New Jersey Car Insurance

When it comes to car insurance, residents of New Jersey have unique considerations and options to navigate. With a diverse range of insurance providers and specific state regulations, understanding the ins and outs of car insurance in the Garden State is crucial for drivers seeking the best coverage and value.

Understanding New Jersey Car Insurance

New Jersey is known for its comprehensive approach to car insurance, with mandatory coverage requirements that aim to protect drivers and ensure financial responsibility. The state's insurance landscape is shaped by a combination of factors, including a high population density, a diverse range of drivers, and a history of legislative decisions that have influenced the insurance market.

One key aspect of New Jersey car insurance is the state's use of a no-fault insurance system. This means that, in the event of an accident, each driver's insurance company is responsible for covering their own medical expenses and lost wages up to a certain limit, regardless of who is at fault. This system is designed to streamline the claims process and reduce the need for lengthy legal battles.

Additionally, New Jersey requires drivers to carry minimum liability coverage to protect against bodily injury and property damage caused to others in an accident. This mandatory coverage ensures that drivers have a basic level of financial protection and helps maintain a safer driving environment.

The Importance of Personalized Coverage

While New Jersey's insurance requirements provide a solid foundation, it's essential for drivers to tailor their coverage to their specific needs. Every driver's situation is unique, and factors such as age, driving record, vehicle type, and daily commute can significantly impact insurance rates and coverage options.

For instance, young drivers in New Jersey may face higher premiums due to their perceived risk level. However, by opting for additional coverage options such as collision and comprehensive insurance, they can protect themselves against a wider range of incidents, including accidents, theft, and natural disasters. This added layer of protection can provide peace of mind and help mitigate financial losses.

Similarly, drivers with a history of accidents or traffic violations may find themselves facing higher insurance premiums. In such cases, it becomes crucial to explore discounts and policy adjustments to manage costs effectively. Many insurance providers offer discounts for safe driving records, defensive driving courses, or even loyalty rewards, which can help offset the impact of past infractions.

| Coverage Type | Description |

|---|---|

| Liability Coverage | Protects against bodily injury and property damage claims made by others in an accident. |

| Collision Coverage | Covers repair or replacement costs for your vehicle after an accident, regardless of fault. |

| Comprehensive Coverage | Provides protection against damage caused by events other than accidents, such as theft, vandalism, or natural disasters. |

| Uninsured/Underinsured Motorist Coverage | Protects you if you're involved in an accident with a driver who has little or no insurance coverage. |

Exploring Car Insurance Providers in New Jersey

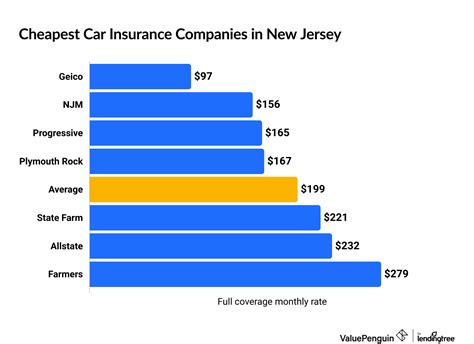

New Jersey boasts a competitive car insurance market, with a variety of providers offering tailored policies to suit different driver profiles. When shopping for car insurance, it's beneficial to compare quotes from multiple insurers to find the best combination of coverage and value.

Top Car Insurance Providers in New Jersey

Here's an overview of some of the leading car insurance providers in New Jersey, along with their unique offerings and considerations:

- State Farm: Known for its extensive network and personalized service, State Farm offers a range of coverage options, including liability, collision, and comprehensive insurance. They provide discounts for safe driving, multiple policies, and good academic performance, making them a popular choice for many New Jersey drivers.

- Geico: With a strong focus on digital convenience, Geico offers a seamless online experience for obtaining quotes and managing policies. They provide competitive rates and cater to a wide range of driver profiles, making them an appealing option for those seeking convenience and affordability.

- Progressive: Progressive is renowned for its innovative approach to insurance, offering flexible policies and a wide range of coverage options. They provide specialized coverage for classic cars and high-value vehicles, making them an excellent choice for collectors and enthusiasts.

- Allstate: Allstate prides itself on its comprehensive coverage options and personalized customer service. They offer unique features like accident forgiveness and safe driving bonuses, which can help offset the impact of past incidents. Allstate's policies are tailored to meet the specific needs of New Jersey drivers.

- Esurance: Esurance combines digital convenience with competitive rates, making it an attractive option for tech-savvy drivers. They provide a straightforward online experience for obtaining quotes and managing policies, along with flexible payment options and 24/7 customer support.

When choosing an insurance provider, it's crucial to consider factors such as coverage options, customer service, claim handling processes, and, of course, the overall cost of the policy. Taking the time to research and compare multiple providers can help ensure you find the best fit for your unique driving situation.

Tips for Navigating Car Insurance in New Jersey

Here are some additional insights and tips to help you navigate the world of car insurance in New Jersey effectively:

- Shop Around: Don't settle for the first insurance quote you receive. Take the time to compare quotes from multiple providers to find the best rates and coverage options that align with your needs.

- Understand Your Coverage: Familiarize yourself with the different types of coverage available and tailor your policy to your specific requirements. This includes considering add-ons like rental car coverage, roadside assistance, and gap insurance.

- Maintain a Clean Driving Record: A safe driving history can lead to significant savings on your insurance premiums. Avoid traffic violations and accidents to keep your record clean and take advantage of safe driver discounts offered by many insurers.

- Explore Discounts: Insurance providers often offer a variety of discounts to help reduce premiums. These can include discounts for good students, mature drivers, loyalty rewards, and even discounts for specific vehicle safety features.

- Consider Bundle Options: Many insurance providers offer discounts when you bundle multiple policies, such as car insurance with home or renters insurance. This can be a cost-effective way to streamline your insurance needs and save money.

By staying informed and taking advantage of these tips, you can make well-informed decisions when it comes to car insurance in New Jersey. Remember, your insurance coverage is a critical aspect of your financial well-being, so it's worth investing the time to find the right fit.

Future of Car Insurance in New Jersey

As technology continues to advance and the insurance industry evolves, the future of car insurance in New Jersey holds exciting possibilities. Here's a glimpse into some potential developments and their implications:

Telematics and Usage-Based Insurance

Telematics technology, which tracks driving behavior through devices installed in vehicles, is gaining traction in the insurance industry. In New Jersey, usage-based insurance programs could offer drivers the opportunity to lower their premiums based on their actual driving habits. This shift towards pay-as-you-drive insurance could incentivize safer driving practices and provide more accurate pricing for individual drivers.

Autonomous Vehicles and Liability Shifts

The emergence of autonomous vehicles raises intriguing questions about liability in the event of accidents. As self-driving cars become more prevalent, the responsibility for accidents may shift from individual drivers to vehicle manufacturers or software developers. This could lead to new insurance products specifically designed for autonomous vehicles, potentially reducing the burden on individual drivers.

Digital Transformation and Customer Experience

The insurance industry is increasingly embracing digital transformation, and this trend is likely to continue in New Jersey. Insurers are investing in digital tools and platforms to enhance the customer experience, offering convenient online quote comparisons, streamlined claims processes, and personalized policy management. This shift towards a more digital-first approach can empower drivers to make informed decisions and efficiently manage their insurance needs.

Collaborative Insurance Models

The future of car insurance may also see the rise of collaborative insurance models, where drivers pool resources and share risks collectively. These models, often facilitated by technology platforms, could offer more affordable and flexible insurance options, particularly for younger or higher-risk drivers. While still in their infancy, these innovative insurance models could disrupt the traditional insurance landscape in New Jersey.

As New Jersey's car insurance market evolves, drivers can expect a more dynamic and personalized insurance experience. By staying informed about emerging trends and technological advancements, drivers can make strategic choices to ensure they have the right coverage at the most competitive rates.

Frequently Asked Questions

What is the average cost of car insurance in New Jersey?

+The average cost of car insurance in New Jersey can vary significantly based on individual factors such as driving record, age, vehicle type, and location. According to recent data, the average annual premium for a minimum liability policy in New Jersey is around $1,500. However, this can range widely, with some drivers paying significantly more or less depending on their unique circumstances.

Are there any discounts available for car insurance in New Jersey?

+Yes, there are various discounts available for car insurance in New Jersey. Common discounts include safe driver discounts, good student discounts, multiple policy discounts (when you bundle car insurance with other types of insurance), and loyalty rewards. Additionally, some insurers offer discounts for vehicles equipped with advanced safety features or for drivers who complete defensive driving courses.

What happens if I’m involved in an accident with an uninsured driver in New Jersey?

+If you’re involved in an accident with an uninsured driver in New Jersey, your insurance policy’s uninsured motorist coverage comes into play. This coverage protects you and your passengers in the event of an accident with a driver who doesn’t have insurance or has insufficient coverage. It helps cover medical expenses, lost wages, and other damages up to the limits of your policy.

Can I choose my own repair shop after an accident in New Jersey?

+Yes, you have the right to choose your own repair shop after an accident in New Jersey. Insurance providers cannot dictate where you take your vehicle for repairs. However, it’s important to ensure that the repair shop you choose is reputable and has the necessary certifications and qualifications to perform the repairs correctly.

What are some common factors that affect car insurance rates in New Jersey?

+Several factors can influence car insurance rates in New Jersey. These include your driving record (history of accidents, traffic violations), age, gender, marital status, credit score, vehicle type and make, annual mileage, and the coverage options you choose. Additionally, the specific insurer and the area you live in can also impact your insurance rates.