalized Quotations: With data analytics and advanced algorithms, insurance providers can offer highly personalized quotations. By understanding individual needs and preferences, providers can tailor quotations to specific requirements, ensuring that consumers receive coverage that aligns with their unique circumstances.

- Real-Time Updates and Transparency: Technology enables insurance providers to offer real-time updates and transparent communication. Consumers can track the progress of their quotations, receive instant notifications, and access their policy information through secure online portals. This transparency builds trust and empowers consumers to make informed decisions.

- Comparison and Price Transparency: Online platforms and insurance marketplaces provide consumers with a comprehensive view of the market. By aggregating quotations from multiple providers, these platforms enable easy comparison and price transparency. Consumers can quickly assess the best value for their money, ensuring they obtain the most favorable quotations.

- Automated Claims Processing: Technological innovations have also streamlined the claims process, making it faster and more efficient. With the integration of digital technologies, insurance providers can automate certain aspects of claims processing, reducing delays and providing prompt settlements. This enhanced efficiency benefits consumers, ensuring they receive the financial support they need when it matters most.

Future Implications and Industry Evolution

As technology continues to advance, the insurance industry is poised for further evolution. Here are some key future implications and industry trends to watch out for:

- Artificial Intelligence and Machine Learning: The integration of artificial intelligence (AI) and machine learning (ML) will continue to revolutionize the insurance industry. These technologies will enable more accurate risk assessment, personalized underwriting, and automated claims processing. AI-powered chatbots and virtual assistants will also enhance customer service, providing instant support and guidance to consumers.

- Internet of Things (IoT) Integration: The proliferation of IoT devices, such as smart home devices and connected vehicles, will impact insurance quotations. Insurance providers will leverage IoT data to assess risks more accurately and offer innovative coverage options. For example, smart home sensors can monitor environmental conditions, while connected cars can provide real-time driving data, leading to more precise quotations.

- Digital Transformation and Customer Experience: Insurance providers will continue to prioritize digital transformation, focusing on enhancing the customer experience. Digital platforms, mobile applications, and online portals will become even more user-friendly, offering seamless quotation processes and personalized policy management. By embracing digital technologies, insurance providers can improve customer satisfaction and retention.

- Regulation and Data Privacy: As technology advances, so do the regulatory frameworks governing the insurance industry. Insurance providers will need to navigate evolving regulations, particularly in the areas of data privacy and cybersecurity. Ensuring compliance with data protection laws and implementing robust security measures will be critical to maintaining consumer trust and confidence.

- Collaborative Insurance Models: The insurance industry is witnessing the emergence of collaborative insurance models, such as peer-to-peer insurance and parametric insurance. These innovative models leverage technology and data sharing to offer alternative coverage options. Collaborative insurance models have the potential to disrupt traditional insurance structures, providing consumers with new avenues for risk management and financial protection.

How often should I review my insurance quotations and policies?

+It is recommended to review your insurance quotations and policies at least once a year. Life circumstances and risk profiles can change over time, and it's important to ensure that your insurance coverage remains adequate and cost-effective. Regular reviews allow you to assess any changes in your needs, evaluate the market, and make necessary adjustments to your policies.

What factors can I negotiate with insurance providers to obtain better quotations?

+There are several factors that you can negotiate with insurance providers to potentially obtain better quotations. These include your claim history, loyalty to the provider, safe driving or health practices, and the installation of security measures. Additionally, bundling multiple policies or paying premiums annually instead of monthly can sometimes lead to discounts.

How can I ensure the accuracy of my insurance quotations?

+To ensure the accuracy of your insurance quotations, it is essential to provide accurate and complete information to insurance providers. Disclose all relevant details, including your medical history, driving record, and any potential risks associated with your property or business. Misrepresenting information can lead to inaccurate quotations and potential issues with your insurance coverage.

What should I consider when comparing insurance quotations from different providers?

+When comparing insurance quotations, it's important to consider several factors. Firstly, evaluate the coverage limits and exclusions to ensure they align with your needs. Compare the premiums, deductibles, and any additional benefits offered. Consider the financial stability and reputation of the insurance providers, as well as their customer service and claims handling processes. Additionally, assess the flexibility and customization options available with each provider.

How do insurance providers determine the cost of quotations for health insurance?

+The cost of health insurance quotations is determined by various factors, including age, gender, health status, and geographical location. Insurance providers assess the risk associated with insuring an individual based on their medical history, pre-existing conditions, and lifestyle factors. Additionally, the scope of coverage, such as the inclusion of dental, vision, or prescription drug benefits, can impact the quotation cost.

Insurance quotations are a vital component of financial protection, empowering individuals and businesses to make informed decisions about their insurance coverage. By understanding the factors that influence quotations, adopting strategic approaches, and leveraging technological advancements, consumers can navigate the insurance landscape with confidence. As the insurance industry continues to evolve, embracing technological innovations and staying informed about market trends will ensure access to the most accurate and favorable insurance quotations.