Get Quote On Car Insurance

Car Insurance: Your Guide to Getting the Best Quotes

Are you in the market for car insurance and wondering how to secure the most competitive rates? This comprehensive guide will walk you through the process of getting quotes on car insurance, providing you with the knowledge and tools to make informed decisions. With the right approach, you can navigate the world of insurance with confidence and find a policy that suits your needs and budget.

In today's digital age, obtaining car insurance quotes has become more accessible and convenient than ever. Insurance companies and comparison websites offer online platforms that allow you to compare various policies and prices with just a few clicks. However, it's essential to understand the factors that influence insurance quotes and the steps you can take to ensure you're getting the best deal.

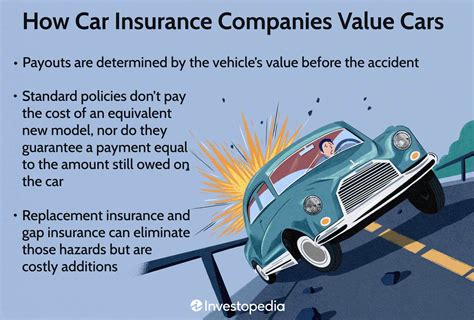

Understanding the Factors That Impact Your Car Insurance Quote

When insurance providers calculate your premium, they consider a range of factors to assess the level of risk associated with insuring your vehicle. These factors can significantly impact the quote you receive. Let’s delve into some of the key considerations:

Your Personal Information

- Age and Gender: Statistically, younger drivers, particularly males, are often considered higher risk, leading to higher premiums. However, as you gain more experience on the road, your rates may decrease.

- Driving History: Your driving record plays a crucial role. A clean driving history with no accidents or violations can result in lower premiums. On the other hand, a history of accidents or traffic violations may lead to higher costs.

- Marital Status: Some insurance companies offer discounts to married individuals, as they are often perceived as more stable and responsible drivers.

- Credit Score: Surprisingly, your credit score can influence your insurance rates. Many insurers use credit-based insurance scores to assess risk, so maintaining a good credit score can potentially lower your premiums.

Vehicle-Related Factors

- Vehicle Type: The make, model, and age of your car can impact your insurance quote. Sports cars or high-performance vehicles, for instance, are often associated with higher premiums due to their increased risk of accidents or theft.

- Vehicle Usage: How and where you use your vehicle matters. Commuting long distances or driving in high-risk areas may result in higher premiums. Conversely, low mileage or primarily using your car for leisure can lead to more affordable rates.

- Safety Features: Vehicles equipped with advanced safety features, such as anti-lock brakes, airbags, or collision avoidance systems, may qualify for discounts as they reduce the risk of accidents and subsequent claims.

Coverage and Deductibles

- Coverage Limits: The amount of coverage you choose directly affects your premium. Higher coverage limits typically result in higher costs, while lower limits may offer more affordable options.

- Deductibles: Deductibles are the amount you agree to pay out of pocket before your insurance coverage kicks in. Opting for a higher deductible can lower your premiums, but it means you’ll pay more if you need to make a claim.

| Coverage Type | Description |

|---|---|

| Liability Coverage | Covers damages and injuries you cause to others. |

| Collision Coverage | Pays for repairs to your vehicle after an accident. |

| Comprehensive Coverage | Protects against non-accident-related incidents like theft or natural disasters. |

| Personal Injury Protection (PIP) | Provides medical coverage for you and your passengers regardless of fault. |

| Uninsured/Underinsured Motorist Coverage | Protects you if an at-fault driver lacks sufficient insurance. |

Strategies for Getting the Best Car Insurance Quotes

Now that we’ve explored the factors influencing your insurance quote, let’s discuss some strategies to help you secure the most competitive rates:

Shop Around and Compare

Don’t settle for the first quote you receive. Take the time to compare offers from multiple insurance providers. Online comparison tools and websites can be incredibly useful for this purpose. By gathering quotes from different companies, you can identify the most cost-effective options and negotiate better terms.

Bundle Your Policies

If you have multiple insurance needs, such as home and auto insurance, consider bundling them with the same provider. Many insurers offer discounts when you combine policies, resulting in significant savings.

Increase Your Deductible

As mentioned earlier, opting for a higher deductible can reduce your premiums. However, be cautious and ensure you can afford the increased out-of-pocket expense if you need to make a claim. It’s a trade-off between lower premiums and a higher financial burden in the event of an accident.

Explore Discounts

Insurance companies often offer various discounts to attract and retain customers. These discounts can significantly lower your premiums. Some common discounts include:

- Safe Driver Discount: For maintaining a clean driving record.

- Multi-Car Discount: If you insure multiple vehicles with the same provider.

- Good Student Discount: For young drivers with good academic performance.

- Loyalty Discount: Rewards long-term customers who have been with the insurer for an extended period.

- Anti-Theft Discount: For vehicles equipped with anti-theft devices or security systems.

Maintain a Good Credit Score

As your credit score can impact your insurance rates, it’s essential to maintain a healthy financial profile. Regularly review your credit report, correct any errors, and take steps to improve your score if needed. A good credit score can open doors to better insurance deals.

Consider Telematics or Usage-Based Insurance

Some insurance providers offer telematics or usage-based insurance programs. These programs use devices or smartphone apps to track your driving behavior, such as mileage, speed, and braking habits. Safe and cautious drivers can benefit from these programs, as their premiums are based on their actual driving habits rather than general risk assessments.

The Process of Obtaining Car Insurance Quotes

Obtaining car insurance quotes is a straightforward process, whether you choose to do it online or through an insurance agent. Here’s a step-by-step guide to help you navigate the process:

Online Quote Process

- Choose a Reputable Comparison Website: Start by selecting a trusted comparison website that allows you to compare quotes from multiple insurance providers. Ensure the website is secure and provides accurate, up-to-date information.

- Provide Personal and Vehicle Information: Enter your personal details, including your name, age, gender, marital status, and driving history. You’ll also need to provide information about your vehicle, such as make, model, year, and usage.

- Select Coverage Options: Choose the type and level of coverage you desire. Consider your needs and budget to strike the right balance between protection and affordability.

- Review and Compare Quotes: Once you’ve provided the necessary information, the website will generate quotes from various insurers. Carefully review the quotes, comparing prices, coverage limits, and deductibles. Look for any additional benefits or discounts offered by each provider.

- Refine Your Search: If you’re not satisfied with the initial quotes, refine your search by adjusting your coverage limits, deductibles, or adding/removing optional coverages. This can help you find more tailored and cost-effective options.

- Contact Insurance Providers: Once you’ve identified a few potential insurers, reach out to them directly to discuss your options. They can provide more detailed information and address any specific concerns you may have.

- Make an Informed Decision: After comparing quotes and discussing your options, choose the insurer and policy that best suits your needs and budget. Ensure you understand the terms and conditions of the policy before finalizing your decision.

Working with an Insurance Agent

If you prefer a more personalized approach, you can work with an insurance agent. Here’s how the process typically unfolds:

- Find a Reputable Agent: Start by researching and finding a reputable insurance agent in your area. Seek recommendations from friends, family, or online reviews to ensure you’re working with a trusted professional.

- Schedule a Consultation: Contact the agent and schedule a consultation to discuss your insurance needs. Provide them with your personal and vehicle information, as well as any specific coverage requirements you have.

- Review Policy Options: The agent will present you with different policy options from various insurers they represent. They’ll explain the coverage, limits, deductibles, and any additional benefits or discounts associated with each policy.

- Compare and Discuss: Take the time to carefully review and compare the policies presented to you. Discuss any questions or concerns you have with the agent, ensuring you fully understand the terms and conditions of each option.

- Choose and Finalize: Once you’ve decided on a policy, the agent will assist you in finalizing the application process. They’ll guide you through any necessary paperwork and help you understand the next steps, including payment options and policy activation.

Conclusion: Making an Informed Decision

Getting car insurance quotes is an essential step in finding the right coverage for your needs. By understanding the factors that influence your quote and employing effective strategies, you can navigate the insurance landscape with confidence. Remember to shop around, compare options, and consider the long-term value of your policy.

Whether you choose to obtain quotes online or work with an insurance agent, ensure you have all the necessary information to make an informed decision. Take the time to review your options, ask questions, and seek expert advice when needed. With the right approach, you can secure a car insurance policy that provides adequate protection at a competitive price.

Frequently Asked Questions (FAQ)

What is the average cost of car insurance in the United States?

+The average cost of car insurance in the US varies depending on factors such as location, driving history, and coverage limits. According to recent data, the average annual premium is approximately $1,674. However, it's important to note that rates can range significantly, with some states having much higher or lower averages.

<div class="faq-item">

<div class="faq-question">

<h3>How can I lower my car insurance premiums?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>There are several strategies to reduce your car insurance premiums. These include shopping around for the best rates, increasing your deductible, maintaining a clean driving record, exploring discounts (such as safe driver or loyalty discounts), and considering usage-based insurance programs that reward safe driving habits.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What is the minimum required car insurance coverage in my state?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Minimum car insurance requirements vary by state. Typically, liability coverage is mandatory, including bodily injury liability and property damage liability. However, the specific limits and additional coverage requirements can differ. It's crucial to understand your state's laws and ensure you meet the minimum coverage standards.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Can I get car insurance quotes without providing my Social Security number?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, you can obtain car insurance quotes without providing your Social Security number. While some insurers may request it to conduct a more thorough credit check, many comparison websites and online quote tools allow you to get quotes without sharing sensitive information like your SSN. However, keep in mind that your credit score may still impact your premiums.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What factors influence my car insurance rates the most?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>The main factors that influence car insurance rates include your age, gender, driving history, credit score, vehicle type, and coverage limits. Additionally, the location where you primarily drive your vehicle and any discounts or incentives you qualify for can significantly impact your rates.</p>

</div>

</div>

</div>