Progressive Insurance Gap Coverage

In the ever-evolving world of automotive insurance, understanding the nuances of different coverage options is crucial for drivers seeking comprehensive protection. Among the array of insurance policies, Progressive Insurance's Gap Coverage stands out as a specialized offering designed to address a specific financial gap that can arise when a vehicle is totaled or stolen. This article aims to delve into the intricacies of Progressive's Gap Coverage, exploring its benefits, how it works, and why it could be a valuable addition to your insurance portfolio.

Unraveling Progressive’s Gap Coverage

Progressive Insurance, a prominent player in the auto insurance market, offers a comprehensive suite of coverage options tailored to meet the diverse needs of drivers. Among these, Gap Coverage, also known as Guaranteed Auto Protection or GAP, is a unique offering designed to bridge a common financial gap that can arise in specific circumstances.

The GAP Dilemma: A Common Scenario

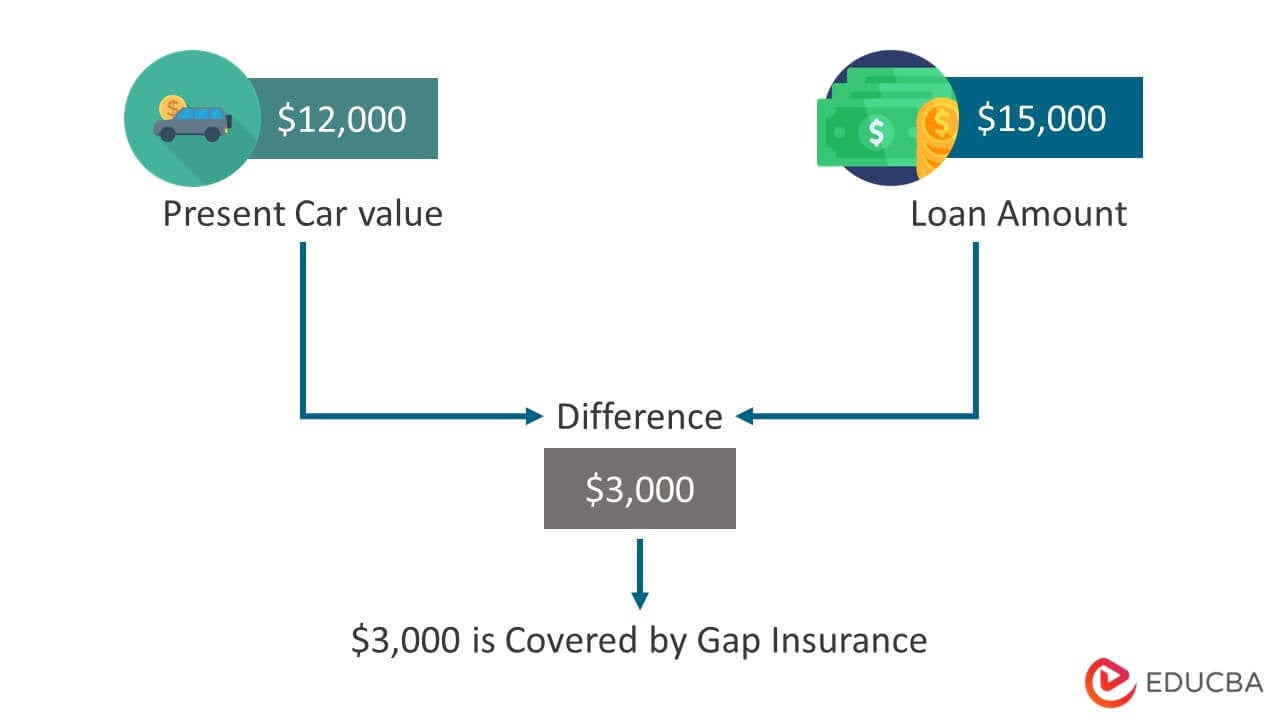

Imagine a driver, let’s call them Alex, who purchases a new car worth 30,000. After a year of driving, Alex's car is involved in an accident, resulting in significant damage. Unfortunately, the car is deemed a total loss, and the insurance company offers a settlement of 25,000, which is the current market value of the vehicle.

Here's where the gap arises: Alex still owes $28,000 on their car loan. Without Gap Coverage, Alex would be responsible for paying the remaining $3,000 difference out of pocket, a significant financial burden.

This scenario highlights the potential financial gap that can occur when the value of a vehicle declines faster than the repayment of its loan. It's a common dilemma for drivers, especially those who purchase new vehicles or finance a significant portion of the purchase price.

How Progressive’s Gap Coverage Works

Progressive’s Gap Coverage is designed to provide a financial safety net in situations where a vehicle is declared a total loss or stolen and not recovered. Here’s a step-by-step breakdown of how it works:

- Total Loss or Theft: If your insured vehicle is declared a total loss due to an accident or other covered event, or if it's stolen and not recovered, Gap Coverage comes into play.

- Assessment of Value: Progressive will assess the current market value of your vehicle at the time of the loss or theft. This value, known as the "actual cash value," is the amount the insurance company would typically pay in a standard insurance claim.

- Loan Balance: Simultaneously, Progressive will determine the outstanding balance on your vehicle loan or lease, including any applicable fees or penalties.

- Bridging the Gap: If the loan balance exceeds the actual cash value, Progressive's Gap Coverage will step in to cover the difference. This ensures that you're not left with a significant financial burden after an unfortunate event.

- Claim Process: The claim process for Gap Coverage is typically integrated with your standard insurance claim. Progressive's claims adjusters will guide you through the process, ensuring a smooth and efficient resolution.

It's important to note that Gap Coverage is an optional add-on to your Progressive auto insurance policy. It's designed to complement your comprehensive or collision coverage, providing an extra layer of financial protection.

Benefits of Progressive’s Gap Coverage

Progressive’s Gap Coverage offers several advantages for drivers, particularly those who have recently purchased a new vehicle or have a substantial loan amount:

- Financial Peace of Mind: Gap Coverage eliminates the worry of being left with a large outstanding loan balance after an accident or theft. It ensures that you're not financially penalized for events beyond your control.

- Avoid Negative Equity: With Gap Coverage, you're protected from falling into negative equity, where the value of your vehicle is less than the remaining loan balance. This is especially relevant for new vehicles, which often depreciate rapidly in the first few years.

- Leased Vehicles: Gap Coverage is particularly beneficial for individuals leasing a vehicle. In the event of a total loss or theft, it ensures that you're not responsible for paying the remaining lease payments or any early termination fees.

- Simplified Claims Process: By integrating Gap Coverage with your standard insurance claim, Progressive streamlines the claims process. You won't need to navigate separate processes, making the overall experience more efficient and less stressful.

- Cost-Effective Protection: While Gap Coverage comes at an additional cost, it's often a small price to pay for the financial security it provides. The peace of mind it offers can be invaluable, especially in high-risk areas or for drivers with significant loan amounts.

Eligibility and Considerations

While Progressive’s Gap Coverage is a valuable option, it’s essential to understand its eligibility criteria and limitations:

| Eligibility Factors | Details |

|---|---|

| Vehicle Type | Gap Coverage is typically available for passenger cars, trucks, and SUVs. It may not be applicable to commercial vehicles or certain specialty vehicles. |

| Loan or Lease Status | Gap Coverage is designed for vehicles with an outstanding loan or lease balance. It's particularly beneficial for drivers who have financed a significant portion of their vehicle's purchase price. |

| Timeframe | Gap Coverage is most effective when purchased early in the vehicle's life. The longer you wait, the less beneficial it may be as the gap between the loan balance and the vehicle's value narrows over time. |

| Coverage Exclusions | Like any insurance policy, Gap Coverage has certain exclusions. It may not cover all types of losses or damages, so it's crucial to review the policy terms and conditions carefully. |

Additionally, it's worth noting that Gap Coverage is not a replacement for comprehensive or collision coverage. It's an add-on that works in conjunction with these primary coverages, providing an extra layer of financial protection.

Real-World Examples

Let’s look at a couple of real-world scenarios to illustrate the value of Progressive’s Gap Coverage:

Scenario 1: Total Loss

Imagine Sarah, a recent college graduate, who purchased a new sedan for 25,000. She financed the entire amount with a 60-month loan. After a year, Sarah's car is involved in an accident, and it's declared a total loss. The insurance company assesses the vehicle's actual cash value at 20,000.

Without Gap Coverage, Sarah would be responsible for paying the remaining $5,000 loan balance out of pocket. However, with Gap Coverage, Progressive would cover the difference, ensuring Sarah doesn't face a significant financial burden.

Scenario 2: Stolen Vehicle

John, a businessman, leases a luxury SUV for his work travels. One evening, his vehicle is stolen from a parking lot. The police are unable to recover the SUV. John’s lease agreement has an early termination fee of $3,000.

Without Gap Coverage, John would have to pay the remaining lease payments and the early termination fee, amounting to a significant financial loss. However, with Gap Coverage, Progressive would cover these costs, allowing John to terminate the lease without financial strain.

Comparative Analysis

Progressive’s Gap Coverage stands out in the market for its comprehensive approach and seamless integration with standard insurance claims. While other insurance providers offer similar coverage, Progressive’s offering is known for its clarity, ease of use, and competitive pricing.

One key advantage is Progressive's reputation for prompt and efficient claims handling. In the event of a total loss or theft, customers can rely on Progressive's experienced claims adjusters to guide them through the process, ensuring a swift and fair resolution.

Future Implications

As the automotive industry continues to evolve, with electric vehicles and autonomous driving technologies gaining traction, the landscape of insurance coverage is likely to change as well. Progressive, with its forward-thinking approach, is well-positioned to adapt its Gap Coverage to meet the needs of these emerging markets.

In the future, we can expect Gap Coverage to evolve to address the unique financial considerations associated with electric vehicles, such as the higher upfront cost and the potential impact of battery depreciation on loan balances. Progressive's commitment to innovation and customer-centric solutions positions it as a leader in this evolving space.

FAQ

Can I add Gap Coverage to my existing Progressive auto insurance policy?

+Yes, you can add Gap Coverage to your existing Progressive auto insurance policy. It’s an optional add-on that complements your comprehensive or collision coverage. Contact your Progressive agent or log into your online account to make the necessary adjustments.

How much does Progressive’s Gap Coverage cost?

+The cost of Progressive’s Gap Coverage varies based on several factors, including the value of your vehicle, the length of your loan or lease, and your specific coverage needs. It’s typically a small additional cost to your standard insurance premium. Contact Progressive for a personalized quote.

Does Gap Coverage apply to all types of vehicles?

+Gap Coverage is generally available for passenger cars, trucks, and SUVs. However, it may not be applicable to commercial vehicles, specialty vehicles, or certain high-performance models. Check with Progressive to confirm eligibility for your specific vehicle.

Is Gap Coverage necessary if I have comprehensive and collision coverage?

+While comprehensive and collision coverage are essential for protecting your vehicle, Gap Coverage provides an additional layer of financial protection. It’s particularly valuable if you have a substantial loan balance or if you lease your vehicle. Gap Coverage ensures you’re not left with a large outstanding debt in the event of a total loss or theft.

How soon after purchasing my vehicle should I consider Gap Coverage?

+It’s recommended to consider Gap Coverage as soon as you purchase your vehicle, especially if you’ve financed a significant portion of the purchase price. The earlier you add Gap Coverage, the more beneficial it will be, as it can protect you from the rapid depreciation that often occurs in the first few years of ownership.