How Much Is Liability Insurance For A Small Business

Navigating the Cost of Liability Insurance for Small Businesses: A Comprehensive Guide

Small business owners often navigate a complex landscape of risks and uncertainties. Among the myriad of considerations, liability insurance stands out as a crucial aspect of financial protection. Understanding the cost of liability insurance is essential for business owners to make informed decisions and safeguard their enterprises. In this article, we delve into the factors influencing liability insurance costs, explore real-world examples, and provide a comprehensive guide to help small businesses navigate this critical aspect of their financial strategy.

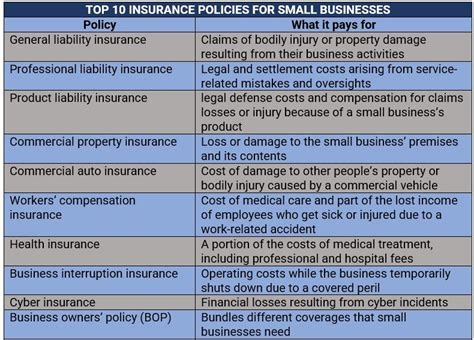

Understanding Liability Insurance

Liability insurance serves as a financial safety net for small businesses, protecting them against potential legal claims and liabilities that could arise from their operations. These claims can stem from a variety of incidents, including property damage, personal injury, or professional errors. By investing in liability insurance, businesses transfer the financial risk associated with such claims to insurance providers, ensuring they have the necessary coverage to mitigate potential losses.

The importance of liability insurance for small businesses cannot be overstated. It not only provides a financial cushion but also enhances credibility and trust with clients, partners, and investors. Furthermore, it is often a prerequisite for obtaining certain business licenses or contracts, making it a critical component of a business's operational strategy.

Factors Influencing Liability Insurance Costs

The cost of liability insurance for small businesses is influenced by a multitude of factors, each playing a unique role in determining the premium. Here’s a detailed breakdown of these factors:

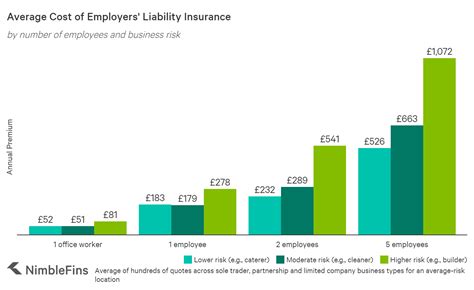

Industry and Business Type

The industry in which a small business operates significantly impacts the cost of liability insurance. Industries with higher inherent risks, such as construction or manufacturing, generally face higher insurance premiums due to the increased likelihood of accidents or claims. Conversely, businesses in less risky industries, like consulting or retail, may enjoy more affordable rates.

Moreover, the specific business type within an industry can also affect insurance costs. For instance, a small construction company specializing in high-rise buildings may face different risk assessments and premiums compared to a general contractor working on residential projects.

Business Size and Revenue

The size and revenue of a small business are crucial factors in determining liability insurance costs. Larger businesses with higher revenues often present a more substantial financial risk to insurance providers, leading to higher premiums. Conversely, smaller businesses with lower revenues may benefit from more affordable rates.

However, it's important to note that while smaller businesses may enjoy lower premiums, they often have fewer resources to absorb potential losses. This makes the choice of liability insurance coverage a critical strategic decision, balancing the need for adequate protection with the financial constraints of the business.

Location and Geographical Factors

The geographical location of a small business plays a significant role in determining liability insurance costs. Different regions have varying levels of risk exposure due to factors like natural disasters, crime rates, or even local regulations. For instance, a business located in an area prone to hurricanes or floods may face higher premiums due to the increased likelihood of property damage claims.

Furthermore, local regulations and laws can also impact insurance costs. Some regions may have more stringent liability requirements, leading to higher insurance premiums to comply with local standards.

Claim History and Risk Assessment

A small business’s claim history is a critical factor in determining liability insurance costs. Businesses with a history of frequent or costly claims are often seen as higher-risk by insurance providers, leading to increased premiums. Conversely, businesses with a clean claim record may enjoy more competitive rates.

Insurance providers also conduct risk assessments to evaluate a business's potential exposure to claims. This assessment considers factors like the business's safety protocols, employee training, and overall risk management strategies. Businesses that demonstrate a proactive approach to risk mitigation may be rewarded with lower insurance premiums.

Coverage Limits and Deductibles

The coverage limits and deductibles chosen by a small business significantly impact the cost of liability insurance. Higher coverage limits, which provide more financial protection in the event of a claim, often result in higher premiums. Similarly, choosing a lower deductible, which means the business pays less out of pocket before the insurance kicks in, can also increase the overall cost of the policy.

Business owners must carefully consider their coverage limits and deductibles based on their risk appetite and financial capabilities. While higher limits and lower deductibles provide more protection, they also result in higher premiums, which can strain the business's finances.

Real-World Examples of Liability Insurance Costs

To illustrate the variation in liability insurance costs, let’s explore some real-world examples based on different business scenarios:

Scenario 1: A Small Retail Store

John operates a small retail store in a suburban area. His business is relatively low-risk, with minimal potential for claims. John’s annual liability insurance premium might range from 500 to 1,000, depending on the coverage limits he chooses.

Scenario 2: A Construction Company

Emily owns a construction company specializing in residential projects. Her business faces moderate risk due to the nature of the work. Emily’s annual liability insurance premium could fall between 2,000 and 3,000, with higher coverage limits required to protect against potential accidents on construction sites.

Scenario 3: A Consulting Firm

David runs a consulting firm with a team of experts. His business faces minimal physical risk but has potential exposure to professional liability claims. David’s annual liability insurance premium might range from 1,500 to 2,500, with a focus on professional liability coverage.

Scenario 4: An Online E-commerce Business

Sarah operates an online e-commerce business, selling a variety of products. Her business has a moderate risk profile due to the potential for product liability claims. Sarah’s annual liability insurance premium could be around 1,200 to 1,800, with a focus on product liability coverage.

Strategies to Optimize Liability Insurance Costs

While the cost of liability insurance is influenced by various factors, small business owners can employ several strategies to optimize their insurance costs and ensure they are getting the best value for their money:

Conduct a Comprehensive Risk Assessment

Before purchasing liability insurance, conduct a thorough risk assessment of your business. Identify potential risks and vulnerabilities, and take proactive measures to mitigate them. This not only reduces the likelihood of claims but also demonstrates to insurance providers that you are a responsible business owner, potentially leading to more competitive rates.

Shop Around and Compare Quotes

Don’t settle for the first insurance quote you receive. Shop around and compare quotes from multiple insurance providers. Each provider has its own risk assessment methodology and pricing structure, so obtaining multiple quotes can help you identify the most cost-effective option for your business.

Bundle Policies for Discounts

Consider bundling your liability insurance with other types of insurance, such as property insurance or business interruption insurance. Many insurance providers offer discounts when multiple policies are purchased together, helping you save on overall insurance costs.

Negotiate with Insurance Providers

Don’t be afraid to negotiate with insurance providers. Explain your business’s unique circumstances, risk management strategies, and claim history. Highlight any steps you’ve taken to mitigate risks and demonstrate your commitment to responsible business practices. Insurance providers often appreciate proactive business owners and may be willing to offer more competitive rates.

Choose the Right Coverage Limits and Deductibles

Carefully evaluate your business’s risk appetite and financial capabilities when choosing coverage limits and deductibles. While higher limits and lower deductibles provide more protection, they also increase your insurance costs. Strike a balance that aligns with your business’s needs and financial health.

Utilize Loss Control Services

Many insurance providers offer loss control services, which help businesses identify and mitigate potential risks. These services can range from safety audits to employee training programs. By utilizing these services, you not only improve your business’s safety culture but also demonstrate to insurance providers that you are actively managing risks, potentially leading to more favorable insurance rates.

Future Implications and Industry Trends

The landscape of liability insurance for small businesses is continually evolving, influenced by a range of factors including technological advancements, regulatory changes, and shifts in consumer behavior. Here’s a glimpse into the future implications and industry trends that may shape the cost and availability of liability insurance:

Impact of Technological Advancements

Technological advancements are transforming the insurance industry, with implications for both insurers and policyholders. The increasing adoption of artificial intelligence, machine learning, and data analytics is enabling insurance providers to make more precise risk assessments and pricing decisions. This enhanced data-driven approach may lead to more accurate and tailored insurance policies, potentially impacting the cost of liability insurance for small businesses.

Additionally, the rise of digital platforms and online insurance marketplaces is providing small businesses with greater access to a wider range of insurance providers and policies. This increased competition and transparency can drive down insurance costs and make it easier for small businesses to find the coverage that best suits their needs.

Regulatory Changes and Industry Standards

Regulatory changes and evolving industry standards can significantly impact the cost and availability of liability insurance. As governments and industry bodies update regulations and standards to address emerging risks and consumer protection concerns, insurance providers must adapt their policies and pricing structures accordingly. This can result in changes to coverage limits, deductibles, and overall policy costs.

For instance, the introduction of stricter environmental regulations may lead to increased liability risks for businesses operating in certain industries. Insurance providers may respond by adjusting their policies and premiums to account for these new risks, potentially impacting the cost of liability insurance for small businesses in those sectors.

Consumer Behavior and Market Demand

Changes in consumer behavior and market demand can also influence the cost and availability of liability insurance. As consumer preferences and expectations evolve, businesses may need to adapt their operations and risk management strategies to meet these new demands. This can lead to shifts in insurance coverage needs and, consequently, changes in insurance costs.

For example, the growing emphasis on sustainability and corporate social responsibility may drive small businesses to adopt more environmentally friendly practices. This shift could result in a higher demand for insurance coverage related to environmental liability, potentially leading to increased insurance costs in this area.

Industry Consolidation and Competition

The insurance industry is subject to consolidation and competitive dynamics that can impact the cost and availability of liability insurance. Mergers and acquisitions among insurance providers can lead to changes in market share and pricing power, potentially affecting the premiums small businesses pay for liability insurance.

Increased competition, on the other hand, can drive down insurance costs as providers strive to offer more attractive policies and pricing to attract customers. Small businesses can benefit from this competitive environment by shopping around for the best deals and negotiating more favorable terms with insurance providers.

Conclusion

Navigating the cost of liability insurance is a critical aspect of small business management. By understanding the factors that influence insurance costs, exploring real-world examples, and employing strategic approaches to optimize insurance expenses, small business owners can make informed decisions to protect their enterprises while managing financial constraints.

As the insurance landscape continues to evolve, staying informed about industry trends and future implications is essential. By adapting to changing dynamics and leveraging technological advancements, small businesses can ensure they have the necessary coverage to mitigate risks while maintaining a competitive edge in their respective markets.

How often should small businesses review their liability insurance coverage and costs?

+Small businesses should review their liability insurance coverage and costs at least annually. Regular reviews ensure that the coverage remains aligned with the business’s evolving needs and risk profile. Additionally, conducting periodic reviews allows businesses to stay informed about changes in the insurance market, enabling them to take advantage of new policies or discounts that may become available.

What are some common exclusions in liability insurance policies for small businesses?

+Common exclusions in liability insurance policies for small businesses may include intentional acts, contract disputes, certain types of professional liability (such as malpractice for professionals like doctors or lawyers), pollution or environmental damage, and employee-related injuries (which are typically covered under workers’ compensation insurance). It’s crucial for small business owners to carefully review their policies to understand any exclusions and ensure they have adequate coverage for their specific risks.

Can small businesses purchase liability insurance on a monthly basis, or is it typically an annual commitment?

+Liability insurance for small businesses is typically sold on an annual basis. While some insurance providers may offer the option to pay premiums monthly or quarterly, the policy itself is usually a yearly commitment. This annual commitment allows insurance providers to assess the risk associated with the business over a longer period and price the policy accordingly. However, it’s worth noting that some providers may offer short-term or temporary liability insurance policies for specific events or projects.