Medicare Medigap Insurance

Medicare Medigap insurance, often referred to as Medicare Supplement Insurance, is an essential topic for millions of Americans approaching retirement age or already enrolled in Medicare. This comprehensive guide aims to demystify Medigap insurance, providing an in-depth understanding of its purpose, benefits, and how it can be utilized to enhance Medicare coverage.

Understanding Medicare Medigap Insurance

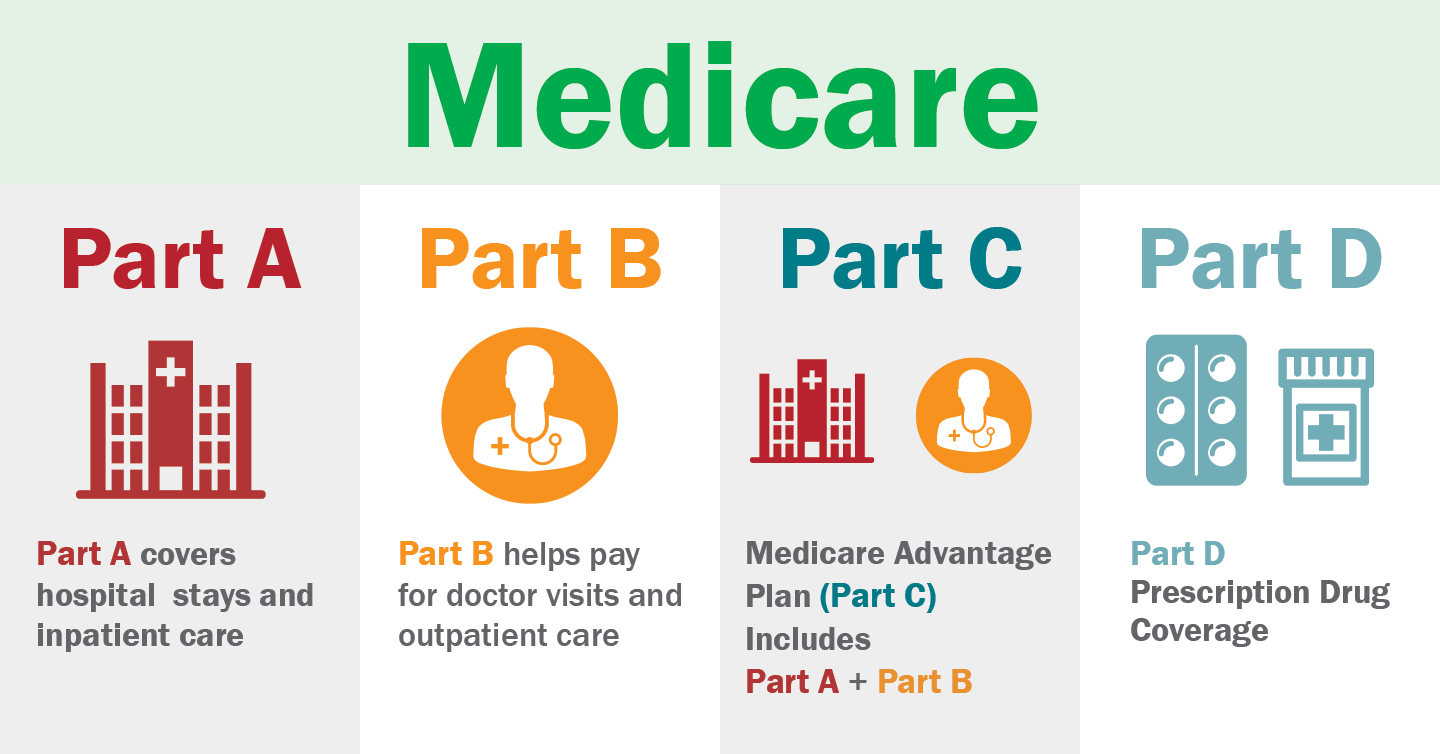

Medicare Medigap insurance is a set of standardized policies designed to supplement original Medicare, Medicare Parts A and B. These policies, offered by private insurance companies, fill in the gaps left by original Medicare, covering costs such as deductibles, co-payments, and co-insurance. The purpose of Medigap is to provide additional financial security and flexibility for Medicare beneficiaries, allowing them to access a wider range of healthcare services without facing significant out-of-pocket expenses.

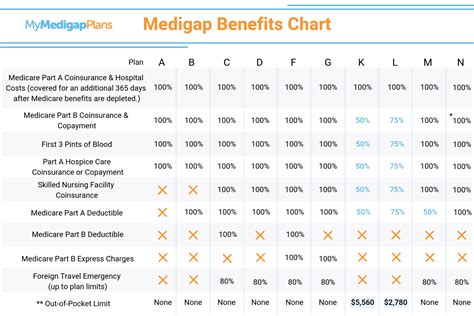

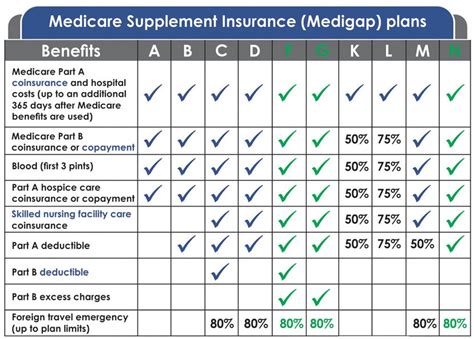

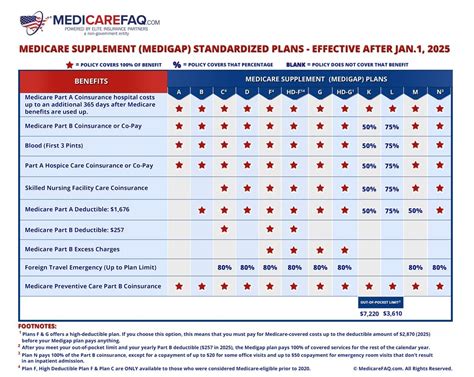

There are currently ten standardized Medigap plans, labeled A through N, with each plan offering a unique set of benefits. The specific benefits covered by each plan can vary depending on the state and the insurance company offering the policy. However, certain benefits, such as coverage for Medicare Part A deductible and Part B coinsurance, are common across all Medigap plans.

Standardized Plans

The standardization of Medigap plans is a key feature that benefits consumers. It ensures that plan A offered by one insurance company provides the same benefits as plan A offered by another company. This standardization makes it easier for individuals to compare plans and choose the one that best fits their needs.

Here's a brief overview of some of the most popular Medigap plans:

| Plan | Coverage Highlights |

|---|---|

| Plan A | Covers Medicare Part A deductible, Part B coinsurance, and blood deductible. |

| Plan F | Most comprehensive plan, covering all Medicare Part A and B deductibles, co-pays, and coinsurance. Also covers skilled nursing care coinsurance, Part A and B excess charges, and foreign travel emergency care. |

| Plan G | Similar to Plan F, but does not cover the Medicare Part B deductible. Covers all other Part A and B costs, including skilled nursing care coinsurance and foreign travel emergency care. |

| Plan N | Covers Part A deductible, co-pays for some Part B services, and up to $50 per day for skilled nursing facility care coinsurance. Also provides a $20 co-pay for some office visits and a $50 co-pay for emergency room visits. |

Eligibility and Enrollment

Medigap policies are available to individuals who are enrolled in original Medicare, which includes Medicare Part A and Part B. It’s important to note that you cannot have a Medigap policy if you’re enrolled in a Medicare Advantage Plan (Part C). Enrollment in Medigap is often during the Medicare Open Enrollment Period, which begins the month you turn 65 and are enrolled in Part B.

The Medicare Open Enrollment Period is a crucial time for those seeking Medigap coverage. During this period, insurance companies cannot refuse to sell you a Medigap policy or charge you more due to pre-existing conditions. This ensures that individuals can access the coverage they need without facing discrimination based on their health status.

The Benefits of Medicare Medigap Insurance

Medigap insurance offers a range of benefits that can significantly enhance the coverage provided by original Medicare. By covering additional costs, Medigap policies provide greater financial security and peace of mind for Medicare beneficiaries.

Reduced Out-of-Pocket Costs

One of the primary advantages of Medigap insurance is the reduction of out-of-pocket healthcare expenses. Original Medicare often requires beneficiaries to pay deductibles, co-pays, and coinsurance for various services. Medigap policies cover these costs, ensuring that individuals are not faced with unexpected or unaffordable medical bills.

For example, Plan F, one of the most comprehensive Medigap plans, covers the Part A deductible, which can be a significant expense for individuals hospitalized for an extended period. By having Plan F, beneficiaries can avoid this financial burden, making it easier to manage their healthcare costs.

Flexibility in Choosing Healthcare Providers

Medicare beneficiaries enrolled in original Medicare alone are often limited in their choice of healthcare providers, as some doctors and hospitals do not accept Medicare. However, Medigap policies, particularly those that cover Medicare Part B excess charges, allow beneficiaries to choose a wider range of healthcare providers.

With Medigap coverage, beneficiaries can access a larger network of doctors and hospitals, including those who do not accept Medicare assignment. This flexibility is especially beneficial for individuals who prefer specific healthcare providers or require specialized medical care.

Coverage for Travel and Emergency Care

Medicare coverage is primarily limited to the United States, with very little coverage available for healthcare services received outside the country. Medigap policies, especially those that cover foreign travel emergency care, can provide valuable protection for individuals who travel frequently or plan to spend time abroad.

These policies typically cover emergency medical services and treatments received during a trip, up to a certain limit. This coverage can be a lifesaver for unexpected illnesses or injuries that occur while traveling, providing financial protection and peace of mind.

Choosing the Right Medigap Plan

Selecting the appropriate Medigap plan is a crucial decision that requires careful consideration of your healthcare needs and financial situation. Here are some factors to keep in mind when choosing a Medigap plan:

- Coverage Needs: Evaluate your current and future healthcare needs. Consider any pre-existing conditions, the frequency of your doctor visits, and the likelihood of needing specialized medical care.

- Budget: Medigap plans come with varying premium costs. Assess your financial situation and choose a plan that aligns with your budget while providing the coverage you require.

- Comparison Shopping: Don't settle for the first Medigap plan you come across. Research and compare different plans offered by multiple insurance companies. This will help you find the best value for your money.

- Plan Availability: Not all Medigap plans are available in every state. Check with your state's insurance department or a licensed insurance agent to determine which plans are offered in your area.

- Medicare Advantage Plans: If you're already enrolled in a Medicare Advantage Plan, remember that Medigap policies are not compatible. You'll need to switch back to original Medicare to be eligible for Medigap coverage.

Working with an Insurance Agent

Navigating the world of Medicare and Medigap insurance can be complex, and it’s often beneficial to seek guidance from a licensed insurance agent. These professionals can provide valuable insights and help you choose the right Medigap plan based on your specific needs.

When working with an insurance agent, be sure to ask about their experience and expertise in Medicare and Medigap policies. They should be able to explain the differences between plans, highlight the benefits and drawbacks of each, and provide personalized recommendations based on your healthcare history and budget.

Performance and Future Implications

Medigap insurance has consistently proven to be a valuable addition to Medicare coverage, providing financial security and flexibility to millions of beneficiaries. The demand for Medigap policies is expected to remain strong, especially as the baby boomer generation continues to age and enroll in Medicare.

Market Trends

The Medigap insurance market has seen steady growth over the years, with more insurance companies offering these policies to meet the increasing demand. This competition among providers has led to more affordable premium rates and a wider range of plan options, benefiting consumers.

Additionally, the implementation of the Affordable Care Act (ACA) has had a positive impact on Medigap insurance. The ACA has made it easier for individuals with pre-existing conditions to access Medigap coverage, ensuring that they receive the necessary healthcare services without facing discrimination or excessive costs.

Future Prospects

Looking ahead, the future of Medigap insurance appears promising. As healthcare costs continue to rise, the need for supplemental insurance to bridge the gaps in Medicare coverage will only become more critical. Insurance companies are likely to continue developing innovative Medigap plans to meet the evolving needs of Medicare beneficiaries.

Furthermore, with the increasing adoption of digital health technologies and telemedicine, Medigap policies may evolve to cover a wider range of remote healthcare services. This could provide even greater flexibility and accessibility for individuals seeking medical care.

Conclusion

Medicare Medigap insurance is a powerful tool for enhancing Medicare coverage and ensuring financial security for individuals as they age. By filling in the gaps left by original Medicare, Medigap policies provide peace of mind and access to a broader range of healthcare services.

As you consider your Medicare options, remember to explore the various Medigap plans available and consult with experts to make an informed decision. With the right Medigap coverage, you can navigate your healthcare journey with confidence and security.

Can I have both a Medigap policy and a Medicare Advantage Plan (Part C)?

+No, you cannot have both a Medigap policy and a Medicare Advantage Plan. Medigap policies are designed to supplement original Medicare (Part A and Part B), so if you’re enrolled in a Medicare Advantage Plan, you won’t need or be eligible for a Medigap policy.

Are Medigap plans guaranteed renewable?

+Yes, Medigap plans are guaranteed renewable, which means your insurance company cannot cancel your policy as long as you pay the premiums. This protection ensures that you’ll always have coverage, even if your health status changes.

Can I switch Medigap plans after my initial enrollment period?

+While you generally have the freedom to switch Medigap plans, there may be limitations. It’s best to consult with a licensed insurance agent to understand the specific rules and timelines for switching plans in your state.