Opm Health Insurance Plans 2024

In the realm of federal employee benefits, the Open Season for 2024 is a significant event, offering federal employees and annuitants an opportunity to review and make changes to their health insurance plans. The Open Season, which typically occurs once a year, provides a crucial window for individuals to assess their current coverage, compare options, and select the most suitable plan for the upcoming year. This article aims to provide an in-depth exploration of the 2024 OPM Health Insurance Plans, delving into the various options, their benefits, and how they can be tailored to meet individual needs.

Understanding OPM Health Insurance Plans

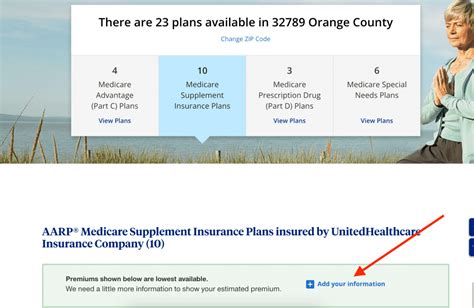

The Office of Personnel Management (OPM) oversees the Federal Employees Health Benefits (FEHB) Program, which offers a wide array of health insurance plans to federal employees, annuitants, and their eligible family members. These plans, designed to cater to diverse health needs and preferences, are provided by various carriers, each with its own unique features and coverage options.

Key Features of OPM Health Insurance Plans

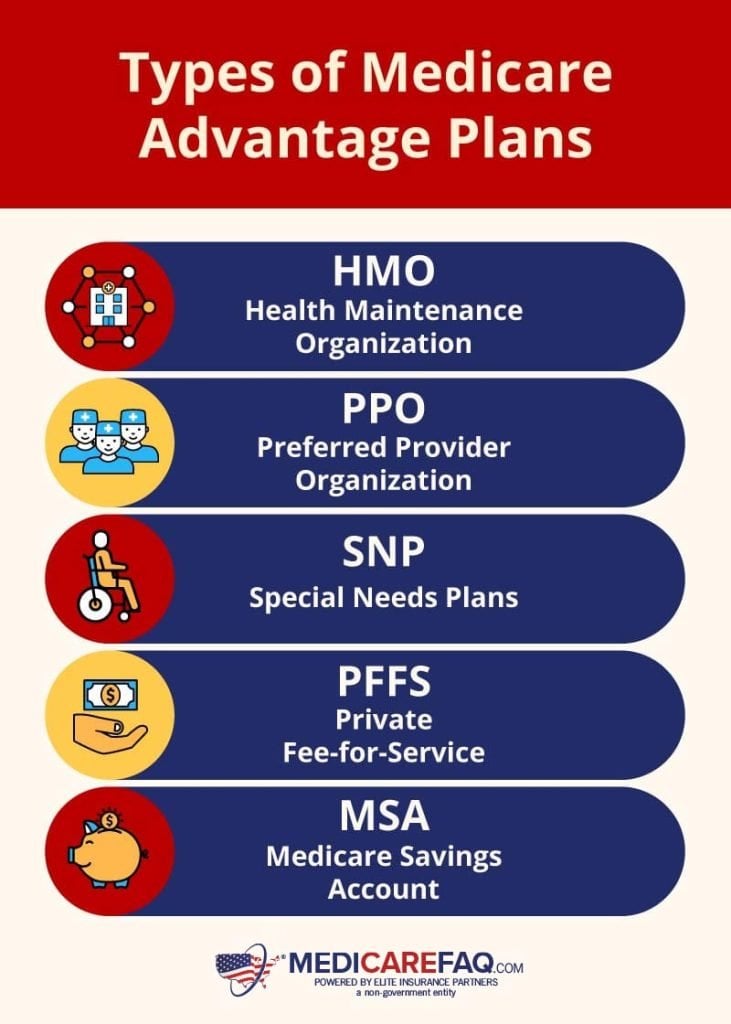

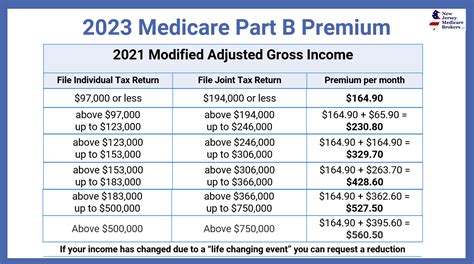

OPM Health Insurance Plans are known for their comprehensive coverage, competitive pricing, and flexibility. They offer a range of options, including traditional fee-for-service plans, preferred provider organizations (PPOs), health maintenance organizations (HMOs), and high-deductible health plans (HDHPs) coupled with health savings accounts (HSAs). This variety ensures that individuals can find a plan that aligns with their specific health needs and financial situations.

One of the standout features of these plans is the inclusion of dental and vision coverage in many options, offering a more holistic approach to healthcare. Additionally, the plans often cover a broad spectrum of medical services, from preventive care to specialized treatments, ensuring that enrollees have access to the care they need without incurring substantial out-of-pocket expenses.

| Plan Type | Description |

|---|---|

| Fee-for-Service | Enrollees can visit any doctor or hospital without a referral. Payment is made based on the service provided. |

| PPO | Offers a network of healthcare providers, with lower costs when using in-network services. No referrals needed for specialists. |

| HMO | Requires a primary care physician (PCP) for referrals to specialists. Typically, the most cost-effective option. |

| HDHP with HSA | Features a high deductible, but offers a tax-advantaged savings account to cover qualified medical expenses. |

OPM Health Insurance Plans for 2024: An In-Depth Look

The 2024 OPM Health Insurance Plans offer a comprehensive suite of options, each designed to meet the diverse needs of federal employees and their families. Here’s a closer look at some of the key plans available during the upcoming Open Season.

Blue Cross Blue Shield Standard Option

The Blue Cross Blue Shield Standard Option is a traditional fee-for-service plan that offers extensive coverage. Enrollees have the freedom to choose any doctor or hospital without a referral, making it an ideal choice for those who prefer flexibility in their healthcare decisions. This plan covers a broad range of services, including preventive care, hospitalizations, and specialty treatments. With a focus on comprehensive coverage, it is well-suited for individuals and families who anticipate a mix of routine and specialized medical needs.

GEHA High Option

The GEHA High Option plan is a comprehensive option that provides generous coverage for a wide array of medical services. This plan, offered by the Government Employees Health Association, features low out-of-pocket costs, making it an attractive choice for individuals seeking extensive coverage without high financial burdens. It includes benefits such as vision and dental coverage, making it a holistic solution for overall healthcare needs. The GEHA High Option is particularly well-received by those who prioritize convenience and affordability in their healthcare plans.

Kaiser Permanente HMO

For those who prefer a more structured approach to healthcare, the Kaiser Permanente HMO plan offers a network of healthcare providers dedicated to delivering coordinated care. Enrollees are required to choose a primary care physician (PCP) who acts as a gatekeeper for referrals to specialists. This plan is known for its efficiency and cost-effectiveness, making it a popular choice among those who value convenience and a streamlined healthcare experience. The Kaiser Permanente HMO plan is particularly well-suited for individuals who reside in areas where Kaiser facilities are readily accessible.

Postal Service Federal Employees Organization (PSFO) HDHP

The PSFO HDHP plan is designed for individuals who are comfortable with a higher deductible and prefer more control over their healthcare decisions. This plan features a high deductible, which means enrollees pay for most services out of pocket until they meet the deductible amount. However, the plan is coupled with a Health Savings Account (HSA), offering a tax-advantaged way to save for qualified medical expenses. This option is ideal for those who anticipate minimal healthcare needs or who are seeking a way to manage their healthcare costs more proactively.

Comparative Analysis: OPM Health Insurance Plans 2024

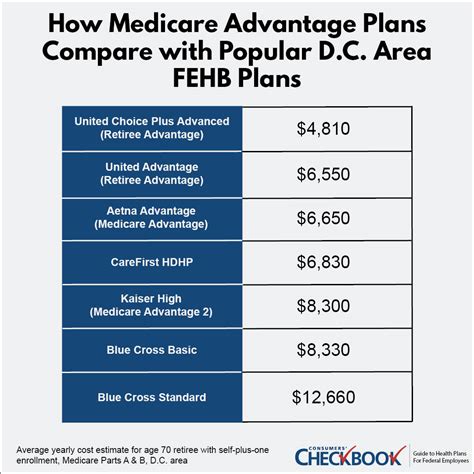

When comparing the various OPM Health Insurance Plans for 2024, several key factors come into play. These include the level of coverage, flexibility, cost-sharing structures, and additional benefits like dental and vision coverage. Each plan offers a unique balance of these elements, catering to different healthcare needs and preferences.

| Plan | Coverage | Flexibility | Cost-Sharing | Additional Benefits |

|---|---|---|---|---|

| Blue Cross Blue Shield Standard Option | Comprehensive, includes preventive care and specialty treatments | High, allows choice of any provider without a referral | Standard deductibles and copayments | Includes vision and dental coverage |

| GEHA High Option | Generous, covers a wide range of services | Moderate, provides a network of providers | Low out-of-pocket costs | Comprehensive vision and dental coverage |

| Kaiser Permanente HMO | Structured, focuses on coordinated care | Moderate, requires a PCP for referrals | Cost-effective, with lower premiums | May include some vision and dental benefits |

| PSFO HDHP | Covers essential services, but with a high deductible | High, allows choice of providers | High deductible, but with a HSA for tax benefits | N/A |

Enrolling in OPM Health Insurance Plans: A Step-by-Step Guide

Enrolling in an OPM Health Insurance Plan is a straightforward process, designed to be user-friendly and accessible. Here’s a step-by-step guide to help you through the enrollment process for the 2024 Open Season.

Step 1: Research and Compare Plans

Start by researching and comparing the various OPM Health Insurance Plans available for 2024. Consider your healthcare needs, the needs of your family members, and your financial situation. Review the coverage, deductibles, copayments, and additional benefits like dental and vision coverage. OPM provides comprehensive plan brochures and comparison tools to aid in your decision-making process.

Step 2: Gather Necessary Documents

Before beginning the enrollment process, ensure you have all the necessary documents. This typically includes proof of identity, such as a driver’s license or passport, and any documentation related to your current health insurance coverage, if applicable. Having these documents readily available will streamline the enrollment process.

Step 3: Access the Enrollment Platform

OPM provides a dedicated enrollment platform, typically accessible online or through a mobile app. You can log in using your federal employee credentials or create an account if you are a new enrollee. The platform is designed to guide you through the enrollment process, step by step, making it a simple and intuitive experience.

Step 4: Select Your Plan

Once you’ve logged into the enrollment platform, you’ll be prompted to select your health insurance plan for 2024. Review the plans carefully, considering the coverage, cost, and any additional benefits. You can also compare the plans side by side to make an informed decision. Select the plan that best aligns with your healthcare needs and budget.

Step 5: Provide Enrollment Information

After selecting your plan, you’ll need to provide personal and family information, including names, dates of birth, and social security numbers for all family members to be covered. You’ll also be asked to choose a primary care physician (if applicable) and provide any additional information required by your chosen plan.

Step 6: Review and Confirm

Before finalizing your enrollment, carefully review all the information you’ve provided. Ensure that the plan details, coverage, and enrollment information are accurate and complete. Once you’re satisfied, confirm your enrollment. You’ll typically receive an email confirmation, and your plan details will be available in your online account.

FAQs

What is the Open Season for OPM Health Insurance Plans?

+

The Open Season is a designated period, typically once a year, when federal employees and annuitants can review and make changes to their health insurance plans. It offers an opportunity to assess current coverage, compare options, and select the most suitable plan for the upcoming year.

Can I change my health insurance plan outside of the Open Season?

+

In certain circumstances, you may be eligible for a mid-year change. This includes life events like marriage, divorce, birth or adoption of a child, or loss of other health coverage. Check with OPM or your HR department to see if you qualify.

How do I know which OPM Health Insurance Plan is best for me?

+

The choice depends on your individual healthcare needs and preferences. Consider factors like coverage, cost-sharing structures, and additional benefits. OPM provides comprehensive plan brochures and comparison tools to help you make an informed decision.

Are dental and vision coverage included in all OPM Health Insurance Plans?

+

Not all plans include dental and vision coverage. However, many OPM Health Insurance Plans offer these additional benefits, providing a more comprehensive healthcare solution. It’s important to review the plan details carefully to understand the extent of coverage.