Review Of Travel Insurance

Welcome to this comprehensive review of travel insurance, a topic that is crucial for anyone planning their next adventure. In an increasingly unpredictable world, travel insurance has become an essential tool to safeguard your journey, providing peace of mind and financial protection against unforeseen circumstances. This article will delve into the intricacies of travel insurance, offering an expert's perspective on its various aspects, benefits, and real-world applications.

Understanding the Importance of Travel Insurance

Travel insurance is a contract between you, the traveler, and an insurance provider. It offers financial protection for various travel-related incidents, including medical emergencies, trip cancellations or interruptions, lost luggage, and more. The purpose of travel insurance is to ensure that your hard-earned vacation doesn’t turn into a financial burden should something unexpected occur.

Consider this: according to a recent survey, over 30% of travelers have faced unexpected expenses during their trips, ranging from medical bills to flight cancellations. This statistic highlights the importance of being prepared and protected by travel insurance.

The Peace of Mind Advantage

One of the primary benefits of travel insurance is the peace of mind it provides. When you’re insured, you can focus on enjoying your trip without constantly worrying about potential risks. Whether you’re hiking in the mountains or exploring a new city, knowing that you’re covered can significantly enhance your travel experience.

For instance, imagine you're on a hiking trip in the Swiss Alps and you suffer a minor injury. With travel insurance, you can access immediate medical assistance without worrying about the cost. The insurance provider will ensure you receive the necessary care, allowing you to continue your adventure with minimal disruption.

Financial Protection and Coverage

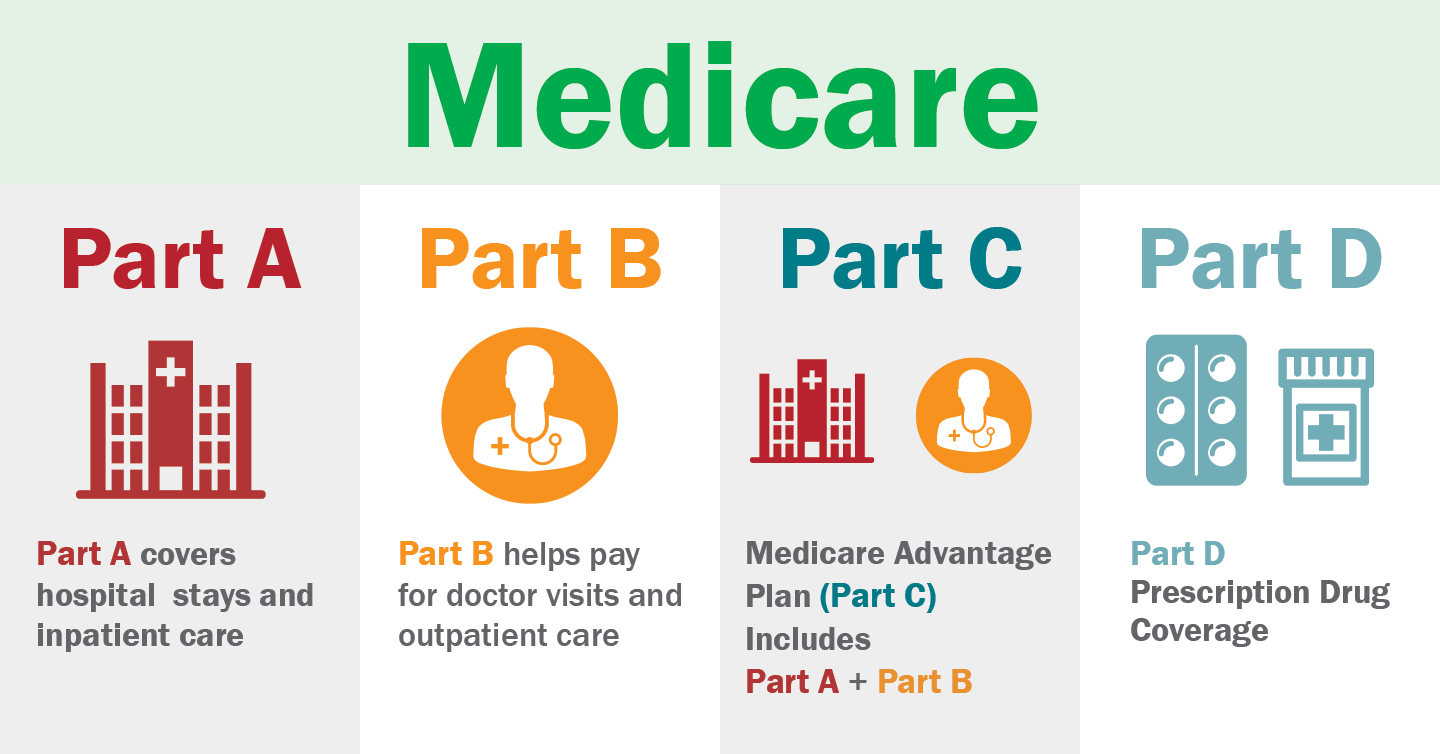

Travel insurance policies offer a range of coverage options, tailored to meet the diverse needs of travelers. These policies typically include medical and dental coverage, trip cancellation or interruption protection, emergency evacuation coverage, and more.

| Coverage Type | Description |

|---|---|

| Medical and Dental | Covers expenses for emergency medical treatments, hospital stays, and dental emergencies during your trip. |

| Trip Cancellation/Interruption | Reimburses you for prepaid, non-refundable trip costs if your travel plans are canceled or interrupted due to covered reasons. |

| Emergency Evacuation | Provides for your transportation to the nearest adequate medical facility in case of a medical emergency. |

| Baggage and Personal Effects | Covers the cost of replacing lost, stolen, or damaged luggage and personal items. |

| Travel Delay | Compensates for additional expenses incurred due to delays in your travel itinerary, such as hotel stays or meals. |

How to Choose the Right Travel Insurance

With numerous travel insurance providers and policies available, choosing the right one can be daunting. Here are some key factors to consider when selecting travel insurance to ensure you get the best coverage for your needs.

Assess Your Travel Needs

Start by evaluating your travel plans and potential risks. Consider the destination, activities you’ll be engaging in, and any specific requirements you may have. For instance, if you’re planning an adventurous trip involving extreme sports, you’ll need a policy that covers such activities.

If you're traveling to a remote location, emergency evacuation coverage should be a priority. On the other hand, if you have pre-existing medical conditions, ensure your policy covers these conditions without exclusions.

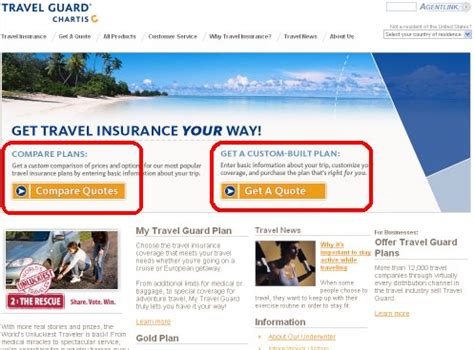

Compare Providers and Policies

Research and compare different travel insurance providers and their policies. Look for reputable companies with a strong track record of customer satisfaction and prompt claim processing. Check online reviews and seek recommendations from fellow travelers.

When comparing policies, pay attention to the coverage limits, deductibles, and any additional benefits offered. Some policies may include travel assistance services, rental car coverage, or even trip cancellation for any reason.

Read the Fine Print

Always read the policy wording carefully to understand the coverage, exclusions, and any conditions that may apply. Pay attention to the terms related to pre-existing conditions, as these can impact your eligibility for certain benefits.

Look for policies that offer clear and concise wording, making it easier to understand your rights and obligations. If you have any questions or concerns, don't hesitate to reach out to the insurance provider's customer support for clarification.

Real-World Scenarios and Benefits

Let’s explore some real-life scenarios where travel insurance proved to be a lifesaver, highlighting its practical benefits.

Medical Emergency Abroad

Imagine you’re on a dream vacation in Southeast Asia when you suddenly fall ill and require hospitalization. Without travel insurance, you could be facing substantial medical bills, potentially running into thousands of dollars. However, with comprehensive travel insurance, you can access quality medical care without worrying about the financial burden.

Trip Cancellation Due to Natural Disasters

Natural disasters are unpredictable, and they can strike at any time. If you have to cancel your trip due to a hurricane, earthquake, or other natural calamity, travel insurance can reimburse you for the costs of your non-refundable travel expenses.

Lost Luggage and Personal Effects

Traveling with valuable items can be stressful, especially when they go missing. Travel insurance provides coverage for lost, stolen, or damaged luggage and personal belongings, helping you replace them without incurring significant costs.

Travel Insurance for Different Traveler Profiles

Travel insurance isn’t a one-size-fits-all solution. Different traveler profiles have unique needs, and insurance providers offer specialized policies to cater to these diverse requirements.

Families and Groups

Family travel insurance policies provide coverage for multiple family members traveling together. These policies often include benefits such as child-specific coverage, family-oriented assistance services, and family-friendly trip cancellation options.

Business Travelers

Business travelers have distinct needs, and business travel insurance policies are designed to meet these requirements. These policies typically cover additional expenses related to business travel, such as business equipment loss or damage, business interruption, and even work-related medical emergencies.

Adventure Seekers

If you’re an adventure enthusiast, seeking thrill-filled experiences, you’ll want a policy that covers a wide range of activities, from skiing and snowboarding to scuba diving and hiking. Adventure travel insurance policies offer specialized coverage for these high-risk activities, ensuring you’re protected while pursuing your passions.

The Future of Travel Insurance

The travel insurance industry is continuously evolving to meet the changing needs of travelers. With advancements in technology and an increasing focus on customer experience, we can expect to see several trends shaping the future of travel insurance.

Digitalization and Instant Coverage

The rise of digital platforms and mobile applications has revolutionized the travel insurance industry. Travelers can now purchase insurance policies online or through mobile apps, often receiving instant coverage. This convenience ensures that travelers can secure insurance quickly, even at the last minute before their trip.

Personalized Coverage and Add-Ons

Travelers are increasingly seeking personalized insurance solutions tailored to their specific needs. Insurance providers are responding by offering customizable policies with add-on coverage options. This allows travelers to choose the coverage they need, whether it’s additional medical coverage, trip cancellation protection, or specialized activity coverage.

Enhanced Customer Support and Claims Experience

Insurance providers are investing in improving their customer support services, recognizing the importance of a seamless and efficient claims process. This includes 24⁄7 customer support, real-time claim tracking, and streamlined claim submission processes. Additionally, some providers are incorporating artificial intelligence and chatbots to provide quick assistance and answer common queries.

Conclusion

Travel insurance is an invaluable tool for travelers, providing financial protection and peace of mind in an uncertain world. By understanding the importance of travel insurance, knowing how to choose the right policy, and recognizing its real-world benefits, you can ensure that your travels are not only enjoyable but also protected.

As the travel industry continues to evolve, so too will travel insurance, offering innovative solutions to meet the changing needs of travelers. Whether you're an adventurous soul, a family traveler, or a business professional, there's a travel insurance policy out there that's perfect for you.

So, before you embark on your next journey, take the time to explore the world of travel insurance and find the coverage that suits your needs. With the right protection, your travels can be filled with unforgettable memories, without the worry of unexpected expenses or incidents.

What should I do if I need to make a claim while traveling?

+If you find yourself in a situation where you need to make a claim while traveling, the first step is to contact your insurance provider’s emergency assistance hotline. They will guide you through the process and provide the necessary support. Ensure you have your policy details and any relevant documentation ready for a smooth claim process.

Are there any exclusions or limitations I should be aware of in travel insurance policies?

+Yes, it’s important to be aware of exclusions and limitations in travel insurance policies. These can vary between providers and policies, so carefully read the fine print. Common exclusions include pre-existing medical conditions, certain high-risk activities, and acts of war or terrorism. It’s crucial to understand these exclusions to ensure you’re adequately covered.

Can I purchase travel insurance after my trip has started?

+In most cases, it’s best to purchase travel insurance before your trip begins. However, some providers offer policies that can be purchased after your trip has started, known as “post-departure” or “trip interruption” coverage. These policies may have specific conditions and limitations, so it’s essential to review them carefully.

How can I save money on travel insurance?

+To save money on travel insurance, consider the following tips: shop around and compare prices and coverage options, look for discounts or promotions, consider bundling your insurance with other travel services, and be mindful of the coverage you truly need. Remember, the cheapest policy may not always offer the best value.

Is travel insurance mandatory for all travelers?

+While travel insurance is not legally mandatory for all travelers, it is highly recommended. Some countries may require specific types of insurance, such as medical coverage, for certain visa categories. Additionally, many travel providers and tour operators now require travelers to have adequate insurance before participating in their tours or activities.